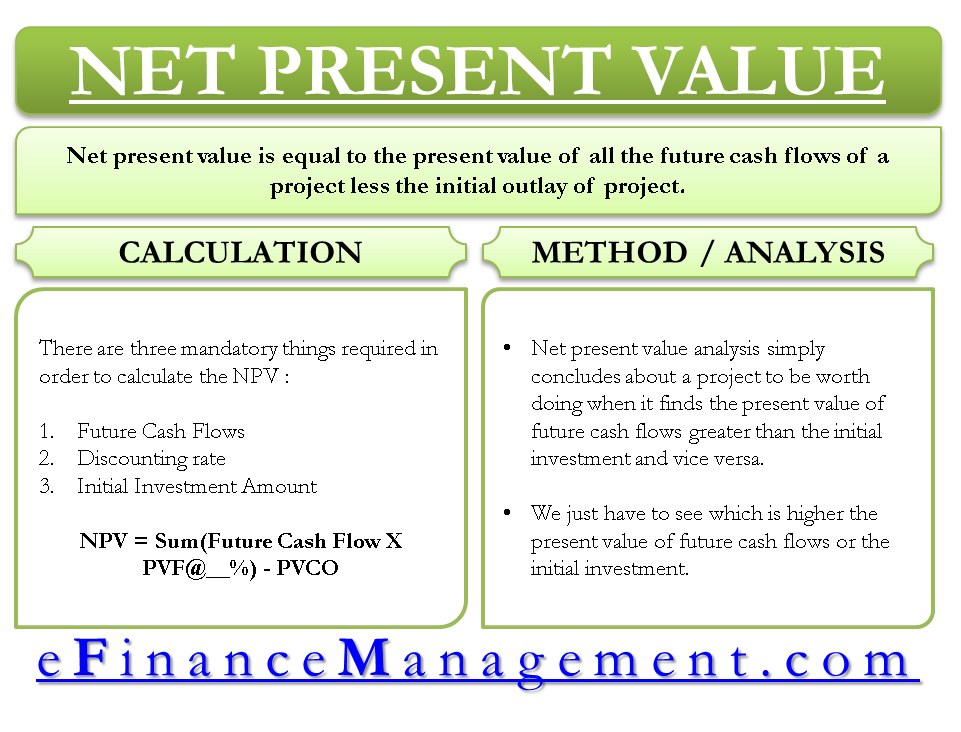

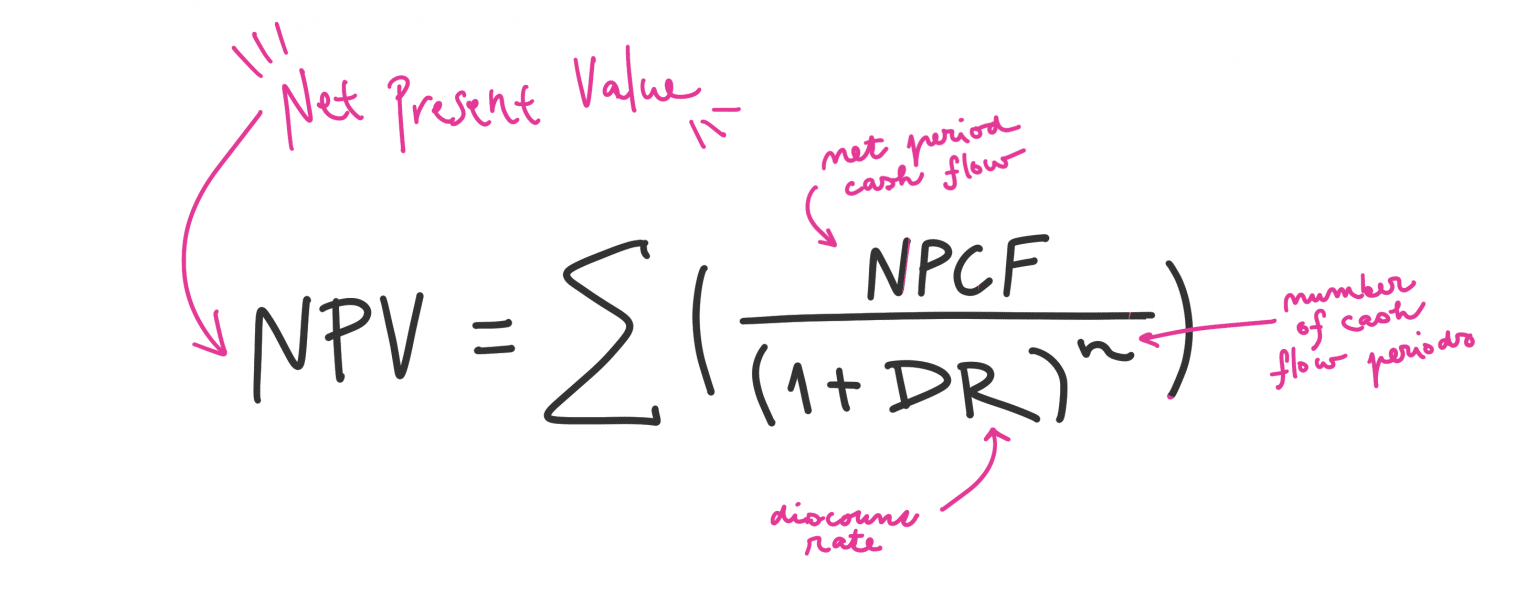

Npv Of Future Cash Flows - Npv is the sum of all the discounted future cash flows. Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value (npv) is the present value of all future cash flows of a project. It takes into account the time. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. Net present value is a financial calculation used to determine the present value of future cash flows.

Because of its simplicity, npv is a useful tool to determine whether a project or. Npv is the sum of all the discounted future cash flows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value (npv) is the present value of all future cash flows of a project. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. It takes into account the time. Net present value is a financial calculation used to determine the present value of future cash flows.

It takes into account the time. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. Because of its simplicity, npv is a useful tool to determine whether a project or. Npv is the sum of all the discounted future cash flows. Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the present value of all future cash flows of a project.

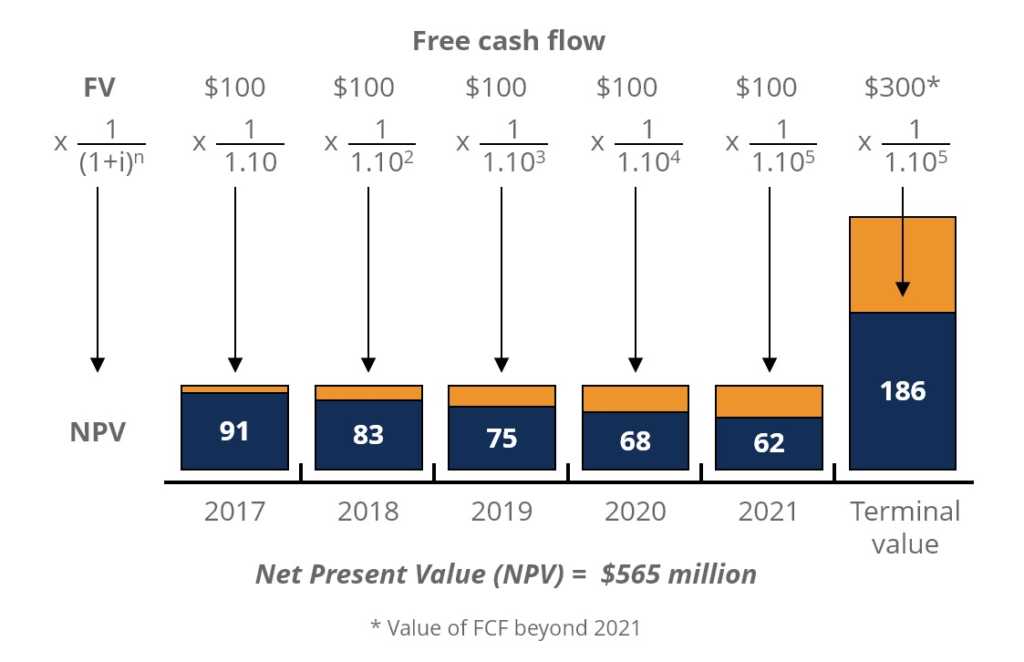

How to Calculate Future Value of Uneven Cash Flows in Excel

Npv is the sum of all the discounted future cash flows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Because of its simplicity, npv is a useful tool to determine whether a project or. It takes into account the time. Net present.

If the Net Present Value of a Project Is Zero Quant RL

Npv is the sum of all the discounted future cash flows. Net present value (npv) is the present value of all future cash flows of a project. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value is a financial calculation.

NPV Present Value) Definition, Benefits, Formula, and Examples

Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. It takes into account the time. Net present value (npv) is the present value of all future.

