Schedule C Worksheet 2022 - Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c simplified method worksheet keep for your records note: Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to the instructions for the simplified. Be sure you have with you today: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your.

2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Be sure you have with you today: Attached is a blank worksheet if this is a new factor in your tax situation. Please refer to the instructions for the simplified. 2022 schedule c simplified method worksheet keep for your records note: Net profit or (loss) buildings and machinery sold outright (no trades):

Be sure you have with you today: Please refer to the instructions for the simplified. Net profit or (loss) buildings and machinery sold outright (no trades): Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c simplified method worksheet keep for your records note: 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule.

Free Printable Schedule C Tax Form

Be sure you have with you today: Net profit or (loss) buildings and machinery sold outright (no trades): Attached is a blank worksheet if this is a new factor in your tax situation. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Please refer to the instructions for the.

Schedule c expenses worksheet Fill out & sign online DocHub

Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c simplified method worksheet keep for your records note: Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both.

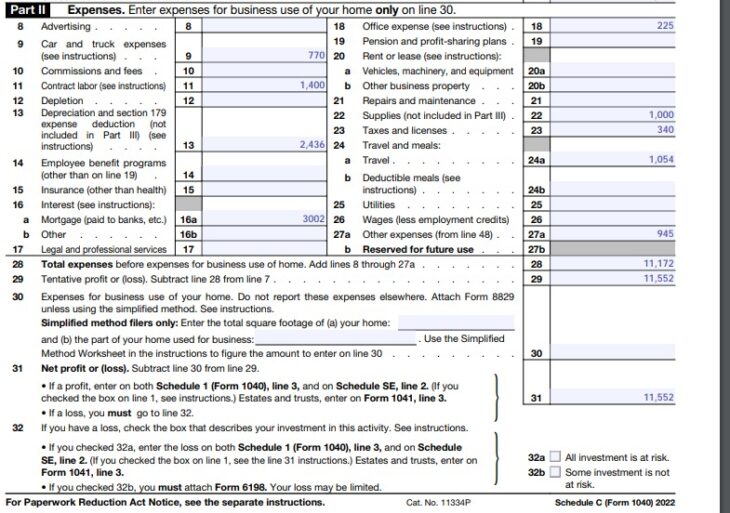

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c simplified method worksheet keep for your records note: 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper.

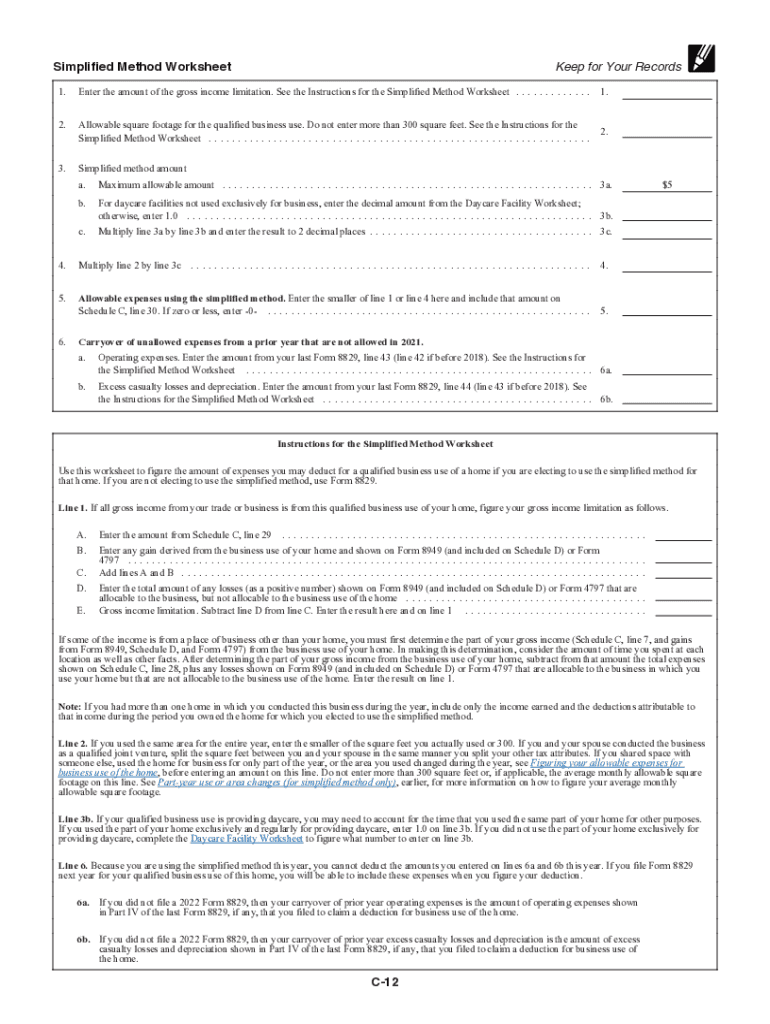

Schedule C Simplified Method Worksheet Printable And Enjoyable Learning

Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to the instructions for the simplified. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to.

How To Fill Out Your 2022 Schedule C (With Example)

Net profit or (loss) buildings and machinery sold outright (no trades): Be sure you have with you today: Please refer to the instructions for the simplified. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Schedule c worksheet for self employed businesses and/or independent contractors.

Schedule C Expenses Worksheet 2022

Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to the instructions for the simplified. Attached is a blank worksheet if this is a new factor in your tax situation. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Be sure you have with you.

1040 schedule c 2022 form Fill out & sign online DocHub

2022 schedule c simplified method worksheet keep for your records note: 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Be sure you have with you today: Attached is a blank worksheet if this is a new factor in your tax situation. Net profit or.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Attached is a blank worksheet if this is a new factor in your tax situation. Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to the instructions for the simplified. Be sure you have with you.

How to Fill Out Your Schedule C Perfectly (With Examples!) Worksheets

Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. 2022 schedule c summary worksheet if you have your own business, it is important that you maintain proper books and records of both your. Be sure you have with you today: Attached is a blank worksheet if this is a.

Schedule C Printable Guide

Attached is a blank worksheet if this is a new factor in your tax situation. 2022 schedule c simplified method worksheet keep for your records note: Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file to support all schedule. Net profit or (loss) buildings and machinery sold outright (no trades): Please refer to.

Schedule C Worksheet For Self Employed Businesses And/Or Independent Contractors Irs Requires We Have On File To Support All Schedule.

Net profit or (loss) buildings and machinery sold outright (no trades): 2022 schedule c simplified method worksheet keep for your records note: Be sure you have with you today: Please refer to the instructions for the simplified.

2022 Schedule C Summary Worksheet If You Have Your Own Business, It Is Important That You Maintain Proper Books And Records Of Both Your.

Attached is a blank worksheet if this is a new factor in your tax situation.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)