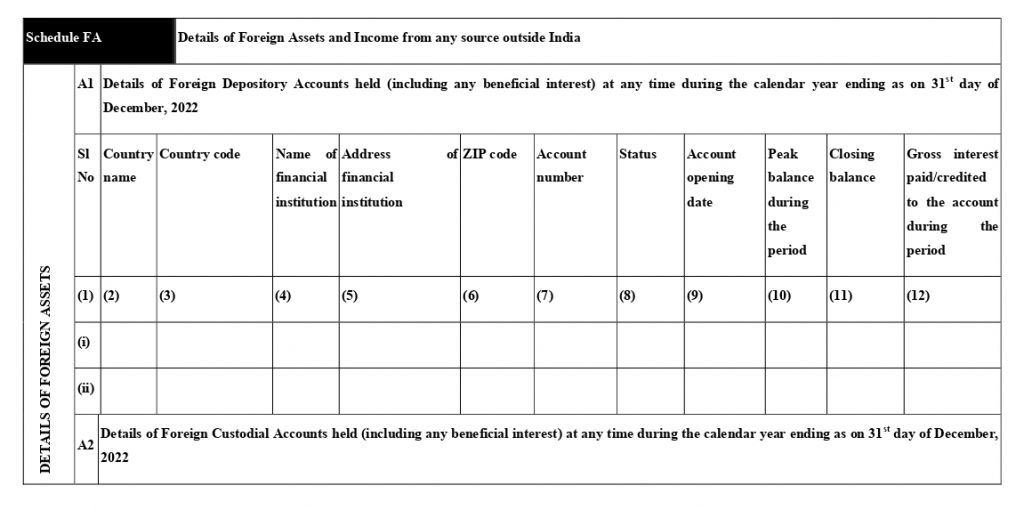

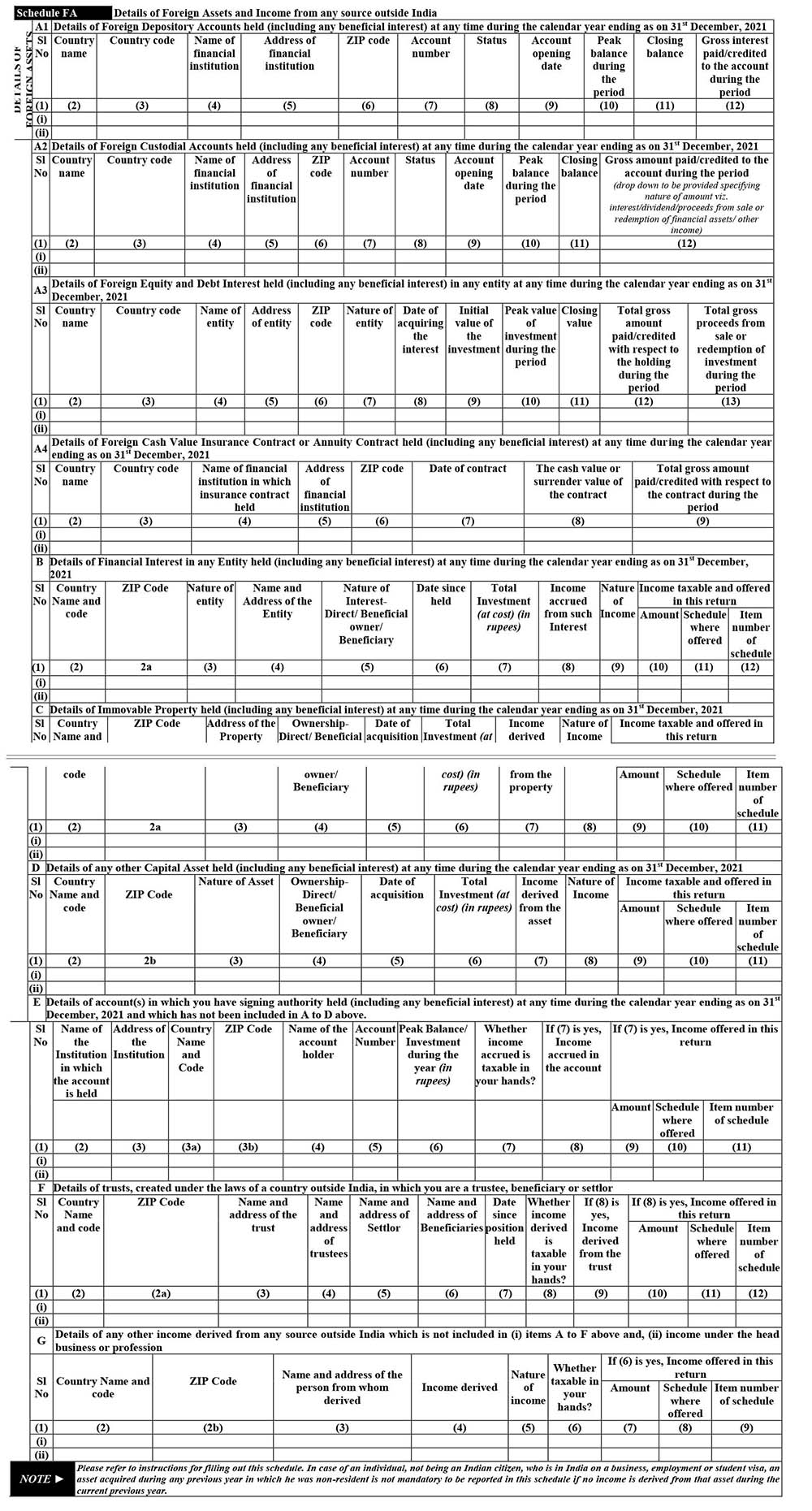

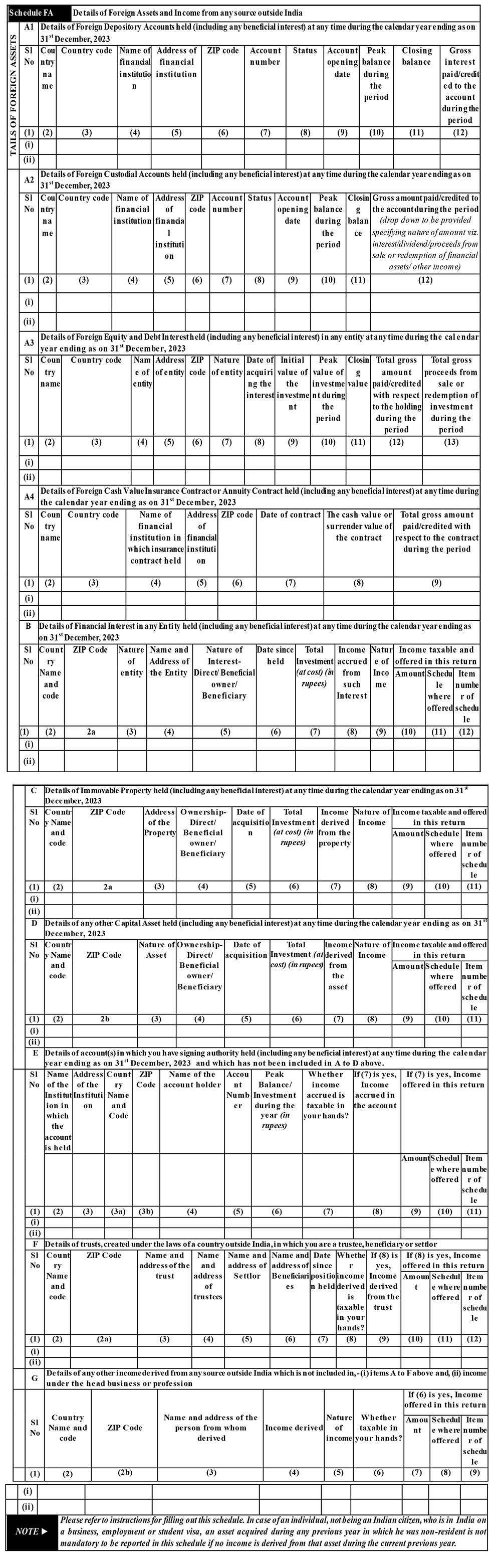

Schedule Fa A3 Example In Excel - A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. Ensure compliance and avoid penalties with this detailed guide on. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Learn about schedule fa in itr forms for reporting foreign shares. Any property or investments held outside india,. Learn about schedule fa in itr for disclosure of foreign assets. Learn how to report overseas assets with our comprehensive guide. The resident assessee must declare the following foreign assets in schedule fa: Get expert insights on how to declare foreign shares in itr and the. Choose itr3 if you have some business income.

