King County Property Tax Appeal Form - To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. For real property appeals, use the real property petition form and. Find, download, and fill out forms for your petition on our appeals forms page. Comparable property sales analysis **comparable sales to complete this form may be obtained from: Most matters filed with the. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The king county tax advisor’s. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta).

Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Most matters filed with the. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The king county tax advisor’s. Find, download, and fill out forms for your petition on our appeals forms page. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). For real property appeals, use the real property petition form and. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. Comparable property sales analysis **comparable sales to complete this form may be obtained from:

Find, download, and fill out forms for your petition on our appeals forms page. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The king county tax advisor’s. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Most matters filed with the. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. For real property appeals, use the real property petition form and. Comparable property sales analysis **comparable sales to complete this form may be obtained from: There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate.

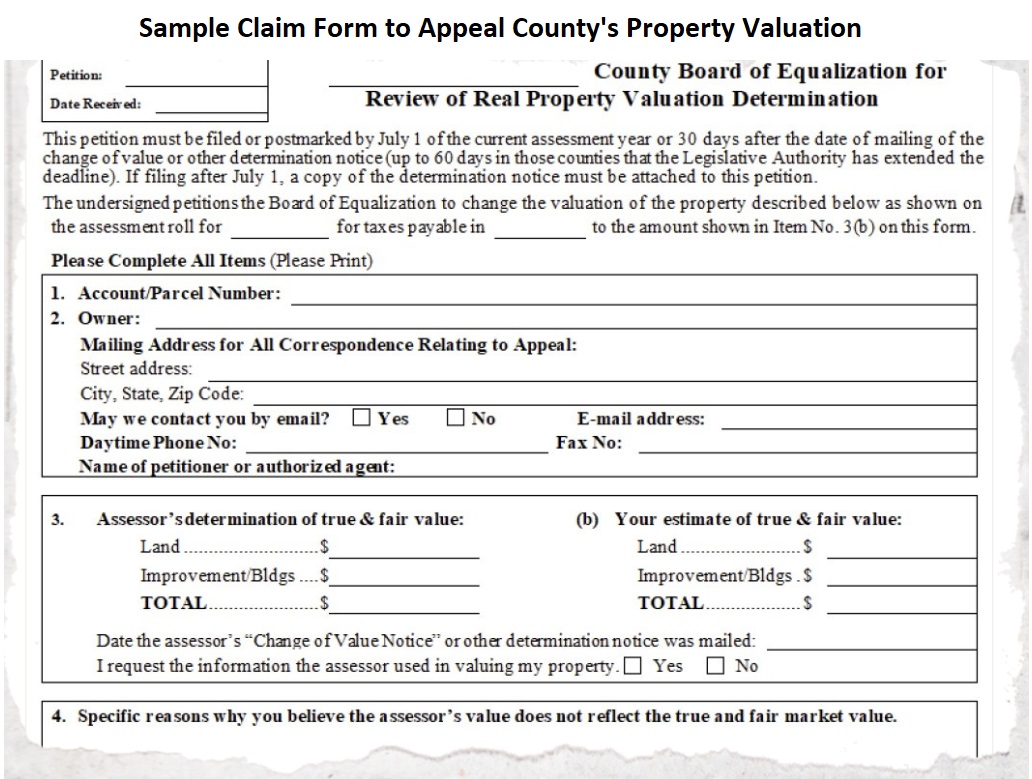

Fillable Online Property Tax Appeal form Fax Email Print pdfFiller

The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. The king county tax advisor’s. Find, download, and fill out forms for your petition on our appeals forms page. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land.

Writing a Property Tax Appeal Letter with Sample Form Fill Out and

There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). Find, download, and fill out forms for your petition on our appeals forms page. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the.

How to Appeal Your Property Taxes in King County Will Springer

Most matters filed with the. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. The king county tax advisor’s. Use this form for appealing denial of an application.

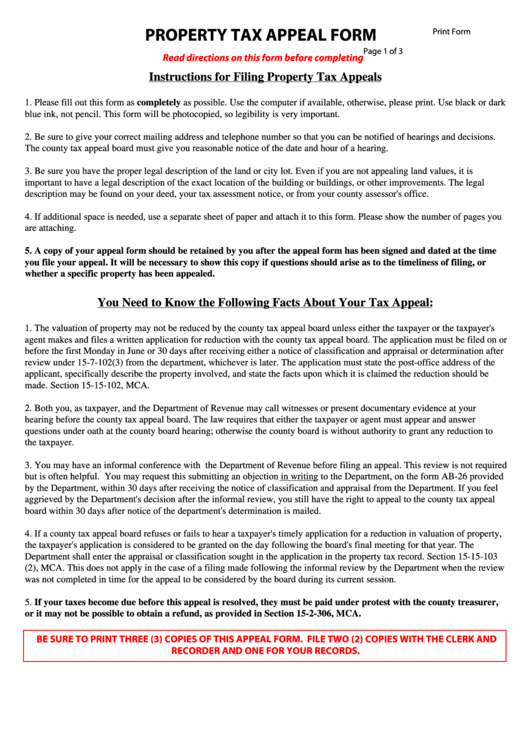

Fillable Property Tax Appeal Form Montana Department Of Revenue

The king county tax advisor’s. Find, download, and fill out forms for your petition on our appeals forms page. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the real property petition form and. There are several types of property tax appeals.

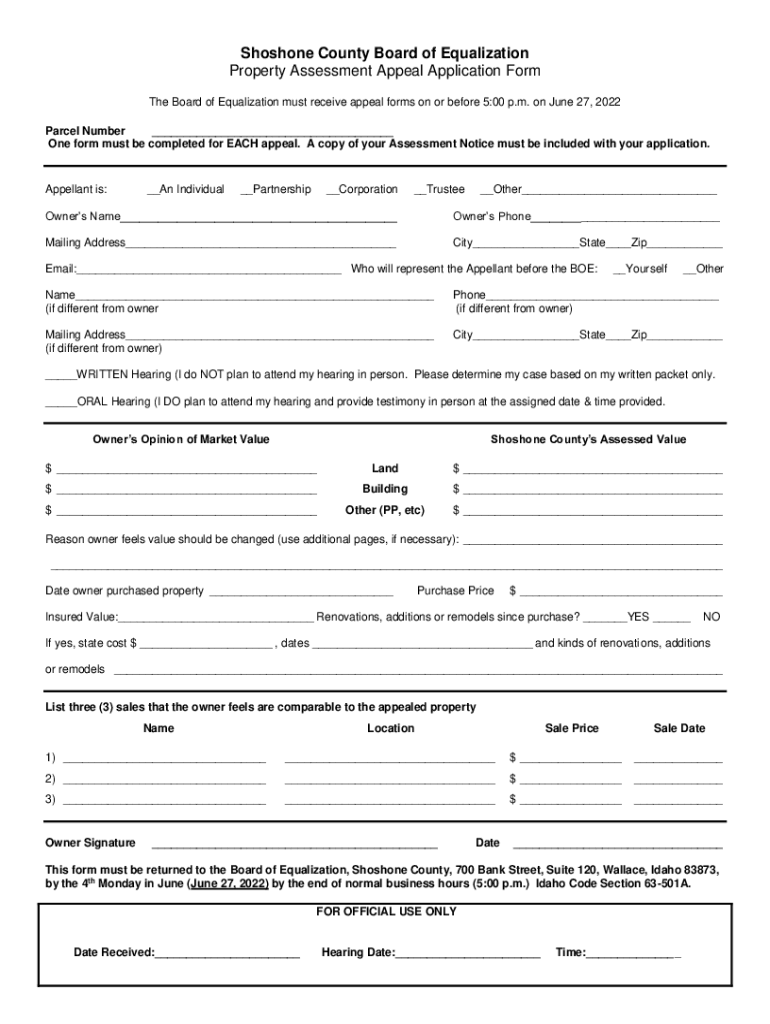

Fillable Online Property Assessment Appeal Application Form Fax Email

Find, download, and fill out forms for your petition on our appeals forms page. The king county tax advisor’s. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe.

