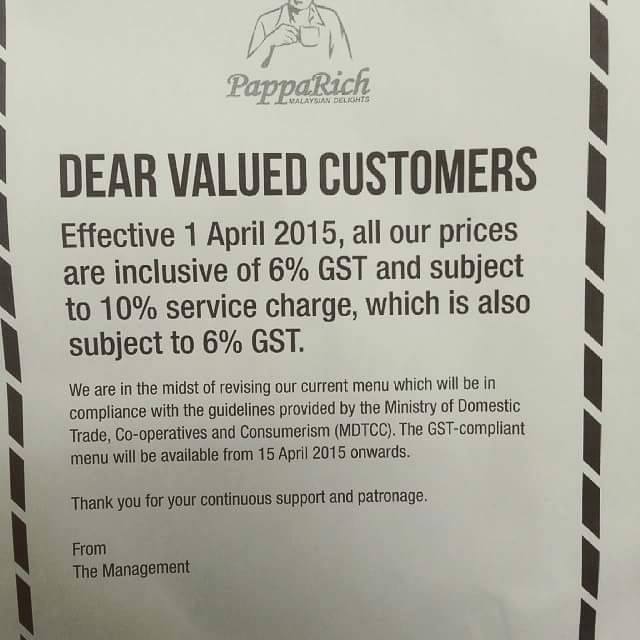

Service Charge In Malaysia - This is normally applied in the hospitality. • selected imported fruits (i.e. About services tax 1.what is service tax ? Made in the course or. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. The effective date to charge sales tax and service tax would be 1 july 2025. Any provision of taxable services; What’s new in malaysia sst 2025:

This is normally applied in the hospitality. • selected imported fruits (i.e. The effective date to charge sales tax and service tax would be 1 july 2025. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. About services tax 1.what is service tax ? The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. What’s new in malaysia sst 2025: Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. Made in the course or. Any provision of taxable services;

Made in the course or. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. About services tax 1.what is service tax ? The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. • selected imported fruits (i.e. Any provision of taxable services; What’s new in malaysia sst 2025: The effective date to charge sales tax and service tax would be 1 july 2025. This is normally applied in the hospitality. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of.

Service Charge Definition, Types, and Why It's Not a Tip

The effective date to charge sales tax and service tax would be 1 july 2025. Any provision of taxable services; Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. What’s new in malaysia sst 2025: About services tax 1.what is service.

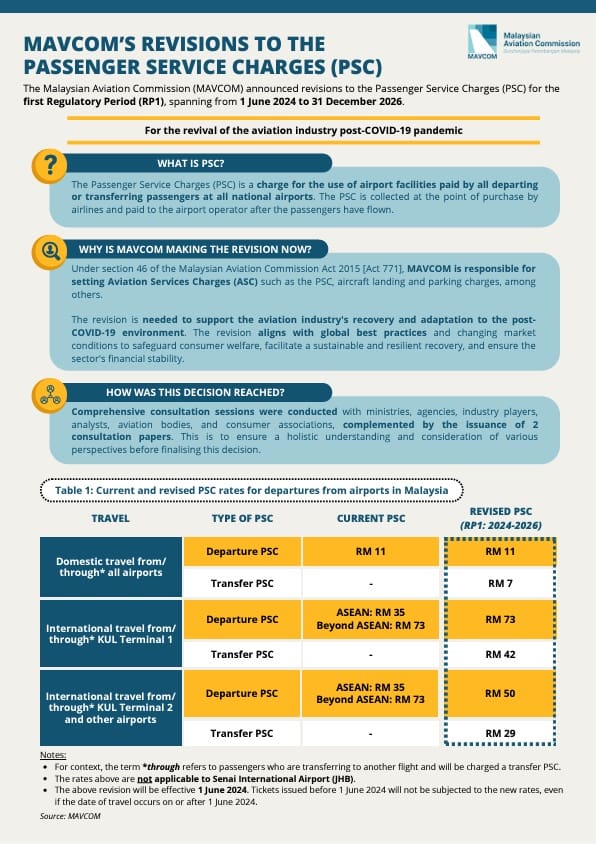

Announces Revisions to the Aviation Services Charges (ASC

• selected imported fruits (i.e. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. Made in the course or. What’s new in malaysia sst 2025:

Service charge trong kinh doanh khách sạn Những điều bạn cần biết

About services tax 1.what is service tax ? Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. • selected imported fruits (i.e. Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. Made in the.

హోటల్ బిల్లు లో వేసే సర్వీస్ ఛార్జ్ మీకు సర్వీస్ నచ్చితేనే

Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. What’s new in malaysia sst 2025: Any provision of taxable services; This is normally applied in the hospitality. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the.

Service Charge vs. Service Tax in Malaysia (2025) Dining Out World

• selected imported fruits (i.e. About services tax 1.what is service tax ? The effective date to charge sales tax and service tax would be 1 july 2025. Any provision of taxable services; Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of.

Sales & Service Tax (SST) in Malaysia VERY Complete Guide

Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. • selected imported fruits (i.e. This is normally applied in the hospitality. Made in the course or. The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific.

Service charge used by businesses for their staff, not paid to govt

The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. • selected imported fruits (i.e. Any provision of taxable services; Made in the course or.

Government May Add New Service Charge for Online Shopping in Malaysia

What’s new in malaysia sst 2025: About services tax 1.what is service tax ? Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. The effective date to charge sales tax and service tax would be 1 july 2025. This is normally.

Regulation of aviation services charges Malaysian Aviation Commission

Made in the course or. This is normally applied in the hospitality. Any provision of taxable services; The effective date to charge sales tax and service tax would be 1 july 2025. • selected imported fruits (i.e.

Restaurant workers worried over service charge backlash Malay Mail

The malaysian government has increased the sales and service tax (sst) to 8% starting from march 1, 2024, affecting specific. The effective date to charge sales tax and service tax would be 1 july 2025. What’s new in malaysia sst 2025: Any provision of taxable services; Prior to 1 march 2024, the rate of service tax is 6% ad valorem.

Any Provision Of Taxable Services;

Tax rate revisions & service scope expansion in line with ongoing fiscal reforms, the ministry of. About services tax 1.what is service tax ? • selected imported fruits (i.e. The effective date to charge sales tax and service tax would be 1 july 2025.

The Malaysian Government Has Increased The Sales And Service Tax (Sst) To 8% Starting From March 1, 2024, Affecting Specific.

Prior to 1 march 2024, the rate of service tax is 6% ad valorem for all taxable services and digital services except for the provision of charge or. This is normally applied in the hospitality. What’s new in malaysia sst 2025: Made in the course or.

:max_bytes(150000):strip_icc()/Service-charge-4189213-FINAL-6fab6812d7ca4f3d9e77387076d623ca.png)