A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. Filing schedule fa (foreign assets) made easy! The resident assessee must declare the following foreign assets in schedule fa: Learn about schedule fa in itr for disclosure of foreign assets. Choose itr3 if you have some business income. Get expert insights on how to declare foreign shares in itr and the. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Learn how to report overseas assets with our comprehensive guide. Learn about schedule fa in itr forms for reporting foreign shares. Any property or investments held outside india,.

A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. Any property or investments held outside india,. The resident assessee must declare the following foreign assets in schedule fa: Ensure compliance and avoid penalties with this detailed guide on. Learn about schedule fa in itr forms for reporting foreign shares. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Learn how to report overseas assets with our comprehensive guide. Filing schedule fa (foreign assets) made easy! Learn about schedule fa in itr for disclosure of foreign assets. Choose itr3 if you have some business income.

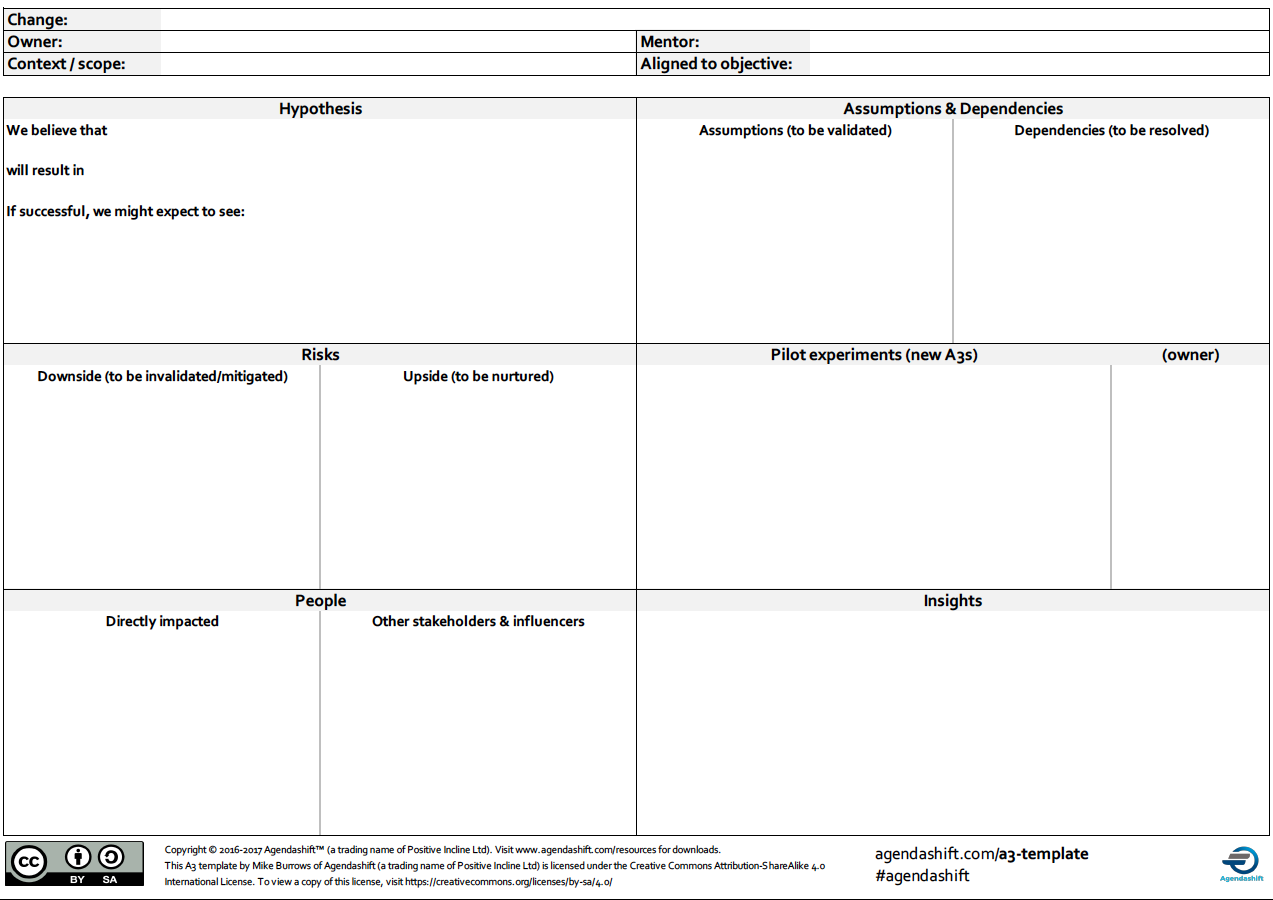

A3 Excel Template

The resident assessee must declare the following foreign assets in schedule fa: A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. Learn how to report overseas assets with our comprehensive guide. Choose itr3 if you have some business income. Learn about schedule fa in itr for disclosure of foreign assets.

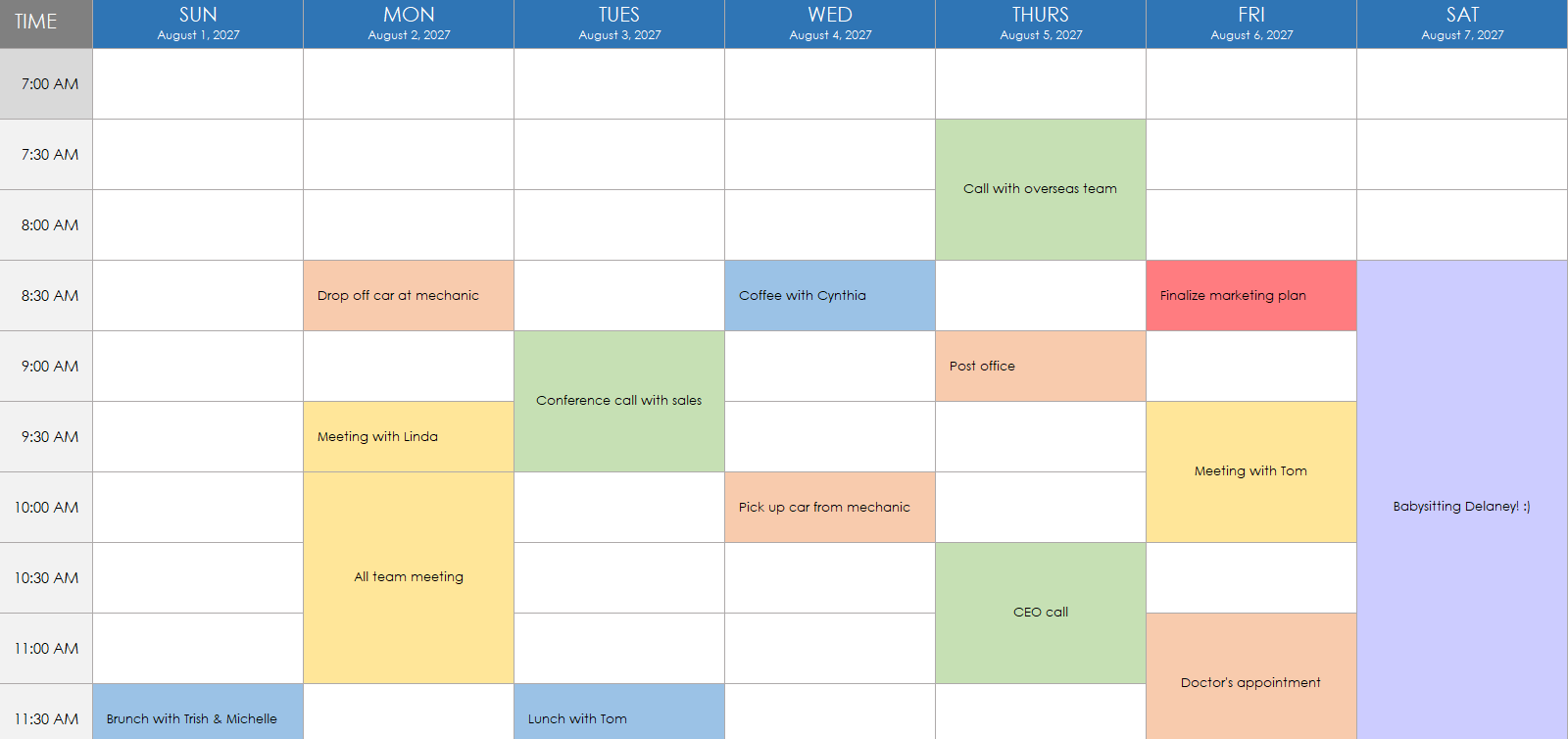

Excel Schedule Template

For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Choose itr3 if you have some business income. Learn about schedule fa in itr forms for reporting foreign shares. Learn how to report overseas assets with our comprehensive guide. Any property or investments held outside india,.

Step by Step Guide to File ITR 2 Online AY 202324 (Full Procedure)

For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Ensure compliance and avoid penalties with this detailed guide on. Choose itr3 if you have some business income. Filing schedule fa (foreign assets) made easy! Learn how to report overseas assets with our comprehensive guide.

Fixed Assets Classification Schedule Excel Template And Google Sheets

Ensure compliance and avoid penalties with this detailed guide on. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. Get expert insights on how to declare foreign shares in.

GST AND TAX INFO Step by Step Guide to File ITR 2 Online AY

Learn how to report overseas assets with our comprehensive guide. A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Learn about schedule fa in itr for disclosure of foreign.

How to Create a Schedule in Excel Smartsheet

Get expert insights on how to declare foreign shares in itr and the. Learn how to report overseas assets with our comprehensive guide. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Ensure compliance and avoid penalties with this detailed guide on. Learn about schedule fa in.

Creating a Work Schedule in Excel 10 Simple Steps + Template

Filing schedule fa (foreign assets) made easy! Learn about schedule fa in itr for disclosure of foreign assets. Ensure compliance and avoid penalties with this detailed guide on. Any property or investments held outside india,. The resident assessee must declare the following foreign assets in schedule fa:

A3 Template Excel Free Ad Organize, Schedule, Plan And Analyze Your

The resident assessee must declare the following foreign assets in schedule fa: Learn about schedule fa in itr forms for reporting foreign shares. Filing schedule fa (foreign assets) made easy! Ensure compliance and avoid penalties with this detailed guide on. A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial.

A3 Report Template

Learn about schedule fa in itr for disclosure of foreign assets. Learn about schedule fa in itr forms for reporting foreign shares. A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the.

Step by Step Guide to File ITR 2 Online AY 202324 (Full Procedure)

Choose itr3 if you have some business income. Any property or investments held outside india,. For foreign assets, in schedule fa, table a2 (custodial accounts) should the peak value & closing value show only the idle cash. Learn about schedule fa in itr forms for reporting foreign shares. Learn how to report overseas assets with our comprehensive guide.

Get Expert Insights On How To Declare Foreign Shares In Itr And The.

Learn how to report overseas assets with our comprehensive guide. Ensure compliance and avoid penalties with this detailed guide on. Choose itr3 if you have some business income. A3 under schedule fa, assessee have to give details of foreign equity and debt interest (including any beneficial.

Filing Schedule Fa (Foreign Assets) Made Easy!

Learn about schedule fa in itr for disclosure of foreign assets. Any property or investments held outside india,. Learn about schedule fa in itr forms for reporting foreign shares. The resident assessee must declare the following foreign assets in schedule fa: