Track Employee Business Expenses Tax - Common deductible expenses include mileage,. Tracking business expenses for taxes is a crucial practice that every business owner must master. Simple pricingeasily track pto & more Tracking business expenses helps maximize tax deductions and manage cash flow effectively.

Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Common deductible expenses include mileage,. Simple pricingeasily track pto & more Tracking business expenses for taxes is a crucial practice that every business owner must master.

Common deductible expenses include mileage,. Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Simple pricingeasily track pto & more Tracking business expenses for taxes is a crucial practice that every business owner must master.

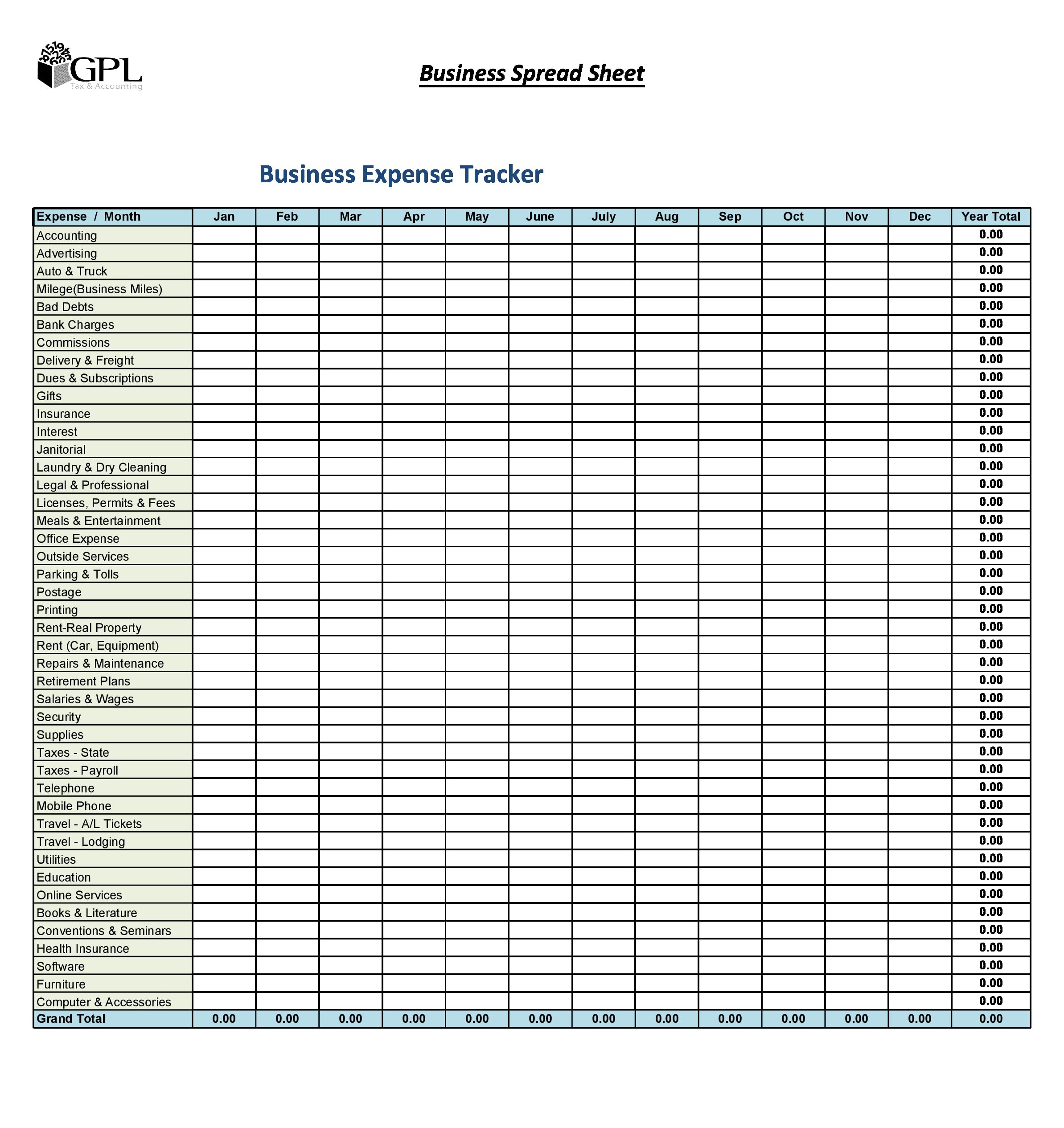

Business expense tracker richnored

Common deductible expenses include mileage,. Simple pricingeasily track pto & more Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Tracking business expenses for taxes is a crucial practice that every business owner must master.

IRS Form 2106 A Guide to Employee Business Expenses

Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Tracking business expenses for taxes is a crucial practice that every business owner must master. Common deductible expenses include mileage,. Simple pricingeasily track pto & more

Free Excel Business Expense Templates

Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Common deductible expenses include mileage,. Tracking business expenses for taxes is a crucial practice that every business owner must master. Simple pricingeasily track pto & more

How to Keep Track of Small Business Expenses in Excel (2 Ways)

Simple pricingeasily track pto & more Tracking business expenses for taxes is a crucial practice that every business owner must master. Common deductible expenses include mileage,. Tracking business expenses helps maximize tax deductions and manage cash flow effectively.

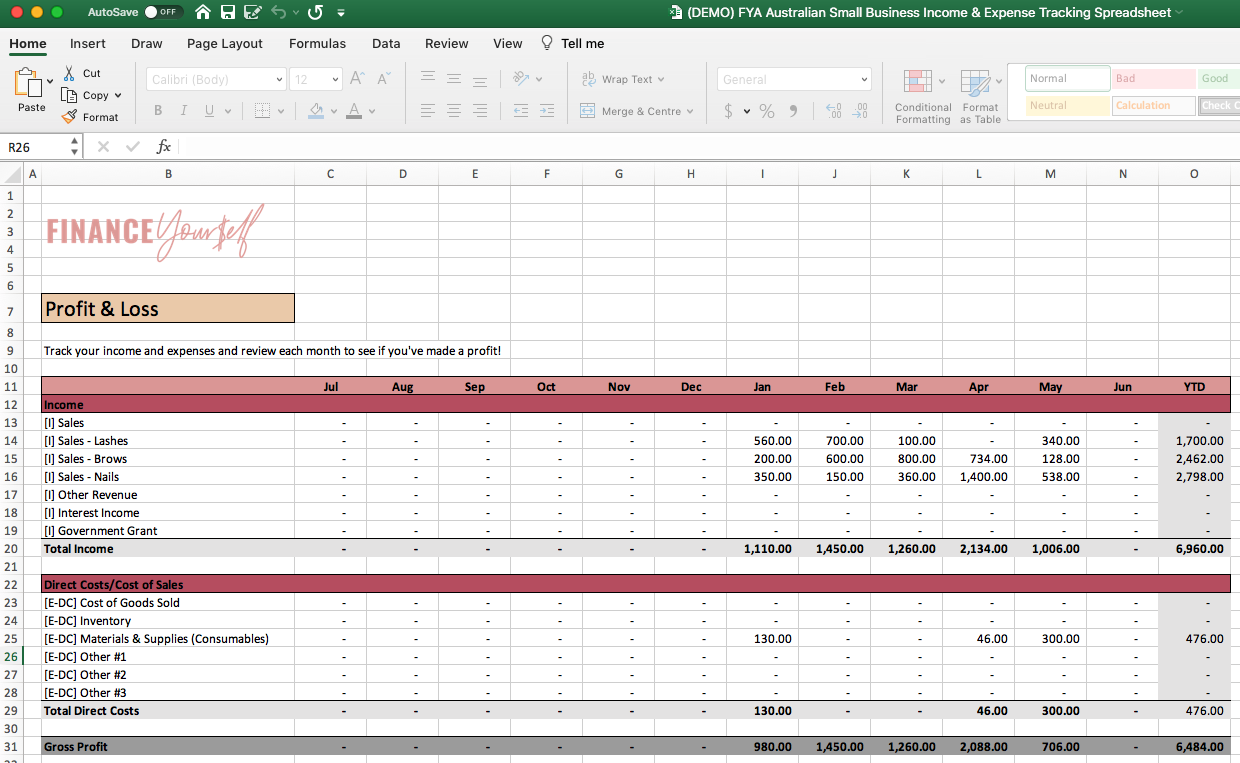

FREE Australian Small Business & Expense Tracking Spreadsheet

Tracking business expenses for taxes is a crucial practice that every business owner must master. Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Common deductible expenses include mileage,. Simple pricingeasily track pto & more

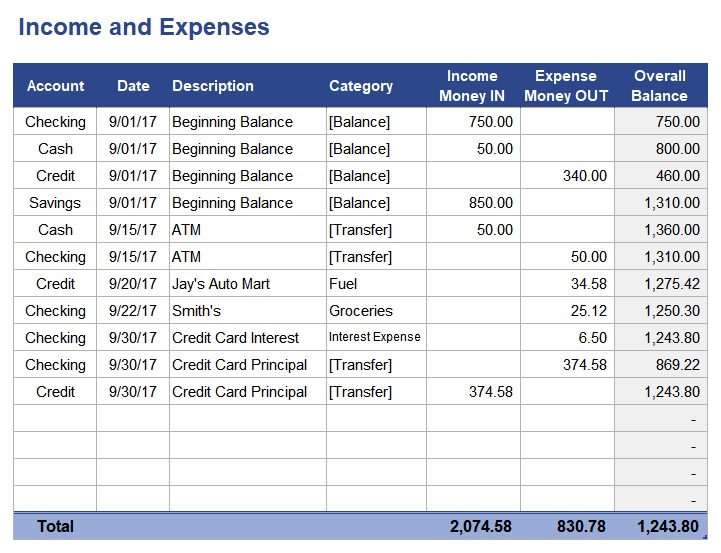

Free Excel Expense Report Templates Smartsheet

Tracking business expenses for taxes is a crucial practice that every business owner must master. Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Simple pricingeasily track pto & more Common deductible expenses include mileage,.

Free Template Excel Spreadsheet for Business Expenses

Common deductible expenses include mileage,. Simple pricingeasily track pto & more Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Tracking business expenses for taxes is a crucial practice that every business owner must master.

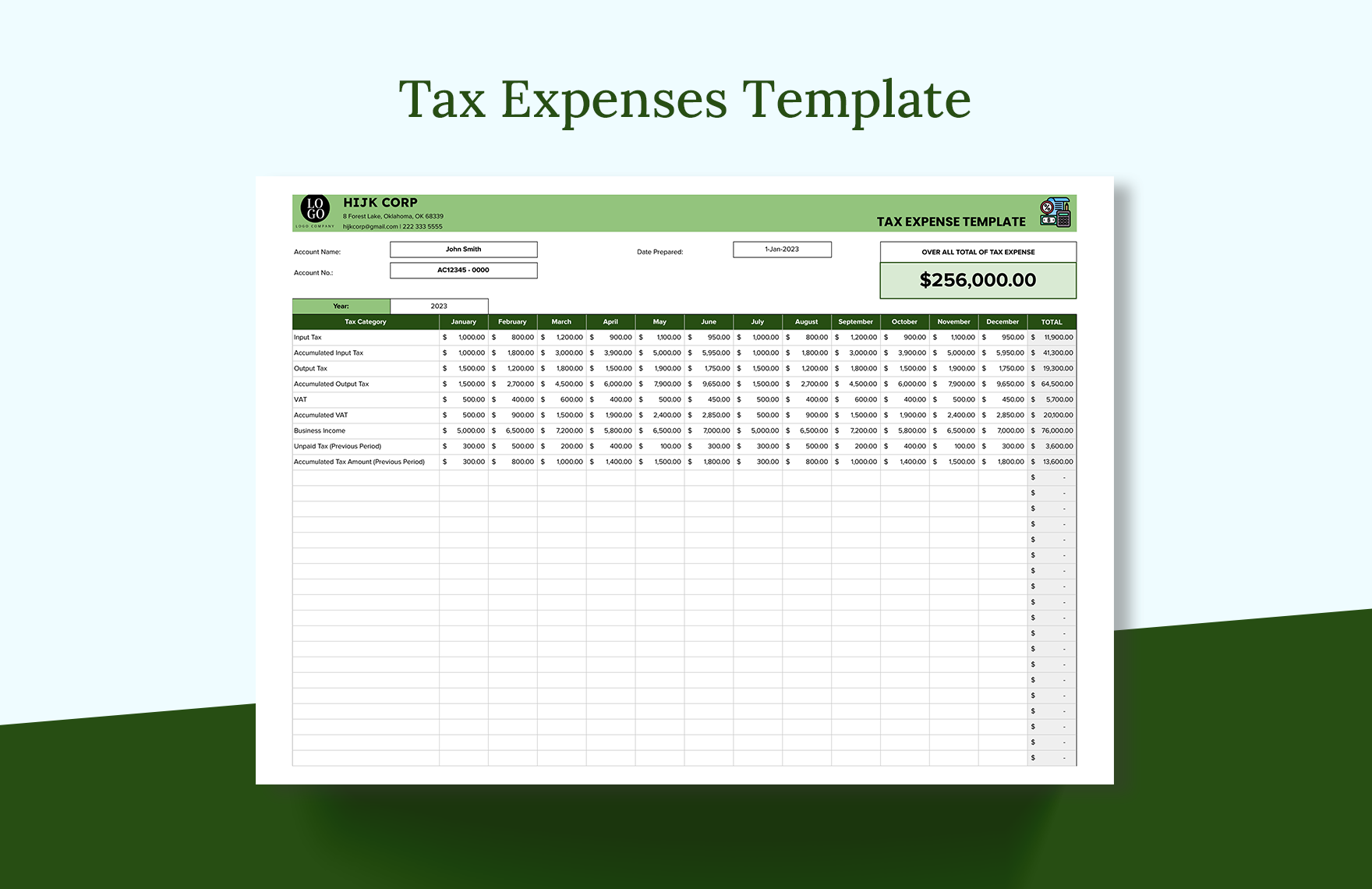

Tax Expenses Template Excel, Google Sheets

Simple pricingeasily track pto & more Tracking business expenses for taxes is a crucial practice that every business owner must master. Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Common deductible expenses include mileage,.

Online Employee Expense Tracking Software Talygen

Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Tracking business expenses for taxes is a crucial practice that every business owner must master. Simple pricingeasily track pto & more Common deductible expenses include mileage,.

30 Best Business Expense Spreadsheets (100 Free) TemplateArchive

Tracking business expenses for taxes is a crucial practice that every business owner must master. Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Simple pricingeasily track pto & more Common deductible expenses include mileage,.

Simple Pricingeasily Track Pto & More

Tracking business expenses helps maximize tax deductions and manage cash flow effectively. Tracking business expenses for taxes is a crucial practice that every business owner must master. Common deductible expenses include mileage,.