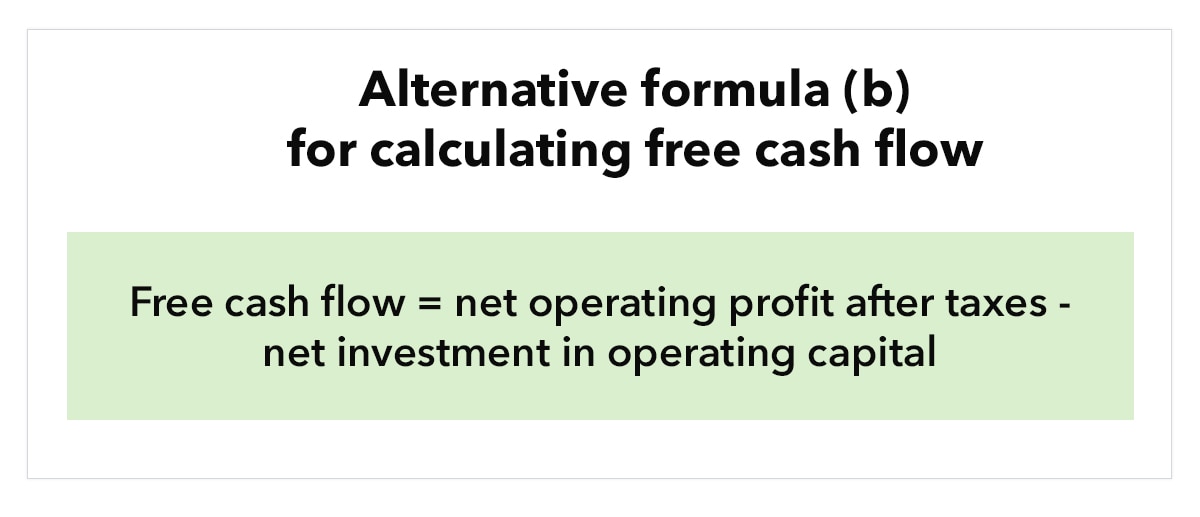

Free Cash Flow Formula Calculator - Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. We discuss its uses and practical examples here. This has guided the free cash flow formula; Operating cash flow $ capital expenditures $ depreciation $ We also provide you with a free. Calculate the free cash flow of a company over a specific period. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital.

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. We also provide you with a free. Operating cash flow $ capital expenditures $ depreciation $ Calculate the free cash flow of a company over a specific period. This has guided the free cash flow formula; Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. We discuss its uses and practical examples here.

We discuss its uses and practical examples here. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Calculate the free cash flow of a company over a specific period. We also provide you with a free. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. Operating cash flow $ capital expenditures $ depreciation $ This has guided the free cash flow formula;

