How To Calculate Npv On Financial Calculator - Our npv calculator is designed to simplify the process of evaluating investment opportunities: Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. This calculator helps you determine the net present value (npv) of an investment. Calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. The npv is the sum of the present values of incoming and. Learn how to calculate net present value (npv) of an investment project using a financial calculator. Enter the initial investment, discount rate, and.

The npv is the sum of the present values of incoming and. This calculator helps you determine the net present value (npv) of an investment. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Our npv calculator is designed to simplify the process of evaluating investment opportunities: Calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Enter the initial investment, discount rate, and. Learn how to calculate net present value (npv) of an investment project using a financial calculator.

Calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. The npv is the sum of the present values of incoming and. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. This calculator helps you determine the net present value (npv) of an investment. Our npv calculator is designed to simplify the process of evaluating investment opportunities: Learn how to calculate net present value (npv) of an investment project using a financial calculator. Enter the initial investment, discount rate, and.

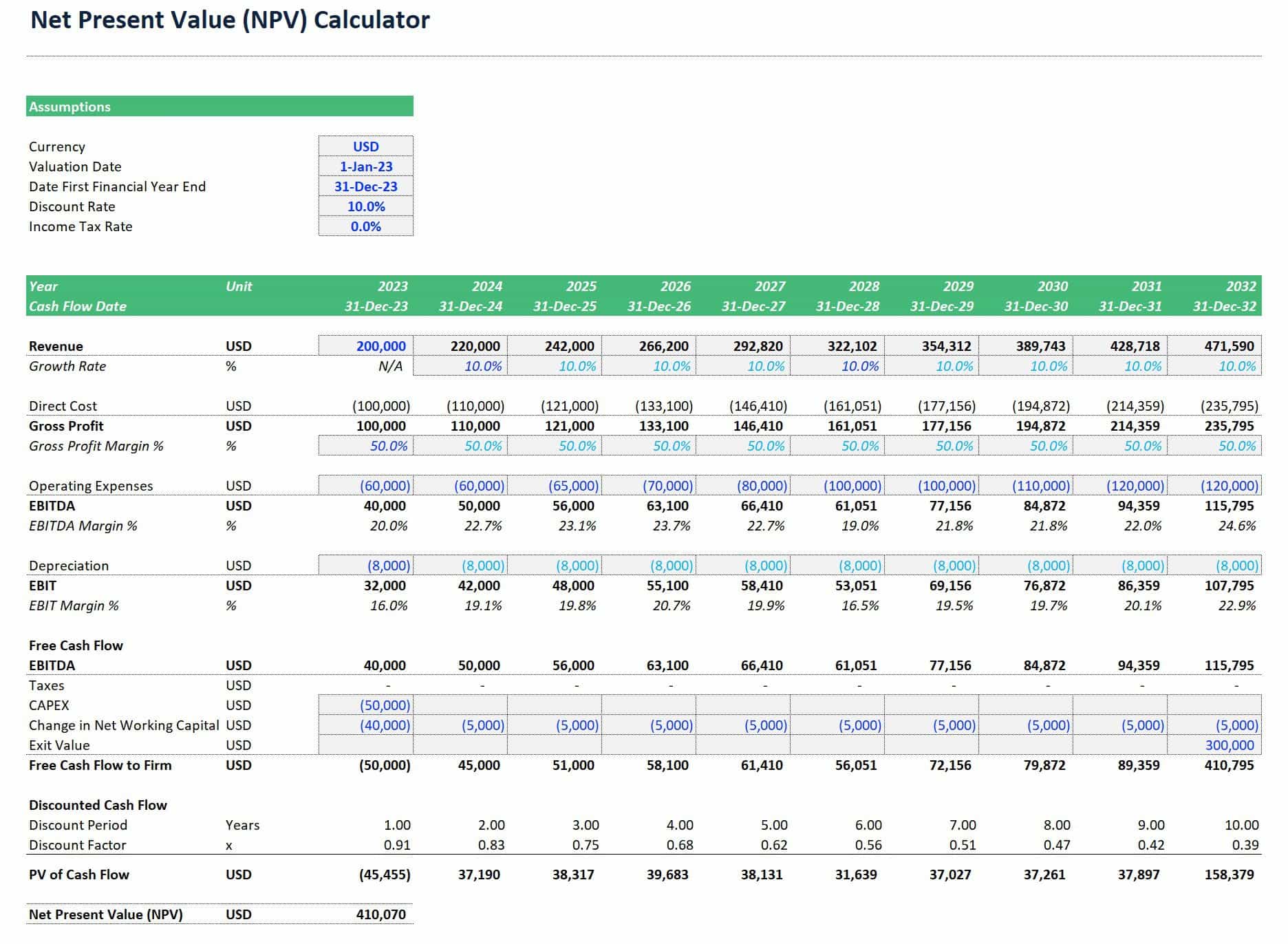

How to Calculate Net Present Value (NPV)? eFinancialModels

Enter the initial investment, discount rate, and. Learn how to calculate net present value (npv) of an investment project using a financial calculator. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. This calculator helps you determine the net present value (npv) of an investment. Our npv calculator is designed to simplify.

