King County Property Tax For Senior Citizens - State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Property tax exemptions and property.

This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Property tax exemptions and property. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. They include property tax exemptions and property. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or.

State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. They include property tax exemptions and property. Property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing.

Senior Discount Property Tax King County at Ida Barrera blog

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. Property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides.

King County Senior Property Tax Exemption 2025 Karen K. Ater

King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Property tax exemptions and property..

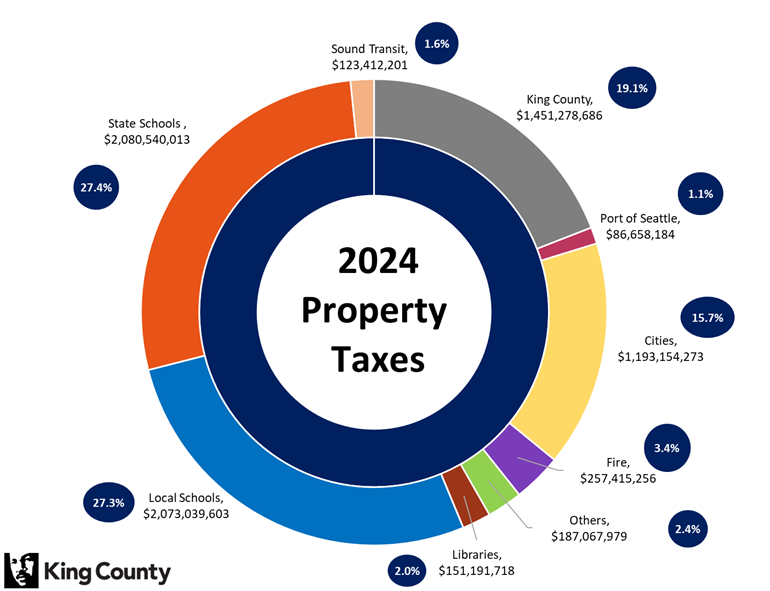

2024 Property Taxes King County, Washington

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: King.

Property Tax King 2025

This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or..

King County Senior Property Tax Exemption 2024 Vina Aloisia

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: They include property tax exemptions.

King County Senior Property Tax Exemption 2025 Britt L. Yokley

King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. State law provides a tax benefit program for.

King County Senior Property Tax Exemption 2025 Lark Aurelia

State law provides 2 tax benefit programs for senior citizens and persons with disabilities. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. For a reduction on your 2025, 2026 and.

Senior Discount Property Tax King County at Ida Barrera blog

Property tax exemptions and property. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. They include property tax exemptions and property. This exemption can reduce your property tax by 30 to.

Senior Tax Relief How to Reduce Property Tax Greatsenioryears

Property tax exemptions and property. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. They include property tax exemptions and property. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: For a reduction on your 2025, 2026 and 2027 property taxes,.

King County Senior Property Tax Exemption 2025 Karen K. Ater

They include property tax exemptions and property. State law provides 2 tax benefit programs for senior citizens and persons with disabilities. This exemption can reduce your property tax by 30 to 90 percent, depending on your income level, property value, and taxing. Property tax exemptions and property. King county's tax relief program expands eligibility and becomes more accessible to seniors.

This Exemption Can Reduce Your Property Tax By 30 To 90 Percent, Depending On Your Income Level, Property Value, And Taxing.

For a reduction on your 2025, 2026 and 2027 property taxes, your household income, after deduction of qualified expenses, is $84,000 or. King county's tax relief program expands eligibility and becomes more accessible to seniors and disabled individuals, allowing. State law provides a tax benefit program for senior citizens, persons with disabilities, and disabled veterans: Property tax exemptions and property.

State Law Provides 2 Tax Benefit Programs For Senior Citizens And Persons With Disabilities.

They include property tax exemptions and property.