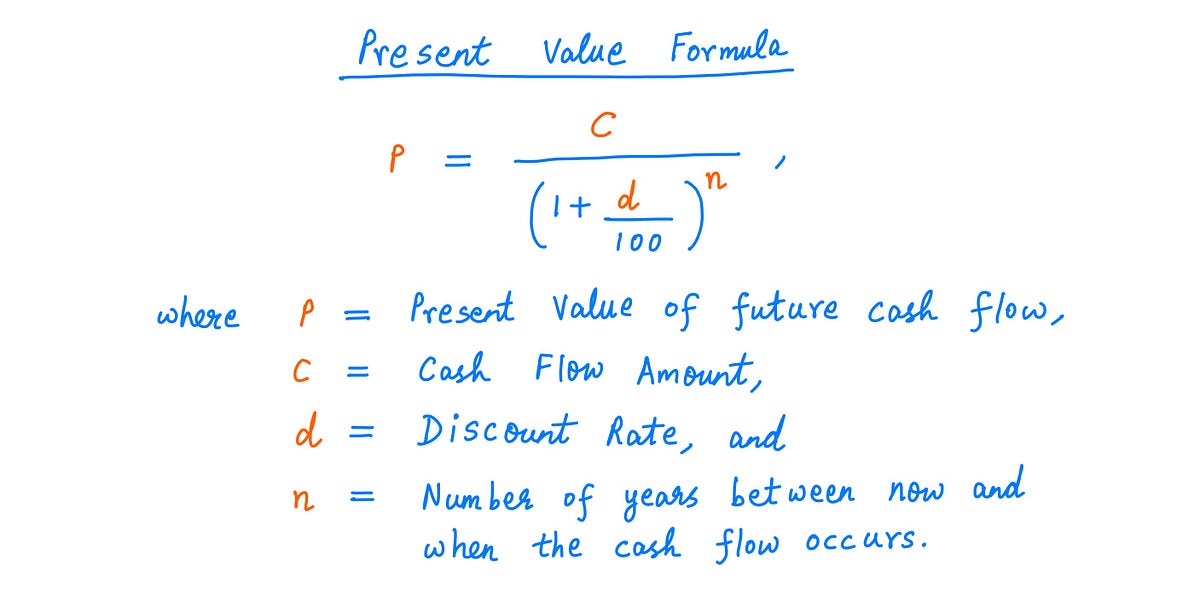

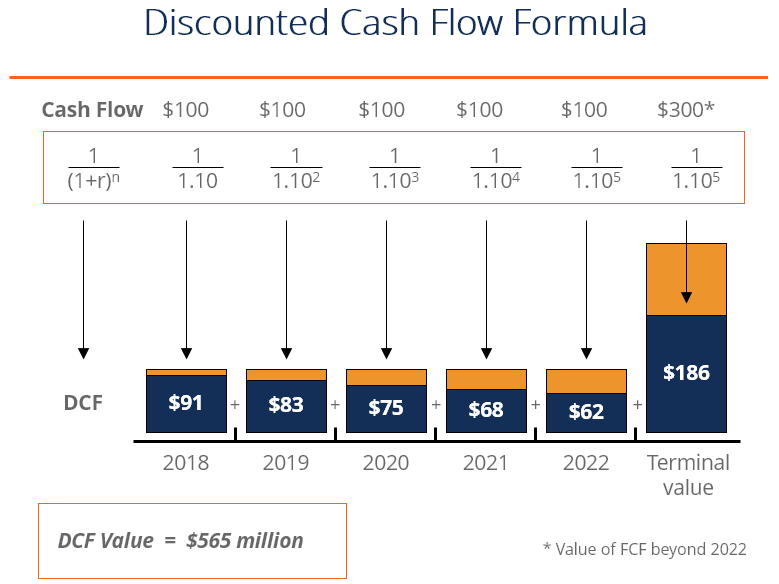

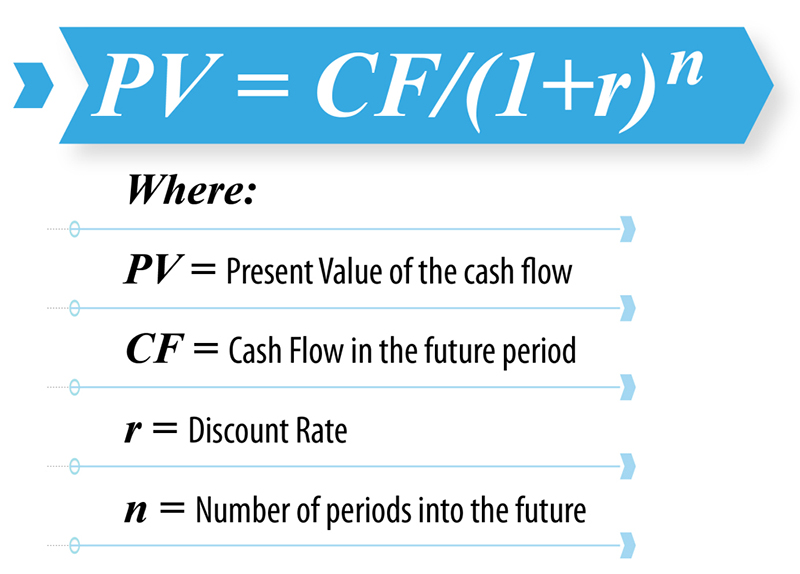

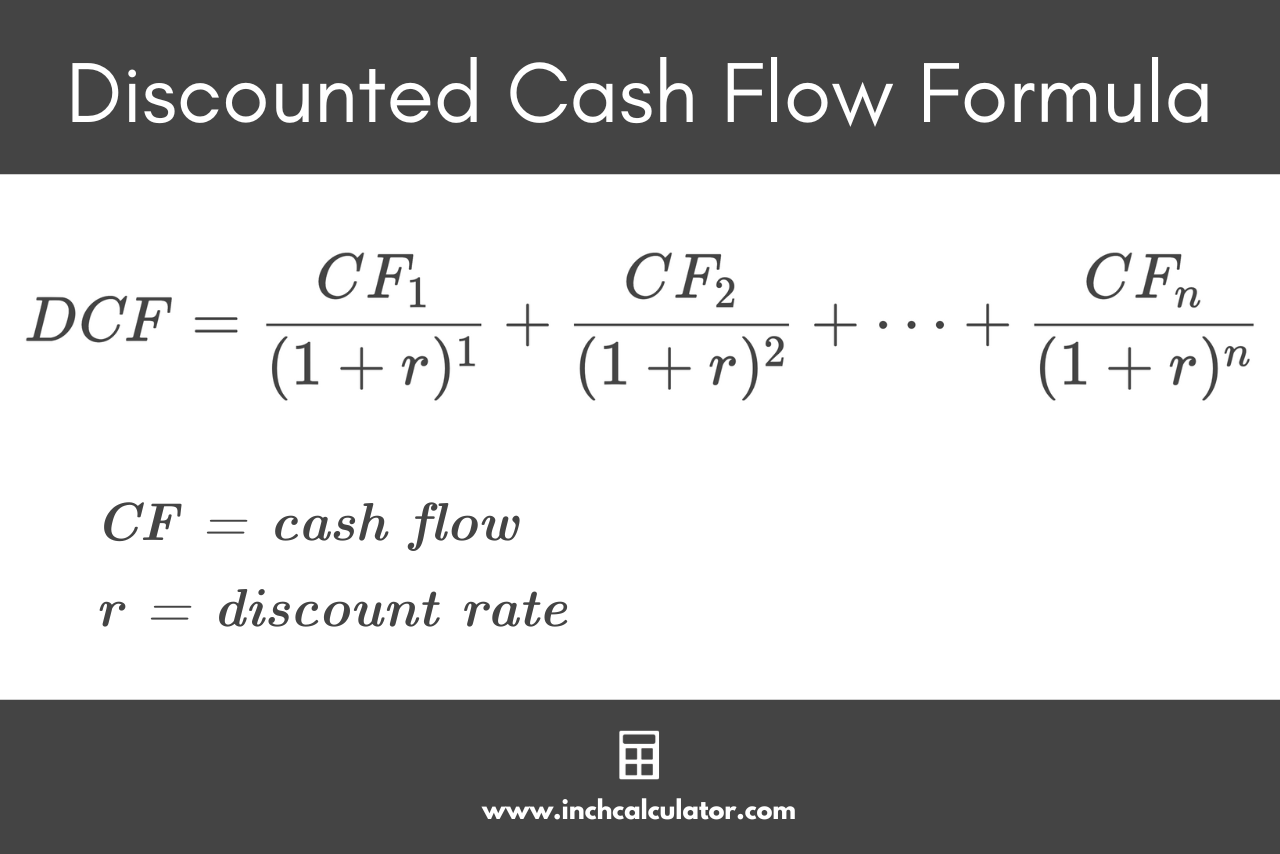

Discount Future Cash Flow Formula - Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Each forecasted cash flow is discounted back to its present value using the discount rate.

