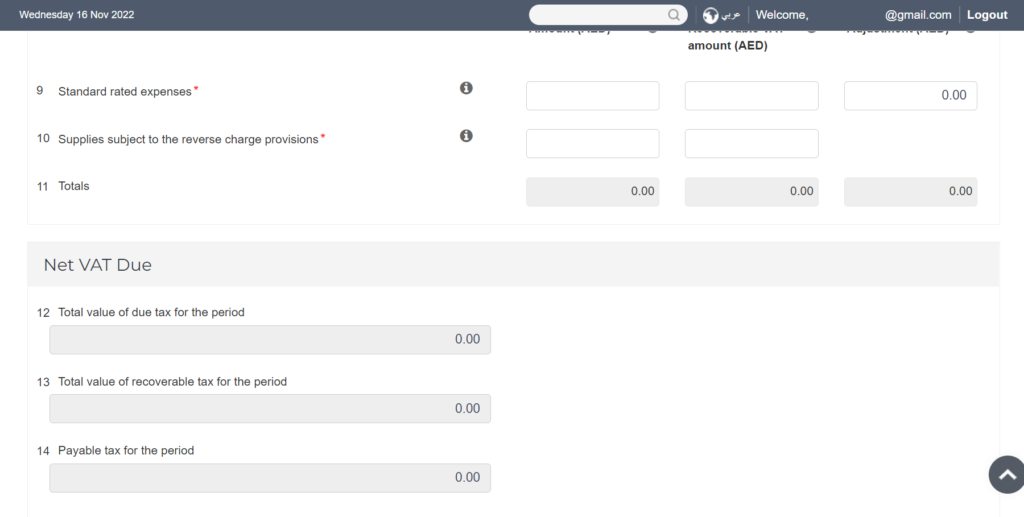

How To Submit Vat In Uae - How to file vat return? You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days.

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal: How to file vat return?

You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days.

How to File VAT Returns in UAE? A stepbystep VAT Returns User Guide

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? You must file for tax return electronically through the fta.

Filing Vat Return in UAE Vat Return UAE How to file VAT Return in

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta).

How to Deregister from vat in UAE? (Cancel VAT)

You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28.

How to Submit VAT Reconsideration Form in UAE?

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta).

How to file Vat Return in UAE Submit Vat Return on Emaratax portal

How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta.

How To Submit VAT Return In UAE Using FTA Portal [2025]

How to file vat return? You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28.

How To Submit Your UAE VAT Return Virtuzone

You must file for tax return electronically through the fta portal: How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28.

How to File VAT Return in UAE New EMARA TAX PORTAL YouTube

How to file vat return? You must file for tax return electronically through the fta portal: Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta).

How to Submit Your UAE VAT Return? Flying Colour Tax Services

How to file vat return? Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. You must file for tax return electronically through the fta.

How To Submit Your UAE VAT Return Virtuzone

You must file for tax return electronically through the fta portal: Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. How to file vat.

You Must File For Tax Return Electronically Through The Fta Portal:

Navigating vat return filing in the uae is essential for businesses to stay compliant with federal tax authority (fta) regulations. How to file vat return? Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days.

![How To Submit VAT Return In UAE Using FTA Portal [2025]](https://nowconsultant.com/wp-content/uploads/2023/11/VAT-Return-Filing-Process-_1_.webp)