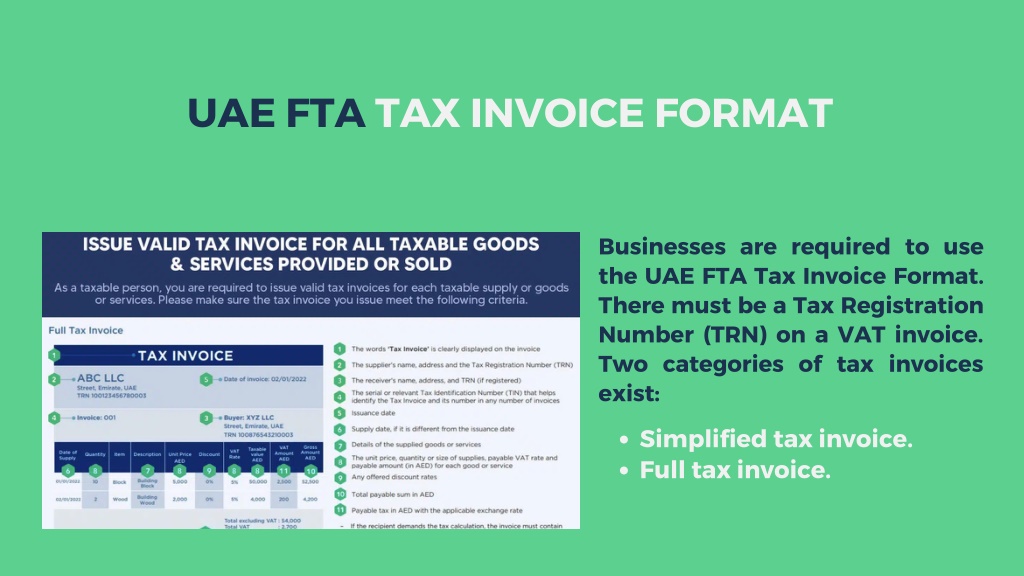

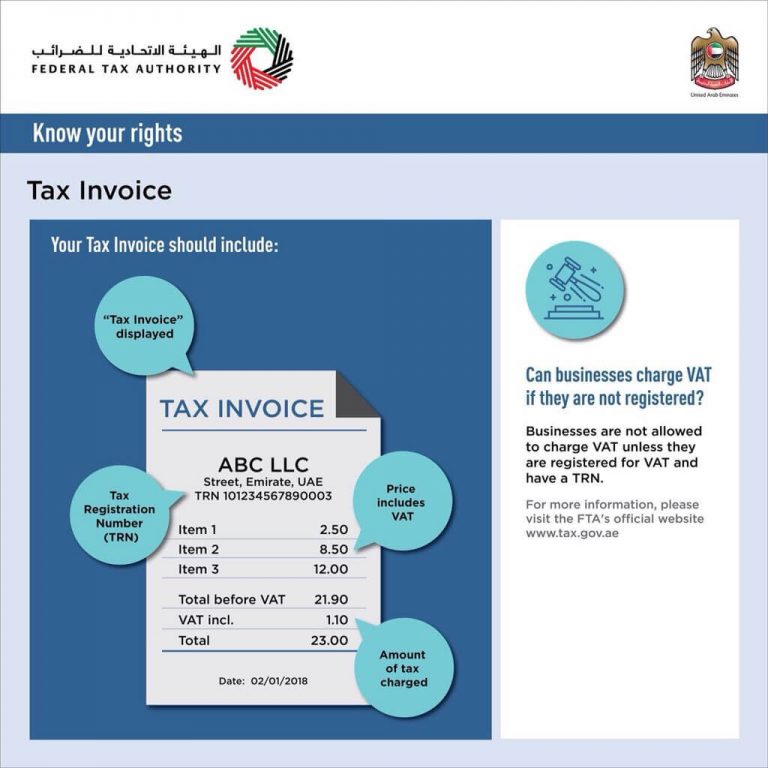

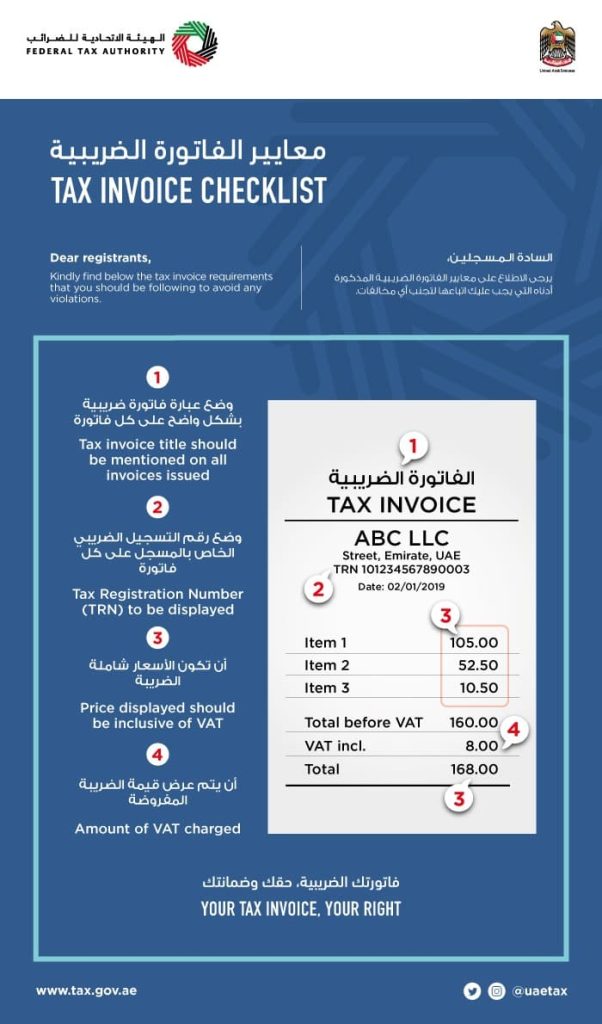

Fta Emirates Tax Invoice - It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. It must include trn, invoice date, vat rate, and total amount.

It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax. A tax invoice is essential under uae vat law for taxable supplies.

PPT Tax Invoice Format UAE PowerPoint Presentation, free download

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.

Record Sales and Print Invoices as per FTA (for UAE)

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

Detailed Tax Invoice All About TAX In UAE

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.

VAT Invoice Format in UAE FTA Tax Invoice Format UAE

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.

Tax Invoice Format UAE FTA VAT Invoice UAE Shuraa Tax

It must include trn, invoice date, vat rate, and total amount. A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae.

Record Sales and Print Invoices as per FTA (for UAE)

A tax invoice is essential under uae vat law for taxable supplies. There are two distinct categories of tax. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. It must include trn, invoice date, vat rate, and total amount.

How to Record Sales and Print Invoices as per FTA (for UAE) in

Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. There are two distinct categories of tax.

Sample Invoice In Arabic New Sample Z vrogue.co

A tax invoice is essential under uae vat law for taxable supplies. It must include trn, invoice date, vat rate, and total amount. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. There are two distinct categories of tax.

There Are Two Distinct Categories Of Tax.

A tax invoice is essential under uae vat law for taxable supplies. Companies are obligated to adhere to the prescribed fta tax invoice format in the uae. It must include trn, invoice date, vat rate, and total amount.