How To Make Vat Payment In Uae - Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of.

Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of.

Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of.

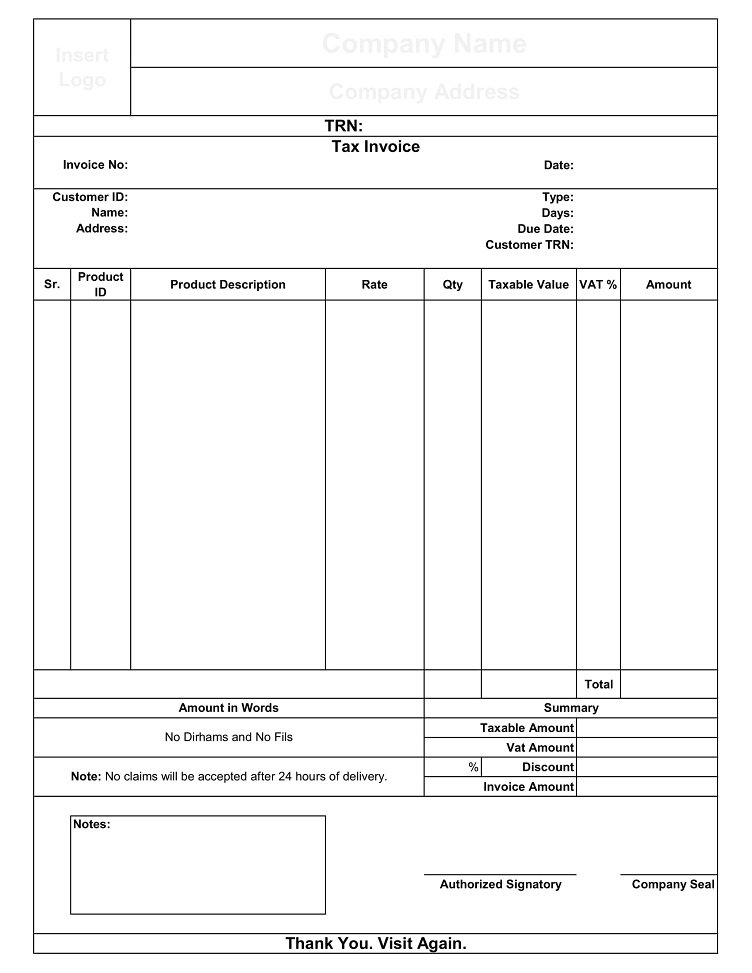

