Uae Vat Guide Pdf - This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. Overview of vat what is vat? If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during.

Overview of vat what is vat? This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter.

Overview of vat what is vat? This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger.

Guide to UAE VAT Registration & Eligibility

If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. Overview of vat what is vat? (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. This guide is an overview of the uae’s value added tax (“vat”) system, focused.

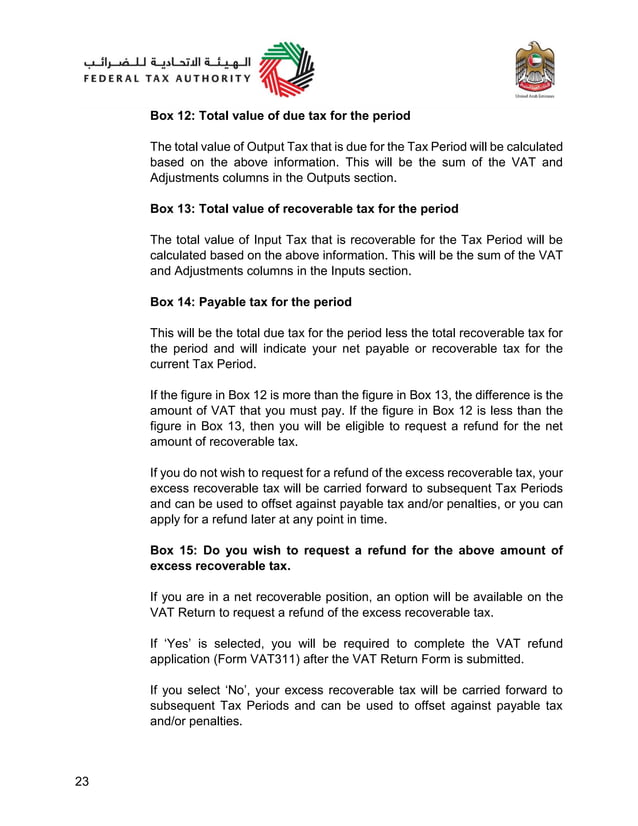

UAE VAT Returns Guide in English PDF

Overview of vat what is vat? All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. (uae) vat on imports is payable on reverse charge basis pi al asset.

