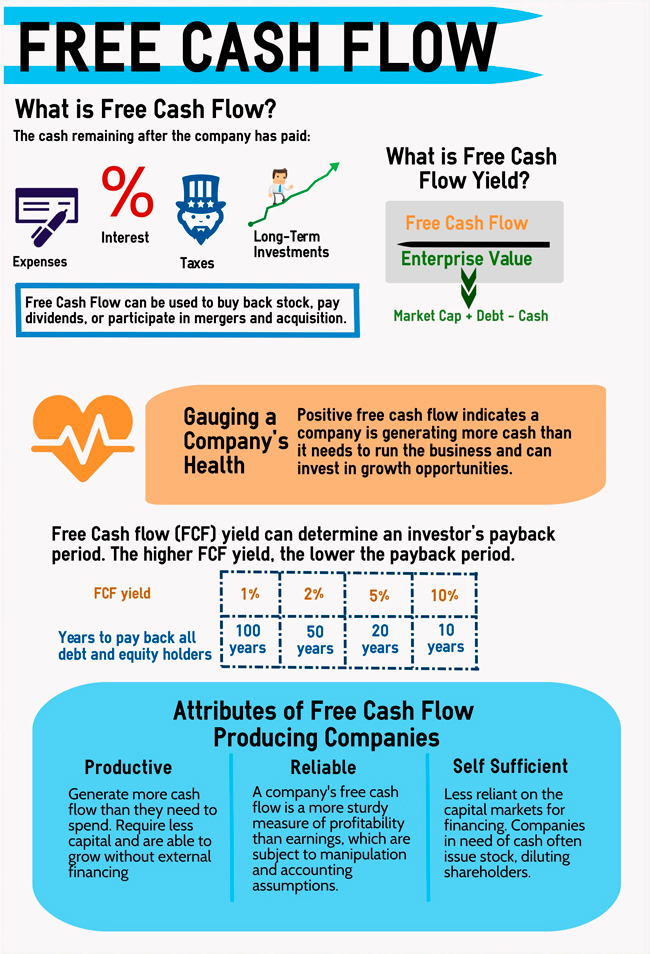

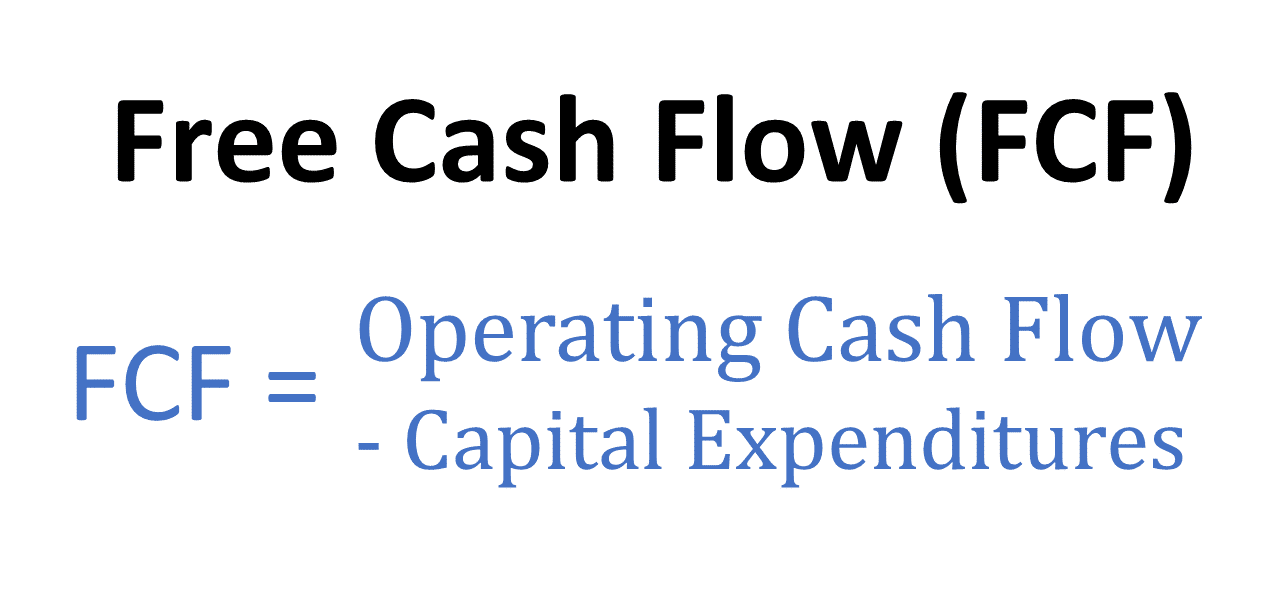

Free Cash Flow Yield Calculation - How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

Free Cash Flow Yield The Best Fundamental Indicator (2025)

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

free cash flow yield private equity Cameron Thornburg

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

free cash flow yield explained Marybeth Wilcox

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

Free Cash Flow Yield Definition, Formula, and How to Calculate (2025)

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn. How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric.

Pacer The Power of Free Cash Flow Yield The WealthAdvisor

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn. How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric.

Free Cash Flow (FCF) Yield Calculation, Importance & Limitations

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

Free Cash Flow Yield FCFY (Formula, Examples) Calculation YouTube

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn. How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric.

Free cash flow yield (FCFY) Discussion, formula, and examples Prophix

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn. How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

Free Cash Flow Yield Formula, Top Example, Calculation

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn. How to calculate free cash flow yield (fcfy) the free cash flow yield, or “fcf yield”, is the ratio between a cash flow metric.

How To Calculate Free Cash Flow Yield (Fcfy) The Free Cash Flow Yield, Or “Fcf Yield”, Is The Ratio Between A Cash Flow Metric.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

:max_bytes(150000):strip_icc()/freecashflowyield.asp-FINAL-ff037b79fb4b41a3b72c95f5ce051662.png)