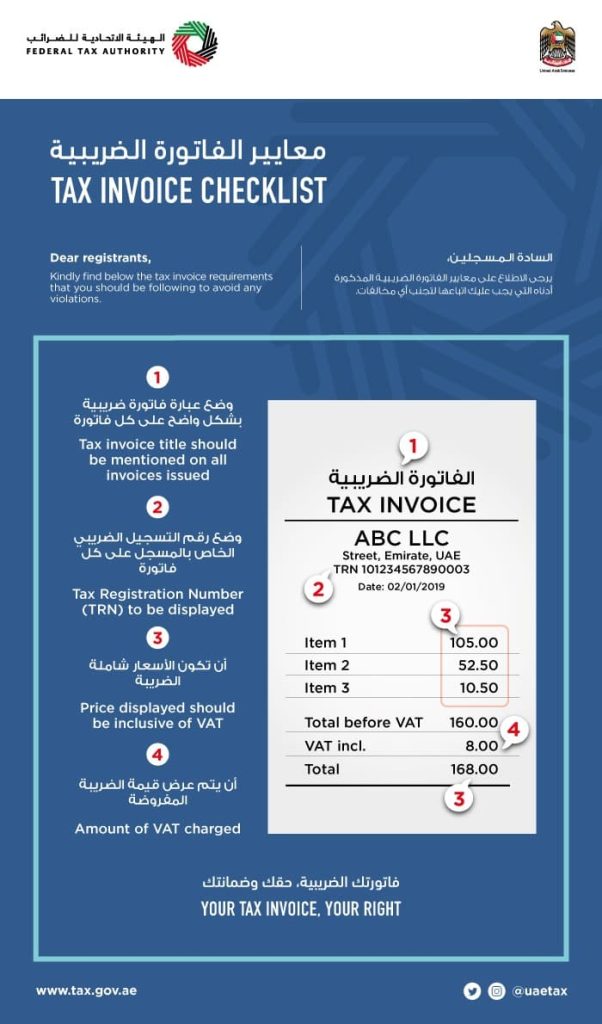

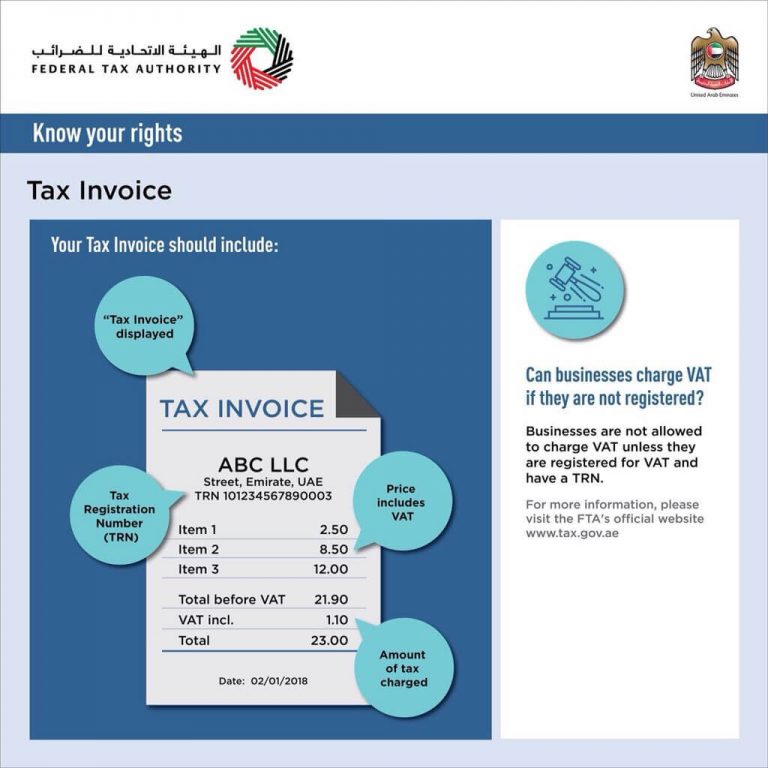

Tax Invoice Rules In Uae - On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount.

It must include trn, invoice date, vat rate, and total amount. On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies.

It must include trn, invoice date, vat rate, and total amount. On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies.

UAE Tax Invoice Formats What You Need to Know

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding.

