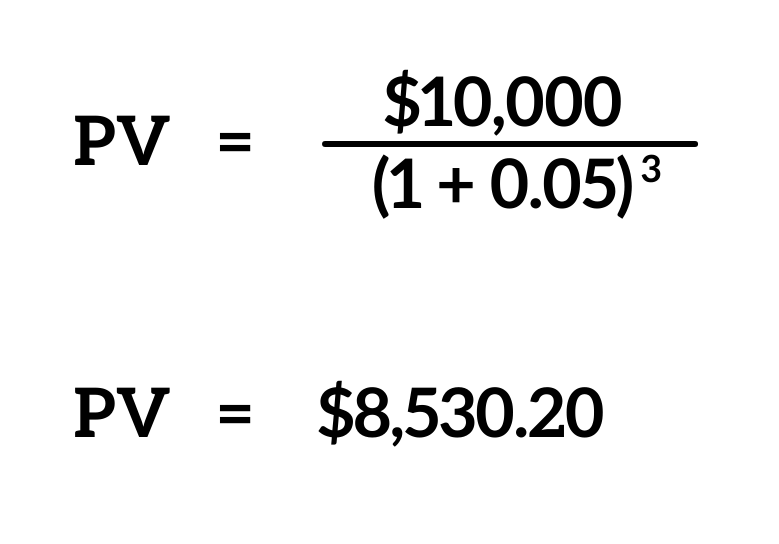

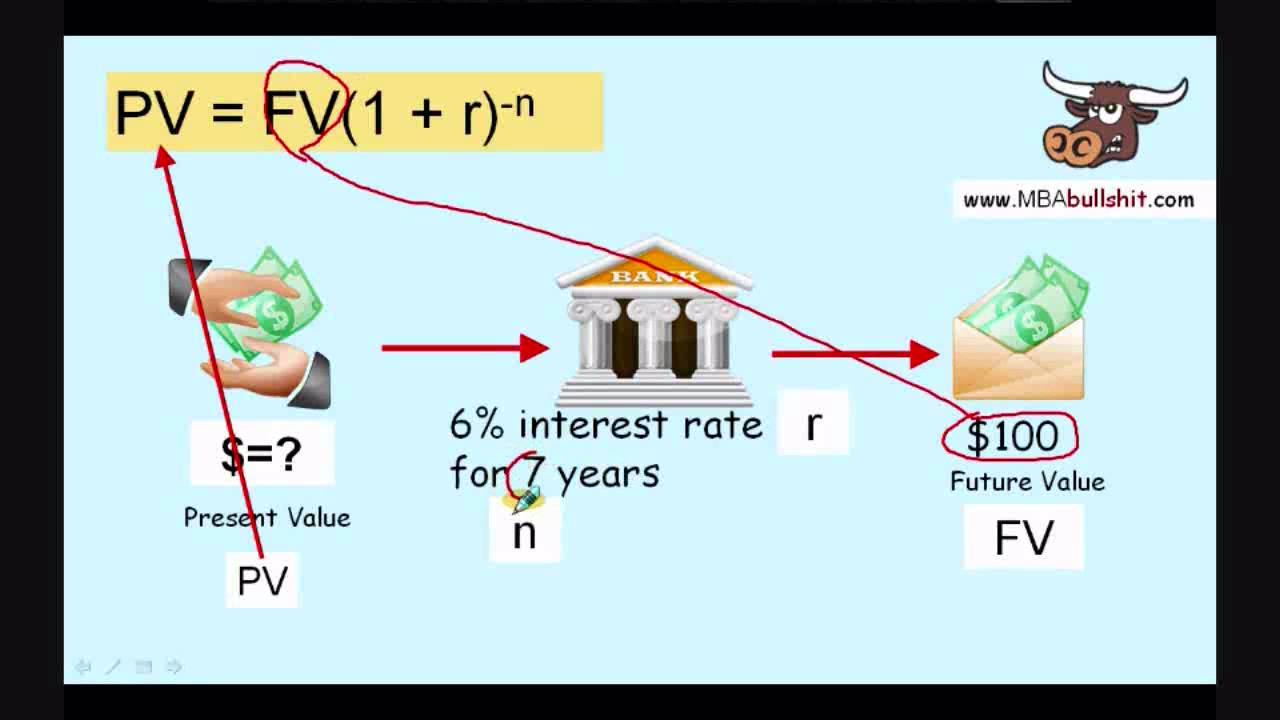

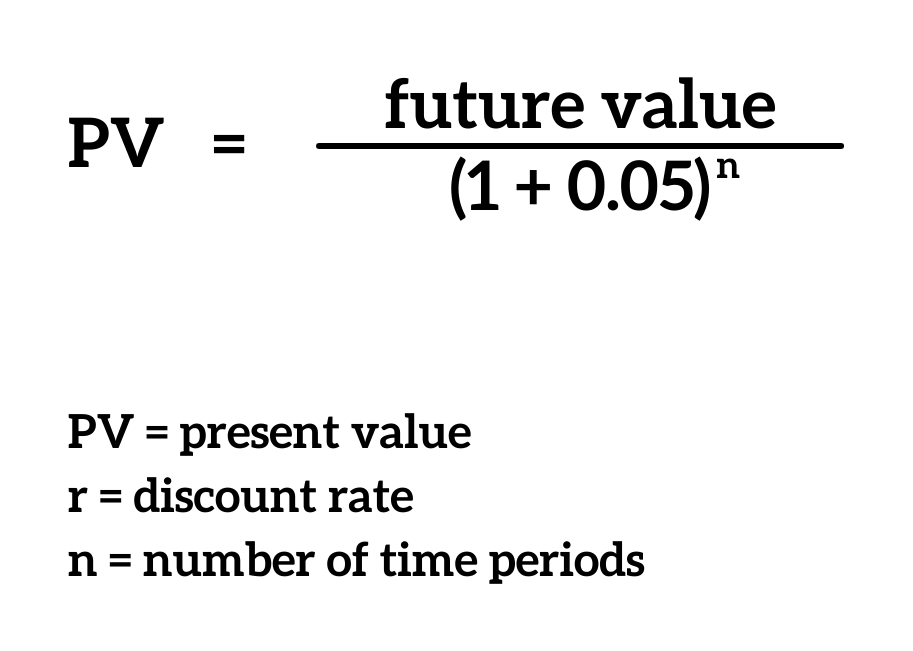

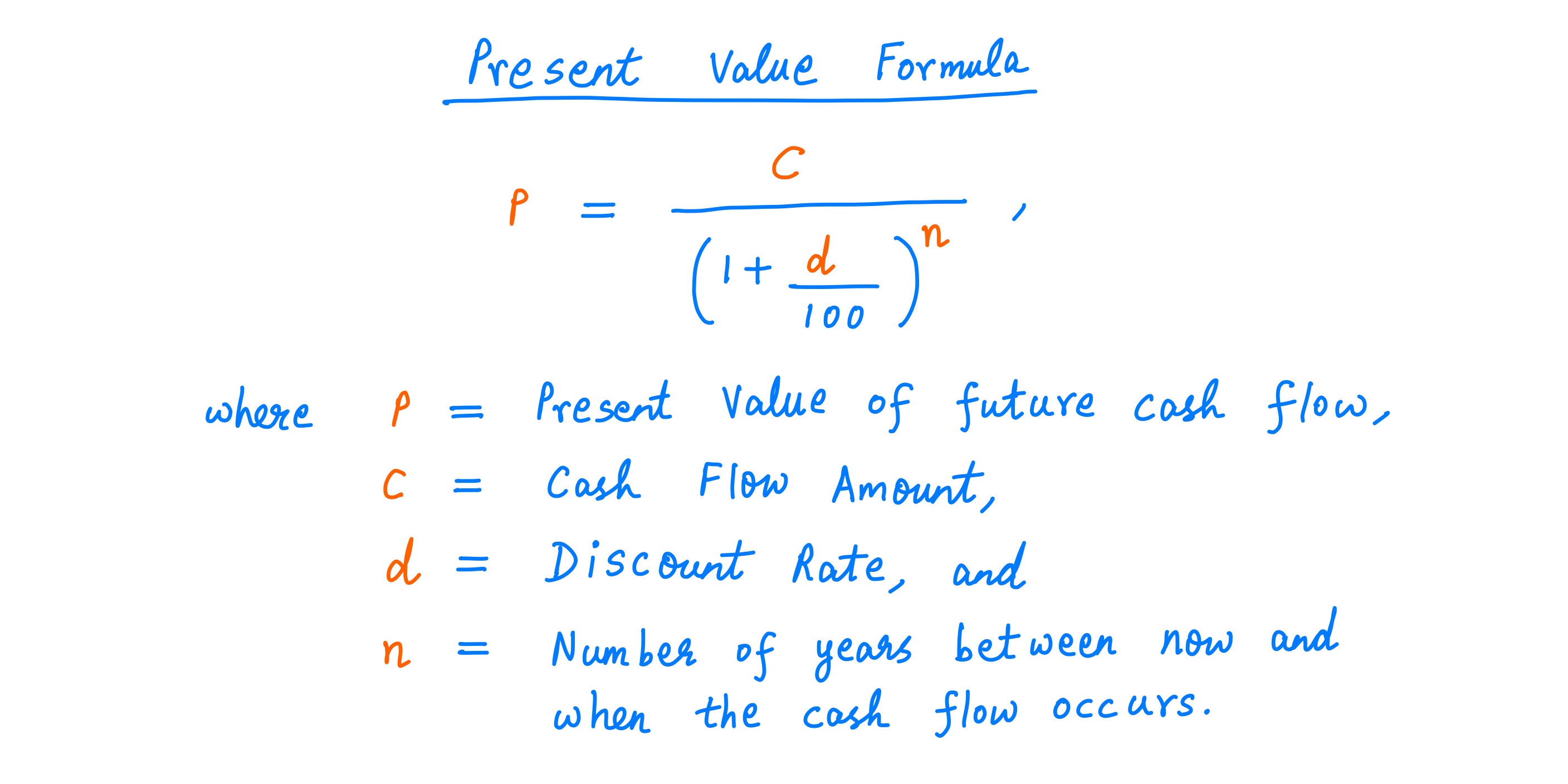

Pv Of Future Cash Flows Formula - Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into.

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as:

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26.

Present Value in Finance Calculations and Applications SuperMoney

Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash.

Present Value Excel Template

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this.