By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Each forecasted cash flow is discounted back to its present value using the discount rate.

By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Each forecasted cash flow is discounted back to its present value using the discount rate. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.

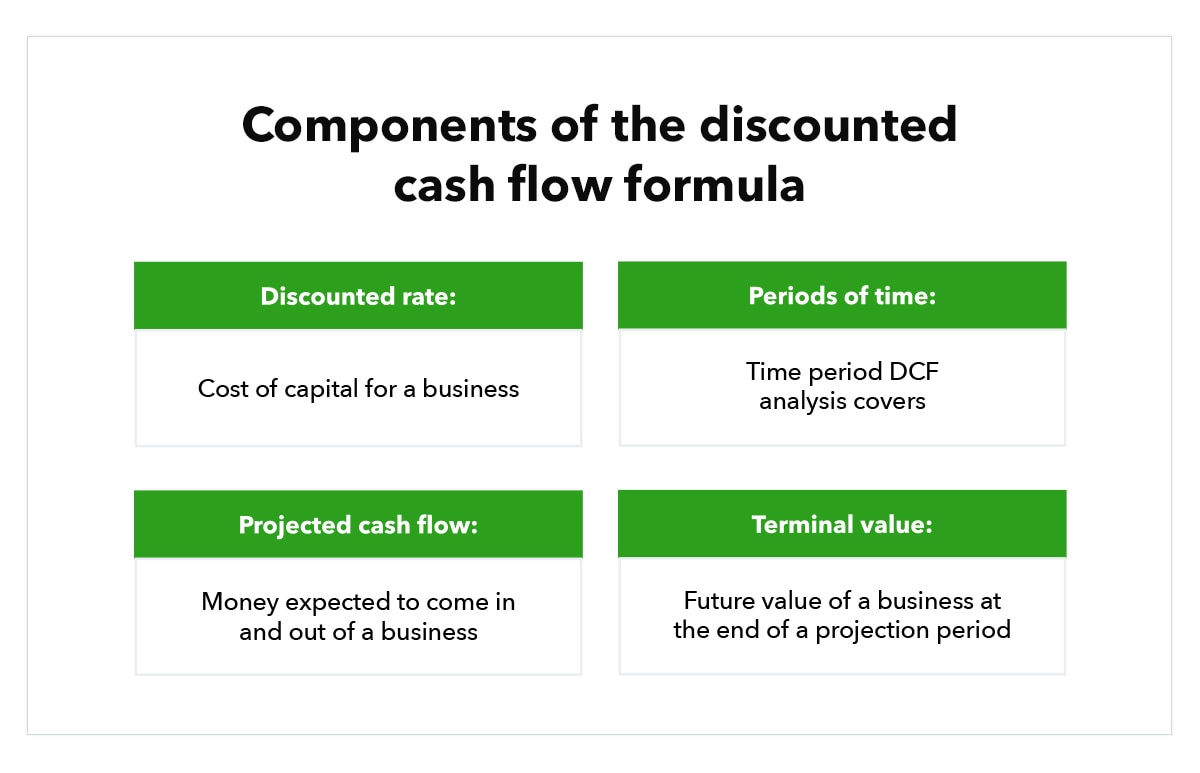

Discounted Cash Flow Method Definition, Formula, and Example

By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its.

How to do a DCF analysis.(Discounted Cash Flow) by Abdul Malik Medium

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Each forecasted cash flow is discounted back to its present value using the discount rate. By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Discounted cash.

