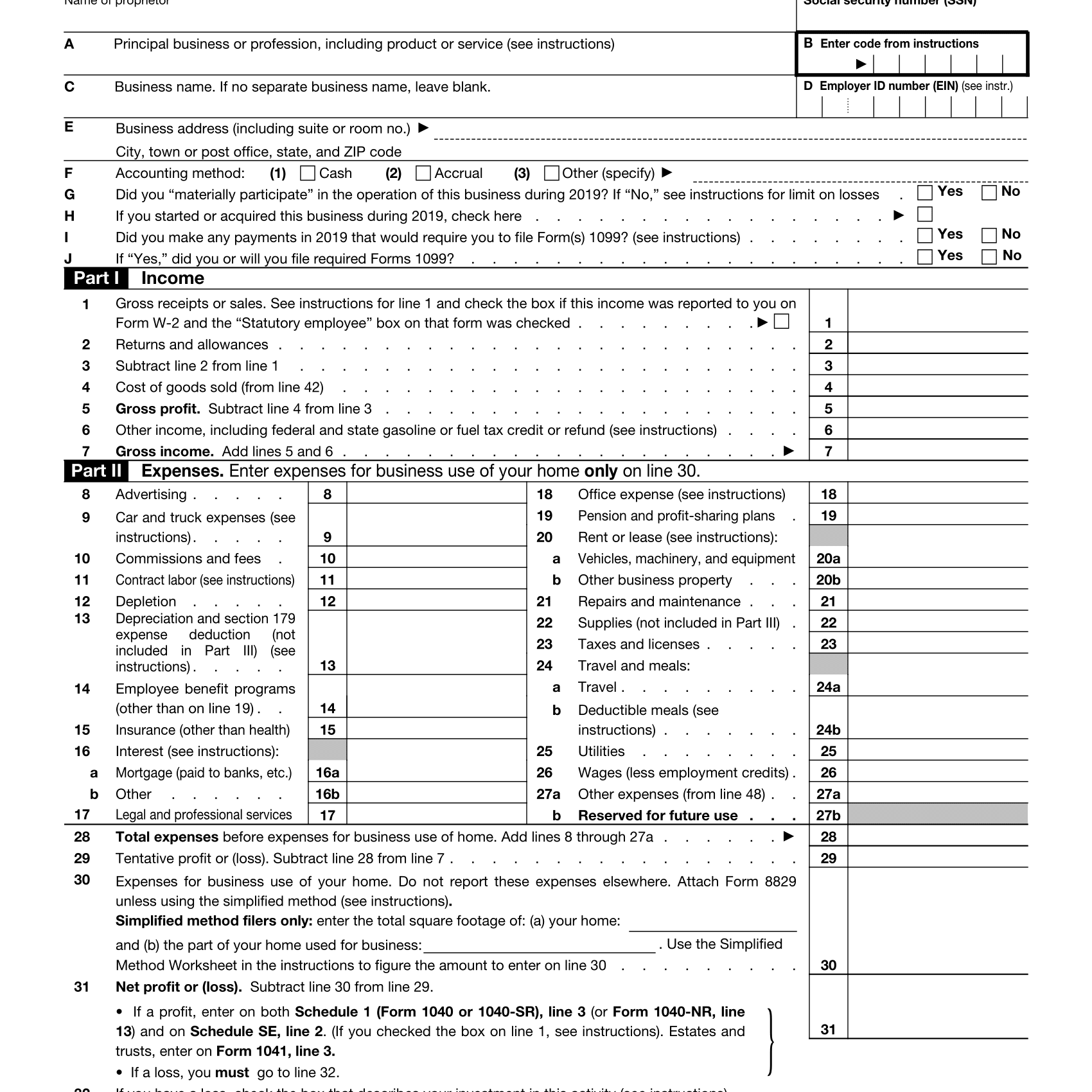

Schedule C Form For 2022 - The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and zip code

Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then.

Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then.