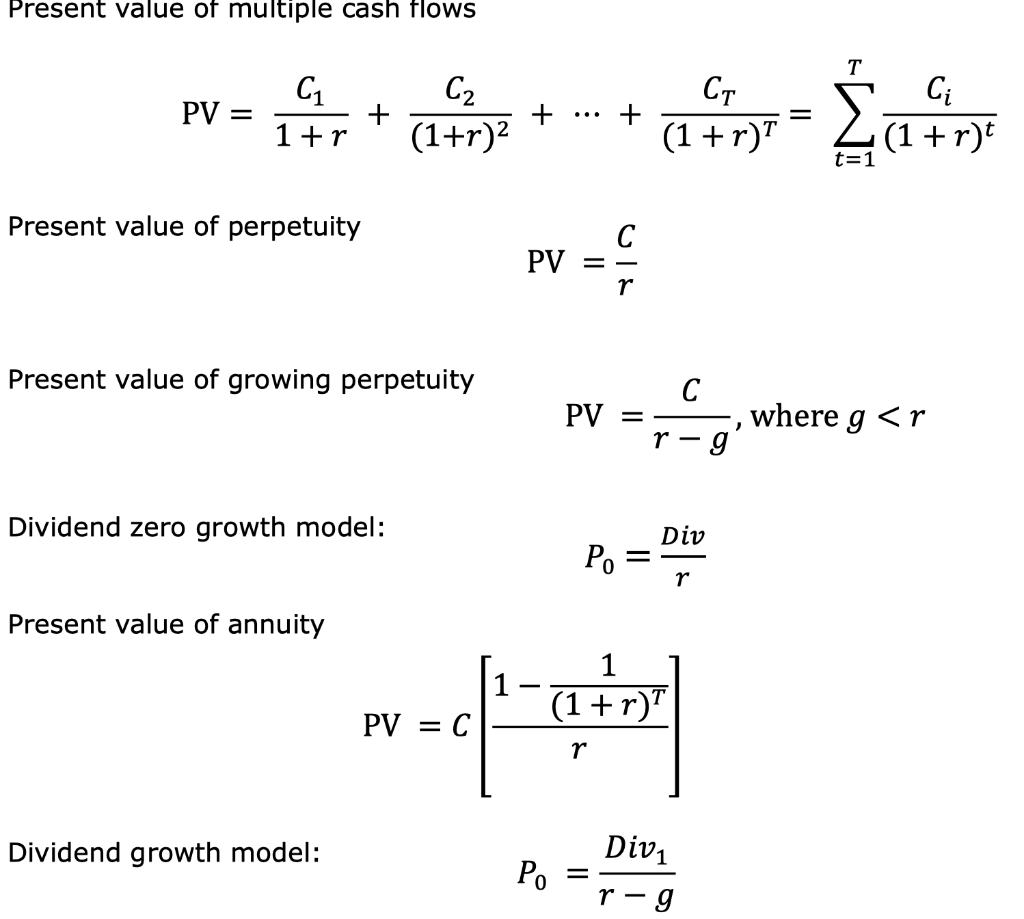

Solved Present value of multiple cash flows CT PV = C1 1+r

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as: Pv =.

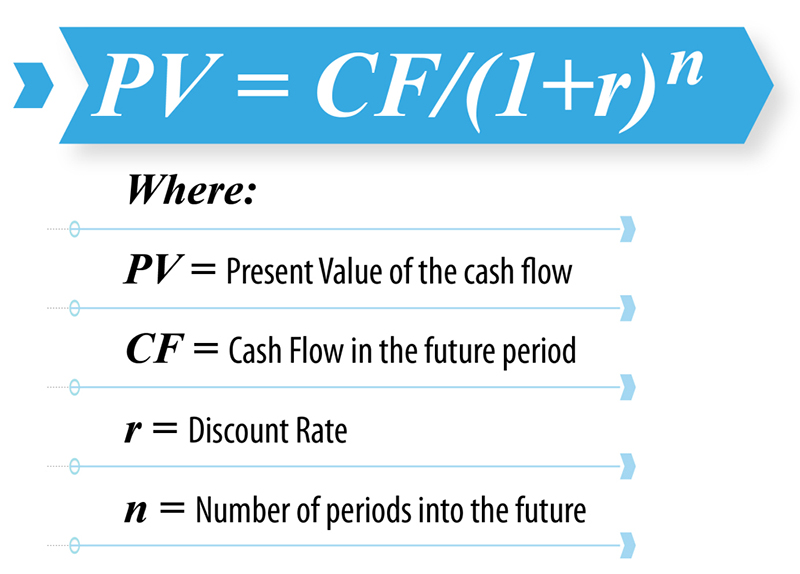

Discounted Cash Flow Analysis Formula, Use, Types & Benefits IBCA

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as: At the heart of present value calculations lies a fundamental mathematical.

Net Present Value Explained

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash.

Present Value Formula for Continuous Compounding Kline Durged

The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this.

Fv Pv Formula

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash.

Present Value in Finance Calculations and Applications SuperMoney

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate. Using the present value formula, the pv of this future cash flow can be calculated as: Pv =.