UAE Comprehensive VAT Guide PDF Value Added Tax Taxes

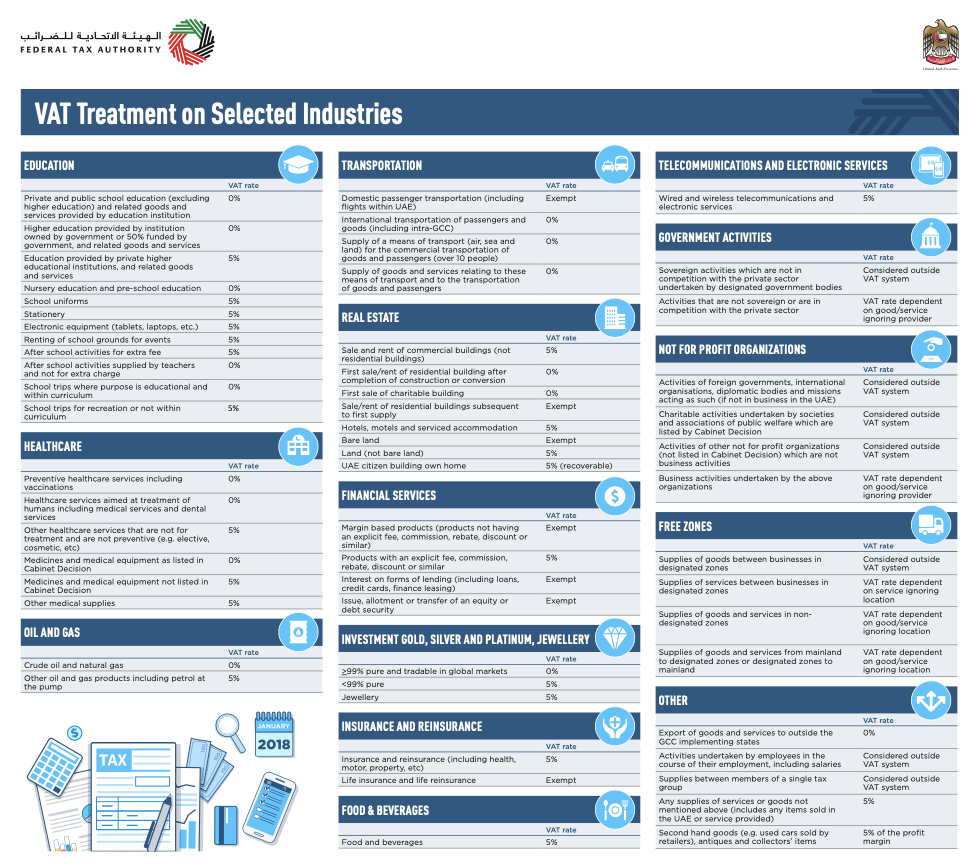

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. All countries that enjoy full membership of the cooperation council for the arab states of the gulf.

UAE VAT and VAT Reports A Complete Guide

If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses.

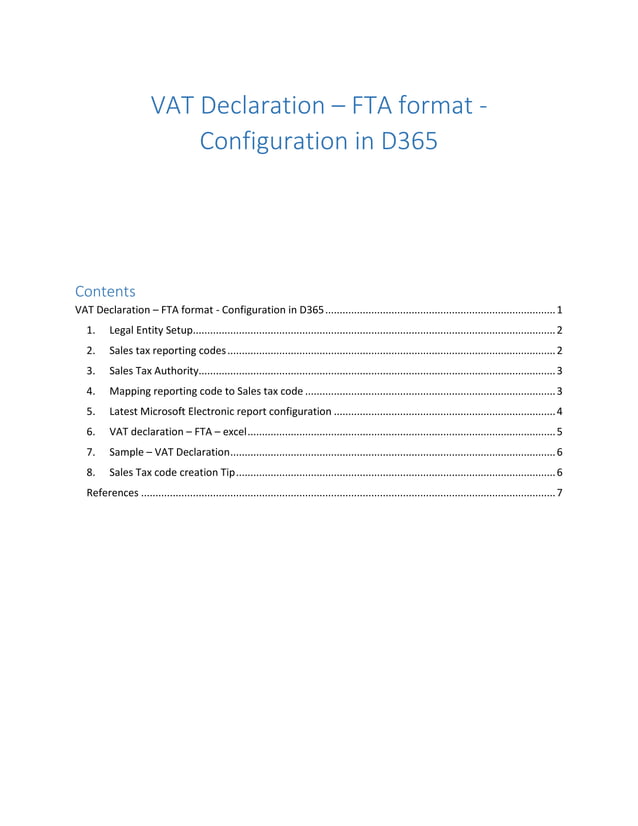

UAE FTA Vat declaration config guide PDF

If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. Broadly, vat exemptions in uae are given for certain financial services, residential building, and.

