Irs Form Schedule C 2024 Worksheet - If you checked none of these above, please continue by completing the worksheet below for each business. Plus irs could ask for odometer readings from oil changes, repair. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. The intent of this worksheet is to summarize your business income and. “evidence” includes mileage logs, appointment records, calendars, etc. If yes, did you file. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written.

The intent of this worksheet is to summarize your business income and. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. If you checked none of these above, please continue by completing the worksheet below for each business. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. “evidence” includes mileage logs, appointment records, calendars, etc. If yes, did you file. Plus irs could ask for odometer readings from oil changes, repair.

Plus irs could ask for odometer readings from oil changes, repair. If yes, did you file. If you checked none of these above, please continue by completing the worksheet below for each business. I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. The intent of this worksheet is to summarize your business income and. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. “evidence” includes mileage logs, appointment records, calendars, etc.

Irs Schedule C 2024 Tove Ainslie

If you checked none of these above, please continue by completing the worksheet below for each business. If yes, did you file. “evidence” includes mileage logs, appointment records, calendars, etc. Plus irs could ask for odometer readings from oil changes, repair. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for.

2024 Schedule C Form Orel Tracey

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Plus irs could ask for odometer readings from oil changes, repair. If you checked none of these above, please continue by completing the worksheet below for each business. The intent of this worksheet is to summarize your business income and. Payments of.

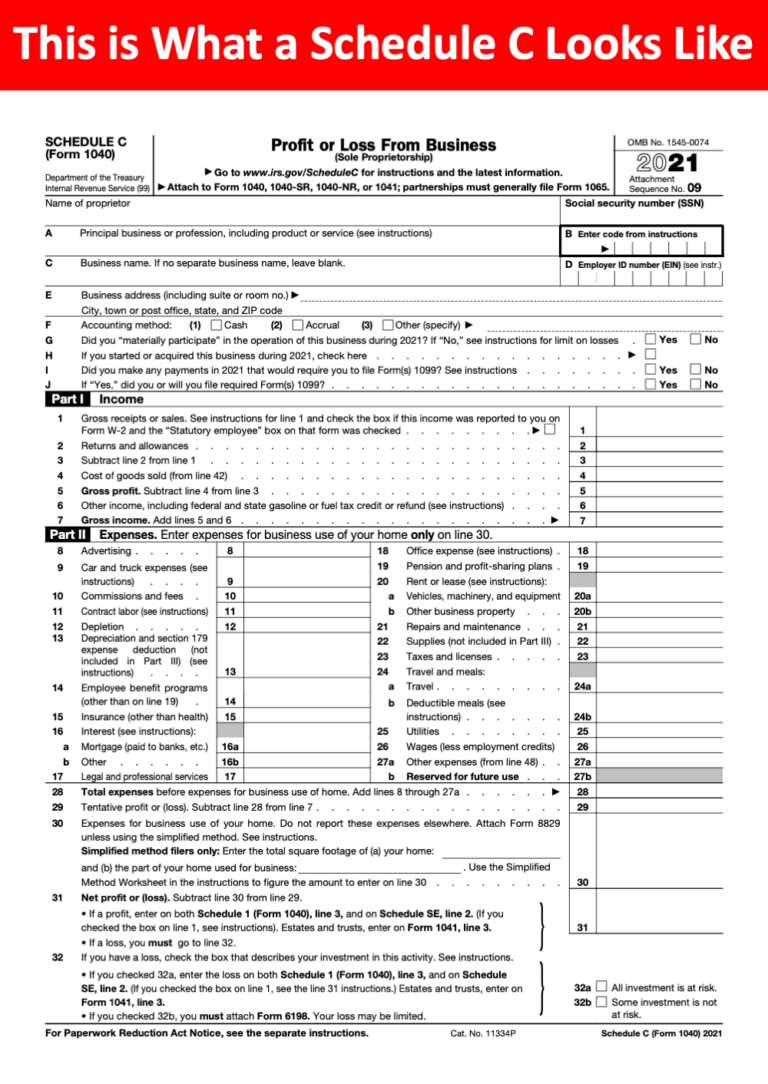

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Plus irs could ask for odometer readings from oil changes, repair. If yes, did you file. The intent of this worksheet.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. The intent of this worksheet is to summarize your business income and. If yes, did you file. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Plus irs could ask.

Irs Schedule C Instructions For 2024 Printable Deena Eveleen

“evidence” includes mileage logs, appointment records, calendars, etc. The intent of this worksheet is to summarize your business income and. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. If yes, did you file. Plus irs could ask for odometer readings from oil changes, repair.

2024 Schedule C Form Maren Florentia

“evidence” includes mileage logs, appointment records, calendars, etc. The intent of this worksheet is to summarize your business income and. If you checked none of these above, please continue by completing the worksheet below for each business. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. Plus irs.

Calculation Worksheet 2024

If yes, did you file. If you checked none of these above, please continue by completing the worksheet below for each business. Plus irs could ask for odometer readings from oil changes, repair. The intent of this worksheet is to summarize your business income and. Payments of $600 or more were paid to an individual, who is not your employee,.

2024 Schedule C Form 1040 Worksheet Alida Barbara

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. “evidence” includes mileage logs, appointment records, calendars, etc. The intent of this worksheet is to summarize your business income and. Plus irs could ask for odometer readings from oil changes, repair. Payments of $600 or more were paid to an individual, who.

IRS Schedule C (Form 1040) Instructions 2024 Guide Excel Capital

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If yes, did you file. If you checked none of these above, please continue by completing the worksheet below for each business. Plus irs could ask for odometer readings from oil changes, repair. Payments of $600 or more were paid to an.

Printable Schedule C 2023

If you checked none of these above, please continue by completing the worksheet below for each business. “evidence” includes mileage logs, appointment records, calendars, etc. If yes, did you file. Payments of $600 or more were paid to an individual, who is not your employee, for services provided for this business. The intent of this worksheet is to summarize your.

Payments Of $600 Or More Were Paid To An Individual, Who Is Not Your Employee, For Services Provided For This Business.

I hereby verify that the income and expense information set forth on this worksheet is substantiated by written. If yes, did you file. If you checked none of these above, please continue by completing the worksheet below for each business. “evidence” includes mileage logs, appointment records, calendars, etc.

The Intent Of This Worksheet Is To Summarize Your Business Income And.

Plus irs could ask for odometer readings from oil changes, repair.