Tracking Expenses And Income For Tax Purposes - Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Tracker Printable

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

expense tracker homepagelord

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

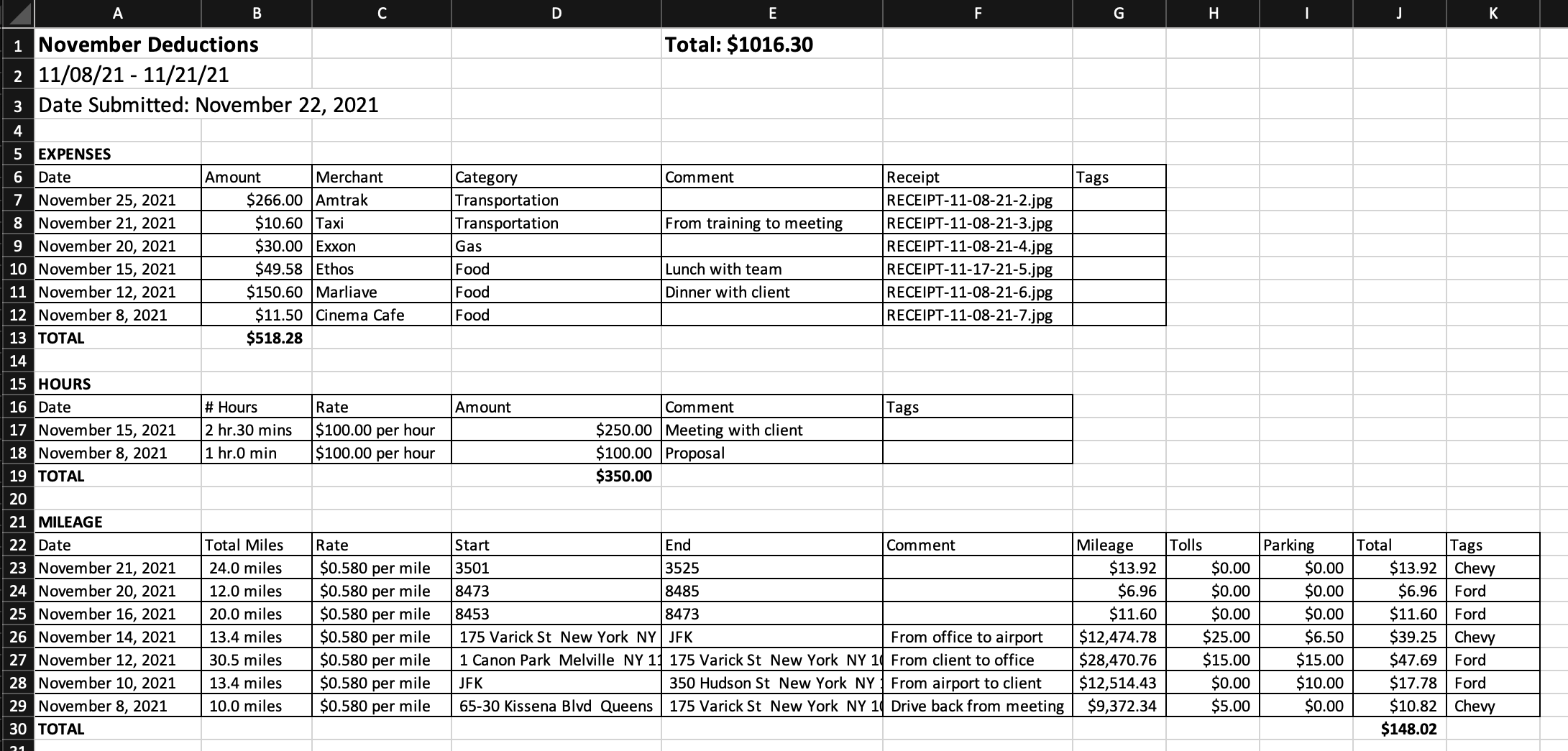

Tax Deduction Tracker Printable Business Tax Log Expenses Etsy

Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

The Best Expense Report Template in Excel Falcon Expenses Blog

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

This Printable and expense tracker allows you to easily track

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

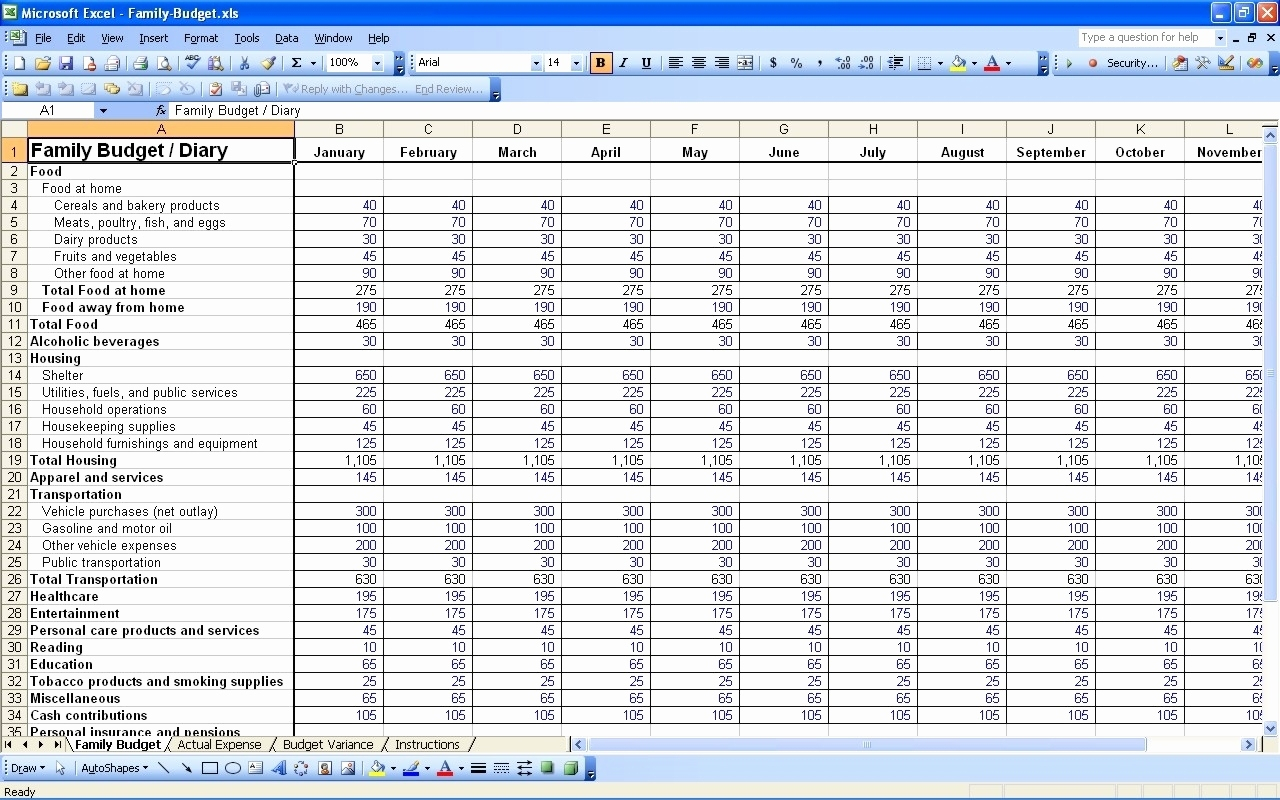

Simple spreadsheets to keep track of business and expenses for

Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.

Free Business Expense Tracking Spreadsheet (2025)

Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Keeper Tax Customers

Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Tax Expenses Spreadsheet Template

Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of. Find out the kinds of records you should keep for your business to show income and expenses for federal tax purposes.

Find Out The Kinds Of Records You Should Keep For Your Business To Show Income And Expenses For Federal Tax Purposes.

Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of.