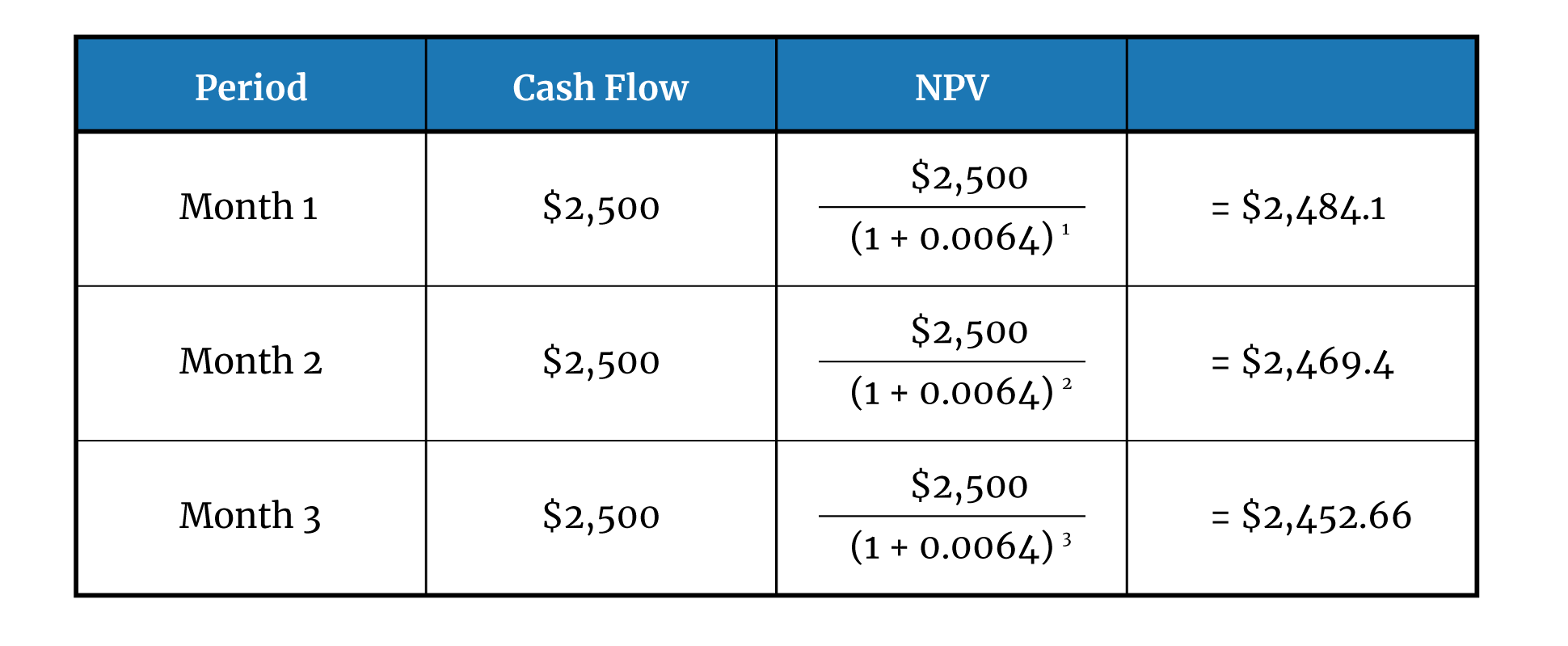

Net Present Value Calculating and Using Payment Savvy

This calculator helps you determine the net present value (npv) of an investment. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Our npv calculator is designed to simplify the process of evaluating investment opportunities: Enter the initial investment, discount rate, and. Learn how to calculate net present value (npv) of an.

BA II Plus Cash Flows 1 Net Present Value (NPV) and IRR Calculations

The npv is the sum of the present values of incoming and. Enter the initial investment, discount rate, and. This calculator helps you determine the net present value (npv) of an investment. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate net present value (npv) of an investment based on a.

Net Present Value Calculator in Excel eFinancialModels

Enter the initial investment, discount rate, and. The npv is the sum of the present values of incoming and. This calculator helps you determine the net present value (npv) of an investment. Calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. Our npv calculator is designed to simplify.

Net Present Value Calculator

The npv is the sum of the present values of incoming and. Learn how to calculate net present value (npv) of an investment project using a financial calculator. Enter the initial investment, discount rate, and. This calculator helps you determine the net present value (npv) of an investment. Net present value (npv) is a capital budgeting method used to determine.

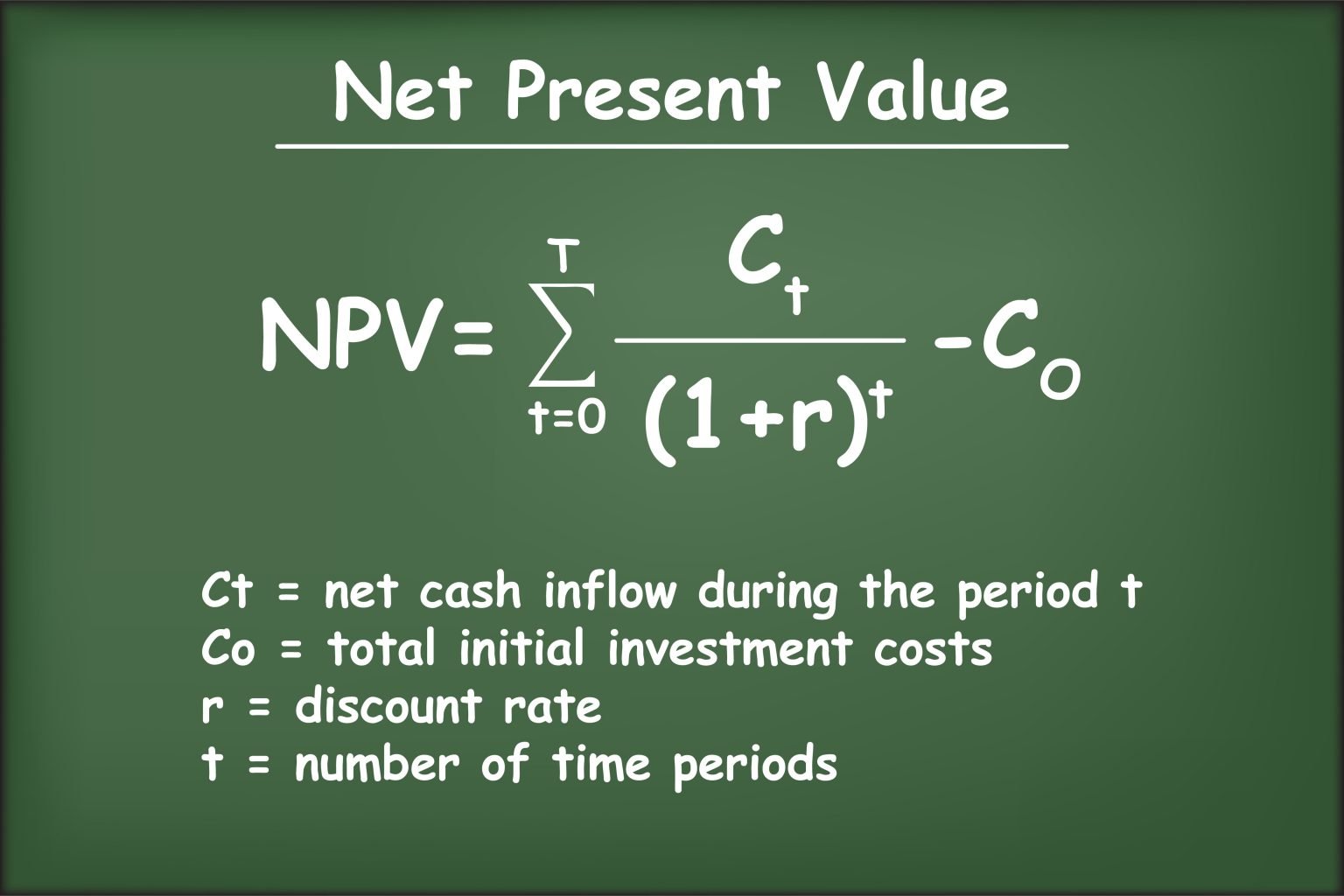

Net Present Value (NPV) What It Means and Steps to Calculate It (2022)

Learn how to calculate net present value (npv) of an investment project using a financial calculator. The npv is the sum of the present values of incoming and. Calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals. This calculator helps you determine the net present value (npv) of.

Net Present Value Calculator with Example + Steps

Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Enter the initial investment, discount rate, and. Learn how to calculate net present value (npv) of an investment project using a financial calculator. This calculator helps you determine the net present value (npv) of an investment. The npv is the sum of the.

Net Present Value Excel Template

Learn how to calculate net present value (npv) of an investment project using a financial calculator. Our npv calculator is designed to simplify the process of evaluating investment opportunities: Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. This calculator helps you determine the net present value (npv) of an investment. Enter.

