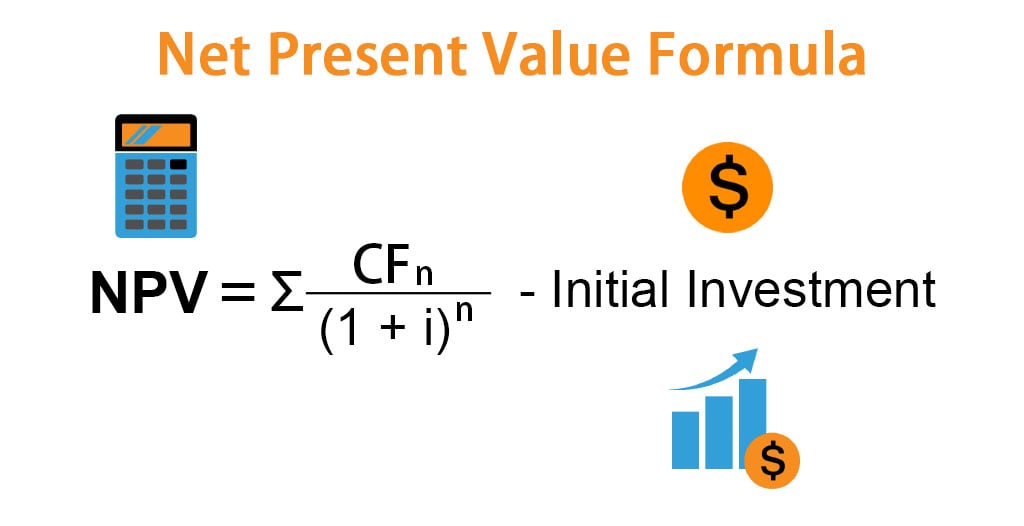

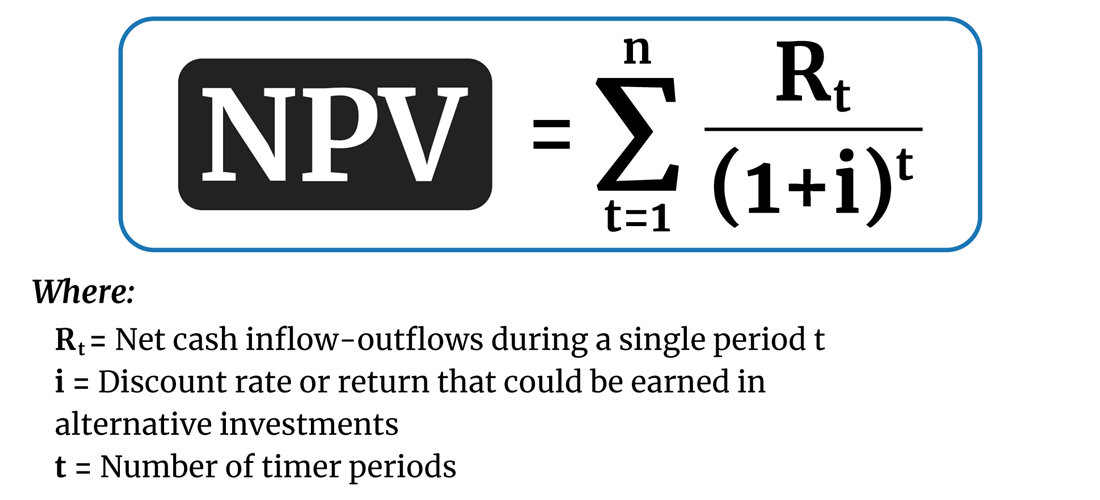

Example Of Npv Calculation - Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. What is net present value (npv)? Here we learn how to calculate npv (net present value) step by step with the help of practical examples.

What is net present value (npv)? Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows.

Here we learn how to calculate npv (net present value) step by step with the help of practical examples. What is net present value (npv)? Net present value is a financial metric used to determine the value of an investment by. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows.

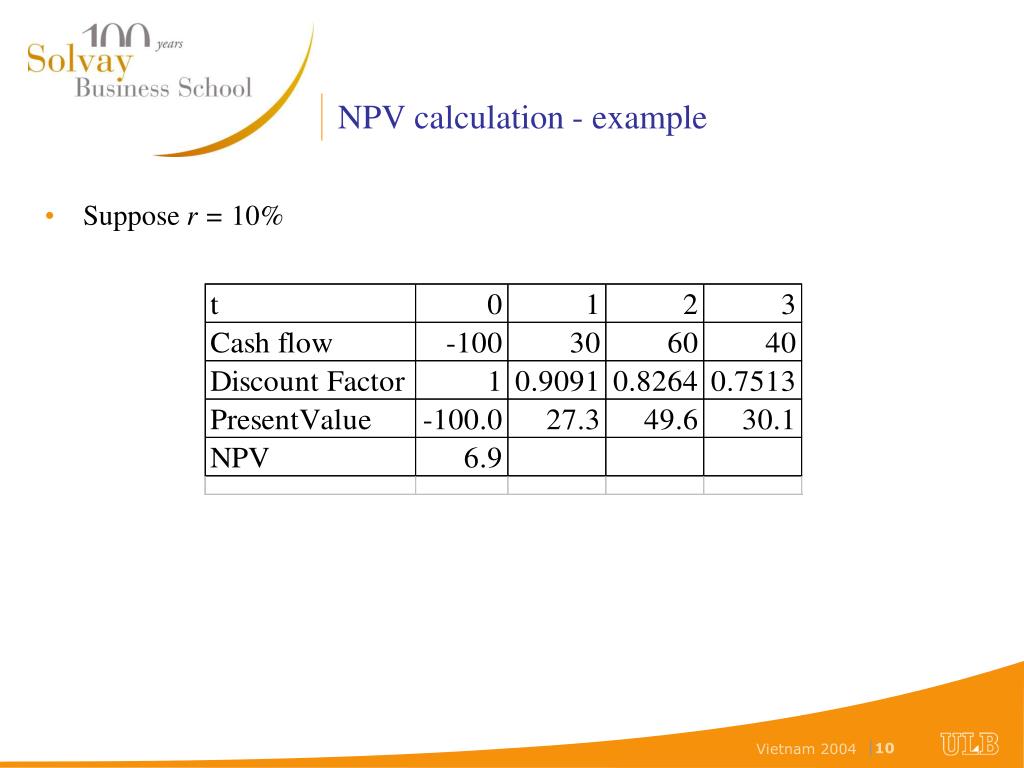

PPT Capital Budeting with the Net Present Value Rule PowerPoint

What is net present value (npv)? Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by. Example of net present value (npv) let’s look at an example of how to calculate the net present value.

Net Present Value Calculator with Example + Steps

What is net present value (npv)? Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value is a financial metric used to determine the value of an investment by. Here we learn how to calculate npv (net present value) step by step with the.

