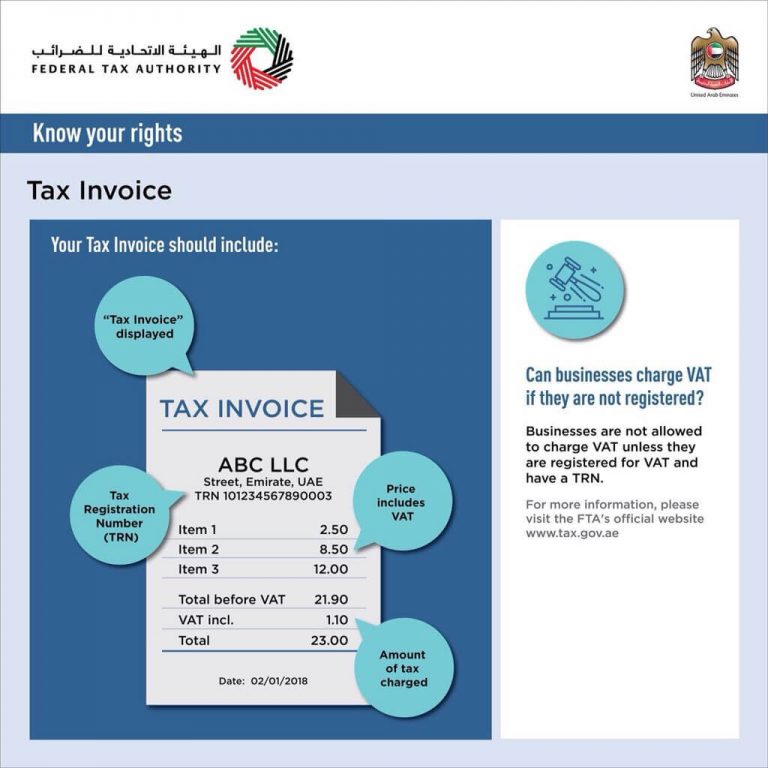

Tax Invoice As Per Fta - Shrink cycle timeseasy to install and use 99% retention ratemultiple erp integrations The federal tax authority (fta) mandates two types of tax invoices: A tax invoice in the uae must meet specific standards set by the federal tax authority. It must include trn, invoice date, vat rate, and total amount. 99% retention ratemultiple erp integrations A tax invoice is essential under uae vat law for taxable supplies. Simplified (for specific cases) and full (for values over. What should a tax invoice in the uae include?

What should a tax invoice in the uae include? Shrink cycle timeseasy to install and use It must include trn, invoice date, vat rate, and total amount. The federal tax authority (fta) mandates two types of tax invoices: A tax invoice is essential under uae vat law for taxable supplies. A tax invoice in the uae must meet specific standards set by the federal tax authority. 99% retention ratemultiple erp integrations 99% retention ratemultiple erp integrations Simplified (for specific cases) and full (for values over.

99% retention ratemultiple erp integrations A tax invoice in the uae must meet specific standards set by the federal tax authority. Shrink cycle timeseasy to install and use What should a tax invoice in the uae include? 99% retention ratemultiple erp integrations It must include trn, invoice date, vat rate, and total amount. Simplified (for specific cases) and full (for values over. The federal tax authority (fta) mandates two types of tax invoices: A tax invoice is essential under uae vat law for taxable supplies.

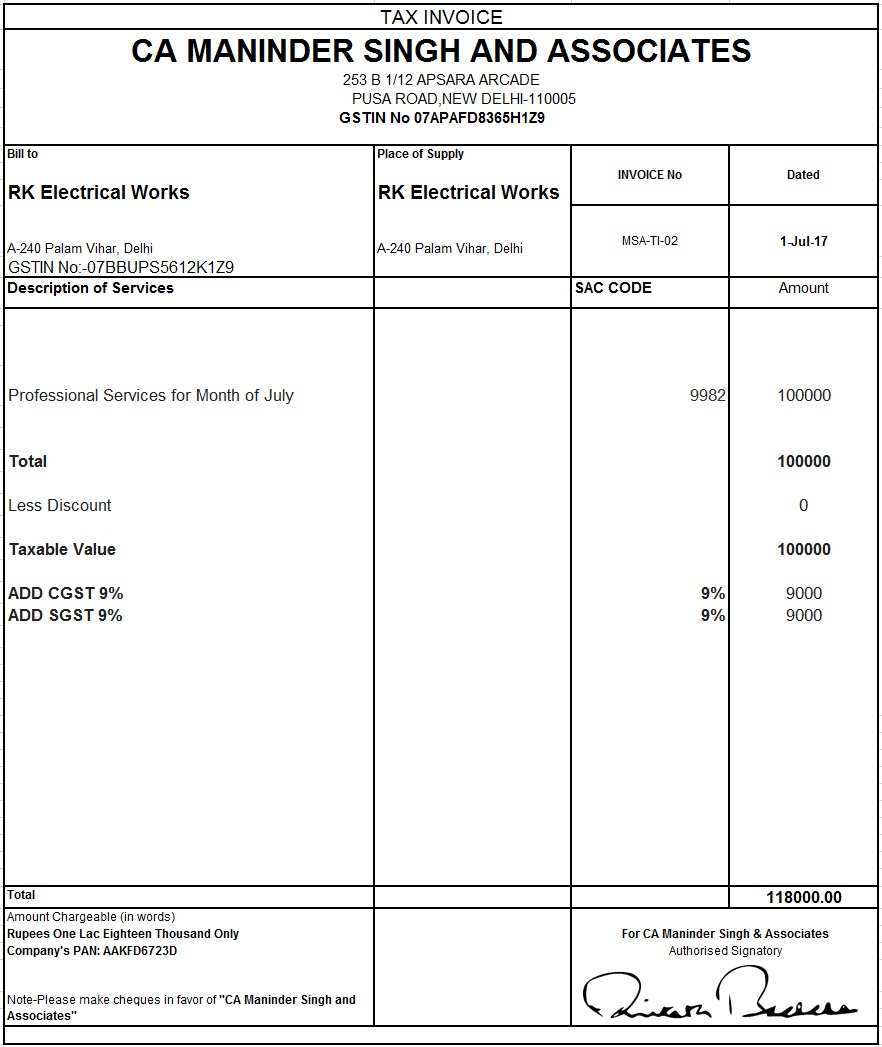

21 Create Tax Invoice Format By Fta For Free by Tax Invoice Format By

A tax invoice in the uae must meet specific standards set by the federal tax authority. 99% retention ratemultiple erp integrations It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. The federal tax authority (fta) mandates two types of tax invoices:

71 Free Printable Vat Invoice Format As Per Fta Maker with Vat Invoice

Simplified (for specific cases) and full (for values over. What should a tax invoice in the uae include? A tax invoice in the uae must meet specific standards set by the federal tax authority. A tax invoice is essential under uae vat law for taxable supplies. 99% retention ratemultiple erp integrations

