Vat Applicable In Uae - The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

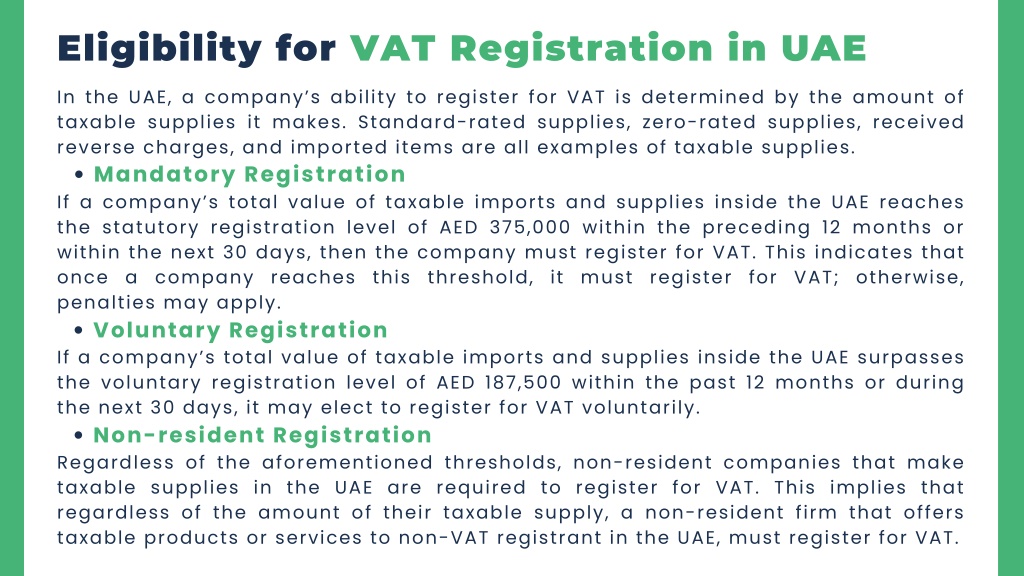

PPT VAT Registration in UAE PowerPoint Presentation, free download

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that. An overview of the main vat rules and procedures in the uae and how to comply with them;

Key Points of VAT in UAE for Businesses

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

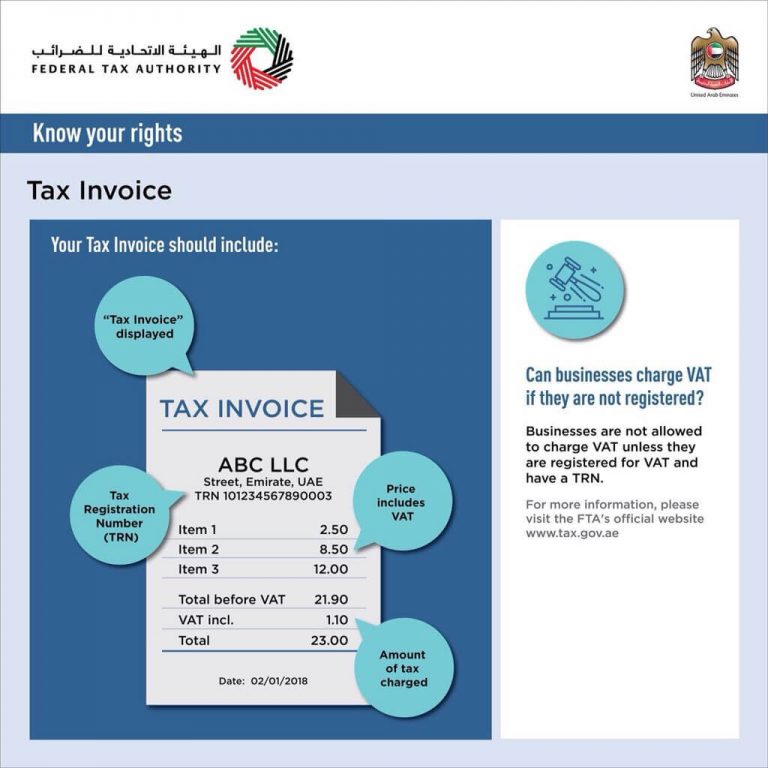

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them;

Detailed Guide to VAT Applicability on Director's Services in the UAE

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.

Is VAT applicable on services in UAE? 2021 Guide TaxHelp.ae

Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them;

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero.

Is Vat Applicable On Commercial Rent

Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them;

Vat Uae 2025 Viola S Vance

Assistance with the more likely questions that. The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. An overview of the main vat rules and procedures in the uae and how to comply with them;

UAE VAT and VAT Reports A Complete Guide

The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that. An overview of the main vat rules and procedures in the uae and how to comply with them;

VAT Rules for Electronic Services in the UAE • NAM Accountants

An overview of the main vat rules and procedures in the uae and how to comply with them; The standard vat rate in uae is 5% which is applicable for most of the goods and services and there are certain exemptions such as zero. Assistance with the more likely questions that.

The Standard Vat Rate In Uae Is 5% Which Is Applicable For Most Of The Goods And Services And There Are Certain Exemptions Such As Zero.

An overview of the main vat rules and procedures in the uae and how to comply with them; Assistance with the more likely questions that.