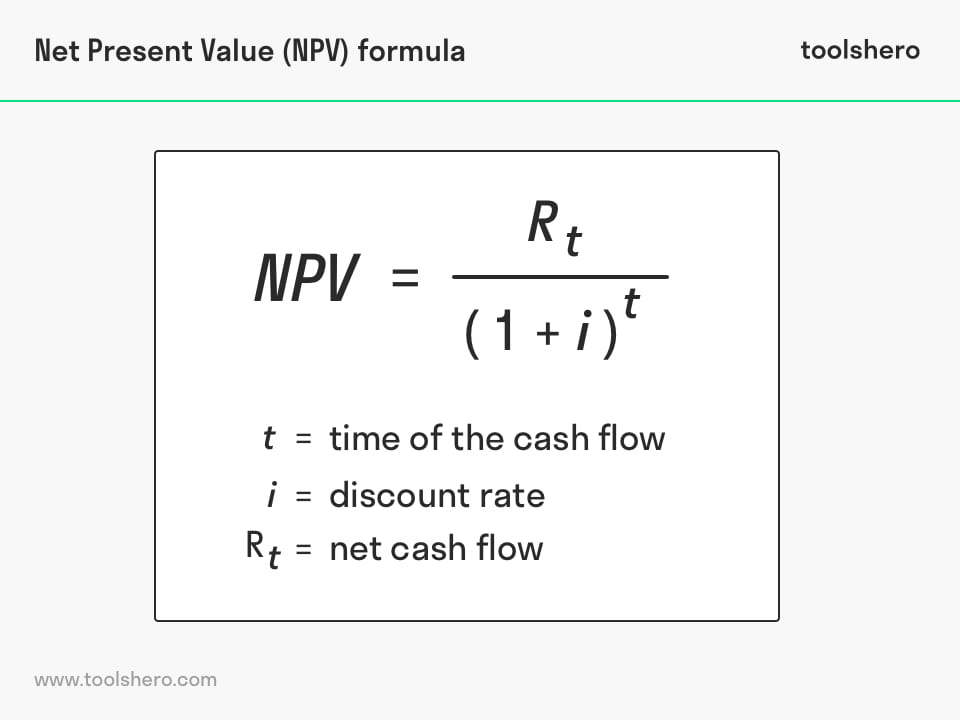

Net Present Value formula and example Toolshero

What is net present value (npv)? Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Net present value, npv, is a capital budgeting formula that.

How To Calculate Net Present Value With Discount Rate In Excel Design

Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a.

Net Present Value Npv Formula And Calculation vrogue.co

Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Example of.

How To Calculate Net Present Value Method Haiper

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. What is net present value (npv)? Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine.

Net Present Value (NPV) What It Means and Steps to Calculate It

Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by. What is net present value (npv)? Example of net present value (npv) let’s look at an example of how to calculate the net present value.

Net Present Value (NPV) What It Means and Steps to Calculate It (2022)

What is net present value (npv)? Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value is a financial metric used to determine the value of an investment by. Example of net present value (npv) let’s look at an example of how to calculate.

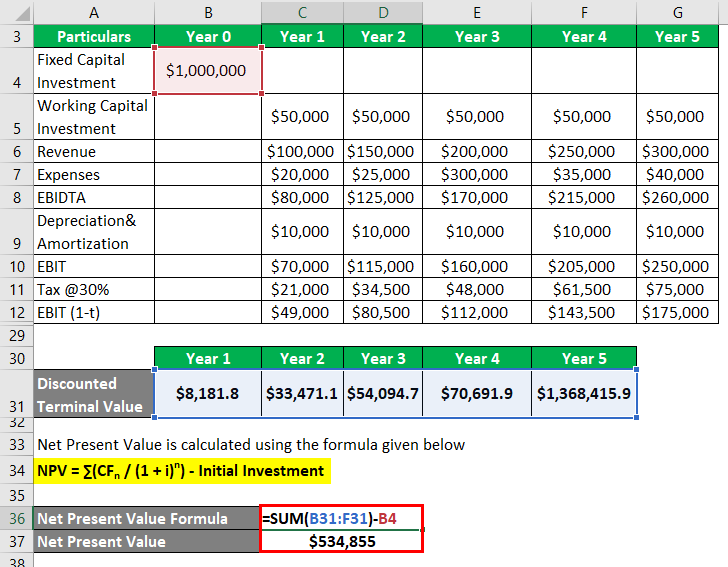

Detailed Steps To Calculate Net Present Value And Internal Rate Of

Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value is a financial metric used to determine the value of an investment by..

Capital Budgeting Presentation

What is net present value (npv)? Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value is a financial metric used to determine the value.

What Is Net Present Value (Npv)?

Here we learn how to calculate npv (net present value) step by step with the help of practical examples. Example of net present value (npv) let’s look at an example of how to calculate the net present value of a series of cash flows. Net present value is a financial metric used to determine the value of an investment by. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows.

:max_bytes(150000):strip_icc()/ScreenShot2019-06-20at10.46.59AM-f30499c2303c44a5a883c6c1e676569b.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)