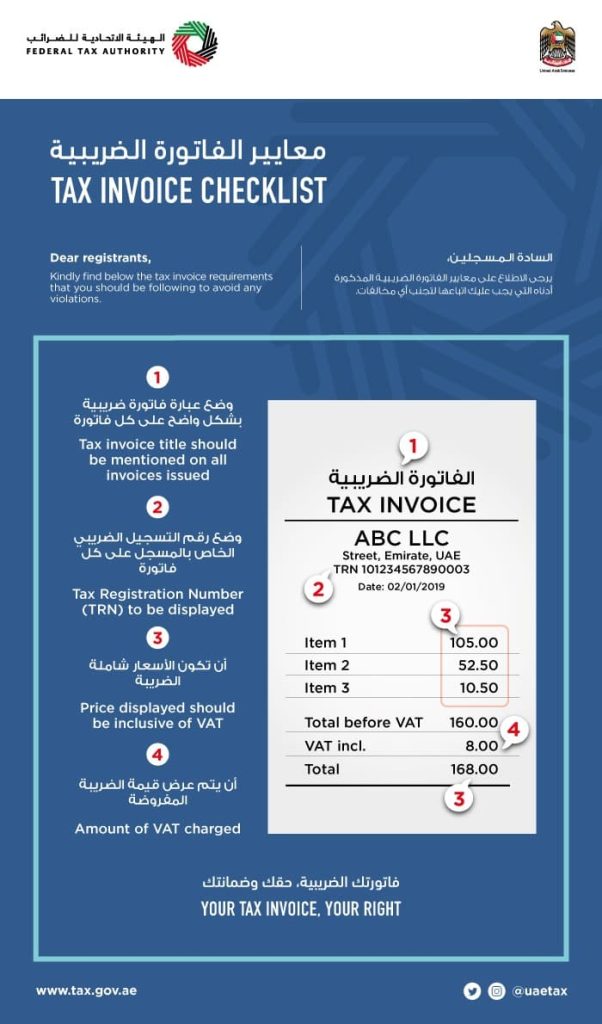

Tax Invoice For Advance Payment Uae - Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month

Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month

Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Detailed Tax Invoice All About TAX In UAE

Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month

Advance Invoice in UAE Meaning, Pros & Cons

Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Invoices in UAE All You Need to Know

Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

10k+ visitors in the past month Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

UAE VAT Tax Invoice Template PDF Invoice Value Added Tax

Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. 10k+ visitors in the past month

Tax Invoice in the UAE, all you need to know

Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Invoice Format Word Arabic

10k+ visitors in the past month Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14.

Invoice Format Word Arabic

10k+ visitors in the past month Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

3 Top Invoicing Tools (Free & Paid) for UAE

Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat.

Free Proforma Invoice Maker for UAE (PDF)

Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. Under uae vat law, you are generally obligated to issue a tax invoice for any advance or down payment received within 14. 10k+ visitors in the past month

Under Uae Vat Law, You Are Generally Obligated To Issue A Tax Invoice For Any Advance Or Down Payment Received Within 14.

Issuing a tax invoice in the uae involves certain key steps that ensure compliance with all the requirements of vat. 10k+ visitors in the past month