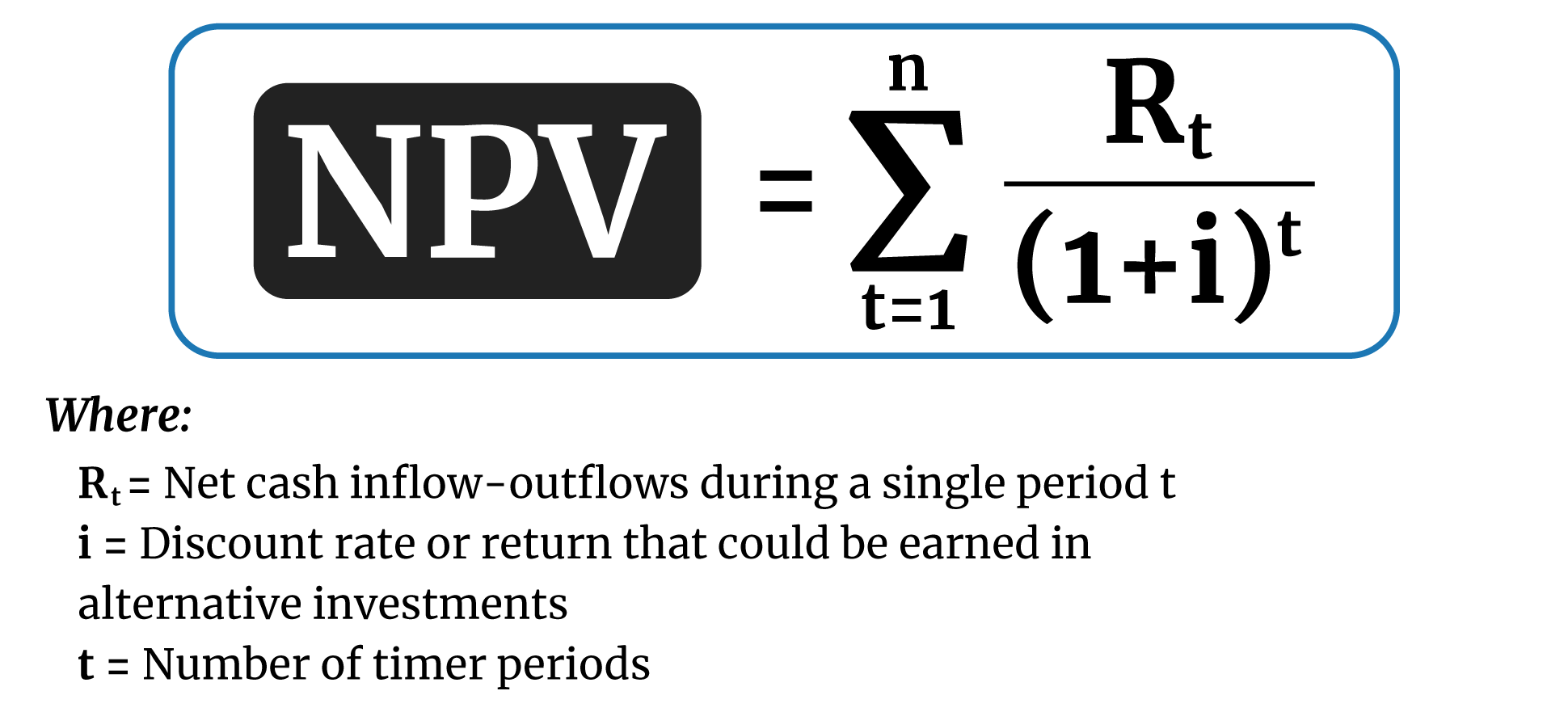

Net Present Value Formula

Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. The npv is the sum of the present values of incoming and. Enter the initial investment, discount rate, and. Learn how to calculate net present value (npv) of an investment project using a financial calculator. Our npv calculator is designed to simplify the.

Net Present Value (NPV) How to calculate via example and using SHARP

Our npv calculator is designed to simplify the process of evaluating investment opportunities: Enter the initial investment, discount rate, and. The npv is the sum of the present values of incoming and. Net present value (npv) is a capital budgeting method used to determine the profitability of an investment. Calculate net present value (npv) of an investment based on a.

Our Npv Calculator Is Designed To Simplify The Process Of Evaluating Investment Opportunities:

Enter the initial investment, discount rate, and. Learn how to calculate net present value (npv) of an investment project using a financial calculator. This calculator helps you determine the net present value (npv) of an investment. Calculate net present value (npv) of an investment based on a series of cash flows that occur at regular time intervals.

Net Present Value (Npv) Is A Capital Budgeting Method Used To Determine The Profitability Of An Investment.

The npv is the sum of the present values of incoming and.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)