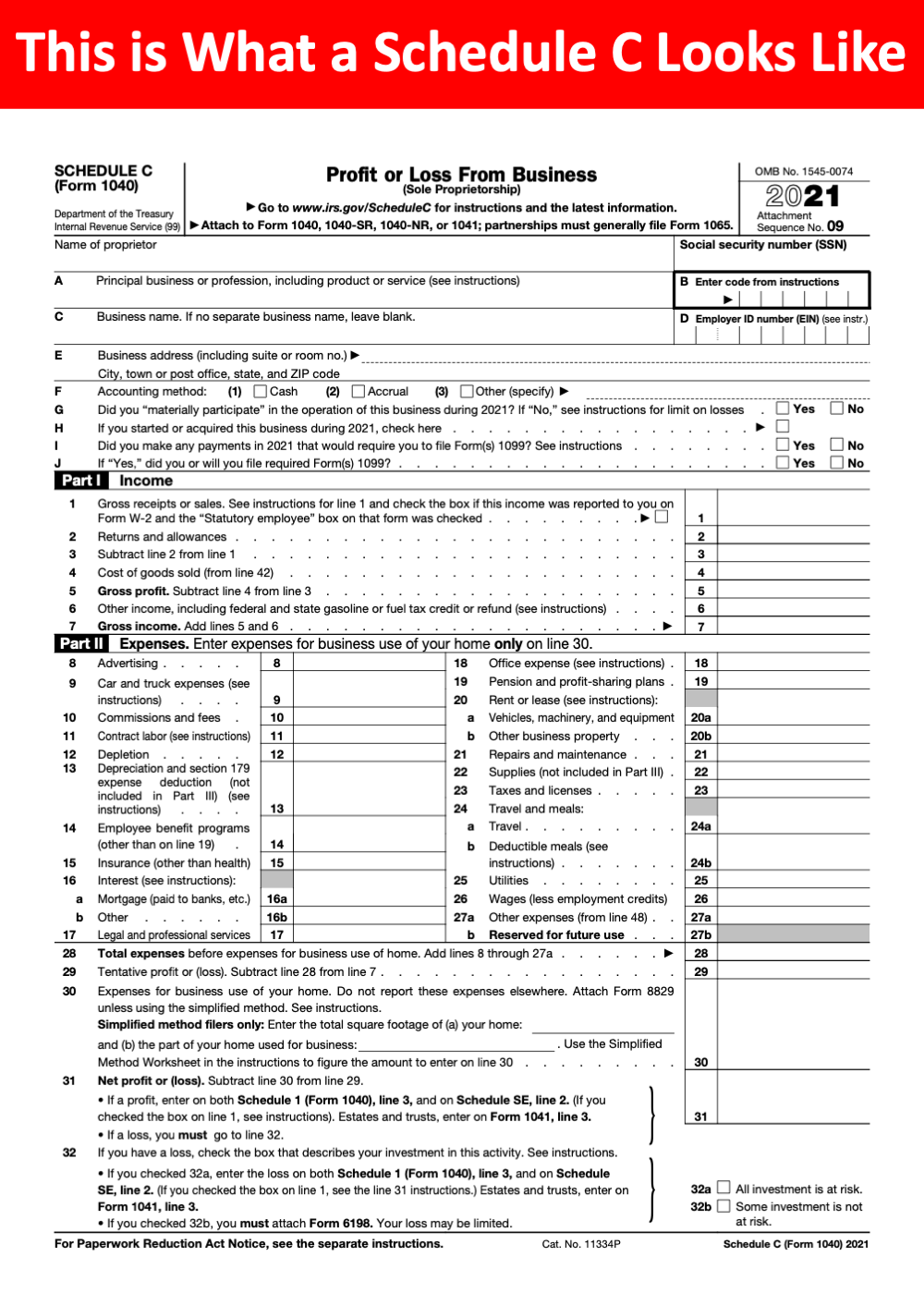

IRS Form 1040 Schedule C (2022) Profit or Loss From Business

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and.

Schedule c 1040 form 2022 Fill out & sign online DocHub

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a.

What Is Schedule C of Form 1040?

Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which.

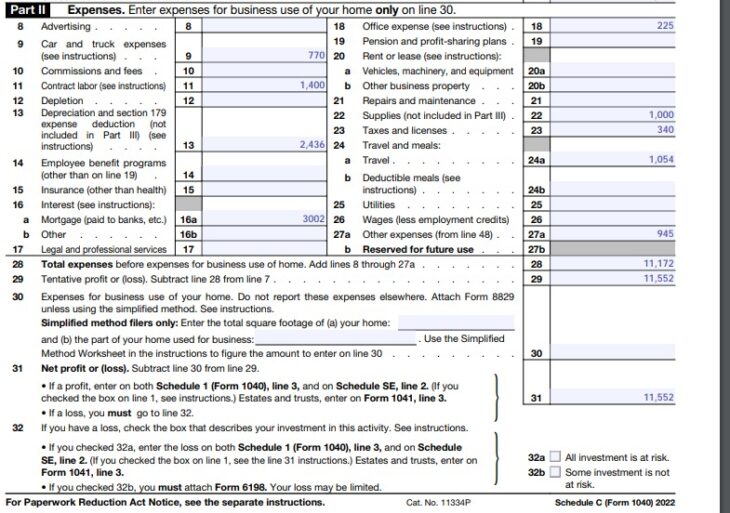

How To Fill Out Your 2022 Schedule C (With Example)

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and.

2025 Schedule C Instructions Polly Camellia

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and.

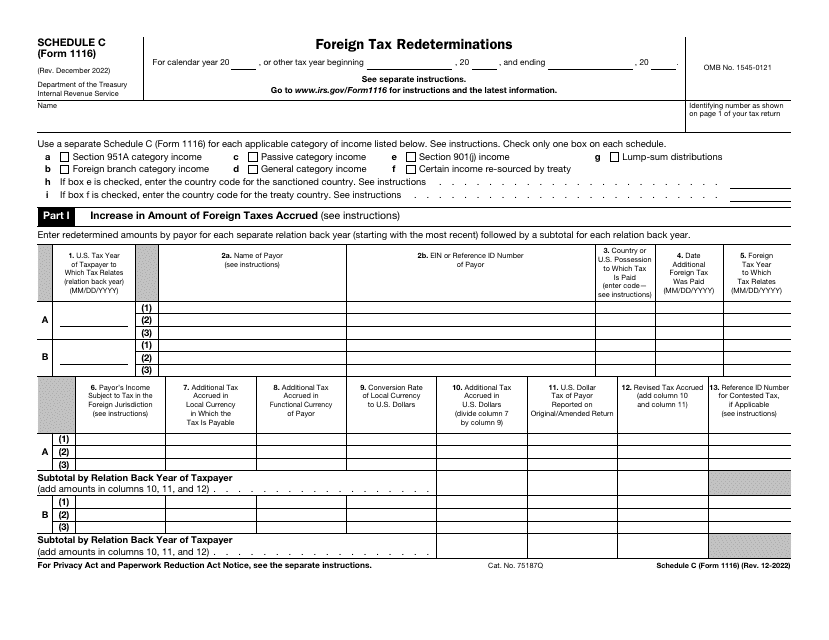

IRS Form 1116 Schedule C Download Fillable PDF or Fill Online Foreign

Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which.

Schedule C (Form 1040) Fill and sign online with Lumin

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. Business address (including suite or room no.) city, town or post office, state, and zip code If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which.

Schedule C What Is It, How To Fill, Example, Vs Schedule E

The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and.

schedule c tax form llc Elnora Teel

Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship. If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which.

1040 schedule c 2022 form Fill out & sign online DocHub

If you are completing federal schedule c (form 1040) profit or loss from business, you will enter the income and expenses which will then. Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a.

If You Are Completing Federal Schedule C (Form 1040) Profit Or Loss From Business, You Will Enter The Income And Expenses Which Will Then.

Business address (including suite or room no.) city, town or post office, state, and zip code The primary purpose of schedule c (form 1040) is to report income or loss from a business operated as a sole proprietorship.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-14at2.10.22PM-ed1958c9bbb642398aec3cacd721b244.png)