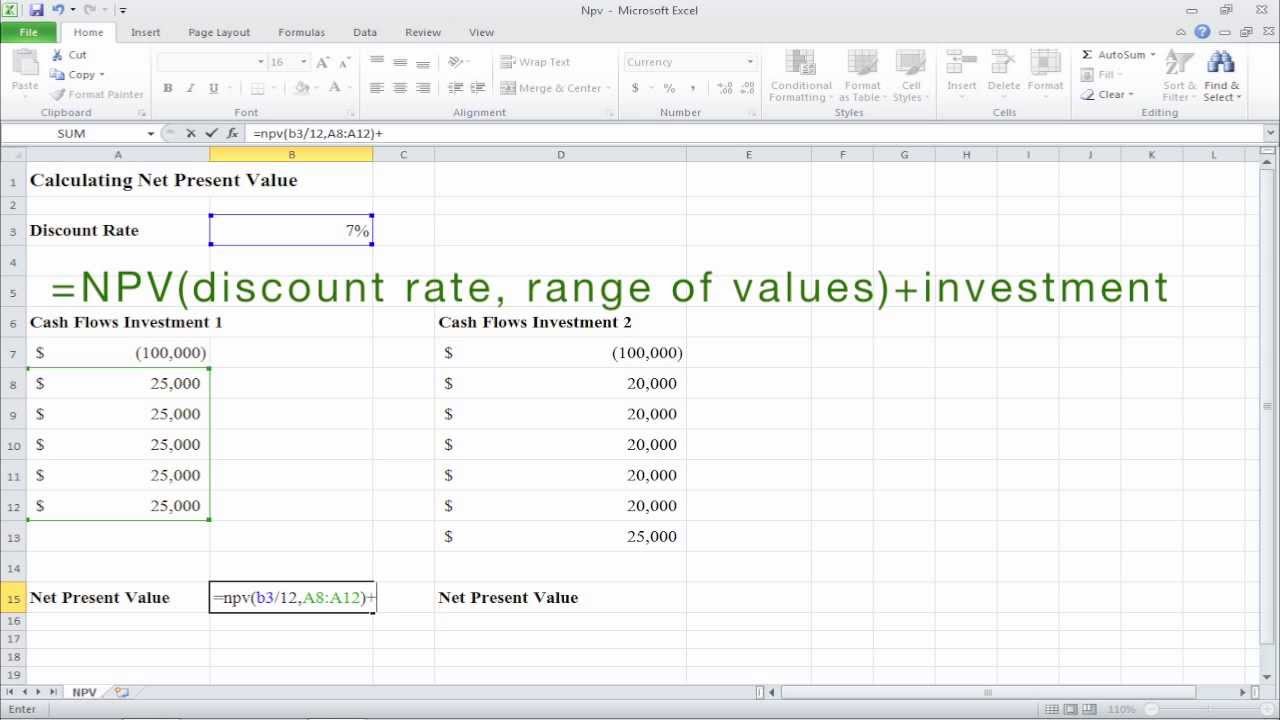

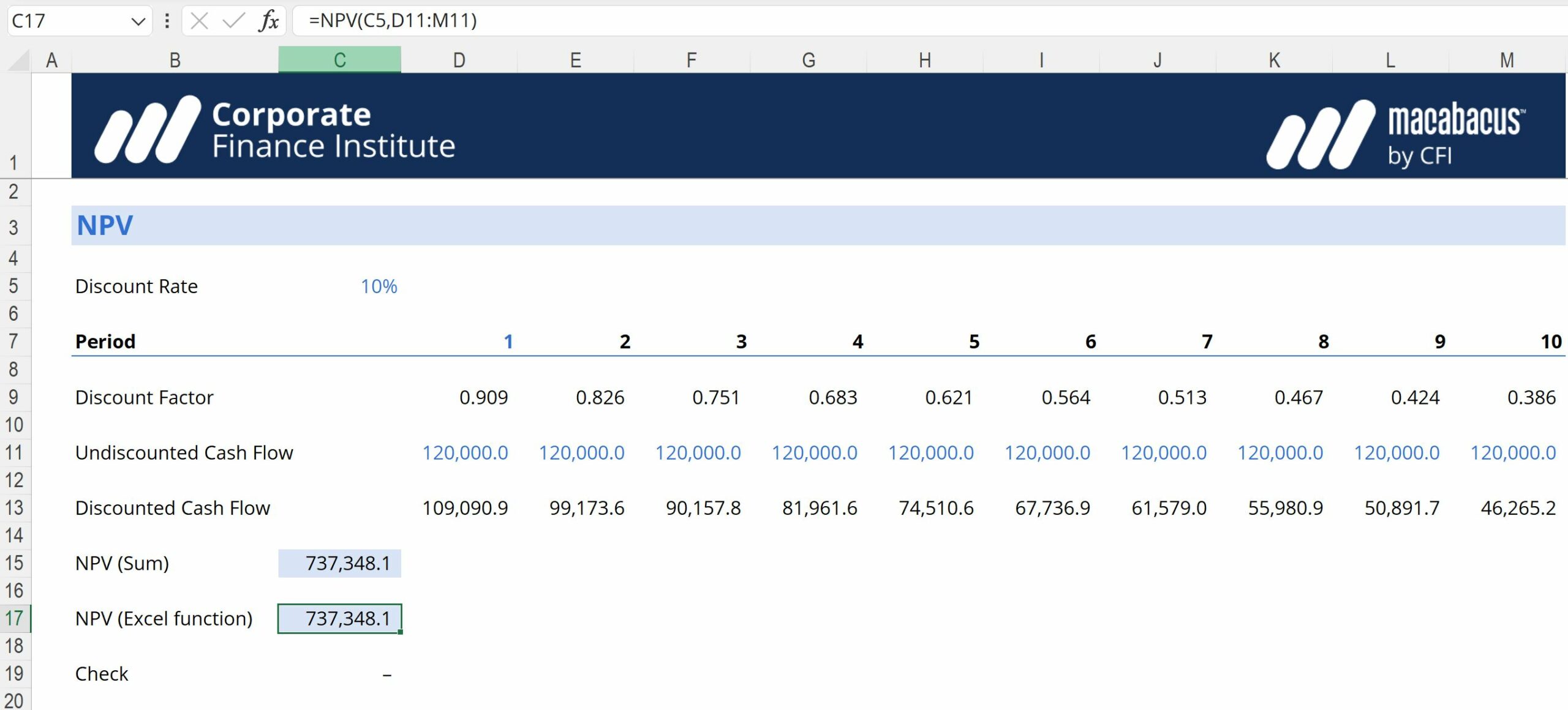

Formula For Calculating Npv In Excel - = npv (rate, value1, value 2,.) let me quickly break this down for you here. Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Here’s the syntax of the npv function of excel:

Here’s the syntax of the npv function of excel: Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. = npv (rate, value1, value 2,.) let me quickly break this down for you here. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial.

= npv (rate, value1, value 2,.) let me quickly break this down for you here. Here’s the syntax of the npv function of excel: Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial.

