Schedule A Worksheet 2024 - State and local sales tax deduction worksheet note: Download and complete this worksheet to calculate your itemized deductions for tax year 2024. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Go to www.irs.gov/schedulea for instructions and the latest information. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Enter your expenses for medical, charity,. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) See the schedule a instructions if taxpayer lived in more than one state during 2024 or had.

Enter your expenses for medical, charity,. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. State and local sales tax deduction worksheet note: See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Go to www.irs.gov/schedulea for instructions and the latest information.

2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Go to www.irs.gov/schedulea for instructions and the latest information. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. State and local sales tax deduction worksheet note: This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Enter your expenses for medical, charity,.

craftcation 2024 schedule planning worksheets Dear Handmade Life

2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Go to www.irs.gov/schedulea for instructions and the latest information. State and local sales tax deduction worksheet note: Download and complete this worksheet to calculate your itemized deductions for tax year 2024. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from.

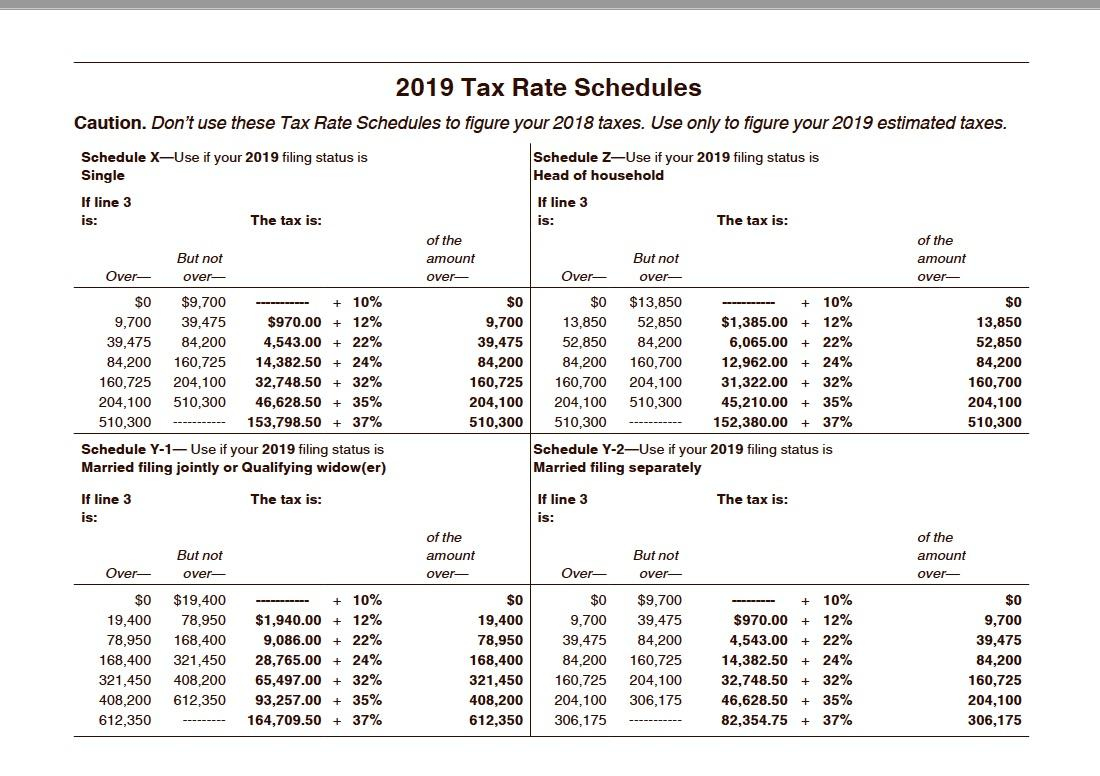

Irs Estimated Tax Worksheet 2024 Fae Letisha

See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Enter your expenses for medical, charity,. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. Go to www.irs.gov/schedulea.

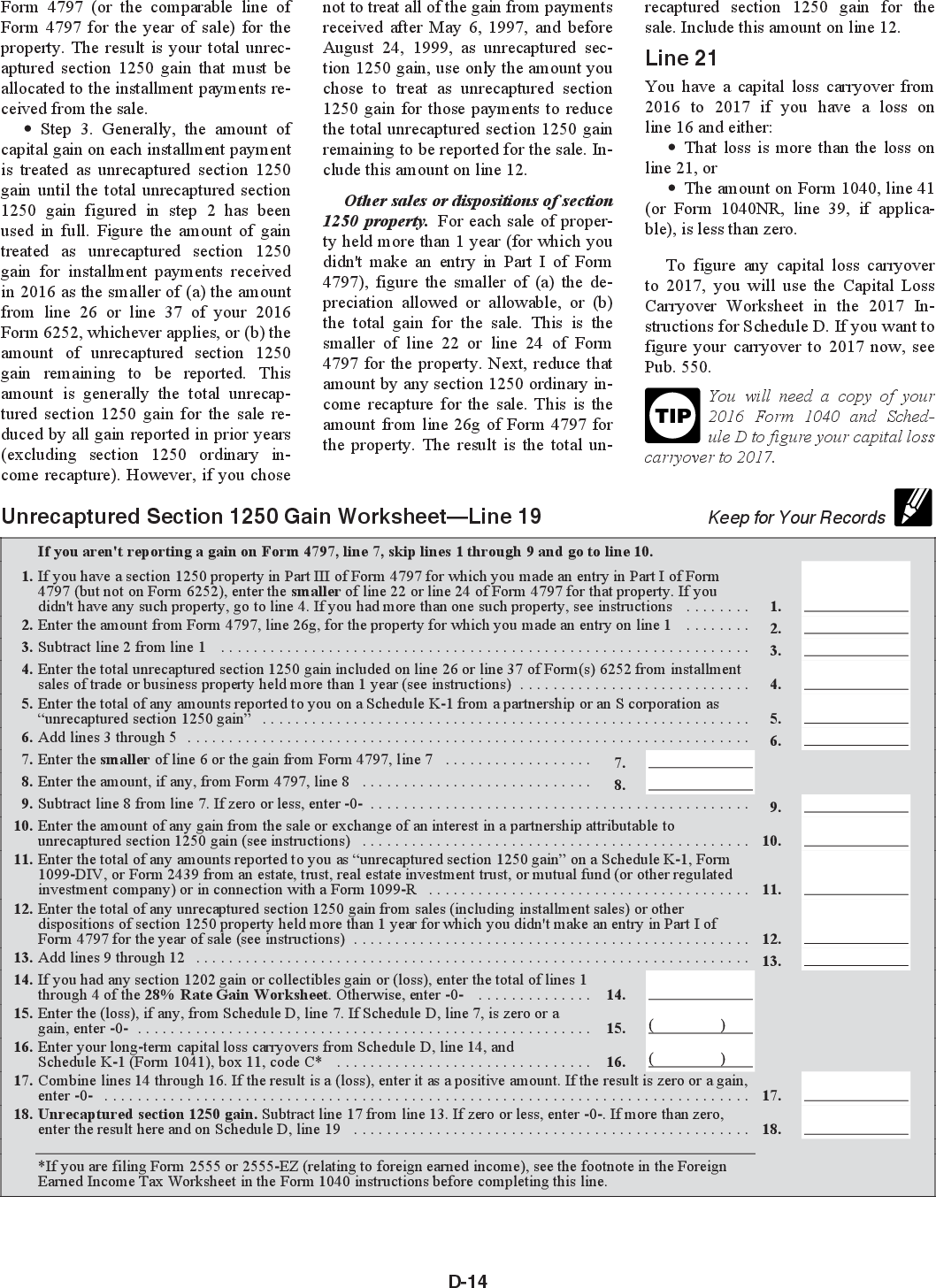

Schedule D (Form 1040) Report Capital Gains & Losses [2024

Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. State and local sales tax deduction worksheet note: This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. See the schedule a instructions if taxpayer lived in more than.

Schedule E Worksheet 2024 Turbotax 2024 Schedule A

2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Enter your expenses for medical, charity,. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Download or.

Schedule D Tax Worksheet 2020

Enter your expenses for medical, charity,. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. State and local sales tax deduction worksheet note: See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Go to www.irs.gov/schedulea for instructions and the latest information.

Free Monthly Work Schedule Template (2024 Version) Homebase

Enter your expenses for medical, charity,. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and.

