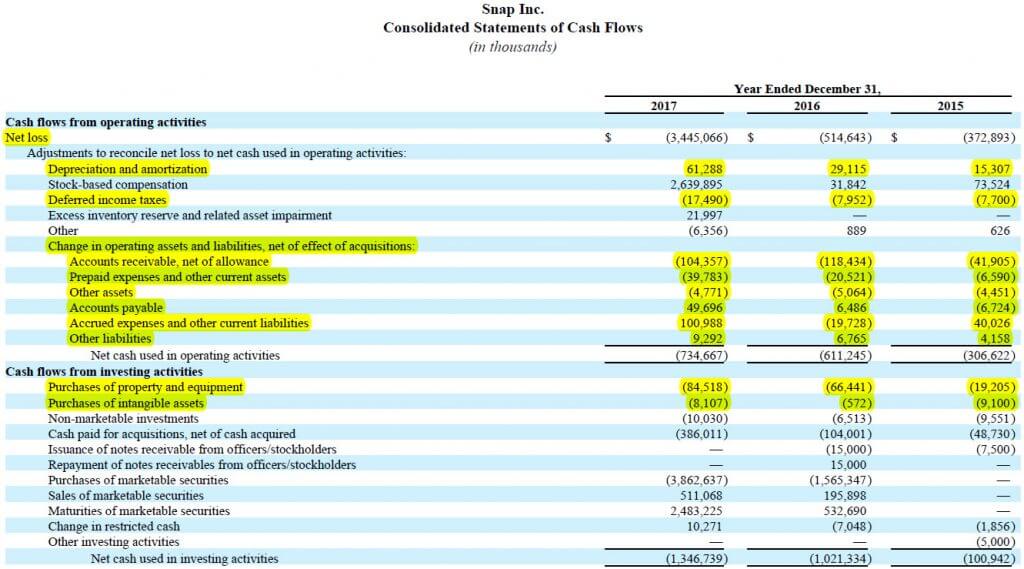

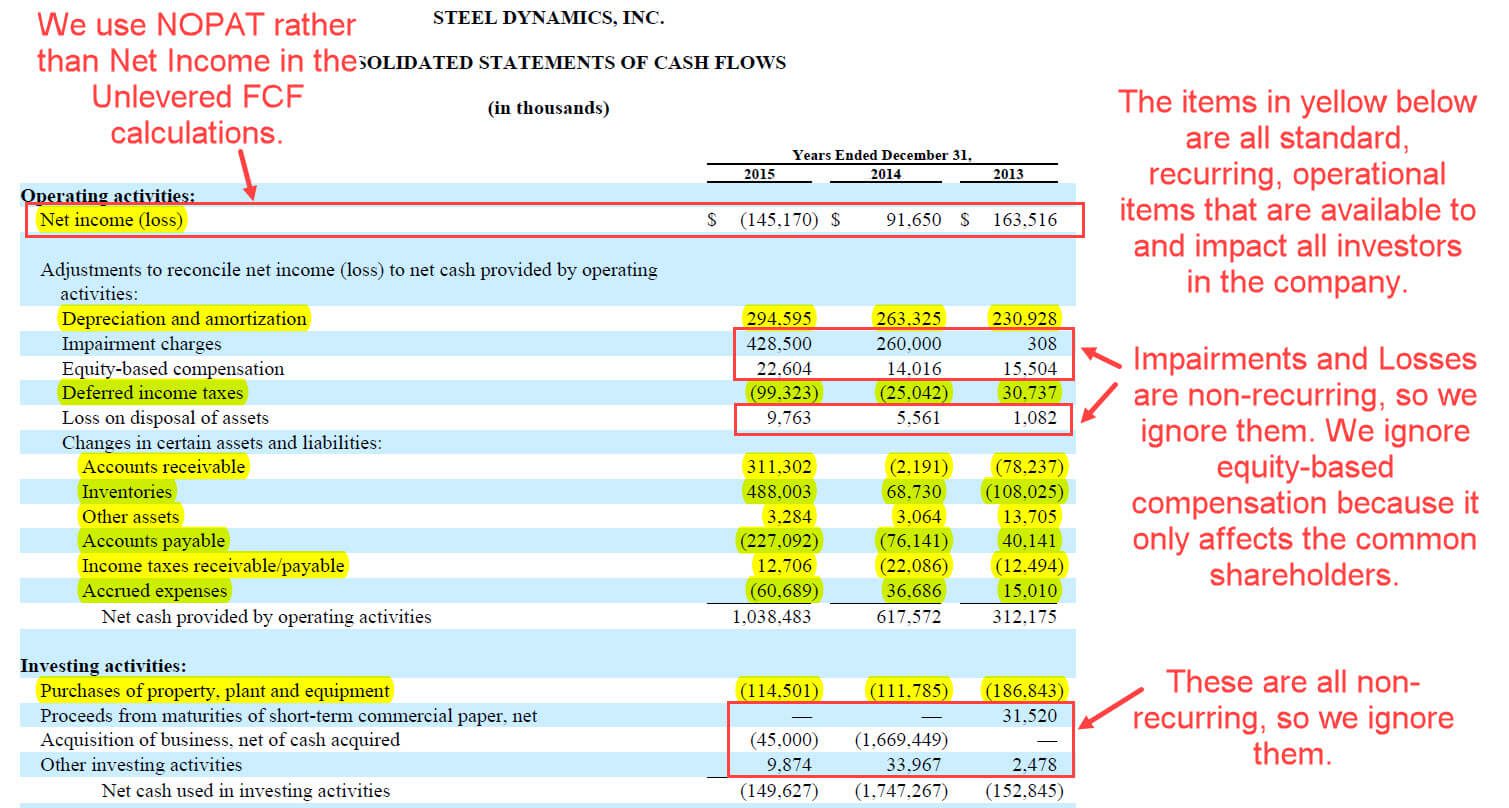

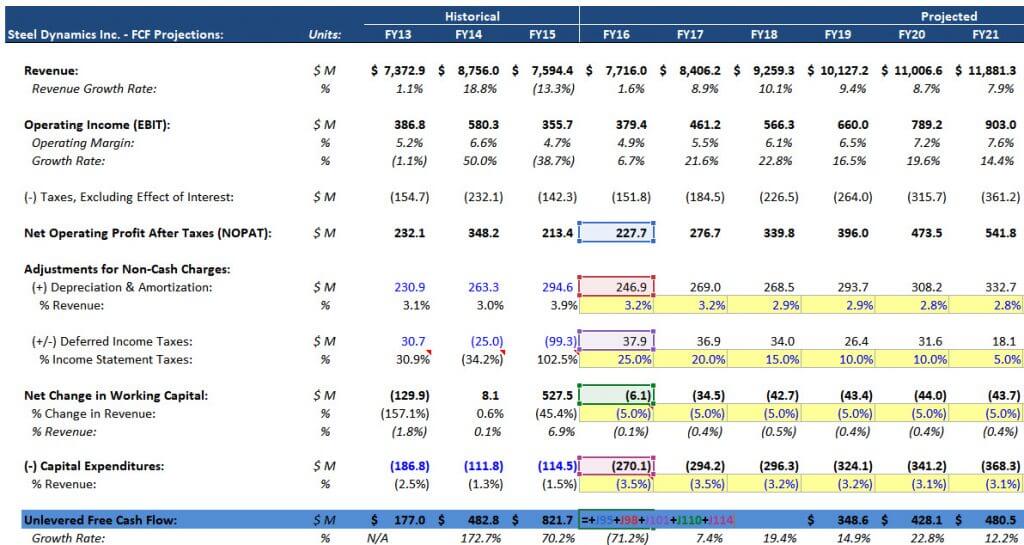

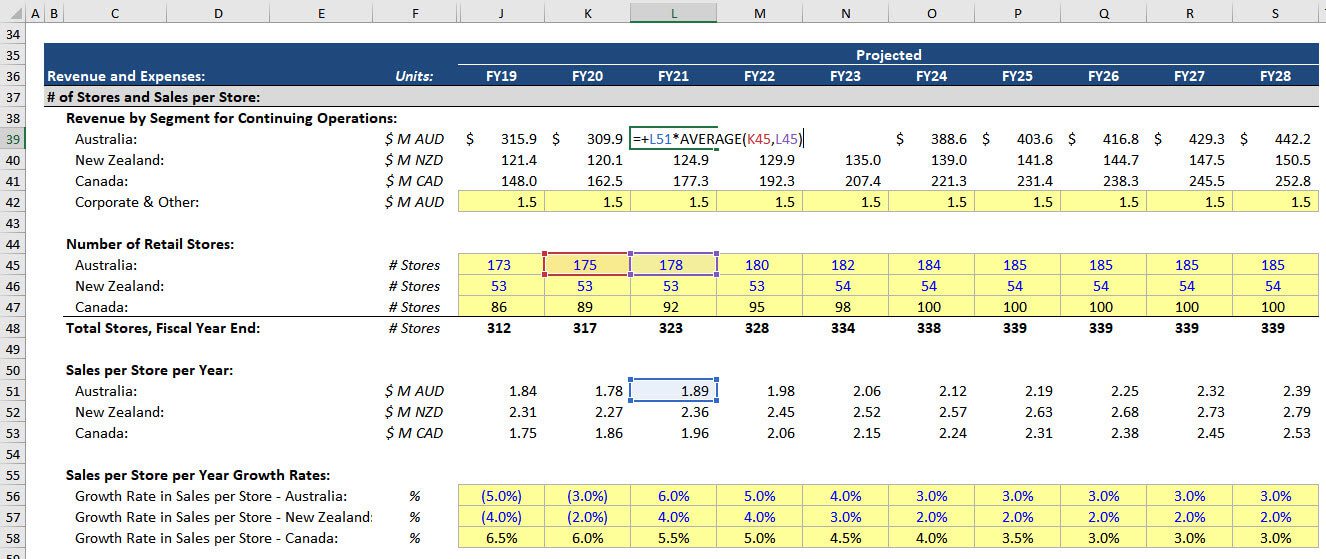

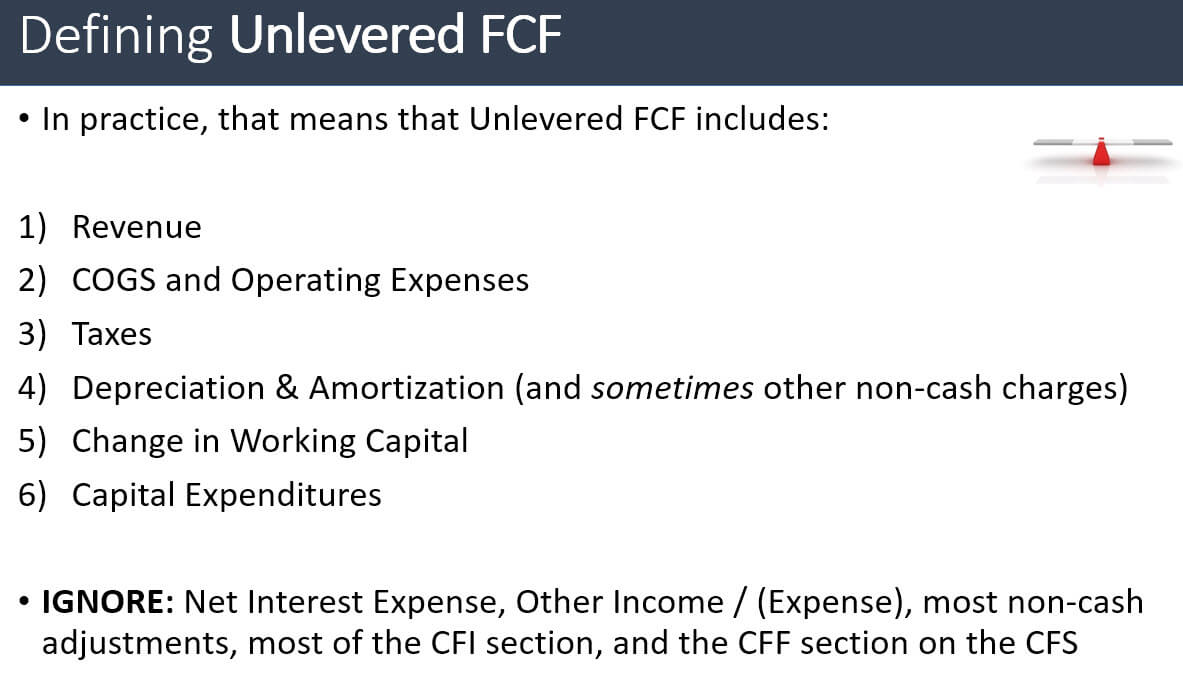

Unlevered Free Cash Flow Calculation - Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense.

Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for.

Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by.

Levered vs. unlevered free cash flow explained (formulas, examples

Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company.

unlevered free cash flow yield Yuri

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with.

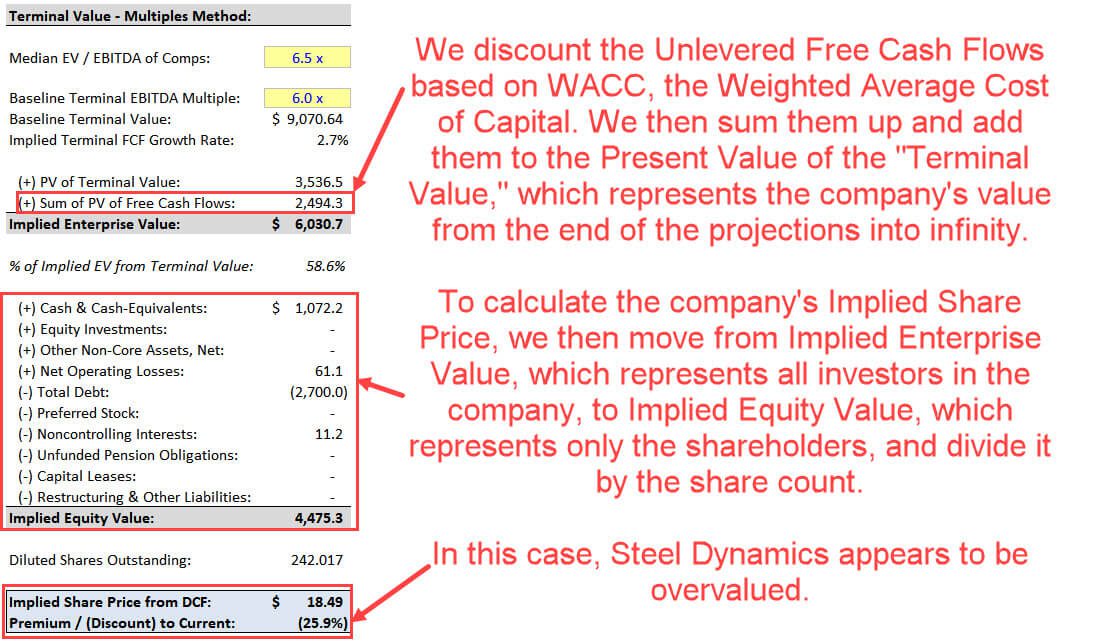

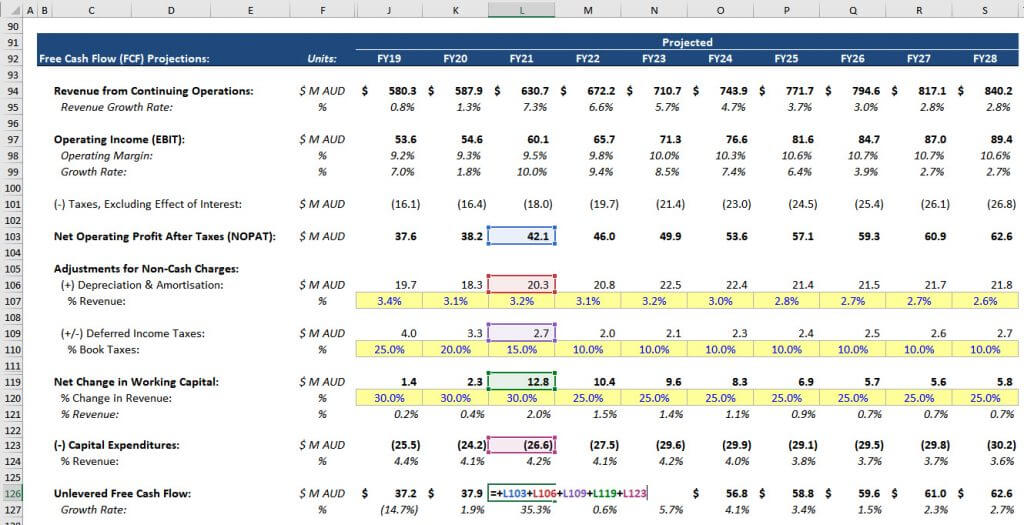

How to Calculate Unlevered Free Cash Flow in a DCF

Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. Unlevered free cash flow (ufcf) is an essential financial metric that.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a.

Unlevered Free Cash Flow Formulas, Calculations, and Full Tutorial

Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by.

How to Calculate Unlevered Free Cash Flow in a DCF

Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with a clear picture of a. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by.

Unlevered free cash flow

In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. Unlevered free cash flow (ufcf) is an essential financial metric that provides investors and analysts with.

Unlevered Free Cash Flow (Ufcf) Is An Essential Financial Metric That Provides Investors And Analysts With A Clear Picture Of A.

Unlevered free cash flow is a theoretical cash flow figure for a business, assuming the company is completely debt free with no interest expense. The formula for calculating unlevered free cash flow (ufcf) is nopat plus d&a, subtracted by increase in net working. In this tutorial, you’ll learn why unlevered free cash flow is important, the items you should include and exclude, and how to calculate it for.