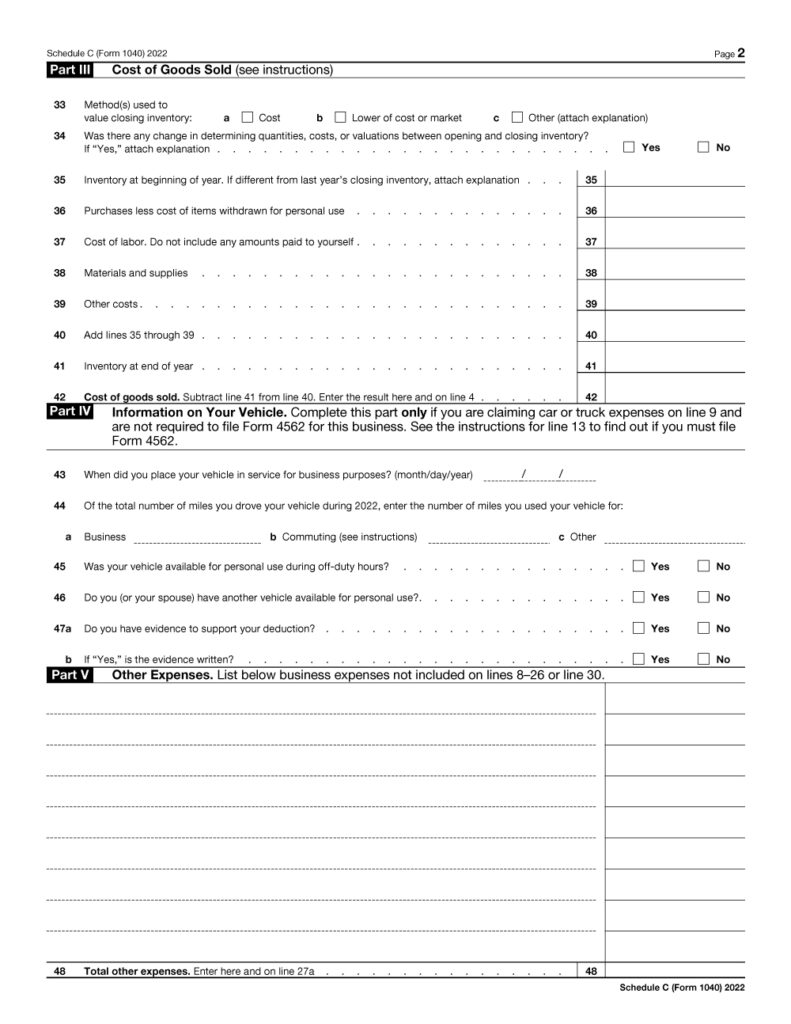

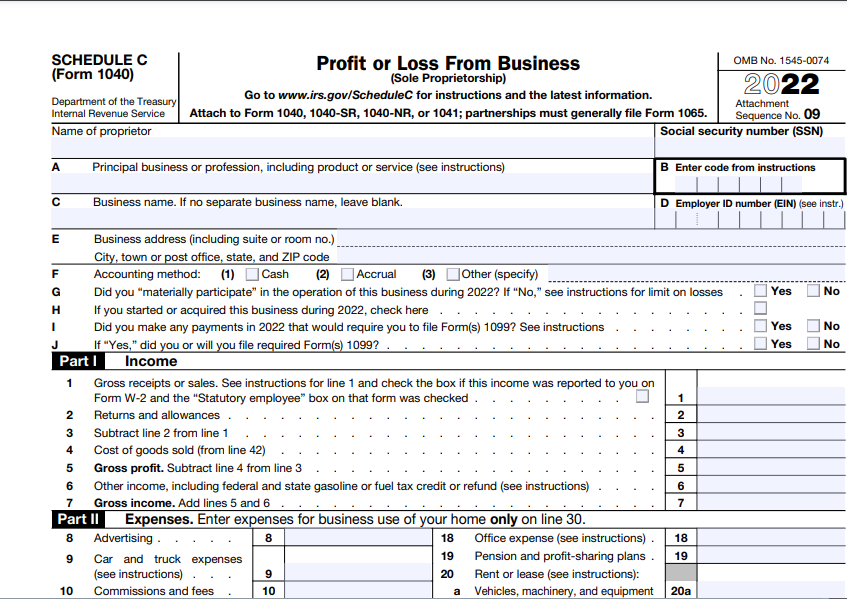

Irs Form Schedule C 2023 Printable - Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability.

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Accurate completion of this schedule.

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession.

Printable Schedule C 2023

Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession.

IRS Form 1040 Schedule C. Profit or Loss From Business Forms Docs

Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Use schedule c to report income or loss from a business or profession.

Printable Schedule C Form

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your.

Schedule C Form Template

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your business activities, impacting your overall.

Printable Schedule C

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated.

Schedule C 2023 Form Printable Forms Free Online

This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or.

Schedule C (Form 1040) 2023 Instructions

Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This form helps you calculate the net profit or loss of your.

Free Printable Schedule C Form

Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Information about schedule c (form 1040), profit or loss from business, used to report income or.

2023 Form IRS Instructions 1040 Schedule C Fill Online, Printable

Use schedule c to report income or loss from a business or profession in which you were the sole proprietor. Accurate completion of this schedule. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. This form helps you calculate the net profit or loss of your.

Printable Schedule C 2023

This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession. Accurate completion of this schedule. Use schedule c to report income or loss from a business or profession.

Information About Schedule C (Form 1040), Profit Or Loss From Business, Used To Report Income Or Loss From A Business Operated Or Profession.

Accurate completion of this schedule. This form helps you calculate the net profit or loss of your business activities, impacting your overall tax liability. Use schedule c to report income or loss from a business or profession in which you were the sole proprietor.

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png)