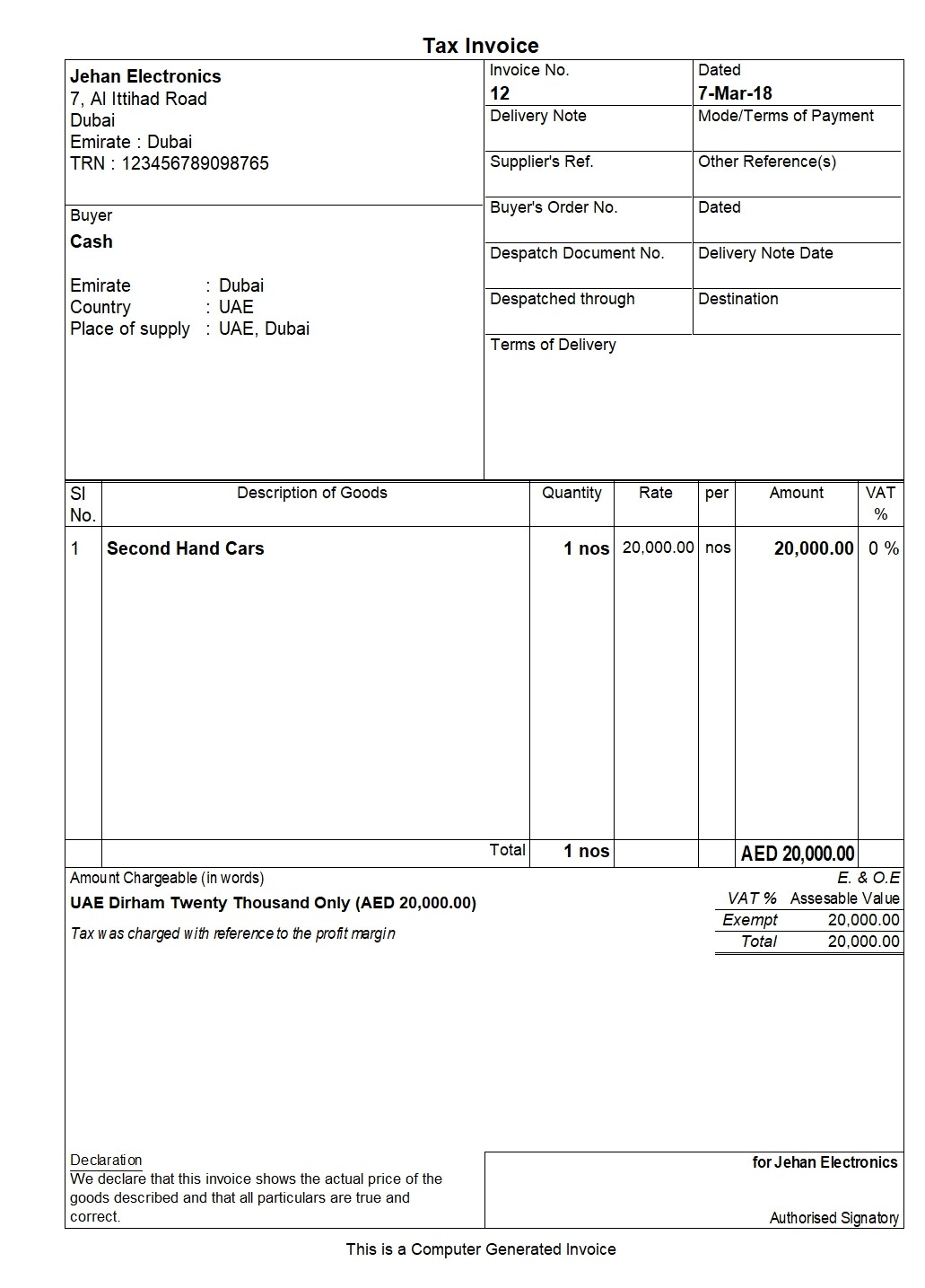

Detailed Tax Invoice All About TAX In UAE

It must include trn, invoice date, vat rate, and total amount. On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount.

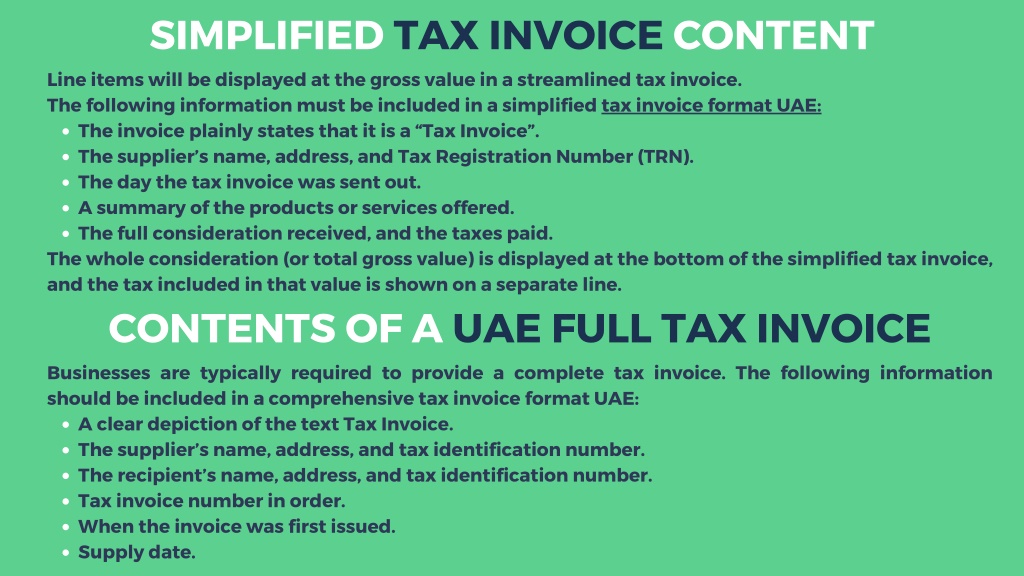

Invoices in UAE All You Need to Know

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount.

Rules Regarding the Issuance of Tax Invoices Format UAE

On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount.

PPT Tax Invoice Format UAE PowerPoint Presentation, free download

On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies.

Tax Invoice Under VAT in UAE Shuraa Tax

On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies.

Simplified Tax Invoice under VAT Tax Invoice Format

On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding. It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. On 30 may 2025, the uae federal tax authority (“ fta ”) issued public clarification vatp044, shedding light on the obligations surrounding.

On 30 May 2025, The Uae Federal Tax Authority (“ Fta ”) Issued Public Clarification Vatp044, Shedding Light On The Obligations Surrounding.

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies.