Example Of Net Present Value Npv - The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present.

The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present.

Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value is a financial metric used to determine the value of an investment by calculating the difference. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows.

NPV Present Value) Definition, Benefits, Formula, and Examples

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value, npv, is a capital budgeting formula that calculates the difference between the.

Excel Npv Template

Net present value is a financial metric used to determine the value of an investment by calculating the difference. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value (npv) is the value of all future cash flows (positive and negative).

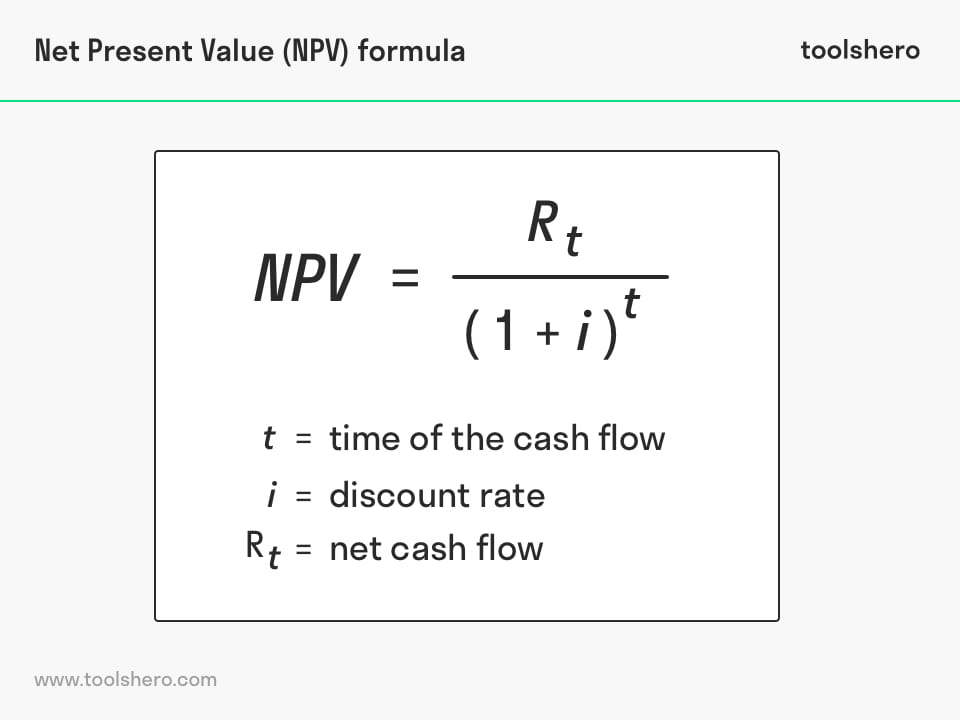

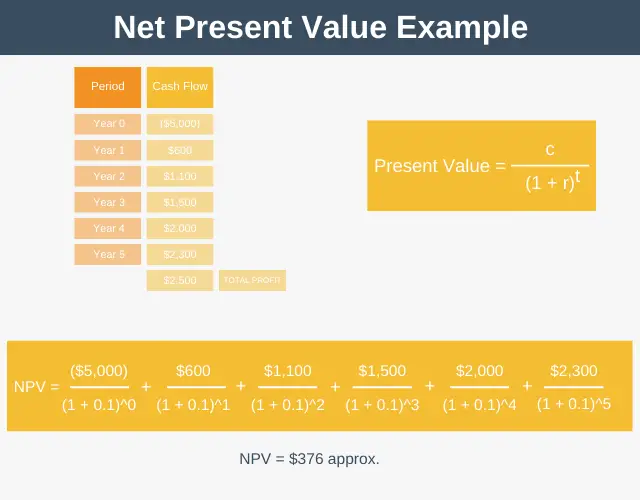

Net Present Value formula and example Toolshero

Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value, npv, is a capital budgeting formula that calculates the difference between the.

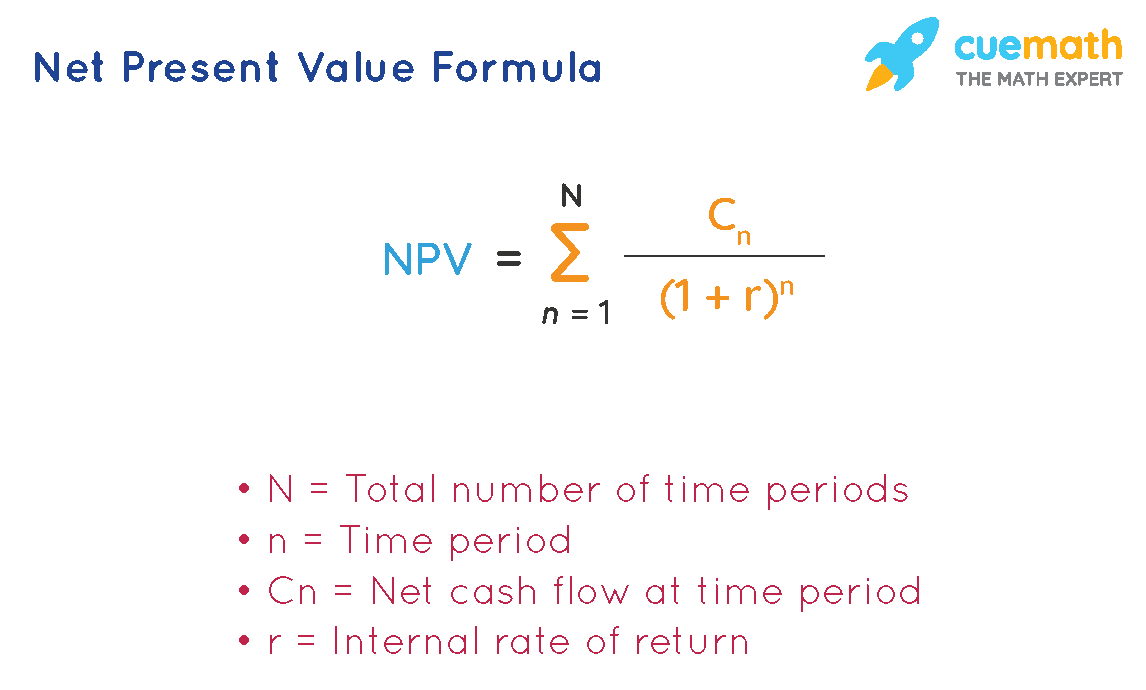

Net present value What is it, NPV formula, Calculation, Examples ,FAQ

Net present value is a financial metric used to determine the value of an investment by calculating the difference. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value (npv) is the value of all future cash flows (positive and negative).

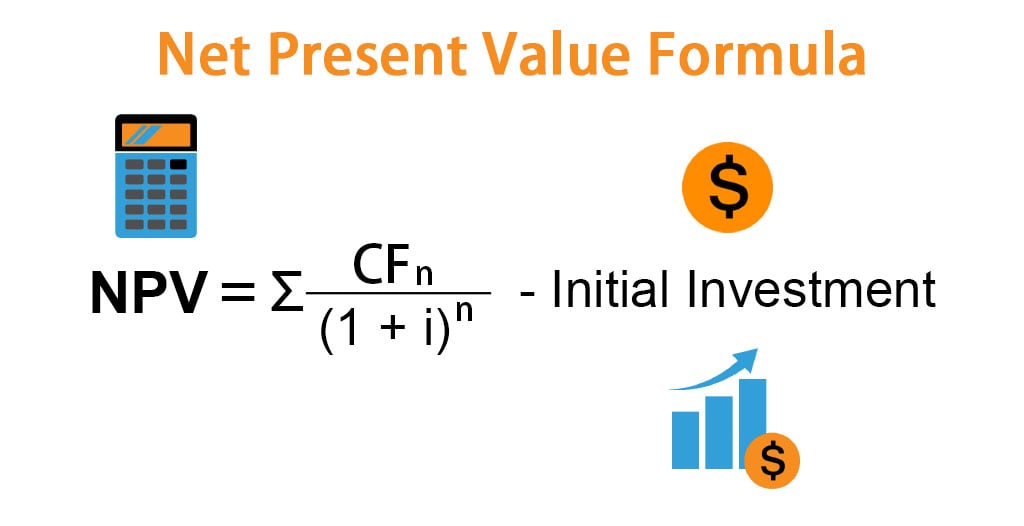

Net Present Value Formula

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire.

Net Present Value Excel Template

The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value (npv) is the value of all future cash flows (positive and negative).

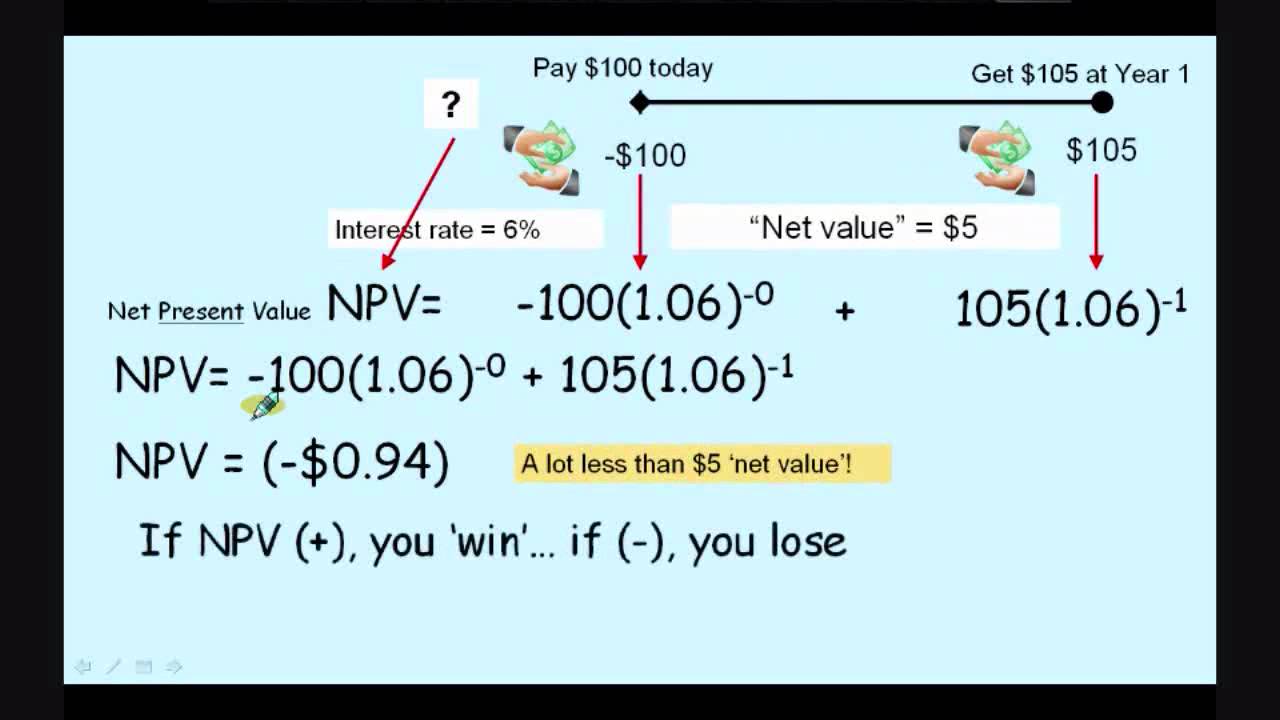

Net Present Value Npv Example Problem Youtube Images

Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value is a financial metric used to determine the.

Net Present Value Explained

Net present value is a financial metric used to determine the value of an investment by calculating the difference. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value (npv) is the value of all future cash flows (positive and negative).

Net Present Value (NPV) What It Means and Steps to Calculate It

Net present value (npv) is the value of all future cash flows (positive and negative) over the entire life of an investment discounted to the present. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The net present value is the difference between the present value.

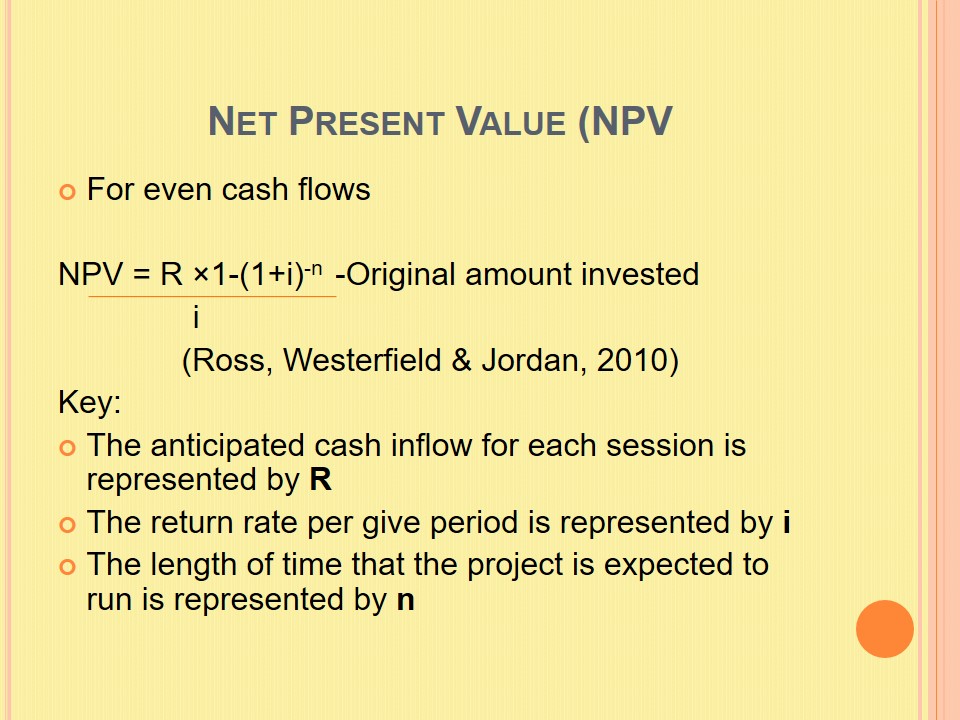

Teaching Net Present Value (NPV) & Future Value (FV) 1043 Words

Net present value is a financial metric used to determine the value of an investment by calculating the difference. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of. Net present value, npv, is a capital budgeting formula that calculates the difference between the.

Net Present Value (Npv) Is The Value Of All Future Cash Flows (Positive And Negative) Over The Entire Life Of An Investment Discounted To The Present.

Net present value is a financial metric used to determine the value of an investment by calculating the difference. Net present value, npv, is a capital budgeting formula that calculates the difference between the present value of the cash inflows and outflows. The net present value is the difference between the present value of future cash inflow and the present value of cash outflow over a period of.