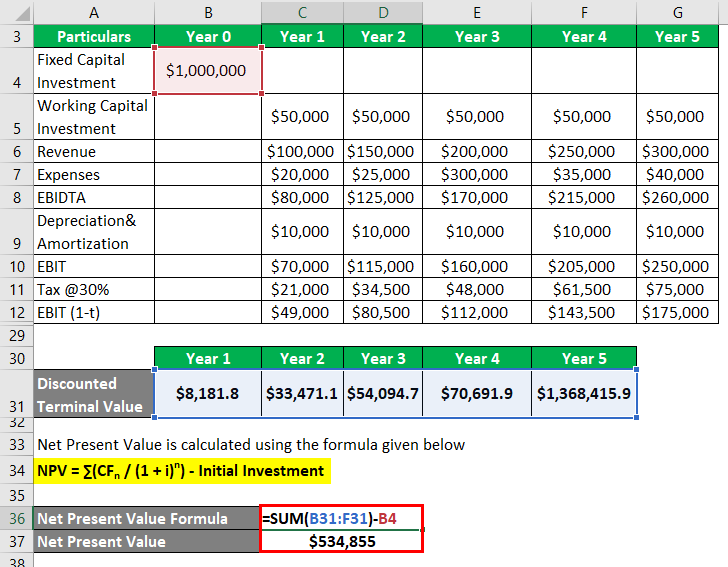

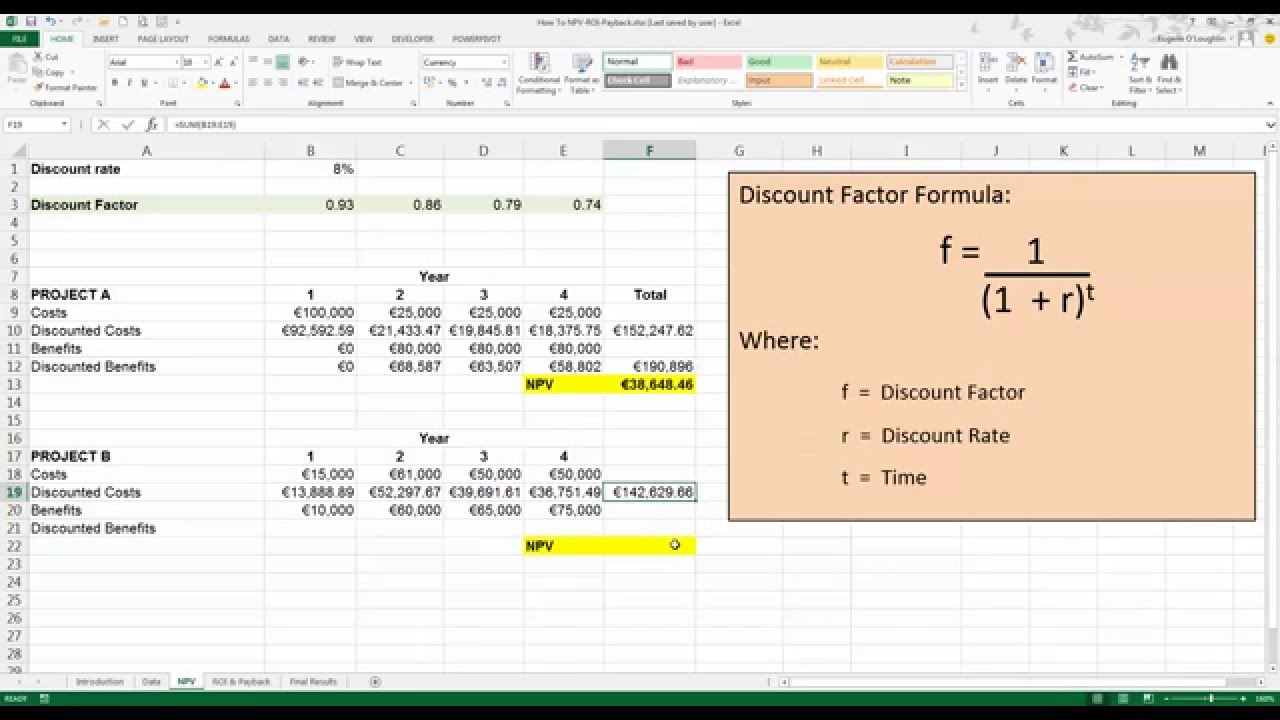

Npv Calculator Excel Template

= npv (rate, value1, value 2,.) let me quickly break this down for you here. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Here’s the syntax of the npv function of excel: Learn how to use the excel npv function to calculate.

