Vat Submission In Uae - To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. Once you have registered for vat in the uae, you are required to file your vat return and make related vat. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta).

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes.

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta).

How To Submit Your UAE VAT Return Virtuzone

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). Once you have registered for vat in the uae, you are required to file.

How to submit VAT return on Emara Tax FTA new portal VAT submission

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. Once you have registered for vat in the uae, you are required to file your vat return and make related vat. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a.

PPT VAT Return Filing Service in UAE PowerPoint Presentation, free

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a.

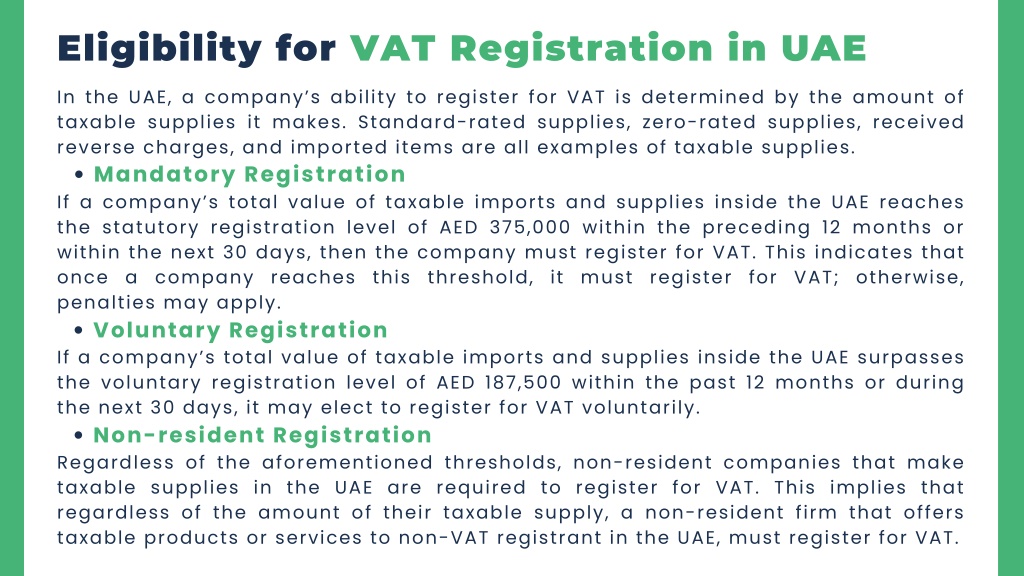

PPT VAT Registration in UAE PowerPoint Presentation, free download

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a.

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. Once you have registered for vat in the uae, you are required to file.

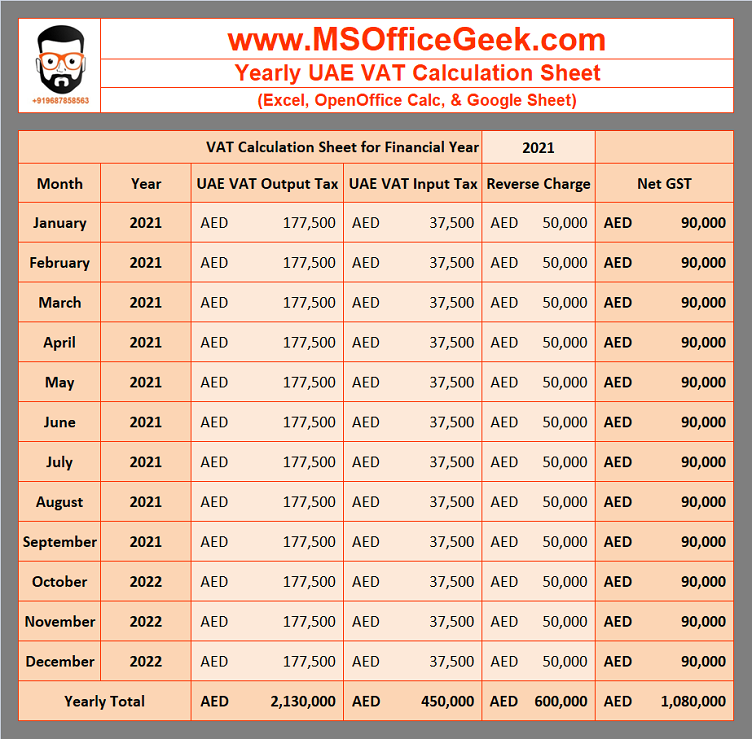

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official.

How to Claim VAT Refund in UAE 2024? (UPDATED)

To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). Once you have registered for vat in the uae, you are required to file.

How to Prepare VAT Invoice in UAE? (100 Accuracy)

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official guidelines provided by the fta, which includes. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a.

VAT Filing in UAE, Dubai VAT Return UAE VAT Submissions

Once you have registered for vat in the uae, you are required to file your vat return and make related vat. At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). To learn how to file vat return in uae, businesses should refer to the official.

How To Submit VAT Return In UAE Using FTA Portal [2025]

At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). Once you have registered for vat in the uae, you are required to file your vat return and make related vat. To learn how to file vat return in uae, businesses should refer to the official.

To Learn How To File Vat Return In Uae, Businesses Should Refer To The Official Guidelines Provided By The Fta, Which Includes.

At the end of each tax period, vat registered businesses or the ‘taxable persons’ must submit a ‘vat return’ to federal tax authority (fta). Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

![How To Submit VAT Return In UAE Using FTA Portal [2025]](https://nowconsultant.com/wp-content/uploads/2023/11/VAT-Return-Review-Form-1.webp)