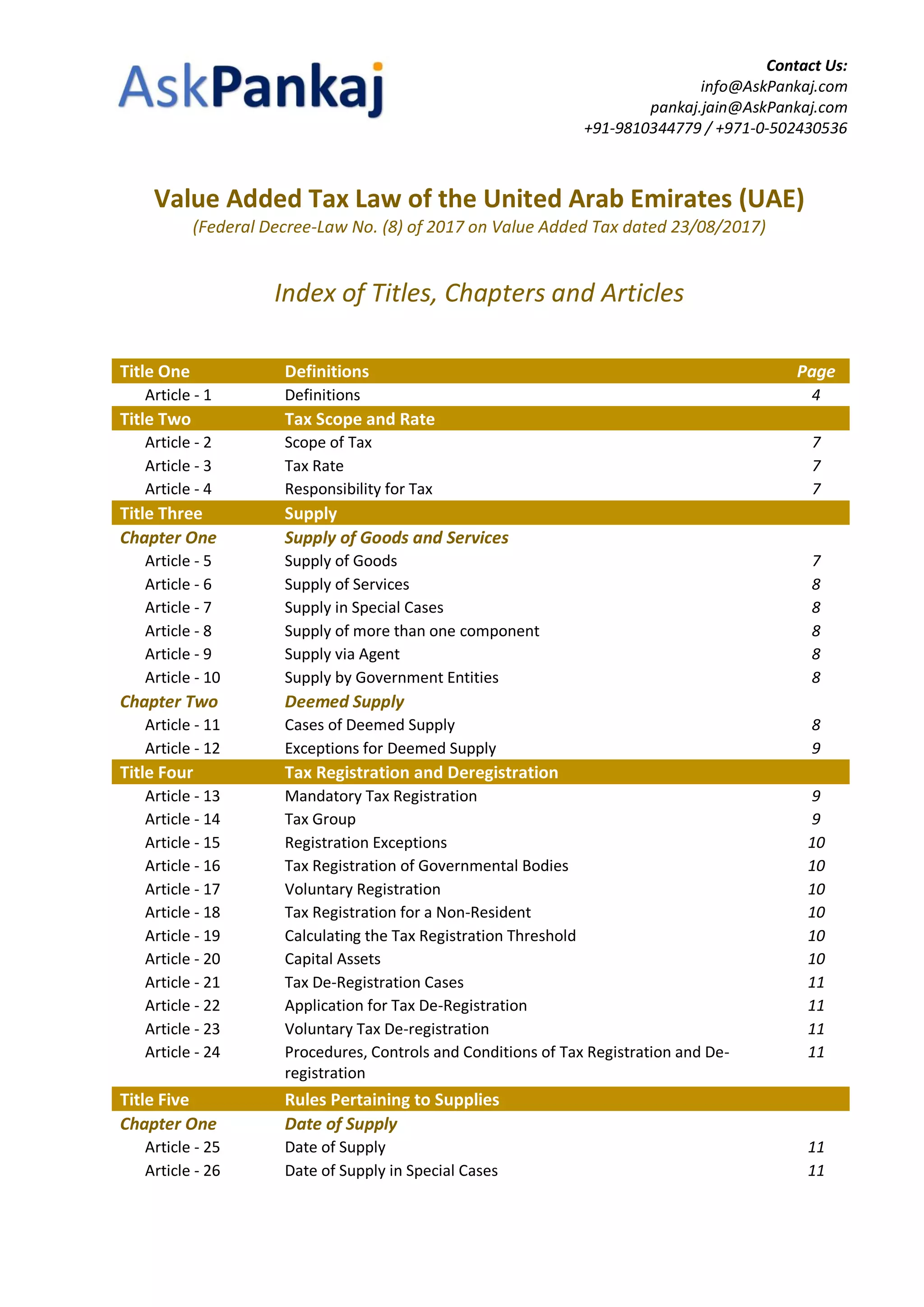

A COMPREHENSIVE GUIDE ON UAE VALUE ADDED TAX UAE VAT SIMPLIFIED by CA

If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of.

Uae Vat Return Hoe To File? PDF Value Added Tax Customs

Overview of vat what is vat? If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. Broadly, vat exemptions in uae are given for certain financial services, residential building, and.

AskPankaj Value Added Tax (VAT) law of the United Arab Emirates (UAE

Broadly, vat exemptions in uae are given for certain financial services, residential building, and supply of bare land, local passenger. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. All countries that enjoy full membership of the cooperation council for the arab states of the gulf.

UAE VAT Returns Guide in English PDF

Overview of vat what is vat? If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. All countries that enjoy full membership of the cooperation council for the arab states.

uaevatguide PDF Value Added Tax Goods

This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. Overview of vat what is vat? All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. (uae) vat on imports is payable on reverse charge basis.

Overview Of Vat What Is Vat?

All countries that enjoy full membership of the cooperation council for the arab states of the gulf pursuant to its charter. (uae) vat on imports is payable on reverse charge basis pi al asset scheme value added 1. This guide is an overview of the uae’s value added tax (“vat”) system, focused on how it affects foreign businesses trading with uae. If you are registered for vat and any circumstances occur that will impact your tax records kept by the fta, as provided during.