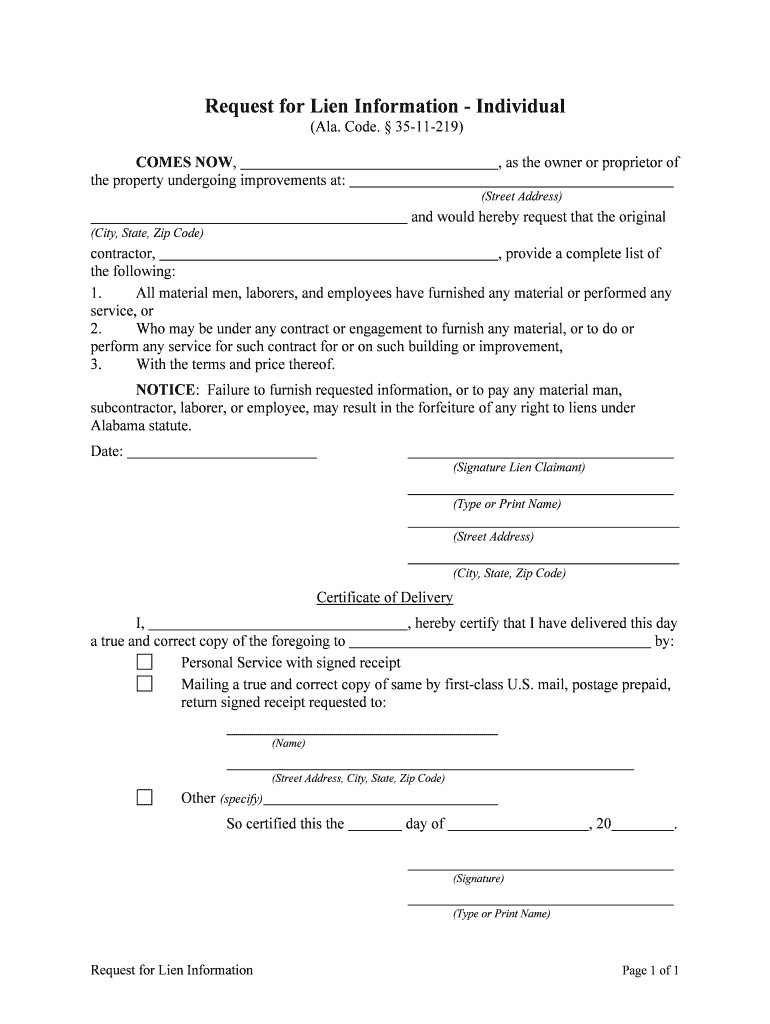

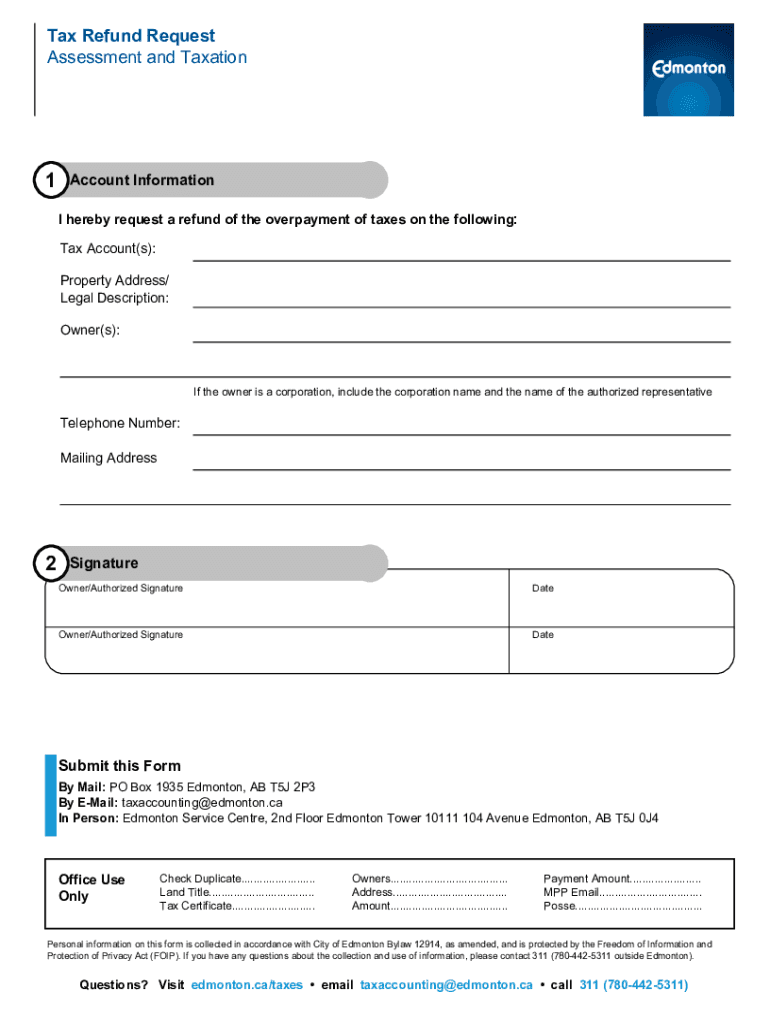

Fillable Online Property Tax Refund Request Form. Property Tax Refund

Find, download, and fill out forms for your petition on our appeals forms page. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Most matters filed with the. The tax appeal process in king county is your legal avenue to contest a property assessment that you believe.

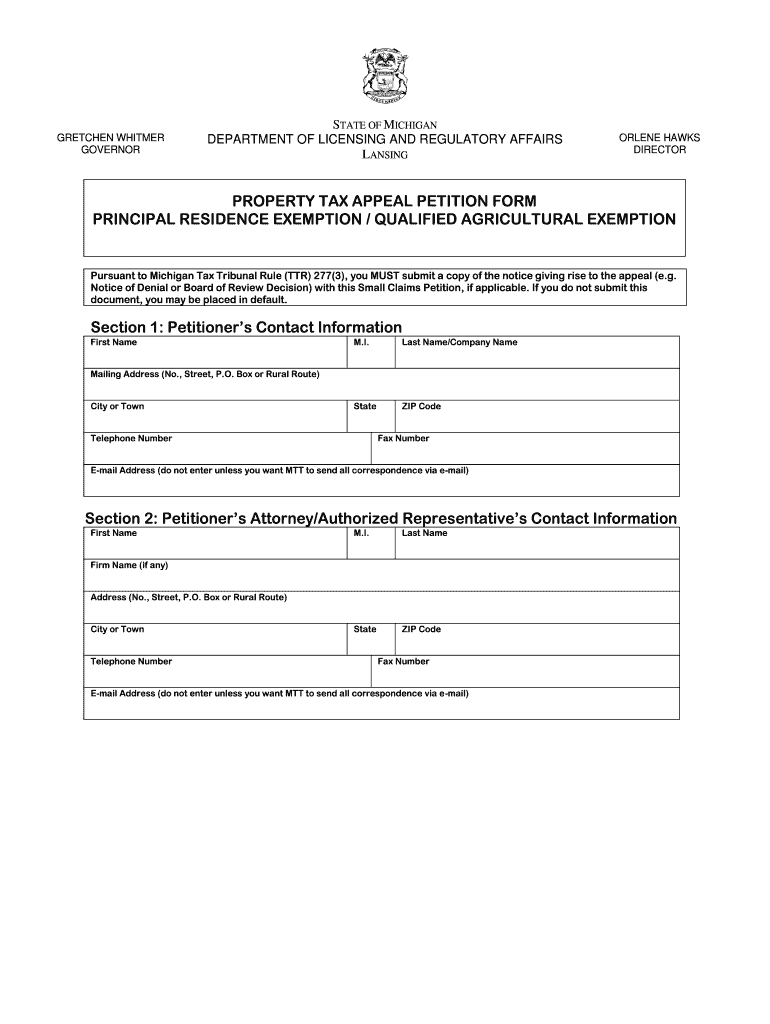

Michigan Property Tax Appeal Complete with ease airSlate SignNow

Most matters filed with the. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The tax appeal process in king county is your legal avenue.

Will County Property Tax Appeal Deadline 2024 Noemi Angeline

To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. For real property appeals, use the real property petition form and. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. The tax appeal process in king county.

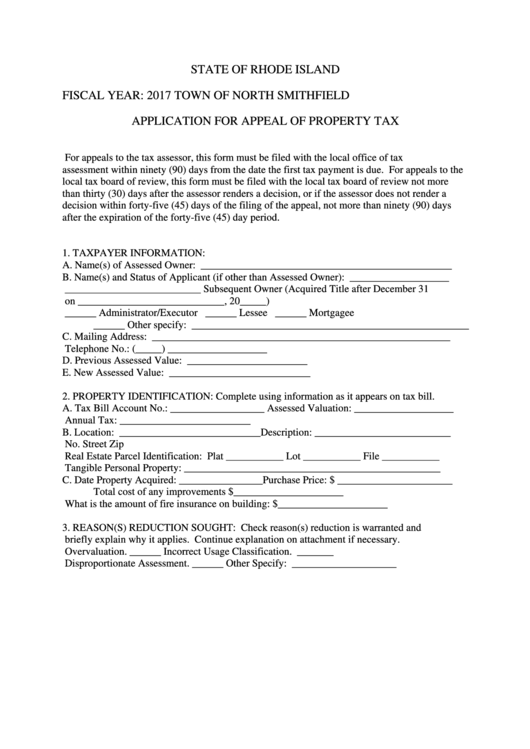

Application Form For Appeal Of Property Tax Printable Pdf Download

The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the real property petition form and. The king county tax advisor’s. To.

Onslow County Property Tax Appeals Form

Find, download, and fill out forms for your petition on our appeals forms page. The king county tax advisor’s. There are several types of property tax appeals handled at the washington state board of tax appeal (wsbta). To appeal your property tax assessment, you must submit your appeal petition to the king county board of equalization within. Comparable property sales.

To Appeal Your Property Tax Assessment, You Must Submit Your Appeal Petition To The King County Board Of Equalization Within.

Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. Use this form for appealing denial of an application from the assessor, removal from the current use or forest land programs, and/or. For real property appeals, use the real property petition form and. Comparable property sales analysis **comparable sales to complete this form may be obtained from:

There Are Several Types Of Property Tax Appeals Handled At The Washington State Board Of Tax Appeal (Wsbta).

The tax appeal process in king county is your legal avenue to contest a property assessment that you believe is inaccurate. Most matters filed with the. The king county tax advisor’s. Find, download, and fill out forms for your petition on our appeals forms page.