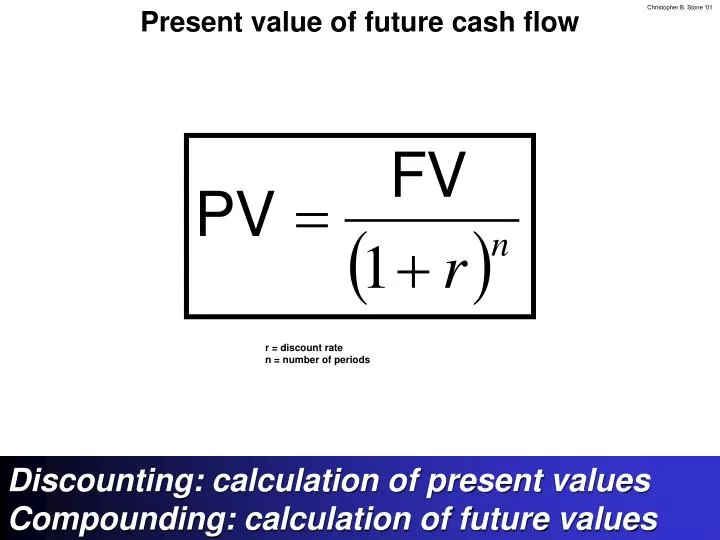

PPT Present value of future cash flow PowerPoint Presentation, free

Because of its simplicity, npv is a useful tool to determine whether a project or. It takes into account the time. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire.

QUANTITATIVE ANALYSIS ppt download

Npv is the sum of all the discounted future cash flows. Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the present value of all future cash flows of a project. Because of its simplicity, npv is a useful tool to determine whether a project or. Net.