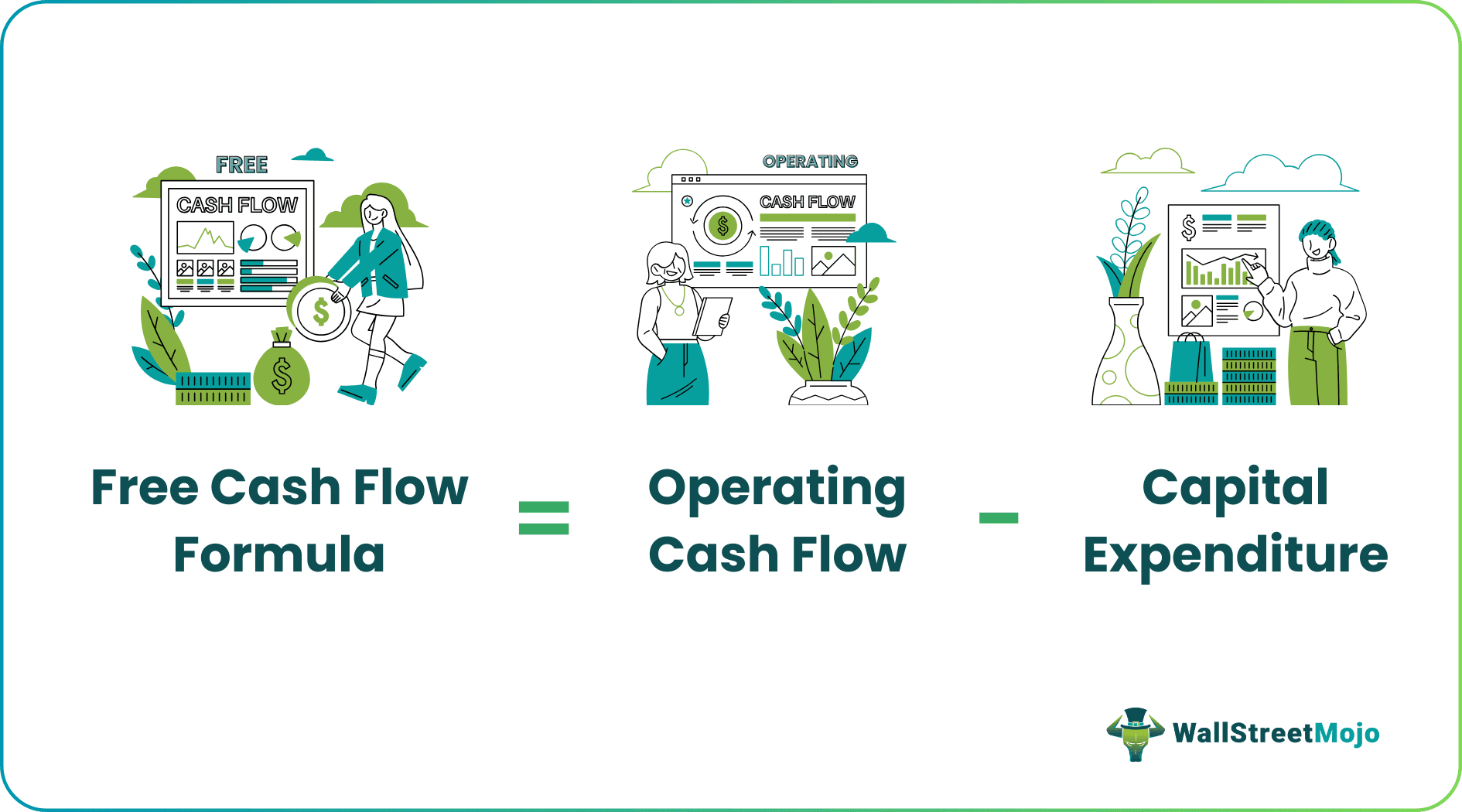

Free Cash Flow (FCF) Formula to Calculate and Interpret It

We also provide you with a free. We discuss its uses and practical examples here. Calculate the free cash flow of a company over a specific period. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. This has guided the free cash flow formula;

Free Cash Flow Plan Projections

Operating cash flow $ capital expenditures $ depreciation $ Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Calculate the free cash flow of a company over a specific period. This has guided the free cash flow formula; We discuss its uses and practical examples here.

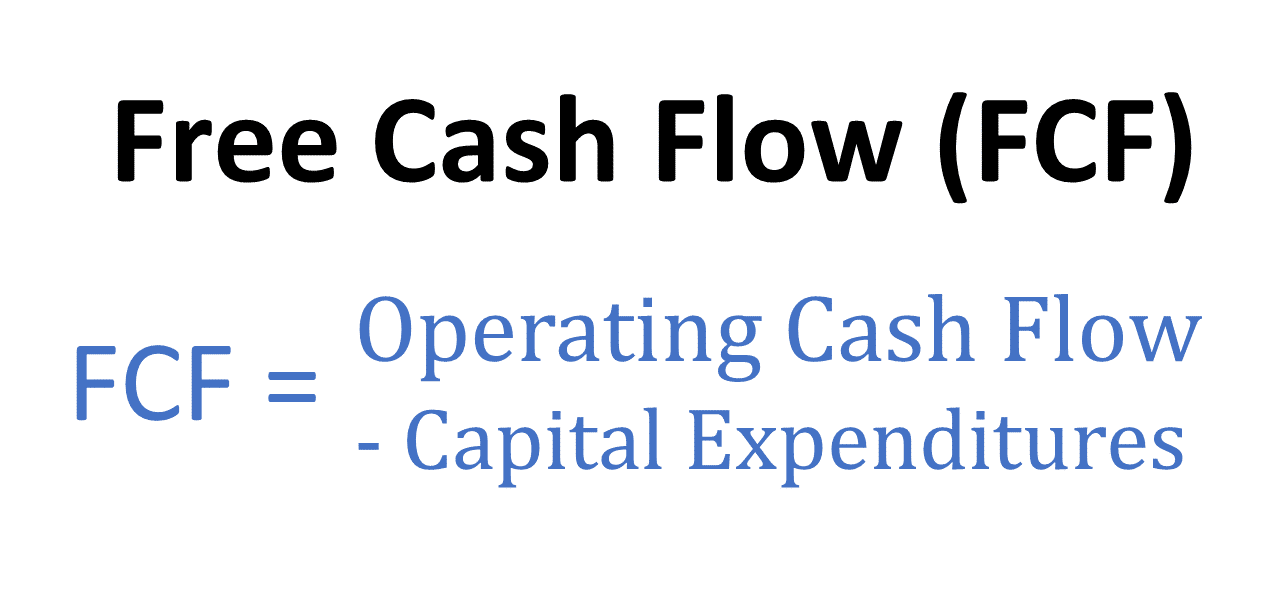

Free Cash Flow Formula

Operating cash flow $ capital expenditures $ depreciation $ Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. We also provide you with a free. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. We discuss.

Free Cash Flow Formula How to Calculate FCF?

Calculate the free cash flow of a company over a specific period. This has guided the free cash flow formula; We discuss its uses and practical examples here. We also provide you with a free. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital.

(FCF) Free Cash Flow Formula and Calculation Financial

Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. Calculate the free cash flow of a company over a specific period. Operating cash flow $ capital expenditures $ depreciation $ We also provide you with a free. Free cash flow (fcf) formula is used to find the company's remaining.

Free Cash Flow What it is and how to calculate it Example and

We discuss its uses and practical examples here. We also provide you with a free. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Calculate the free.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. We discuss its uses and practical examples here. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. Calculate the free cash flow of a company over a.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

We discuss its uses and practical examples here. Calculate the free cash flow of a company over a specific period. Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. This has guided the free cash flow formula; We also provide you with a free.

Awesome Equation For Free Cash Flow Preparing A Profit And Loss

Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. Operating cash flow $ capital expenditures $ depreciation $ Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Calculate the free cash flow of a company over.

Free Cash Flow What it is and how to calculate it Example and

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. We discuss its uses and practical examples here. Calculate free cash flow quickly estimate the fcf of a business by entering the net income, capital expenditures, working capital. Operating cash flow $ capital expenditures $ depreciation $ This.

Calculate Free Cash Flow Quickly Estimate The Fcf Of A Business By Entering The Net Income, Capital Expenditures, Working Capital.

Free cash flow (fcf) formula is used to find the company's remaining cash after meeting expenses and is an important financial metric. Operating cash flow $ capital expenditures $ depreciation $ This has guided the free cash flow formula; We also provide you with a free.

We Discuss Its Uses And Practical Examples Here.

Calculate the free cash flow of a company over a specific period.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)