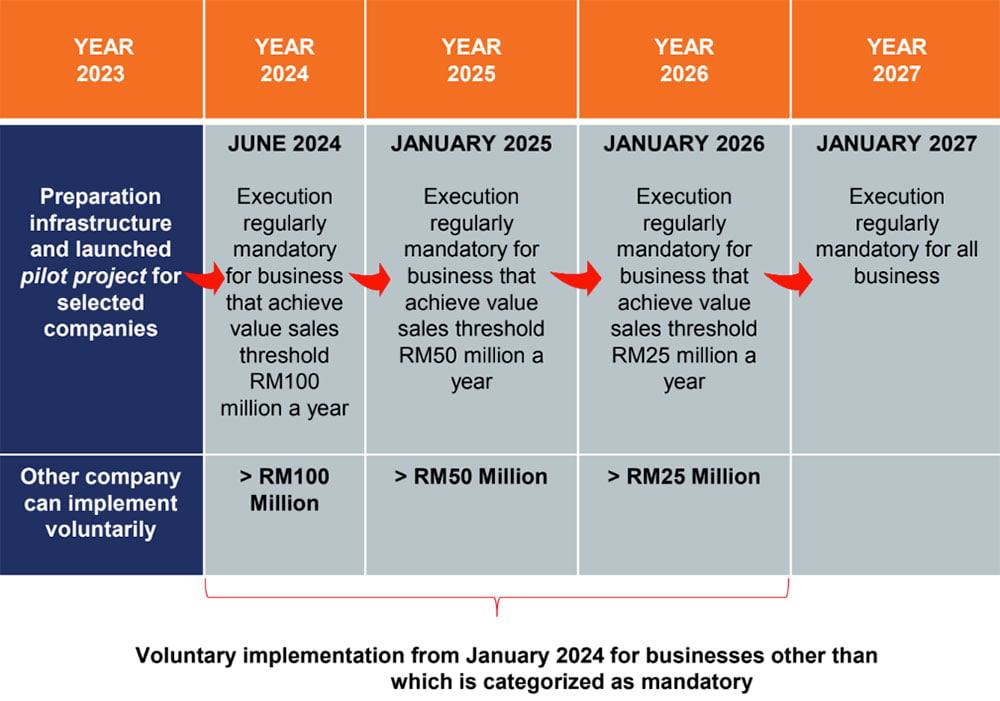

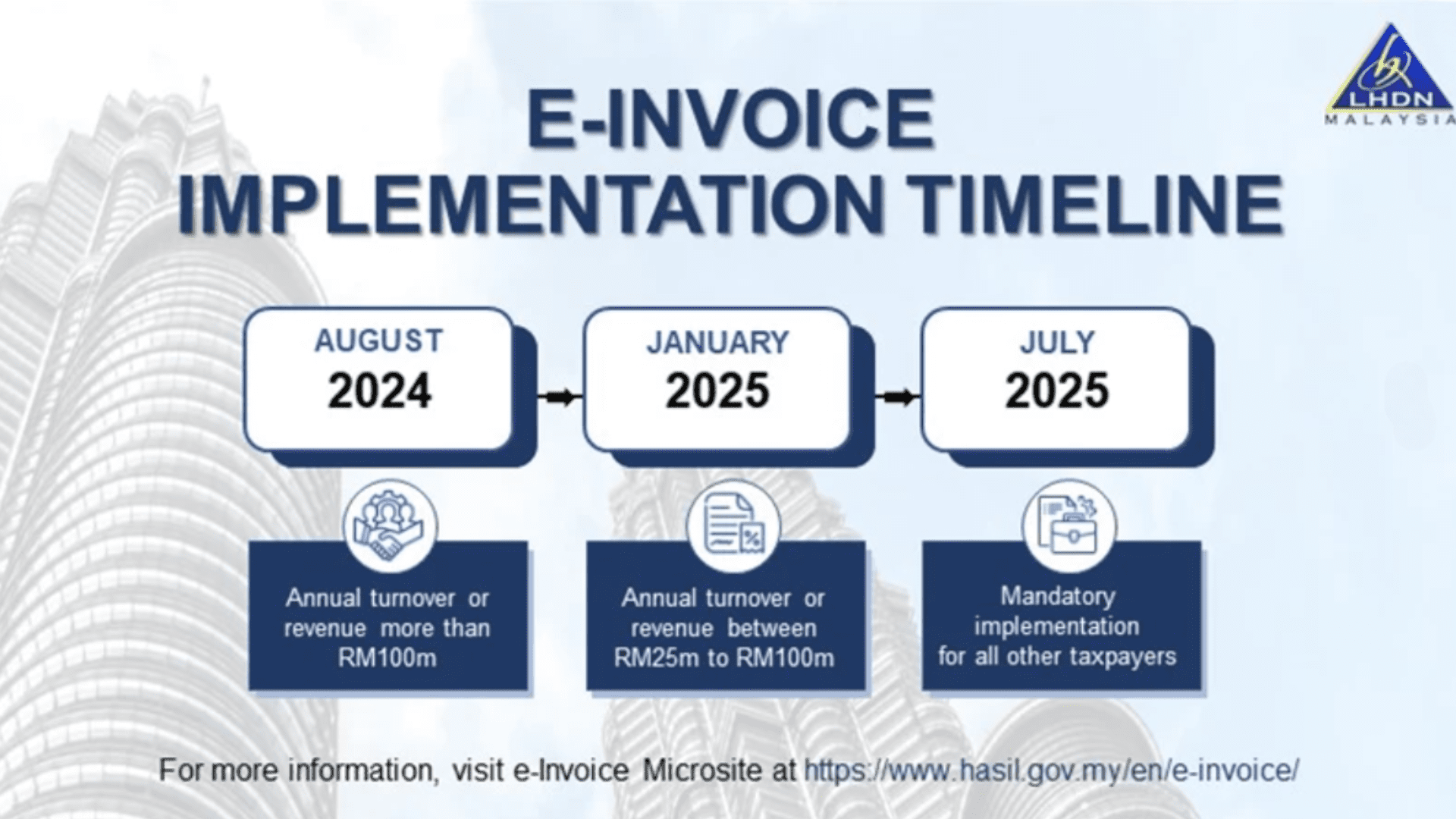

E Invoice Implementation Date Malaysia - Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue.

1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month The timeline includes implementation dates of:

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue.

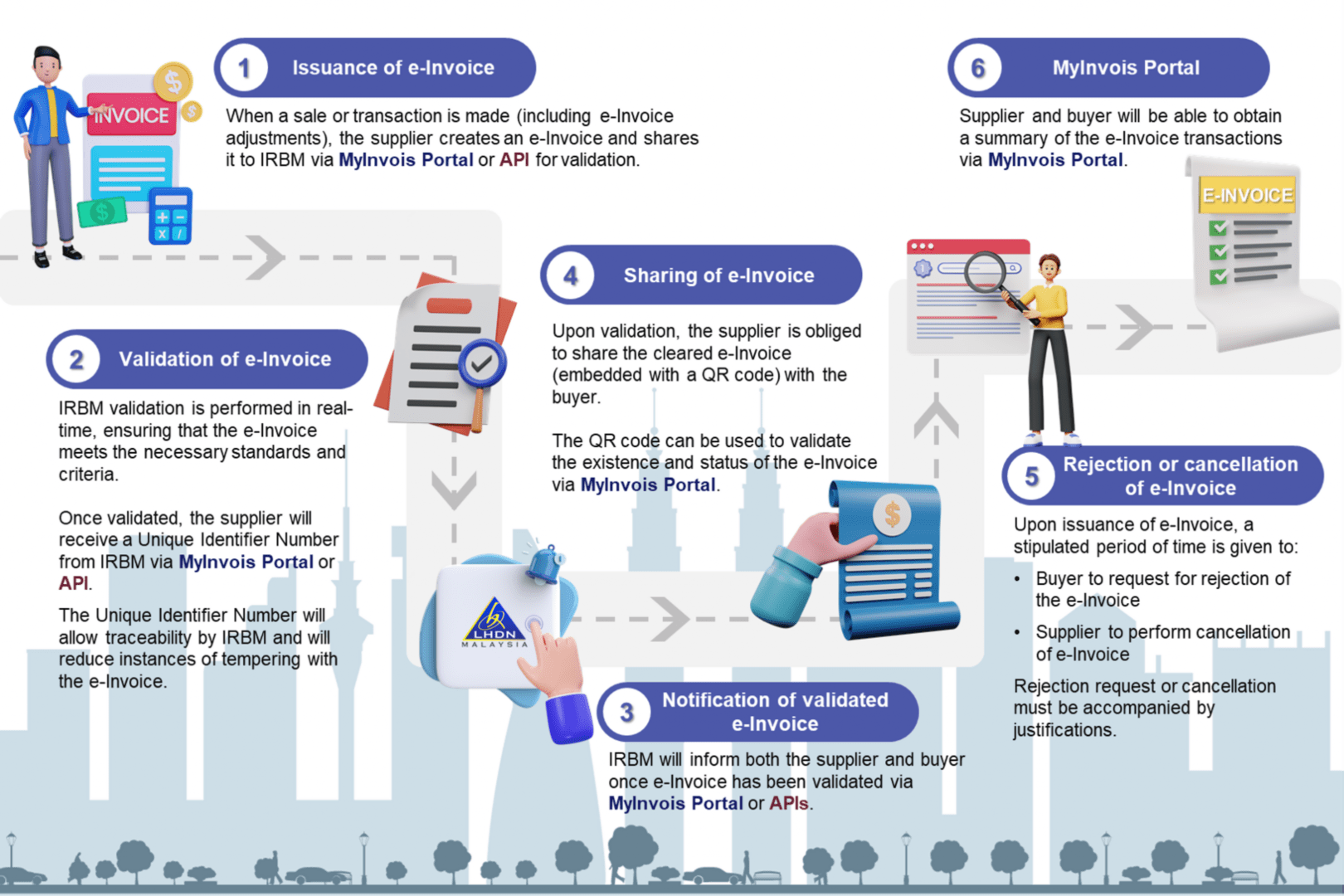

eInvois HASiL Info Lembaga Hasil Dalam Negeri Malaysia

The timeline includes implementation dates of: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month

EINVOICE FREQUENTLY ASKED QUESTION (FAQ)

1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Mandatory eInvoicing System Starting From June 2024 ShineWing TY TEOH

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of:

Navigating EInvoice Regulations IRB Malaysia's 2023 Guidelines

1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of: Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 10k+ visitors in the past month

Malaysia LHDN eInvoice Guidelines 50 QnA L & Co Accountants

10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of:

Implementation of EInvoicing Malaysia IVAOTR

The timeline includes implementation dates of: 10k+ visitors in the past month Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue.

2024 LHDN EInvoice Malaysia How it impact your business

Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. 1, 2024, for taxpayers with annual turnover or revenue. 10k+ visitors in the past month The timeline includes implementation dates of:

Adapting to EInvoicing A New Era for Malaysian Businesses SiteGiant

10k+ visitors in the past month The timeline includes implementation dates of: 1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026.

Pelaksanaan eInvois di Malaysia Apa maksudnya

1, 2024, for taxpayers with annual turnover or revenue. Implementation for those with annual income or sales up to rm1 million will be deferred to 1 july 2026. The timeline includes implementation dates of: 10k+ visitors in the past month

Implementation For Those With Annual Income Or Sales Up To Rm1 Million Will Be Deferred To 1 July 2026.

10k+ visitors in the past month 1, 2024, for taxpayers with annual turnover or revenue. The timeline includes implementation dates of:

.jpeg)