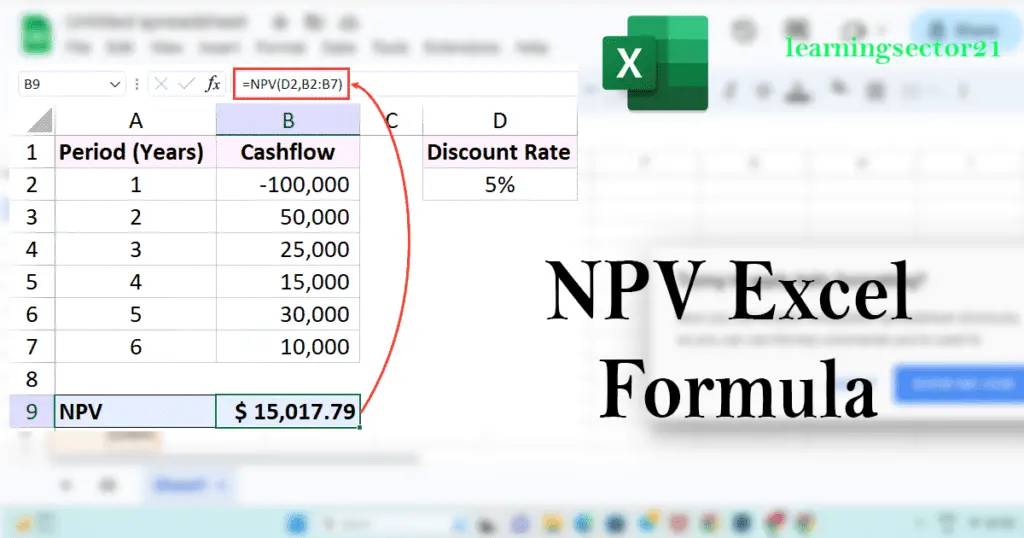

Excel Npv Template

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. = npv (rate, value1, value 2,.) let me quickly break this down for you here. Here’s the syntax of the npv function of excel: Learn how to use the excel npv function to calculate.

How to calculate NPV in Excel? Initial Return

= npv (rate, value1, value 2,.) let me quickly break this down for you here. Here’s the syntax of the npv function of excel: The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Learn how to use the excel npv function to calculate.

Calculate NPV for Monthly Cash Flows with Formula in Excel

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Here’s the syntax of the npv function of excel: Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in..

Excel Npv Template

Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. = npv (rate, value1, value 2,.) let me quickly.

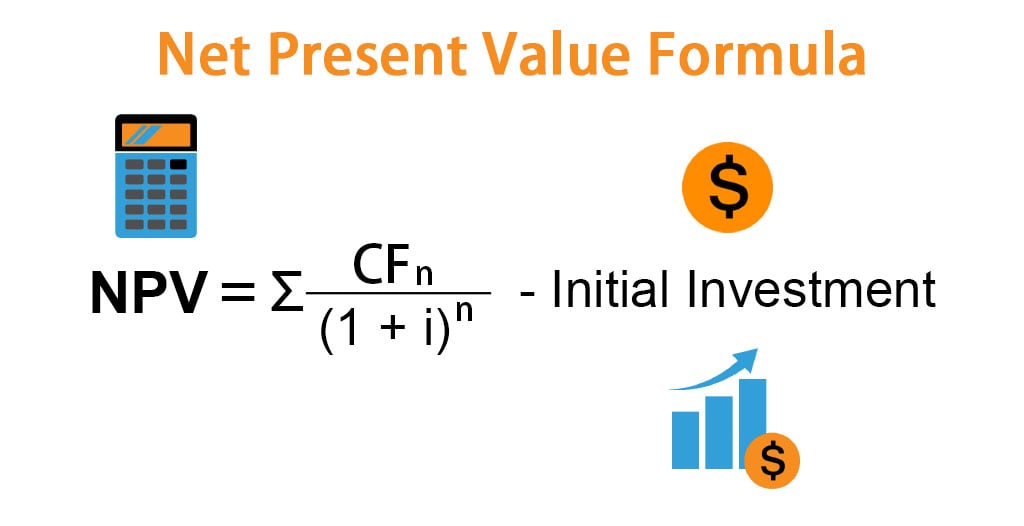

NPV Excel Formula Understanding and Implementing

= npv (rate, value1, value 2,.) let me quickly break this down for you here. Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. The correct npv formula in excel uses the npv function to calculate the present value of a series of future.

Net Present Value Formula On Excel at sasfloatblog Blog

Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. = npv (rate, value1, value 2,.) let me quickly break this down for you here. Here’s the syntax of the npv function of excel: The correct npv formula in excel uses the npv function to.

NPV Function Formula, Examples, How to Calculate NPV in Excel

Here’s the syntax of the npv function of excel: Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. = npv (rate, value1, value 2,.) let me quickly break this down for you here. The correct npv formula in excel uses the npv function to.

Npv Calculator Excel Template

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. = npv (rate, value1, value 2,.) let me quickly.

How to Calculate NPV Using Excel

= npv (rate, value1, value 2,.) let me quickly break this down for you here. Here’s the syntax of the npv function of excel: The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Learn how to use the excel npv function to calculate.

Here’s The Syntax Of The Npv Function Of Excel:

= npv (rate, value1, value 2,.) let me quickly break this down for you here. Learn how to use the excel npv function to calculate net present value of a series of cash flows, build your own npv calculator in. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial.