Tax Procedures Law Uae Vat - • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person.

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person.

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax.

Major announcement on amendments in Tax Procedure Law in UAE

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information,.

UAE VAT Law Key Updates and Expert Advice 2023

• under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person. Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta,.

UAE Tax Laws for Businesses VAT and Corporate tax

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information,.

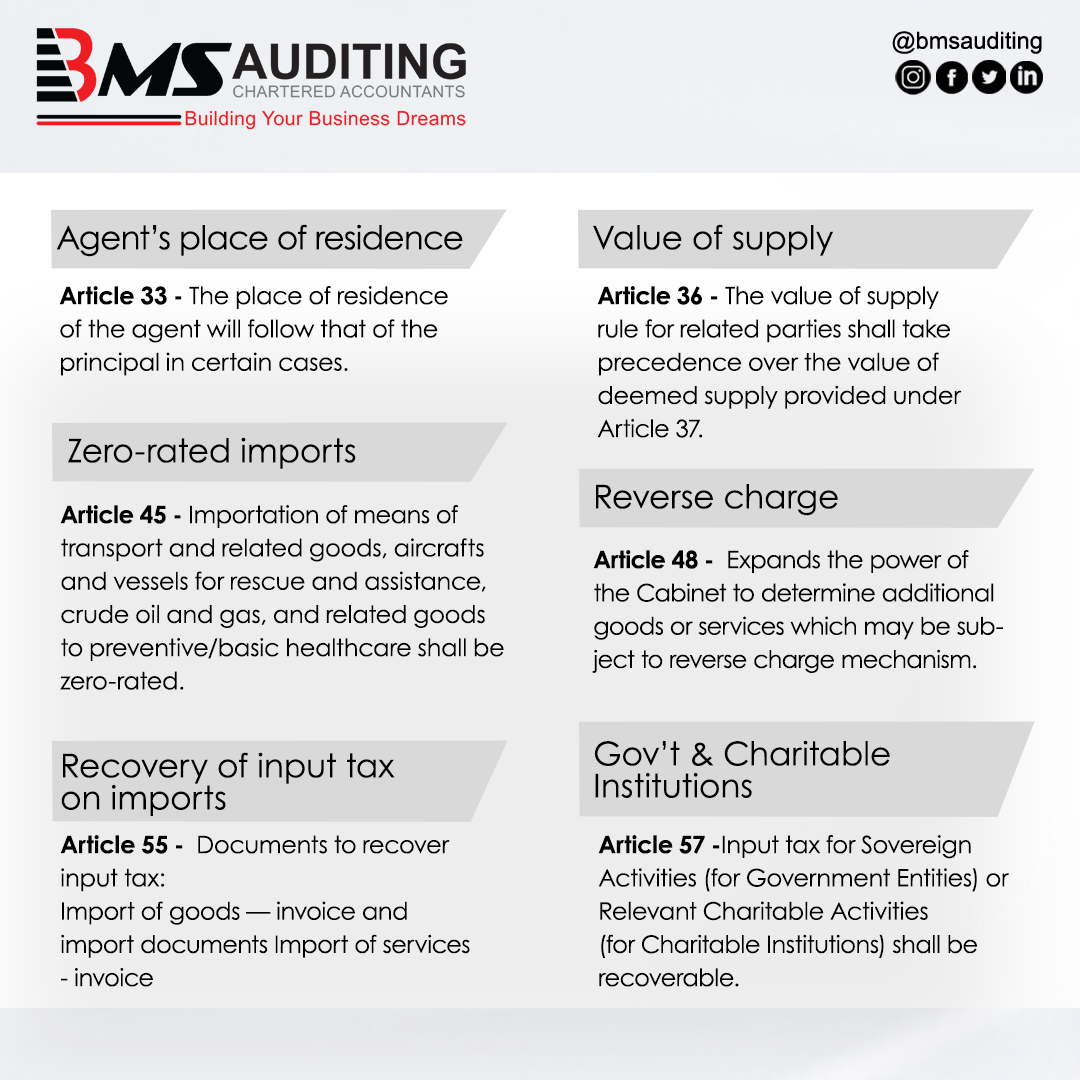

UAE announces changes to VAT provisions (Updated) BMS

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information,.

VAT Audit Are you ready for FTA VAT Audit in UAE? VAT inspection UAE

• under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person. Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta,.

UAE's Tax Procedures Law VAT & Excise Tax Compliance Guide

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person. • under the uae tax procedure law, any person conducting business must keep accounting and commercial.

A Brief Guide on UAE VAT Filling Process AKA

• under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. A procedure undertaken by the authority to inspect the commercial records or any information,.

Everything You Must know about New Tax Procedure Law of UAE for VAT

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information,.

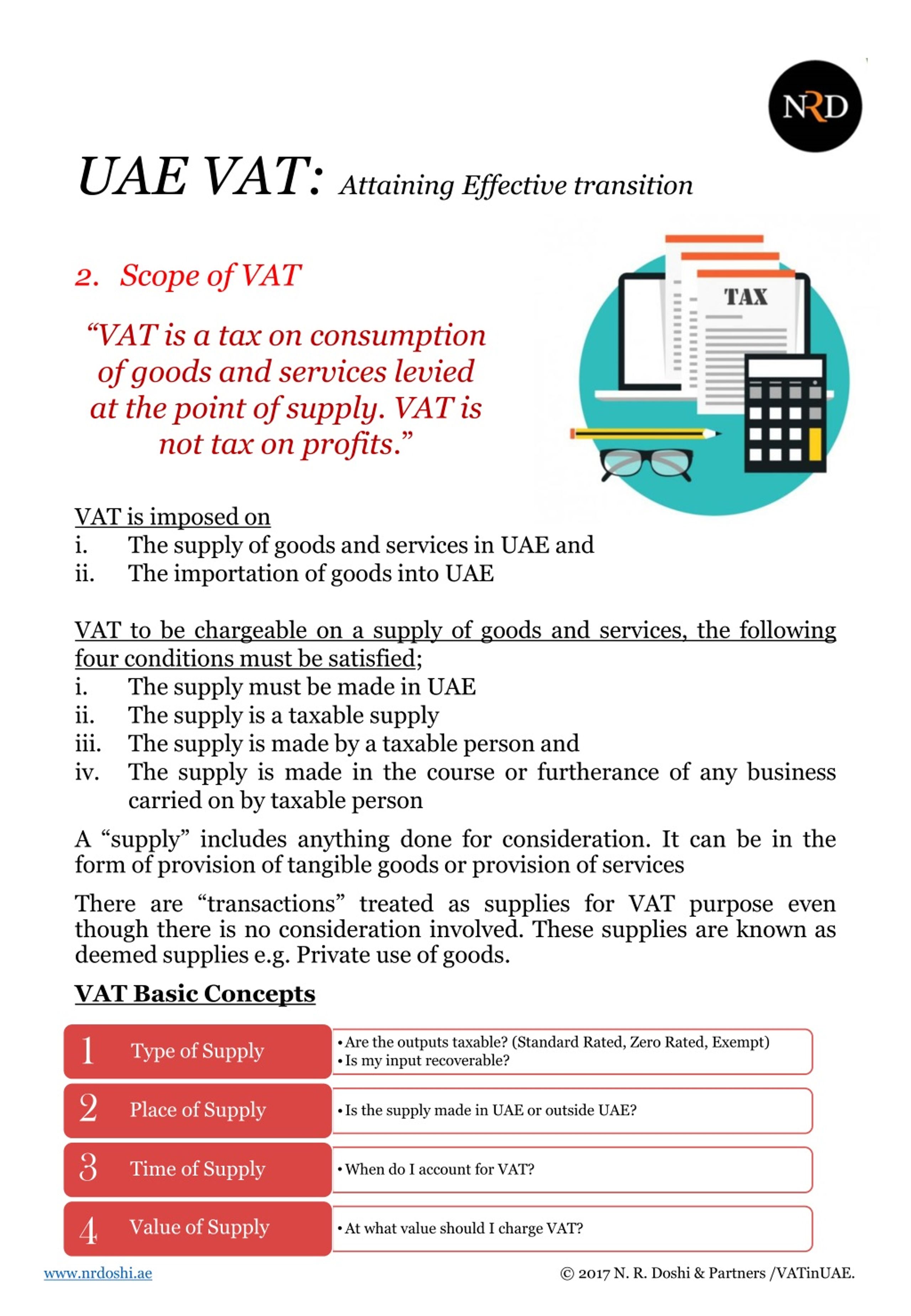

PPT UAE VAT Attaining an Effective Transition PowerPoint

A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta,.

Chapter 1 UAE VAT Laws and Procedures Course PDF Value Added Tax

Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this. • under the uae tax procedure law, any person conducting business must keep accounting and commercial books of his business and any tax. A procedure undertaken by the authority to inspect the commercial records or any information,.

• Under The Uae Tax Procedure Law, Any Person Conducting Business Must Keep Accounting And Commercial Books Of His Business And Any Tax.

A procedure undertaken by the authority to inspect the commercial records or any information, data or goods related to a person. Regulate rights and obligations of the fta, taxpayers and any other person dealing with the fta, in compliance with the provisions of this.