Vat Laws In Uae - All countries that are full members of the cooperation council. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. For the arab states of the. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Liable to register for vat? The person residing in uae or in an vat implementing state is obligated to register under the decree la. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that.

Liable to register for vat? The person residing in uae or in an vat implementing state is obligated to register under the decree la. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. For the arab states of the. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. All countries that are full members of the cooperation council. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made.

For the arab states of the. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. All countries that are full members of the cooperation council. Liable to register for vat? The person residing in uae or in an vat implementing state is obligated to register under the decree la. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value.

New VAT Rules in UAE (2023) RSN Finance Accounting Company

Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The person residing in uae or in an vat implementing state is obligated to register under the decree la. Liable to register for vat? Value added tax (vat) everything you need to know about vat implementation.

VAT law in UAE Explained FINTAXCA YouTube

Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. For the arab states of the. The person residing in uae or in an vat.

New UAE VAT rules Exemptions for businesses and registration for the 5

Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The person residing in uae or in an vat implementing state is obligated to register under the decree la. For the arab states of the. All countries that are full members of the cooperation council. Anyone.

UAE VAT Law Key Updates and Expert Advice 2023

Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. Liable to register for vat? Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. For the arab states of the. All countries that are.

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. Liable to register for vat? For the arab states of the. All countries that are full members of the cooperation council. The uae government decided to diversify its economy and sources of income beyond oil resources and to.

A Guide to New Amendments to UAE VAT Decree Law

For the arab states of the. Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. The person residing in uae or in.

Statute of Limitations Under the Amended UAE VAT Law

Liable to register for vat? For the arab states of the. All countries that are full members of the cooperation council. The person residing in uae or in an vat implementing state is obligated to register under the decree la. The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable.

Derecho Constitucional Suaed UNAM, 42 OFF

The uae government decided to diversify its economy and sources of income beyond oil resources and to provide a stable living for their. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. Value added tax (vat) everything you need to know about vat implementation in the.

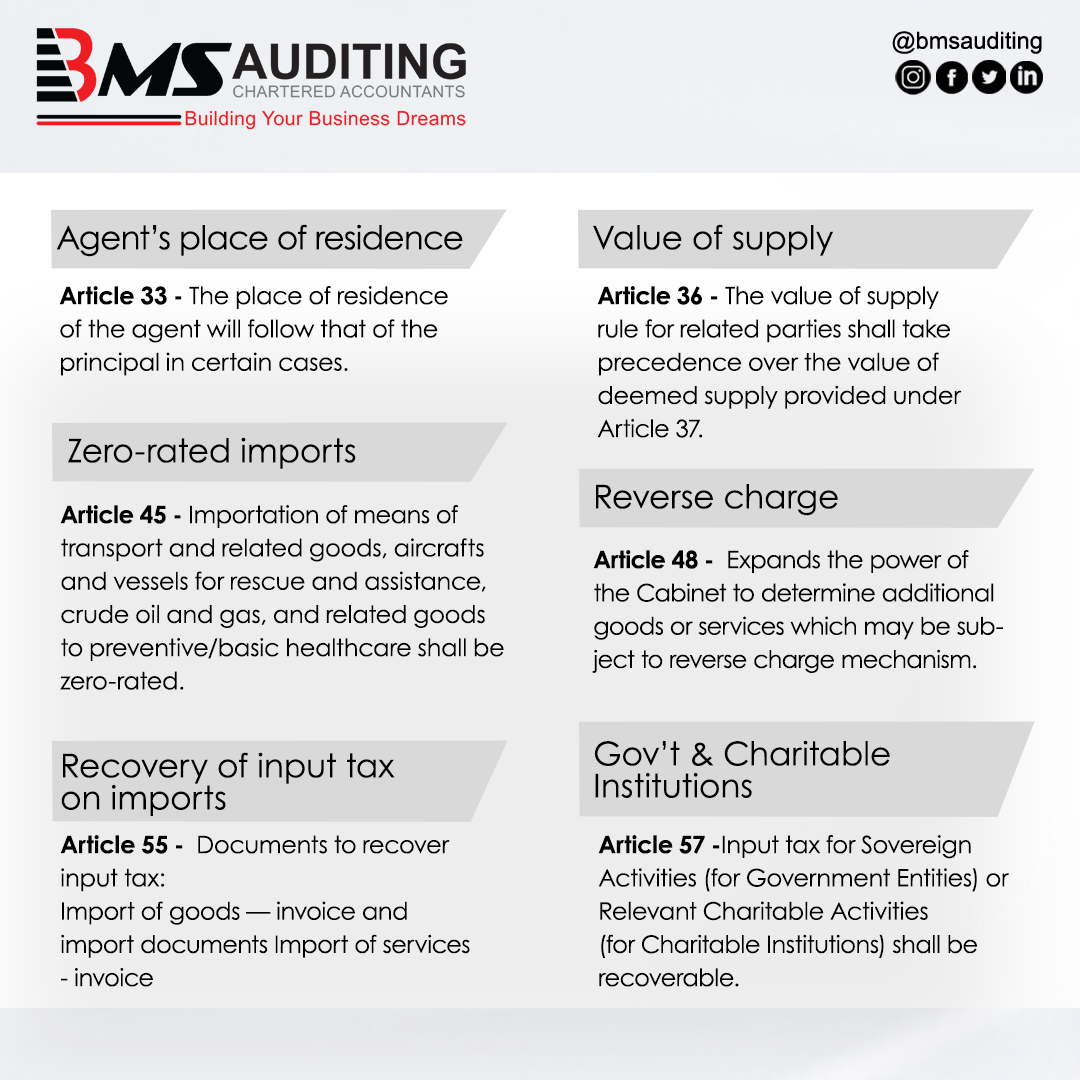

UAE announces changes to VAT provisions (Updated) BMS

Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. All countries that are full members of the cooperation council. Liable to register for.

Comprehensive List of UAE VAT Law Changes in 2023

The person residing in uae or in an vat implementing state is obligated to register under the decree la. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes.

Liable To Register For Vat?

Vat is levied on the supply of all goods and services, including food, commercial buildings and hotel services, if no explicit provision is made. Anyone excepted from tax registration according to clause (1) of this article shall inform the authority of any changes to his business that. All countries that are full members of the cooperation council. Value added tax (vat) everything you need to know about vat implementation in the uae this page provides general information on value.

The Uae Government Decided To Diversify Its Economy And Sources Of Income Beyond Oil Resources And To Provide A Stable Living For Their.

For the arab states of the. The person residing in uae or in an vat implementing state is obligated to register under the decree la.