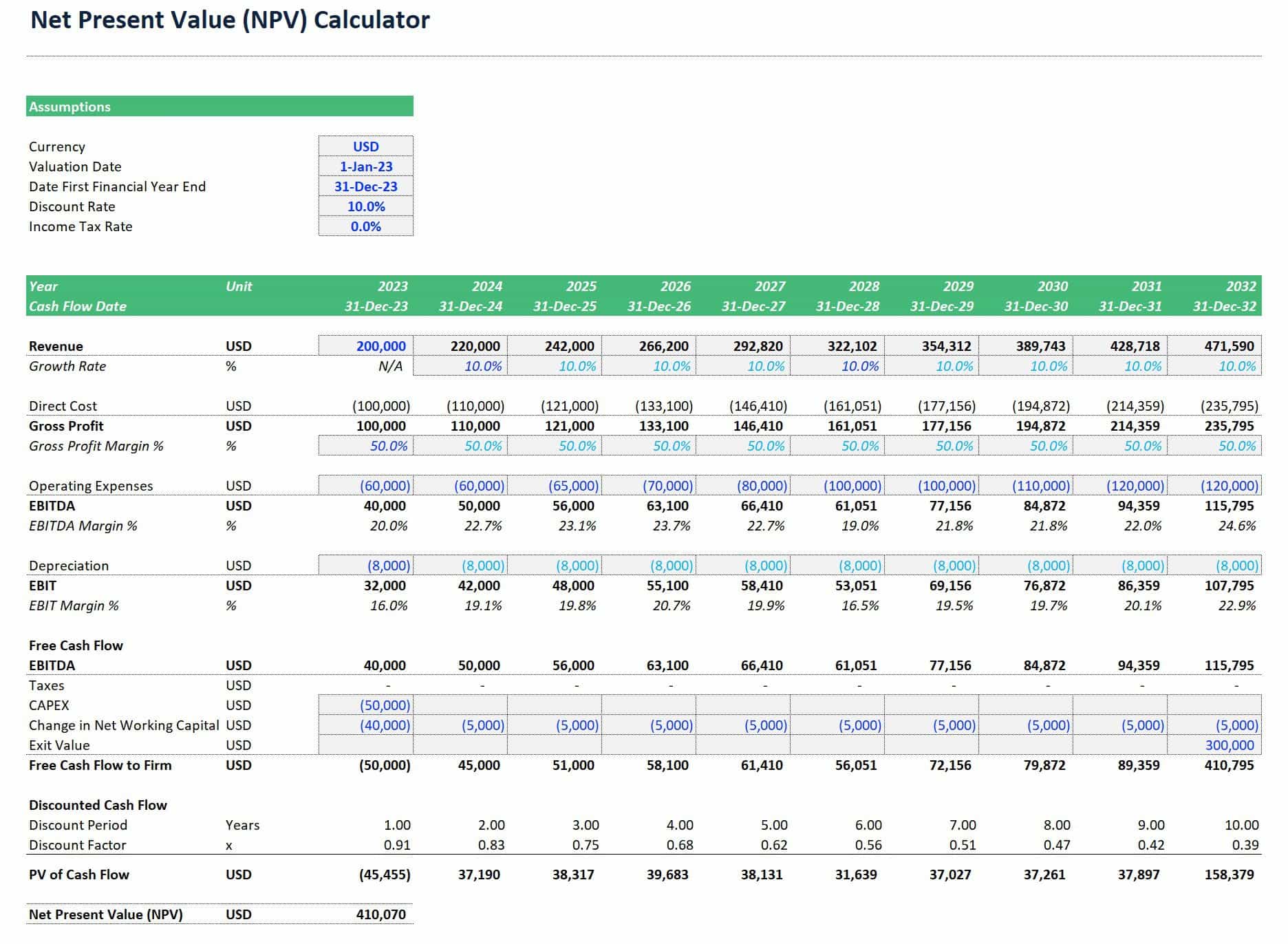

Net Present Value Formula On Excel at sasfloatblog Blog

Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value (npv) is the present value of all future cash flows of a project. It takes into account the time. Npv is the sum of all the discounted future cash flows. Net present value (npv) is the value of all future cash flows.

How to Use NPV in Excel to Calculate the Present Value of Future Cash

Net present value (npv) is the present value of all future cash flows of a project. Npv is the sum of all the discounted future cash flows. The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. Because of its simplicity, npv is a useful tool to determine whether.

NPV Formula Learn How Net Present Value Really Works, Examples

It takes into account the time. Npv is the sum of all the discounted future cash flows. Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value is a financial calculation used to determine the present value of future cash flows. Net present value (npv) is the value of all future cash.

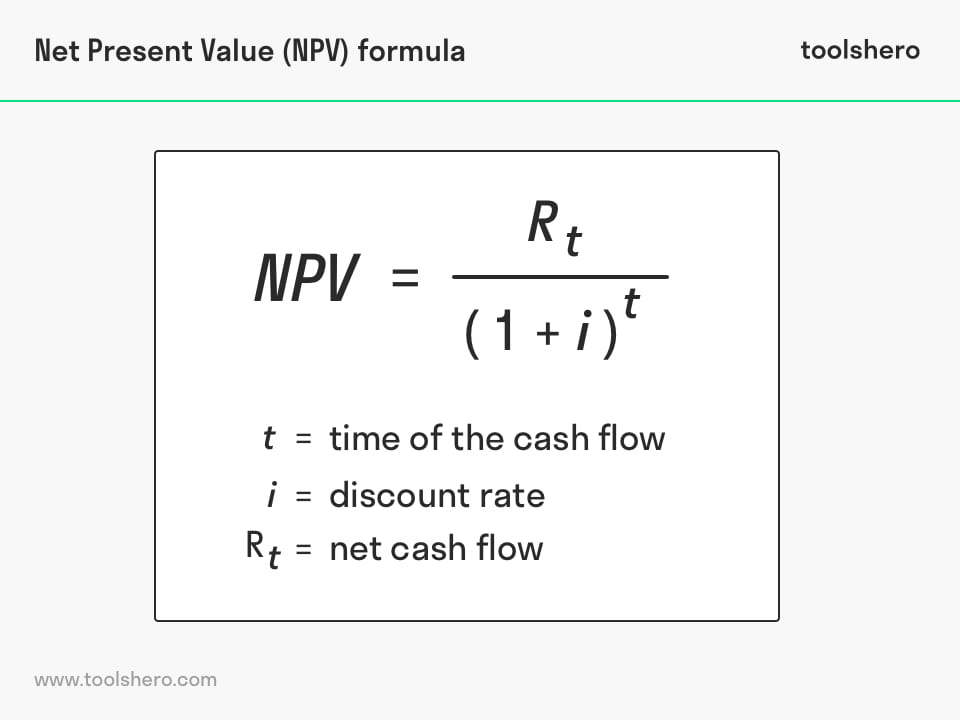

Net Present Value formula and example Toolshero

Net present value (npv) is the present value of all future cash flows of a project. Net present value is a financial calculation used to determine the present value of future cash flows. It takes into account the time. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an.

Net Present Value Calculator in Excel eFinancialModels

The net present value (npv) is the difference between the present value (pv) of a future stream of cash inflows and. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Because of its simplicity, npv is a useful tool to determine whether a.

The Net Present Value (Npv) Is The Difference Between The Present Value (Pv) Of A Future Stream Of Cash Inflows And.

Npv is the sum of all the discounted future cash flows. It takes into account the time. Because of its simplicity, npv is a useful tool to determine whether a project or. Net present value (npv) is the present value of all future cash flows of a project.

Net Present Value (Npv) Is The Value Of All Future Cash Flows (Positive And Negative) Over The Entire Life Of An Investment Discounted To The Present.

Net present value is a financial calculation used to determine the present value of future cash flows.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg)

+Future+Cash+x+Discount+Factor+%3D+NPV.jpg)