Irs Schedule E 2024 Printable Karry Marylee

See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Download and complete this worksheet to calculate your itemized deductions for tax year 2024. State and local sales tax deduction worksheet note: 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) This worksheet helps you calculate your itemized.

Free printable class schedule templates to customize Canva

Enter your expenses for medical, charity,. Go to www.irs.gov/schedulea for instructions and the latest information. State and local sales tax deduction worksheet note: This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. See the schedule a instructions if taxpayer lived in more than one state during 2024 or.

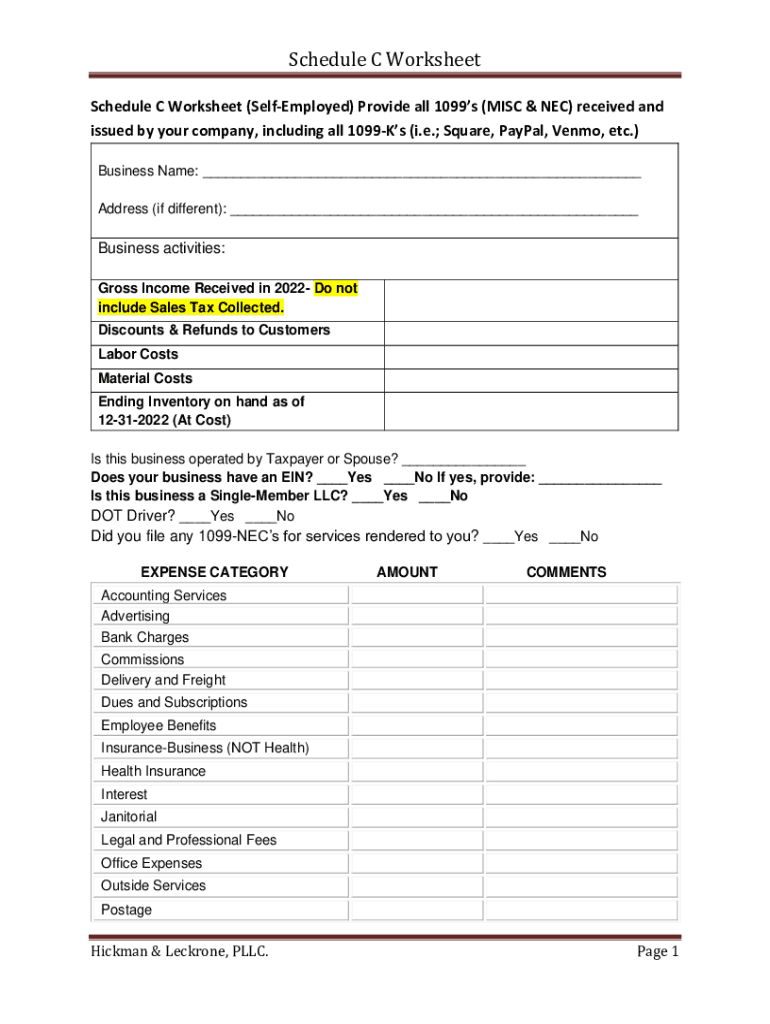

20222024 Form TX Hickman & Leckrone Schedule C Worksheet Fill

Download and complete this worksheet to calculate your itemized deductions for tax year 2024. 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. Enter your expenses for medical, charity,. Go to www.irs.gov/schedulea for instructions and.

Capital Loss Carryover 2024

Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. State and local sales tax deduction worksheet note: 2024 itemized deduction worksheet standard deduction (single $14,600, head of household $21,900, married $29,200) See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. This.

2024 Itemized Deduction Worksheet Standard Deduction (Single $14,600, Head Of Household $21,900, Married $29,200)

Download or print the 2024 federal (itemized deductions) (2024) and other income tax forms from the federal internal revenue service. See the schedule a instructions if taxpayer lived in more than one state during 2024 or had. Go to www.irs.gov/schedulea for instructions and the latest information. State and local sales tax deduction worksheet note:

Enter Your Expenses For Medical, Charity,.

This worksheet helps you calculate your itemized deductions for tax year 2024, such as medical expenses, mortgage interest, state and local. Download and complete this worksheet to calculate your itemized deductions for tax year 2024.