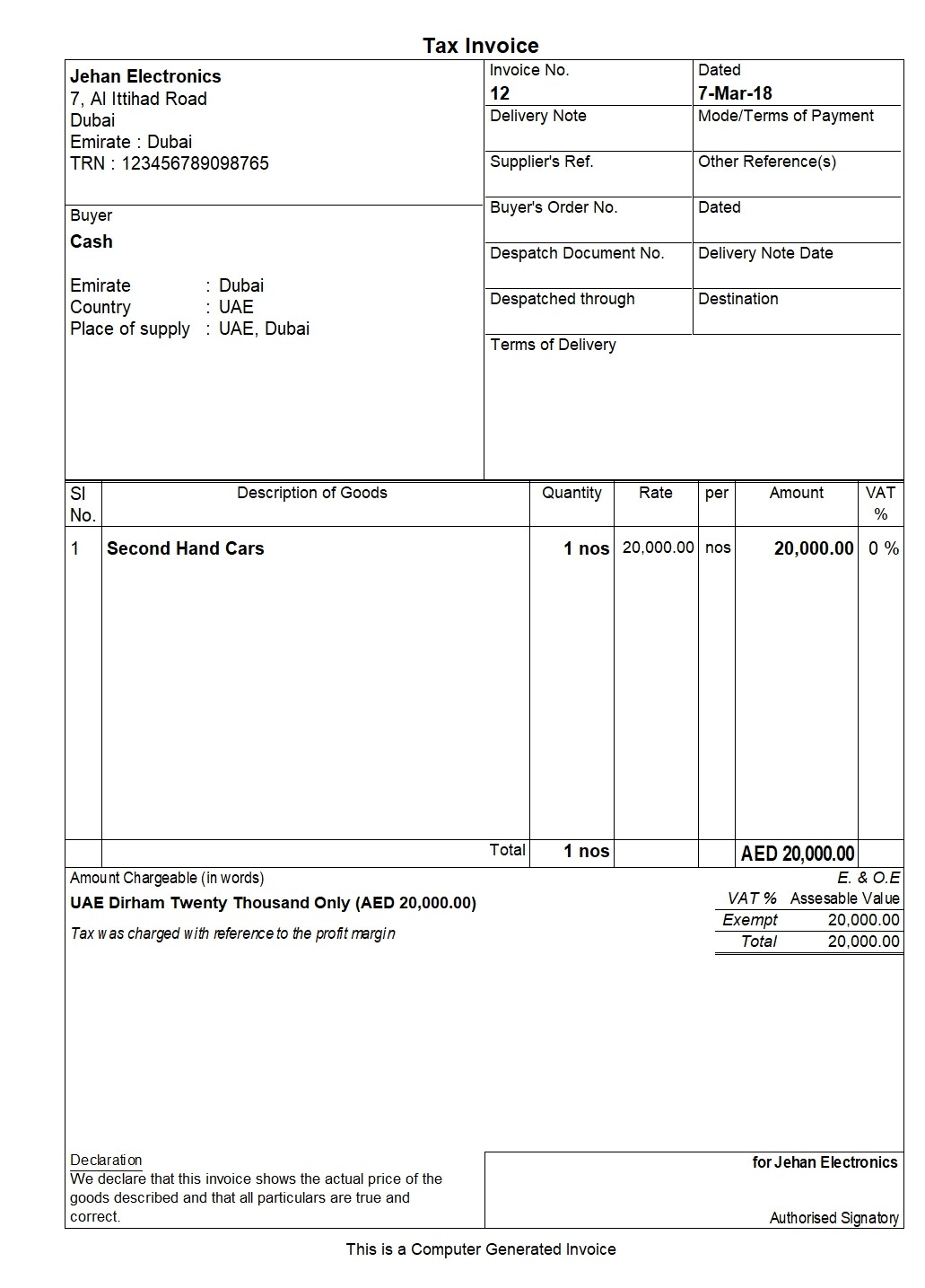

How To Make Vat Payment In Uae Download Free Uae Vat vrogue.co

Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of. Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

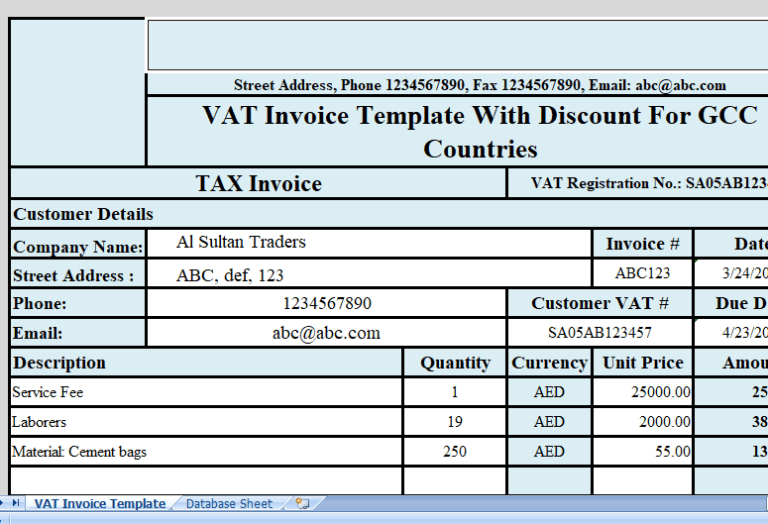

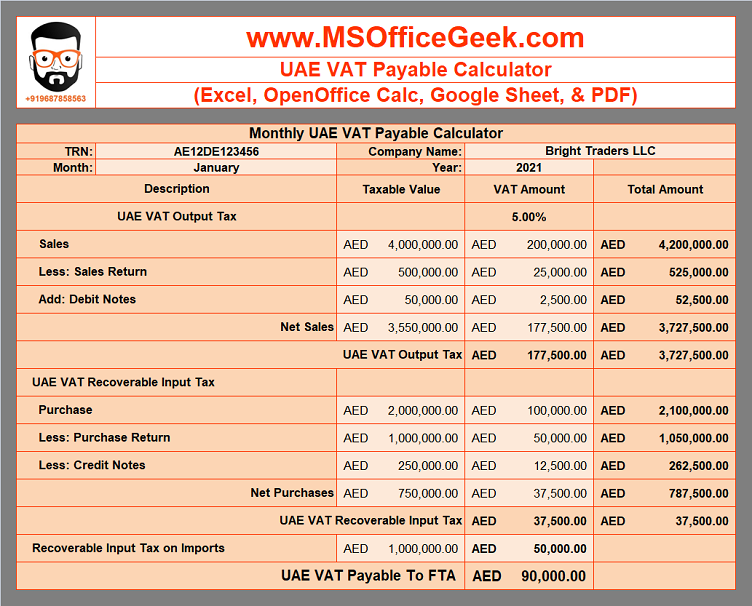

Fully Automated UAE VAT Invoice Template MSOfficeGeek

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Vat and excise tax registered businesses must pay their tax dues electronically through the website.

UAE VAT Archives Excel templates

Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of. Once you.

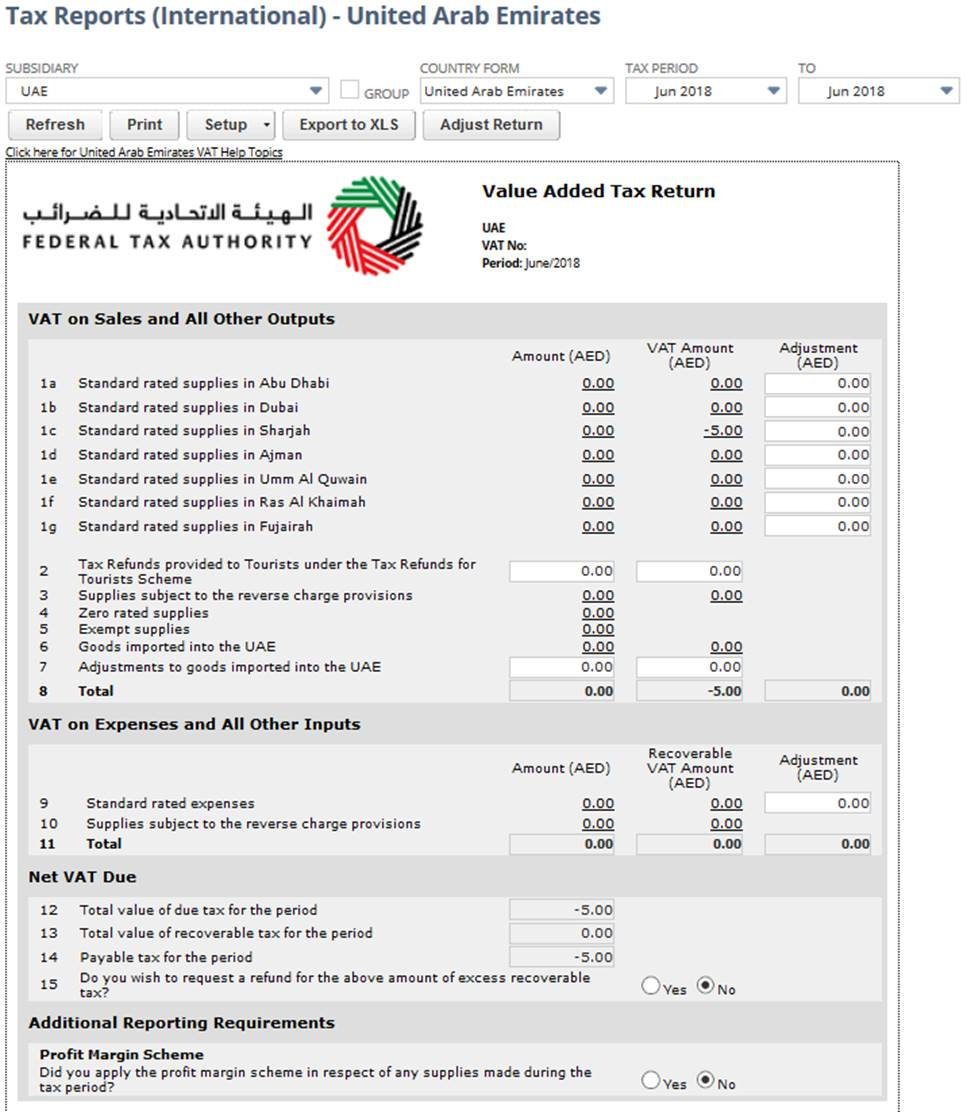

NetSuite Applications Suite United Arab Emirates VAT Report

Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

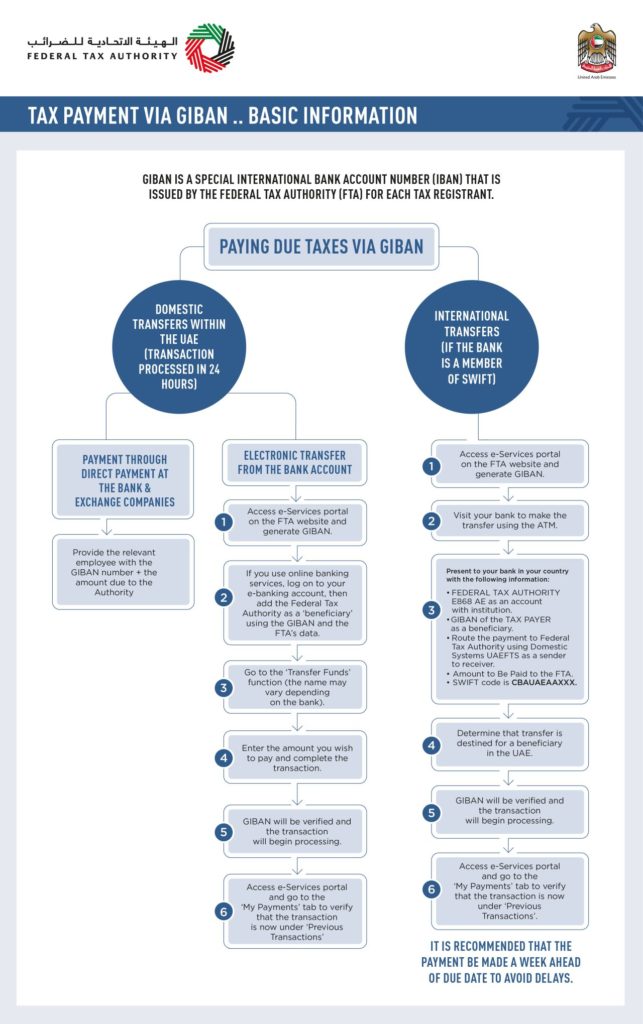

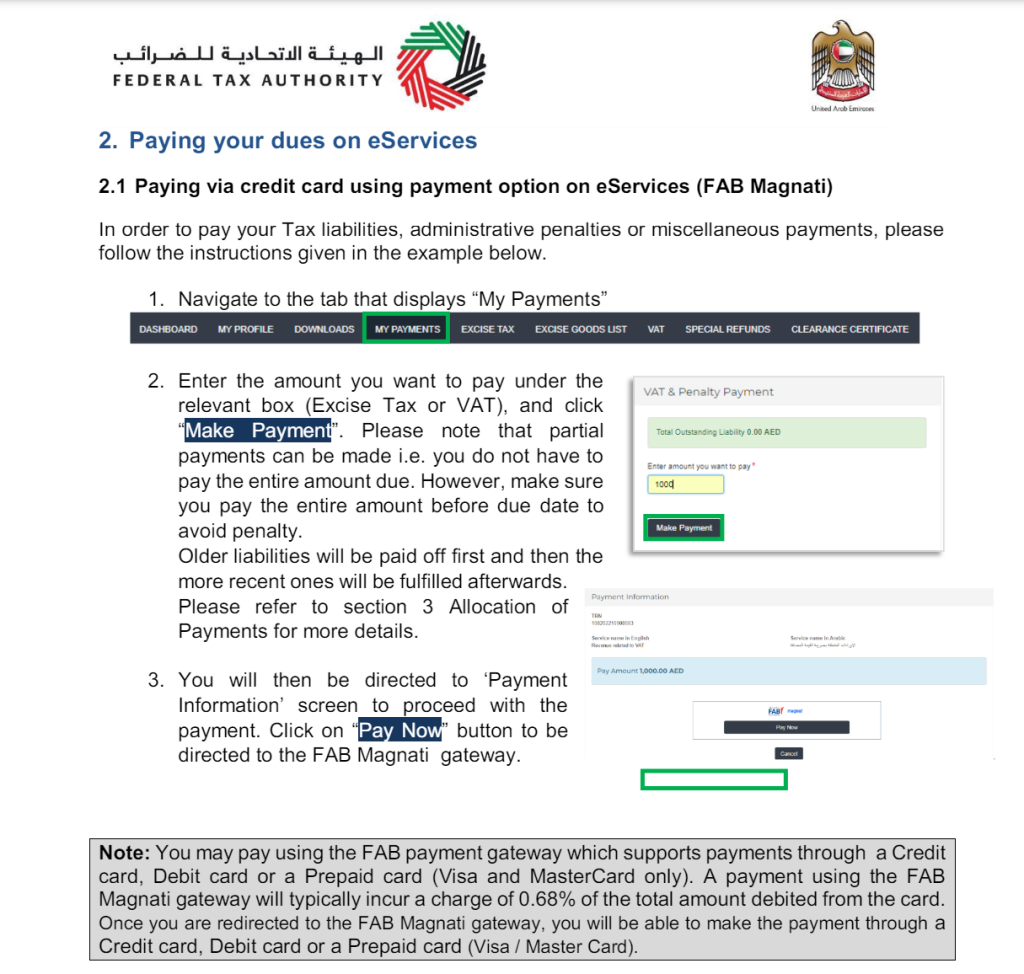

How to make tax payments to FTA in UAE VAT payment Emaratax

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying vat in the uae is a straightforward process with multiple payment options available to suit.

Simplified Tax Invoice under VAT Tax Invoice Format

Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of. Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Once you.

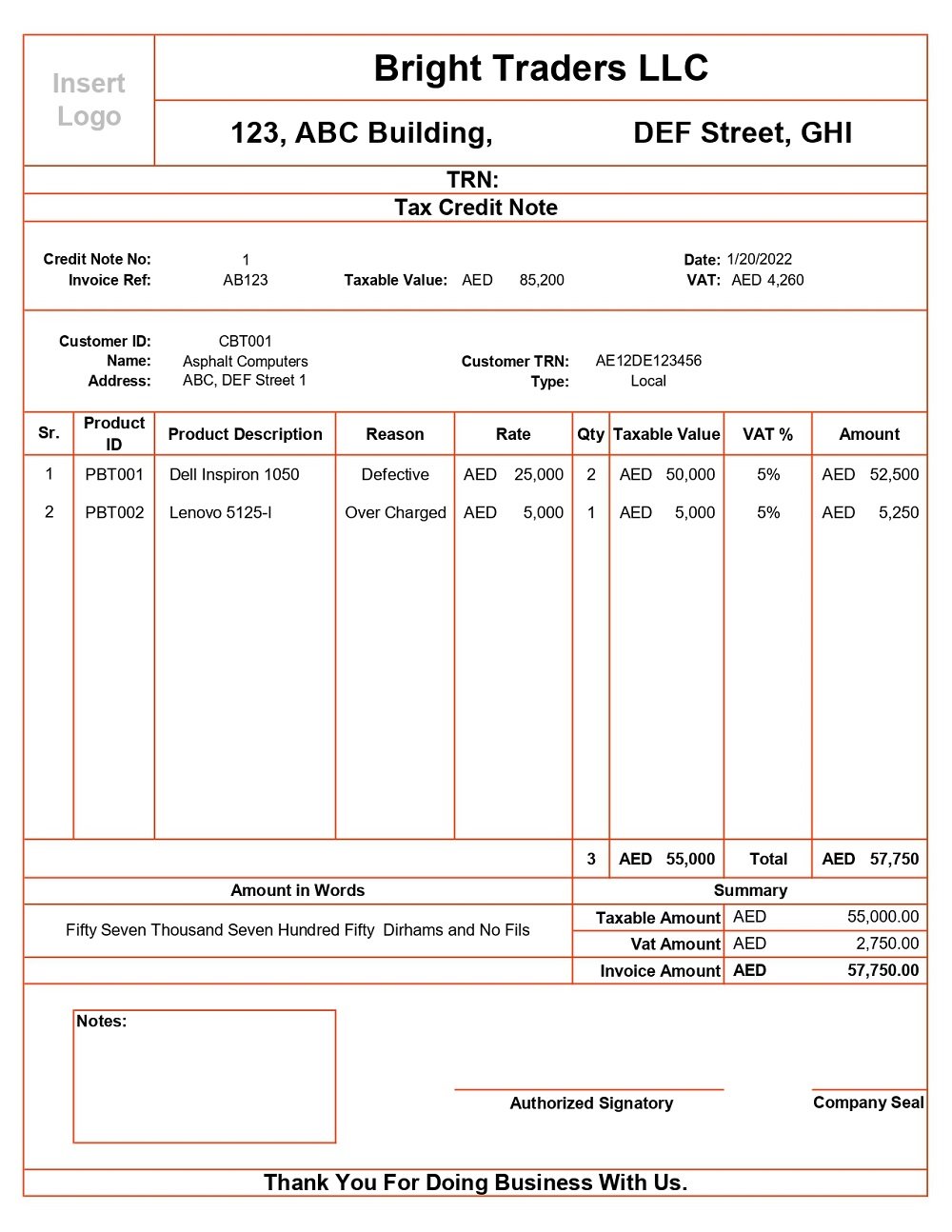

ReadyToUse UAE VAT Credit Note Format MSOfficeGeek

Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat.

ReadyToUse UAE VAT Payable Calculator Template MSOfficeGeek

Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under.

Uae Vat Rate 2024 Estel Janella

Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under.

How to make VAT payment in UAE?

Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority. Once you have registered for vat in the uae, you are required to file your vat return and make related vat payments within 28 days. Paying vat in the uae is a straightforward process with multiple payment options available to.

Once You Have Registered For Vat In The Uae, You Are Required To File Your Vat Return And Make Related Vat Payments Within 28 Days.

Vat and excise tax registered businesses must pay their tax dues electronically through the website of federal tax authority. Paying vat in the uae is a straightforward process with multiple payment options available to suit the needs of. Paying value added tax (vat) in the uae is a mandatory process for businesses registered under the federal tax authority.