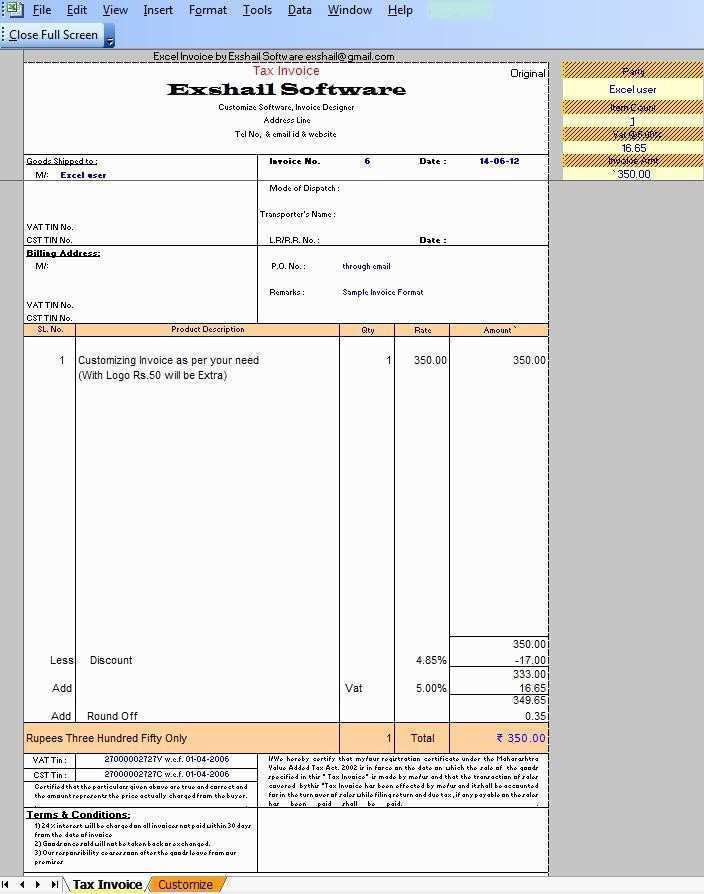

Record Sales and Print Invoices as per FTA (for UAE)

Simplified (for specific cases) and full (for values over. It must include trn, invoice date, vat rate, and total amount. Shrink cycle timeseasy to install and use A tax invoice is essential under uae vat law for taxable supplies. The federal tax authority (fta) mandates two types of tax invoices:

18 Free Tax Invoice Format By Fta Photo by Tax Invoice Format By Fta

Simplified (for specific cases) and full (for values over. A tax invoice is essential under uae vat law for taxable supplies. Shrink cycle timeseasy to install and use 99% retention ratemultiple erp integrations 99% retention ratemultiple erp integrations

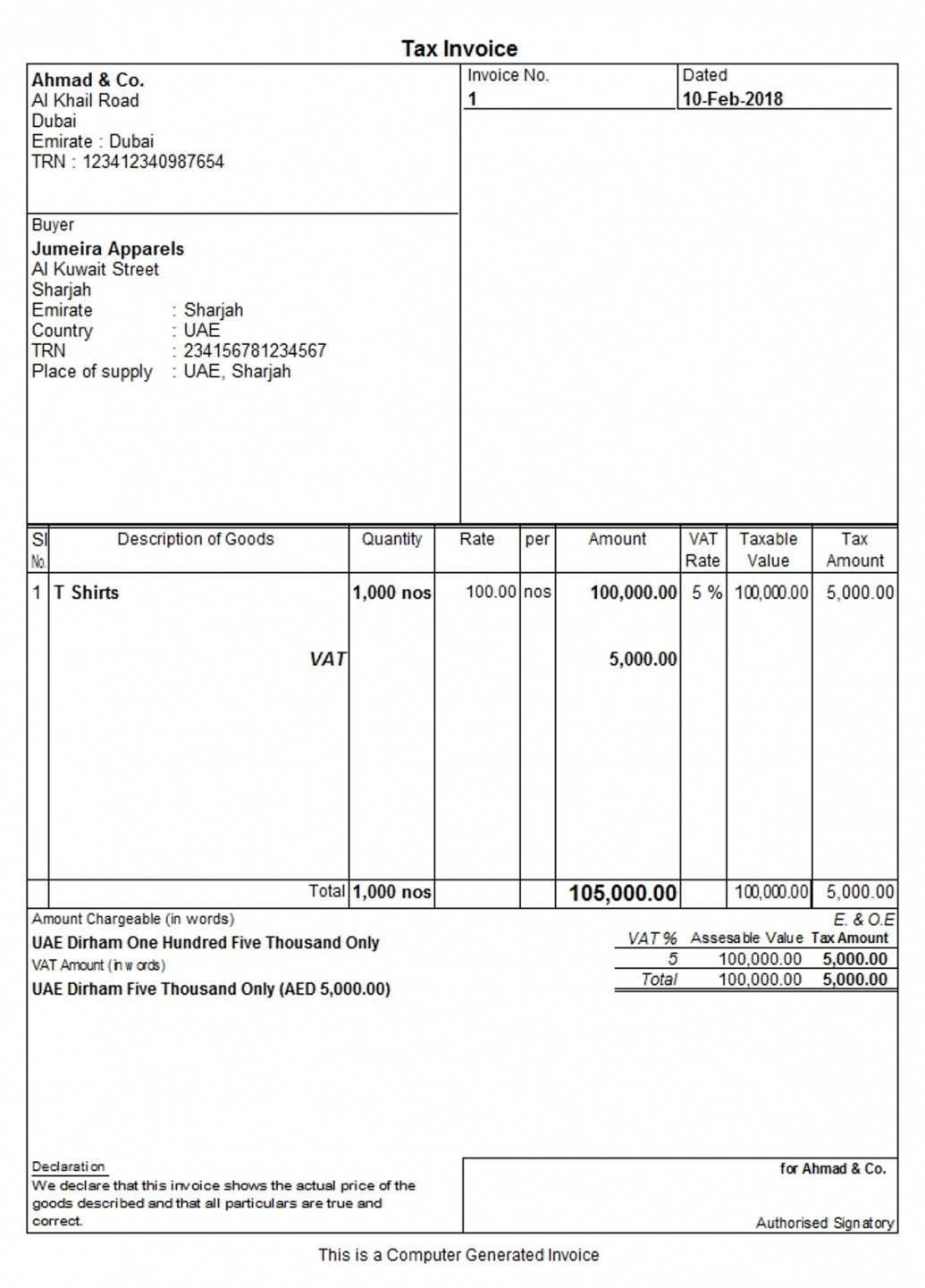

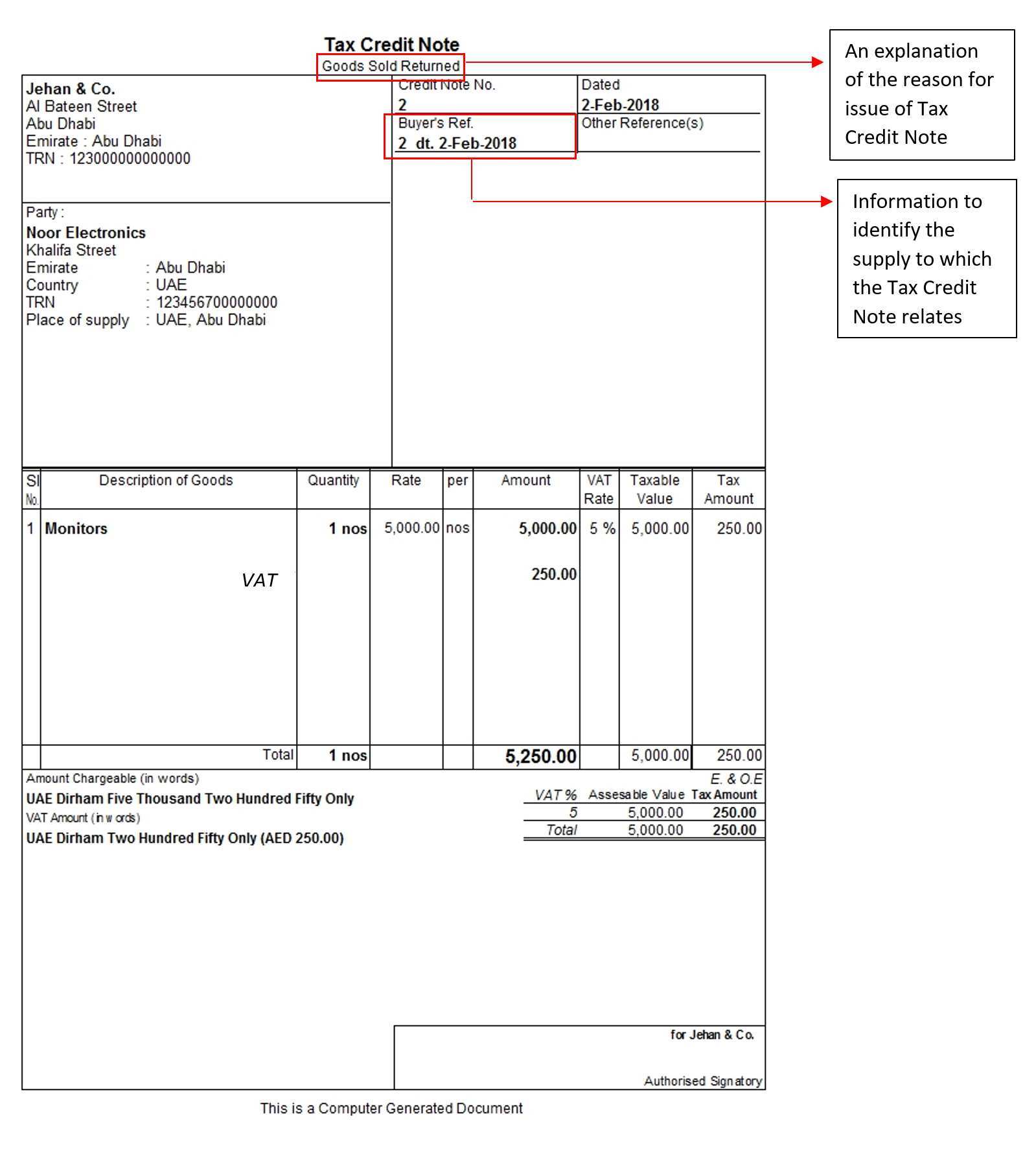

Detailed Tax Invoice All About TAX In UAE

It must include trn, invoice date, vat rate, and total amount. Shrink cycle timeseasy to install and use Simplified (for specific cases) and full (for values over. A tax invoice in the uae must meet specific standards set by the federal tax authority. The federal tax authority (fta) mandates two types of tax invoices:

Record Sales and Print Invoices as per FTA (for UAE)

Shrink cycle timeseasy to install and use 99% retention ratemultiple erp integrations What should a tax invoice in the uae include? The federal tax authority (fta) mandates two types of tax invoices: A tax invoice is essential under uae vat law for taxable supplies.

29 Blank Vat Invoice Format As Per Fta Templates by Vat Invoice Format

Shrink cycle timeseasy to install and use It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. 99% retention ratemultiple erp integrations 99% retention ratemultiple erp integrations

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

99% retention ratemultiple erp integrations It must include trn, invoice date, vat rate, and total amount. A tax invoice in the uae must meet specific standards set by the federal tax authority. A tax invoice is essential under uae vat law for taxable supplies. The federal tax authority (fta) mandates two types of tax invoices:

Tax invoice format Checklist as per FTA

A tax invoice in the uae must meet specific standards set by the federal tax authority. Simplified (for specific cases) and full (for values over. A tax invoice is essential under uae vat law for taxable supplies. 99% retention ratemultiple erp integrations The federal tax authority (fta) mandates two types of tax invoices:

Record Sales and Print Invoices as per FTA (for UAE)

Shrink cycle timeseasy to install and use What should a tax invoice in the uae include? Simplified (for specific cases) and full (for values over. A tax invoice in the uae must meet specific standards set by the federal tax authority. 99% retention ratemultiple erp integrations

The Federal Tax Authority (Fta) Mandates Two Types Of Tax Invoices:

Simplified (for specific cases) and full (for values over. 99% retention ratemultiple erp integrations Shrink cycle timeseasy to install and use What should a tax invoice in the uae include?

A Tax Invoice In The Uae Must Meet Specific Standards Set By The Federal Tax Authority.

99% retention ratemultiple erp integrations A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount.