Income Tax Calculator From Salary Slip - 10k+ visitors in the past month Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Account for federal & state taxes, deductions like fica, medicare, health. If you are salaried, your annual salary will be your gross income. 10k+ visitors in the past month Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Federal tax, state tax, medicare,. It can also be used. First, we need to determine your gross income. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. First, we need to determine your gross income. Federal tax, state tax, medicare,. Account for federal & state taxes, deductions like fica, medicare, health. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used. If you are salaried, your annual salary will be your gross income. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. 10k+ visitors in the past month 10k+ visitors in the past month

10k+ visitors in the past month Federal tax, state tax, medicare,. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. It can also be used. First, we need to determine your gross income. Account for federal & state taxes, deductions like fica, medicare, health. 10k+ visitors in the past month If you are salaried, your annual salary will be your gross income.

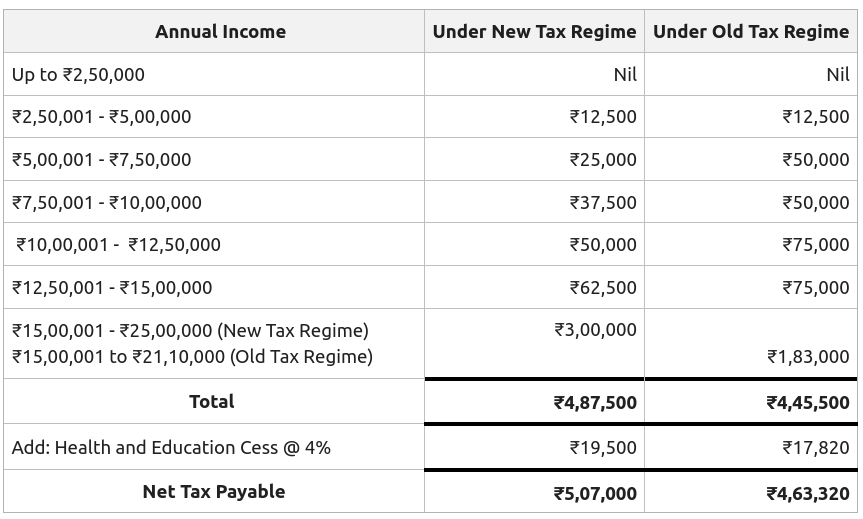

How To Calculate Tax FY 202223 Example (Salary Payslip

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Account for federal & state taxes, deductions like fica, medicare, health. First, we need to determine your gross income. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Use smartasset's paycheck.

How to Calculate Tax on Salary with Example in Excel FinCalC Blog

Federal tax, state tax, medicare,. If you are salaried, your annual salary will be your gross income. 10k+ visitors in the past month Account for federal & state taxes, deductions like fica, medicare, health. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

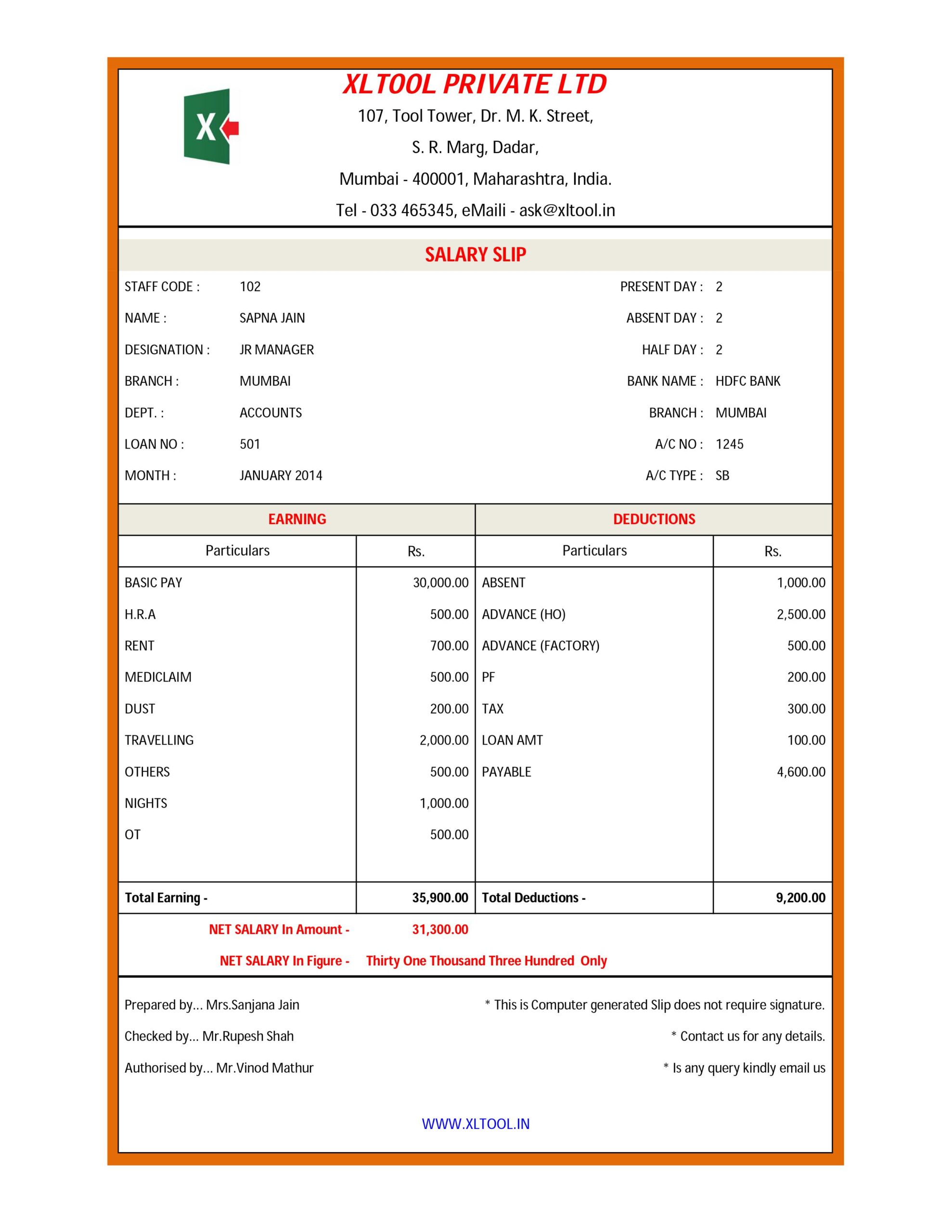

EXCEL of Salary Slip Calculator.xlsx WPS Free Templates

If you are salaried, your annual salary will be your gross income. Account for federal & state taxes, deductions like fica, medicare, health. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. First, we need to determine your gross income. Use our united states salary tax calculator to determine how.

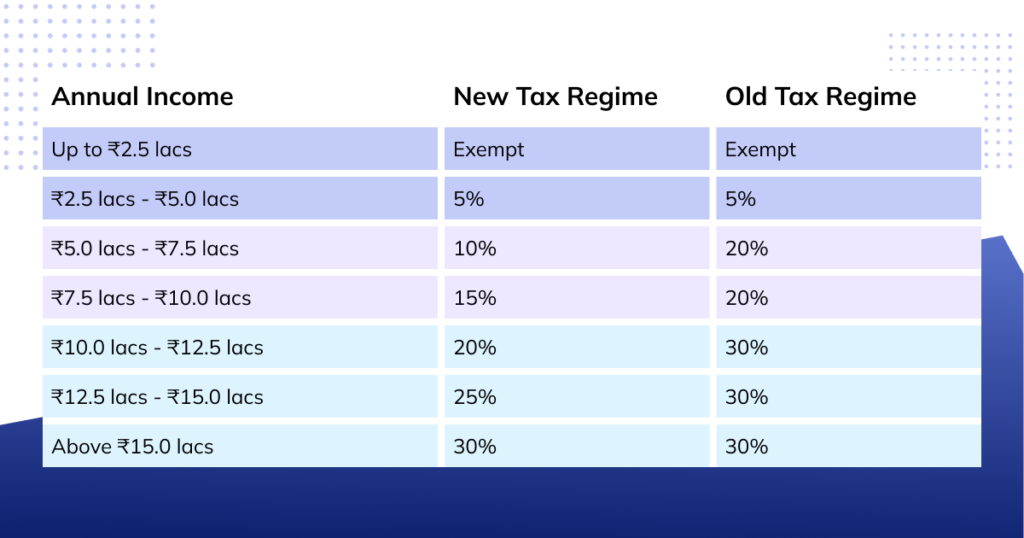

Tax calculation in salary slipPayroll tax

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. If you are salaried, your annual salary will be your gross income. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 10k+ visitors in the past month 10k+ visitors in the.

8 Essential Components Of Salary Slip That You Should vrogue.co

10k+ visitors in the past month It can also be used. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Federal tax, state tax, medicare,. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Salary Slip Template In Excel

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 10k+ visitors in the past month First, we need to determine your gross income. Federal tax, state tax, medicare,.

How to Calculate Tax on Salary (With Example)

If you are salaried, your annual salary will be your gross income. 10k+ visitors in the past month It can also be used. Account for federal & state taxes, deductions like fica, medicare, health. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into.

How to Calculate Tax on Salary (With Example)

Account for federal & state taxes, deductions like fica, medicare, health. It can also be used. Federal tax, state tax, medicare,. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. 10k+ visitors in the past month

How to calculate Tax on salary? (with example) cyberdime.io

Use our united states salary tax calculator to determine how much tax will be paid on your annual salary. Federal tax, state tax, medicare,. It can also be used. If you are salaried, your annual salary will be your gross income. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after.

How to Calculate Tax on Salary (With Example)

It can also be used. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 10k+ visitors in the past month 10k+ visitors in the past month Use our united states salary tax calculator to determine how much tax will be paid on your annual salary.

If You Are Salaried, Your Annual Salary Will Be Your Gross Income.

It can also be used. Federal tax, state tax, medicare,. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into. Use our united states salary tax calculator to determine how much tax will be paid on your annual salary.

10K+ Visitors In The Past Month

Account for federal & state taxes, deductions like fica, medicare, health. 10k+ visitors in the past month First, we need to determine your gross income. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.