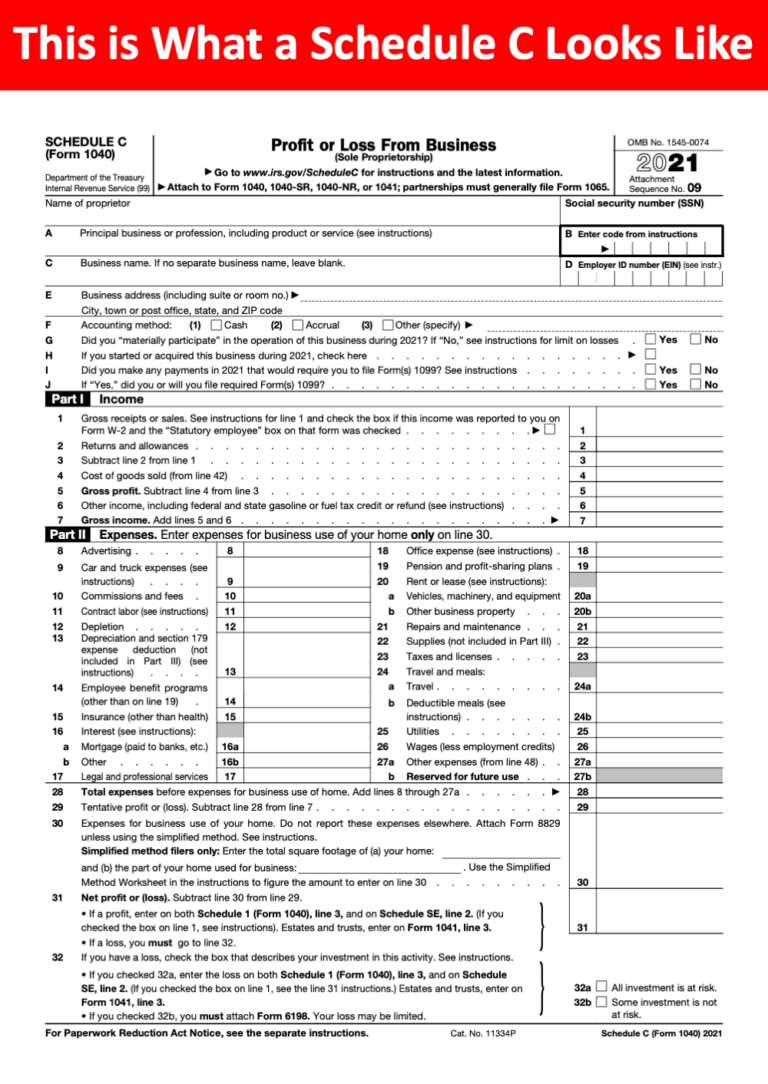

Schedule C Form For 2024 - The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on.

(if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2.

Schedule C Instructions 2024 Tax Form Aurie Carissa

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. The 2024 form 1040 schedule c profit or.

2024 Schedule C Form Lizzy Margarete

(if you checked the box on. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or.

Schedule C 2024 Herta Giralda

(if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. The 2024 form 1040 schedule c profit or.

2024 Schedule C Form Tine Stephenie

(if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. • if you checked 32a, enter.

Irs Schedule C 2024 Tove Ainslie

The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. (if you checked the box on. • if you checked 32a, enter.

2024 Schedule C Form Orel Tracey

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. (if you checked the box on. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or.

Irs Fillable Forms 2024 Schedule C Penny Blondell

• if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. (if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as.

2024 Irs Schedule C 2024 Calendar Template Excel

The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. (if you checked the box on. • if you checked 32a, enter.

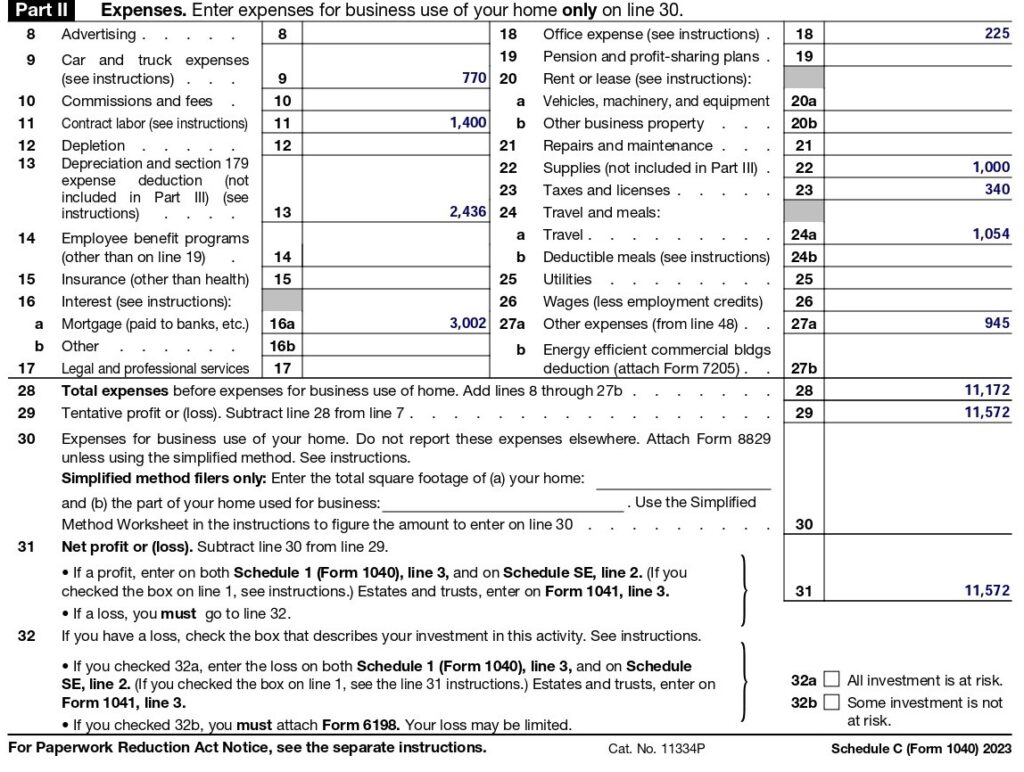

How To Fill Out Schedule C in 2024 (With Example)

(if you checked the box on. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or. • if you checked 32a, enter the loss on both schedule 1 (form 1040), line 3, and on schedule se, line 2. The 2024 form 1040 schedule c profit or.

• If You Checked 32A, Enter The Loss On Both Schedule 1 (Form 1040), Line 3, And On Schedule Se, Line 2.

(if you checked the box on. The 2024 form 1040 schedule c profit or loss from business (sole proprietorship) is used to report the income and expenses of a sole. The schedule c tax form, also known as the “profit or loss from business” form, is used by sole proprietors to report income or.