Present Value Pv Formula And Calculation Riset

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash.

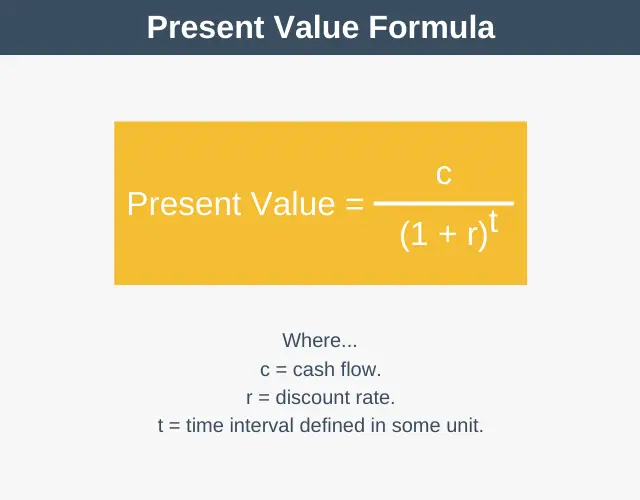

Present Value Formula

Using the present value formula, the pv of this future cash flow can be calculated as: Pv = $10,000 / (1 + 0.05)^5 = $7,835.26. At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. The formula used to calculate the present value (pv) divides the future value of a future cash.

Pv = $10,000 / (1 + 0.05)^5 = $7,835.26.

At the heart of present value calculations lies a fundamental mathematical formula that translates future cash flows into. Using the present value formula, the pv of this future cash flow can be calculated as: The formula used to calculate the present value (pv) divides the future value of a future cash flow by one plus the discount rate.