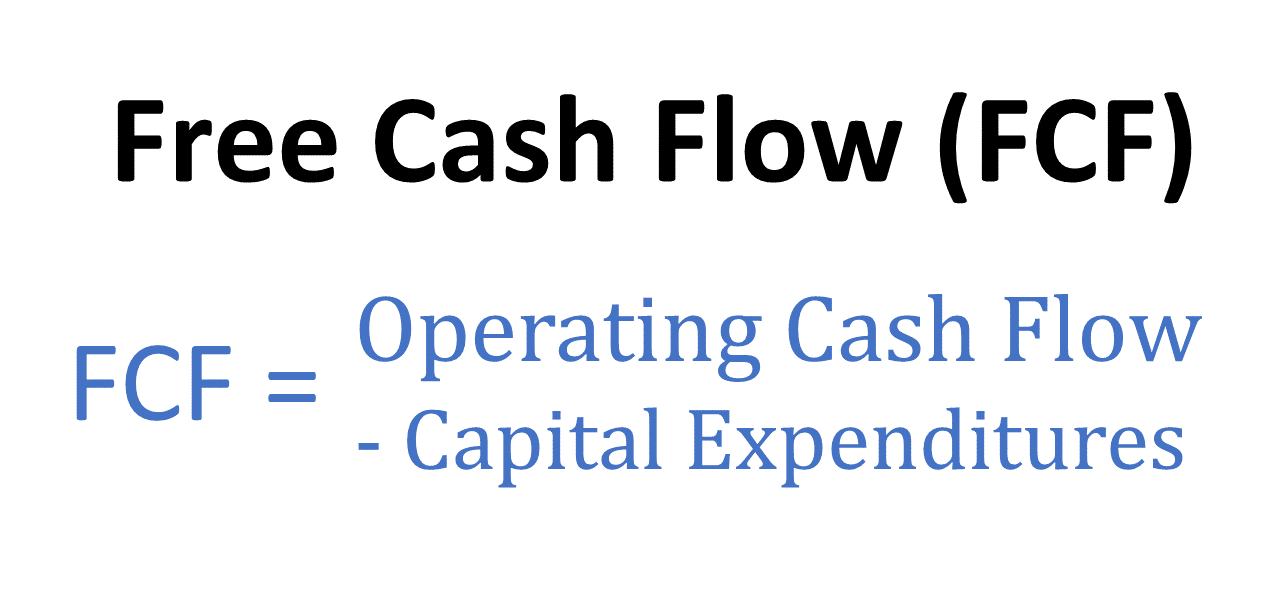

Free Cash Flow Calculation - Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Fcf is a measure of cash a company generates after. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after.

Learn how to calculate free cash flow (fcf) using two different formulas and examples. Fcf is a measure of cash a company generates after. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Fcf measures a company's ability to generate.

Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Fcf is a measure of cash a company generates after.

Free Cash Flow Calculation and Analysis Investing Post

Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Fcf is a measure of cash a company generates after. Fcf measures a company's ability to generate. Learn how to calculate free cash flow, an efficiency and.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Fcf is a measure of cash a company generates after. Learn how to calculate free cash flow (fcf) as.

(FCF) Free Cash Flow Formula and Calculation Financial

Fcf is a measure of cash a company generates after. Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures.

Free Cash Flow (FCF) Formula to Calculate and Interpret It

Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Fcf measures a company's ability to generate. Learn how to calculate free.

Free Cash Flow Plan Projections

Fcf measures a company's ability to generate. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Learn how.

Free cash flow (FCF) Equation and meaning [2025]

Fcf is a measure of cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess.

How to Calculate Free Cash Flow per Share Wisesheets Blog

Fcf is a measure of cash a company generates after. Learn how to calculate free cash flow (fcf) using two different formulas and examples. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Fcf measures.

Free Cash Flow (FCF) Definition, Formula and How to Calculate Stock

Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Fcf is a measure of cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) as.

Free Cash Flow (FCF) Formula

Fcf is a measure of cash a company generates after. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) using.

Free cash flow (FCF) Equation and meaning [2025]

Fcf is a measure of cash a company generates after. Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) using.

Fcf Is A Measure Of Cash A Company Generates After.

Learn how to calculate free cash flow, an efficiency and liquidity ratio that measures how much excess cash a company generates after. Learn how to calculate and interpret free cash flow (fcf), a measure of a company's profitability and financial health. Learn how to calculate free cash flow (fcf) as cash from operations minus capital expenditures. Learn how to calculate free cash flow (fcf) using two different formulas and examples.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic1b.jpg)

![Free cash flow (FCF) Equation and meaning [2025]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_us/Blog/Graphic/quickbooks_paymentseditorial9_graphic4.png)