Vat Invoice Or Proforma Invoice Rules - My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront.

My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

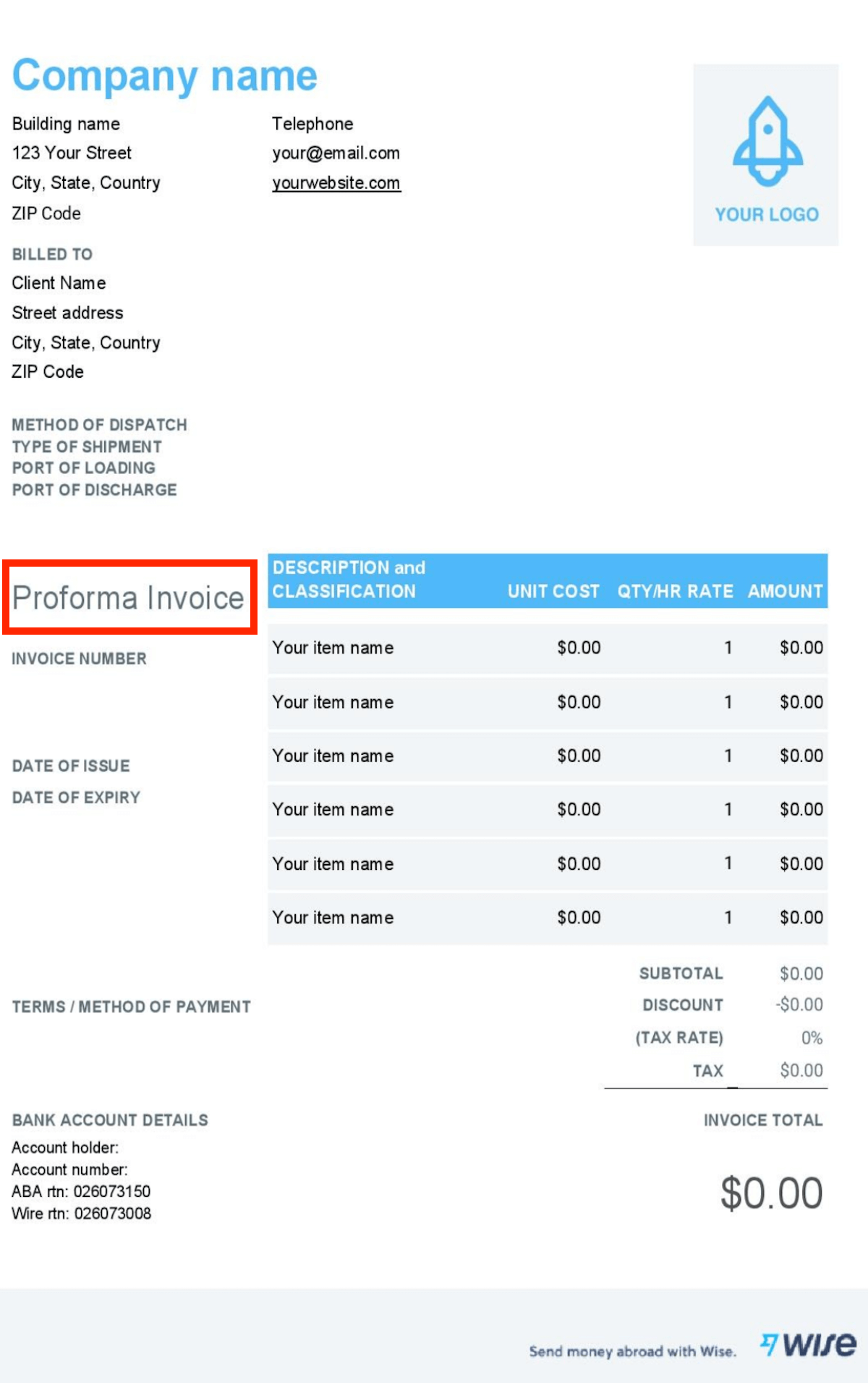

What is a proforma invoice? When and why to use Wise

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront.

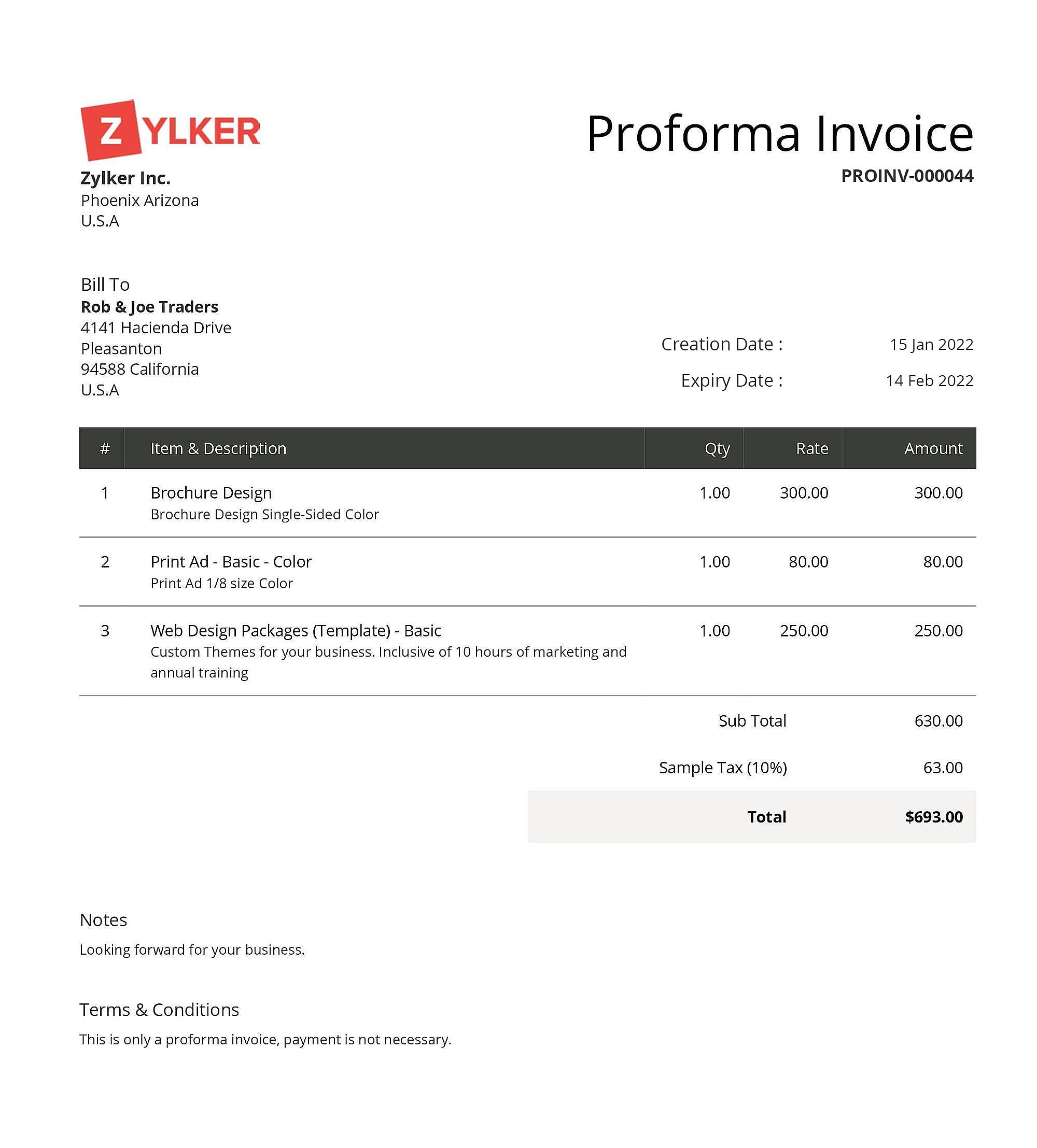

What is Proforma Invoice? 5 Free Templates to Billing

A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

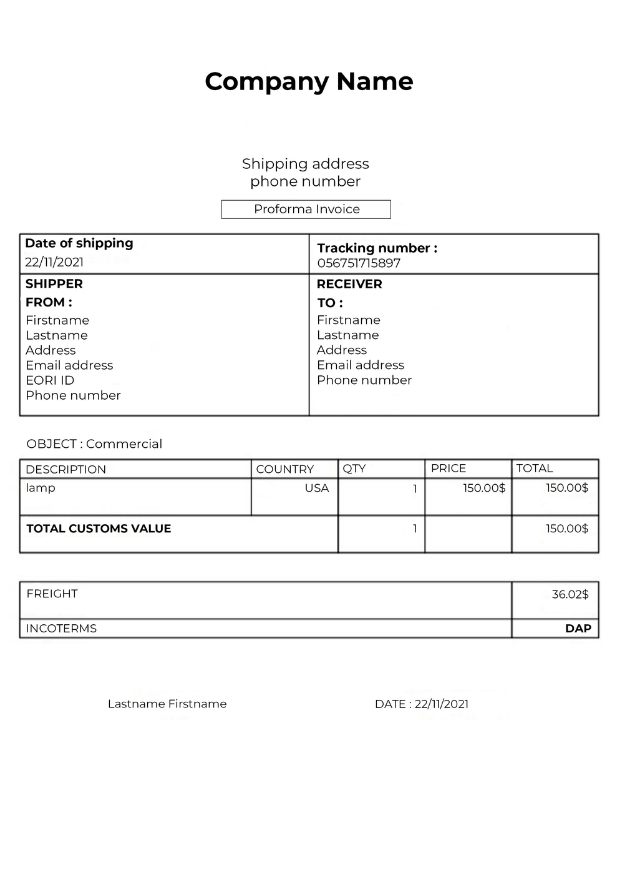

Proforma Invoice example, uses, definition

My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

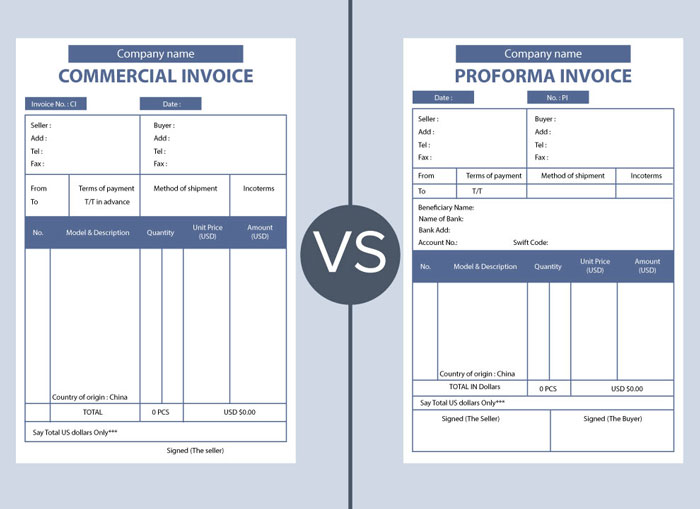

Proforma Invoice vs Commercial Invoice What's the Difference?

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

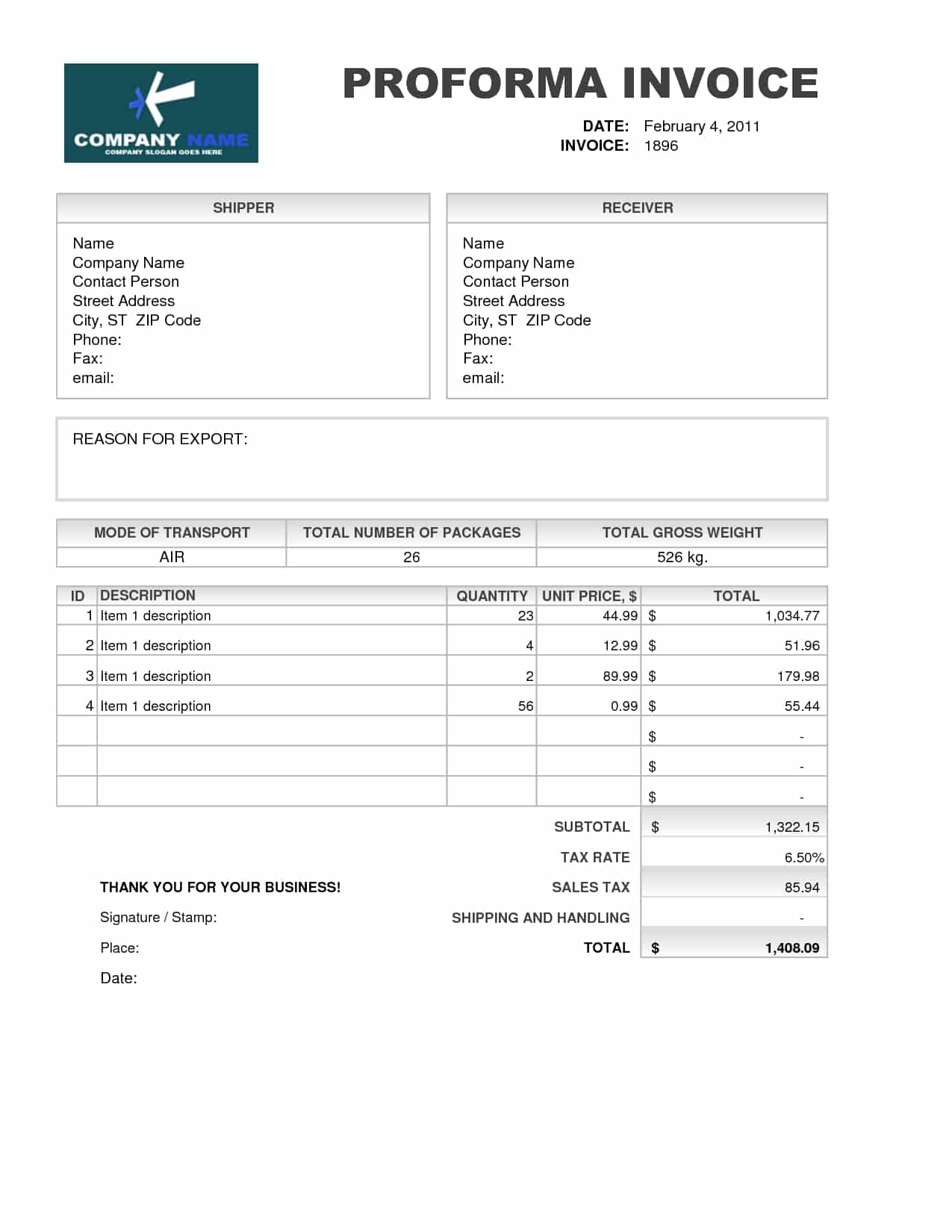

Free Printable Proforma Invoice Templates [Word, Excel, PDF]

My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

Proforma Invoice Pengertian, Contoh, dan Cara Membuatnya

A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

Proforma Invoice Format Sample Formats for Use & Benefits

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

What is a proforma invoice? Meaning, uses, format, example Essential

My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

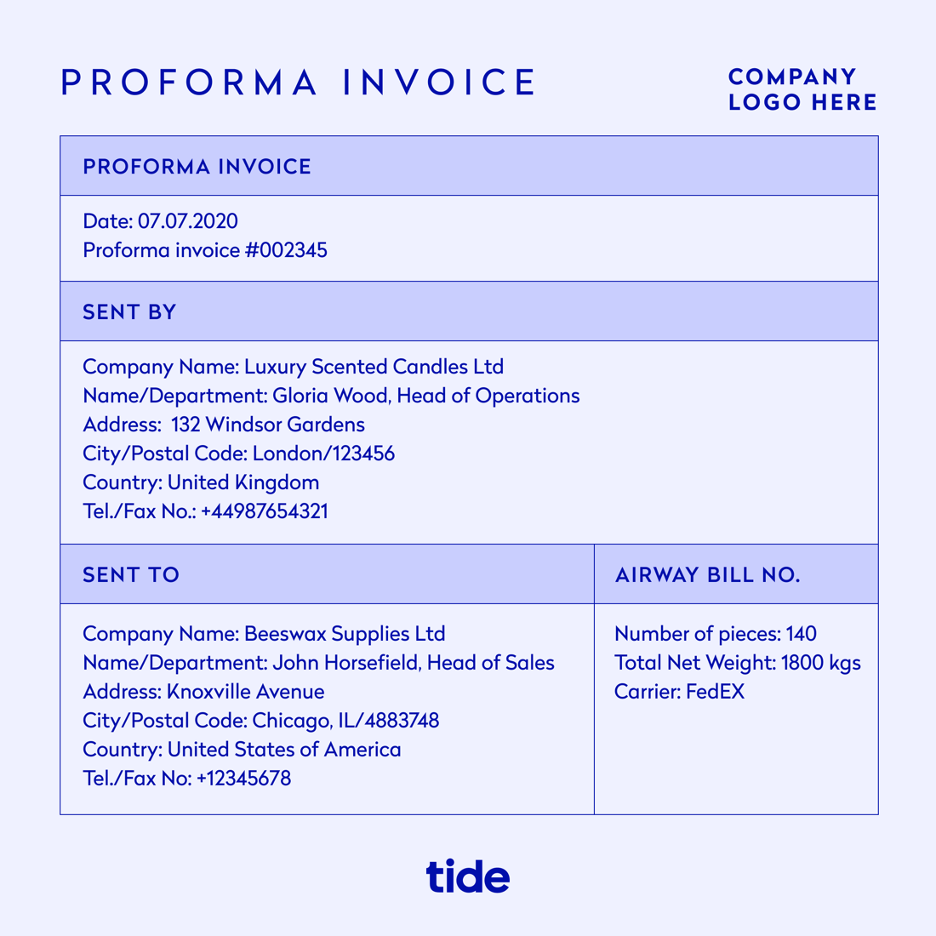

What is a proforma invoice? How and when to use one Tide Business

My understanding is that it should and that the customer pays this vat upfront. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that.

Free Printable Proforma Invoice Templates [Word, Excel, PDF]

My understanding is that it should and that the customer pays this vat upfront. A proforma is not required to follow any set form, apart from the facts that they must not have an invoice number and must state that. Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions.

A Proforma Is Not Required To Follow Any Set Form, Apart From The Facts That They Must Not Have An Invoice Number And Must State That.

Proforma invoices are not legally binding documents, which serve as estimates or quotations for potential transactions. My understanding is that it should and that the customer pays this vat upfront.

![Free Printable Proforma Invoice Templates [Word, Excel, PDF]](https://www.typecalendar.com/wp-content/uploads/2023/06/Proforma-Invoice-1536x864.jpg)

![Free Printable Proforma Invoice Templates [Word, Excel, PDF]](https://www.typecalendar.com/wp-content/uploads/2023/07/Proforma-Invoice-Free-Template.jpg?gid=724)