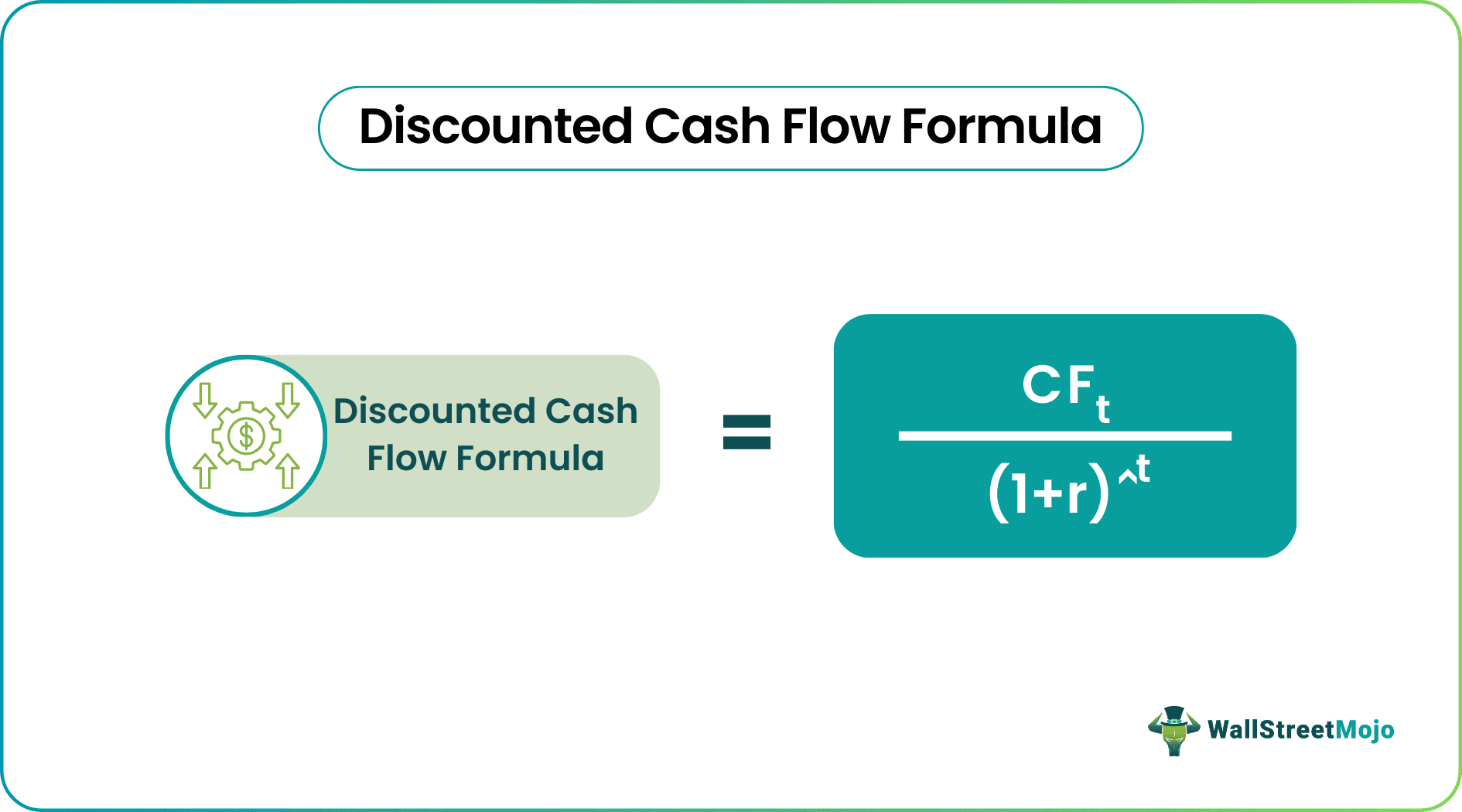

Discounted Cash Flow DCF Formula

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Each forecasted cash flow is discounted back to its present value using the discount rate. By discounting future cash flows.

Discounted Cash Flow Analysis Formula, Use, Types & Benefits IBCA

Each forecasted cash flow is discounted back to its present value using the discount rate. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. By discounting future cash flows.

Discounted Cash Flow Method Discounted Cash Flow PowerPoint Templates,

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Each forecasted cash flow is discounted back to its present value using the discount rate. By discounting future cash flows.

Discounted Cash Flow Calculator Inch Calculator

Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Each forecasted cash flow is discounted back to its present value using the discount rate. By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Calculating the.

Formula for Discounted Cash Flow in Excel Quant RL

By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Each forecasted cash flow is discounted back to its present value using the discount rate. Discounted cash.

DCF Formula What Is It, Examples, How To Calculate

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and.

Discounted Cash Flow Model in Excel Solving Finance

By discounting future cash flows back to their present value using a suitable discount rate, we can accurately assess and compare the worth. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its.

Discounted Cash Flow DCF Formula

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash. Each forecasted cash flow is discounted back to its present value using the discount rate. By discounting future cash flows.

By Discounting Future Cash Flows Back To Their Present Value Using A Suitable Discount Rate, We Can Accurately Assess And Compare The Worth.

Each forecasted cash flow is discounted back to its present value using the discount rate. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow (dcf) is a valuation method that estimates the value of an investment using its expected future cash.