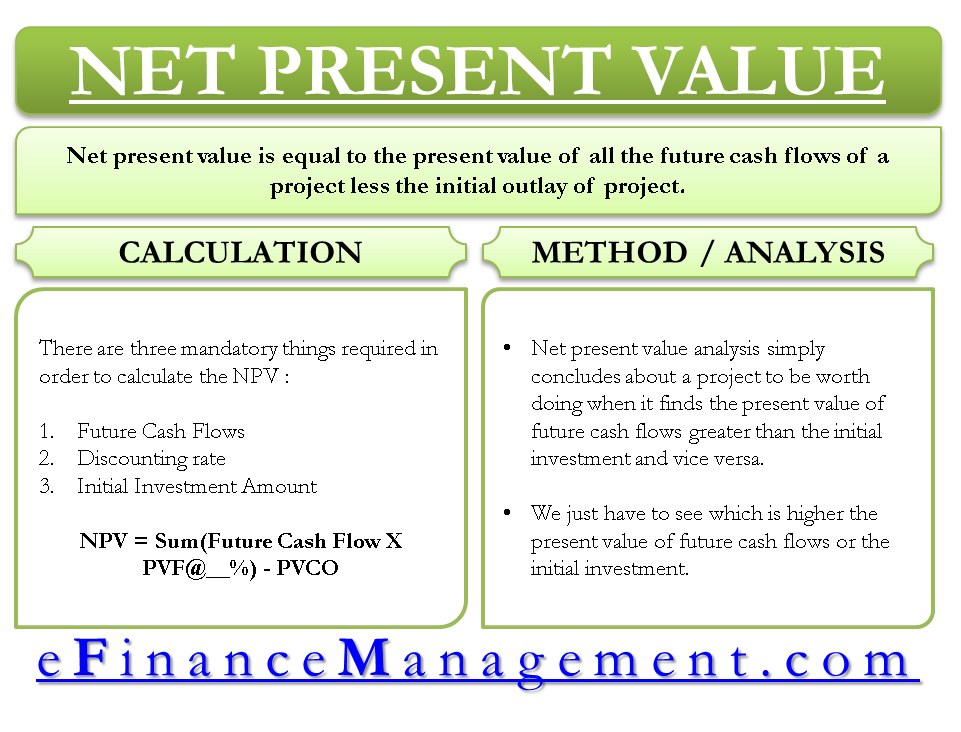

Cash Flow Formula Excel Net Present Value - The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. It helps determine whether a project will be. Npv, or net present value, is a fundamental component of financial analysis.

Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. Npv, or net present value, is a fundamental component of financial analysis. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. It helps determine whether a project will be.

Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. It helps determine whether a project will be. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Npv, or net present value, is a fundamental component of financial analysis.

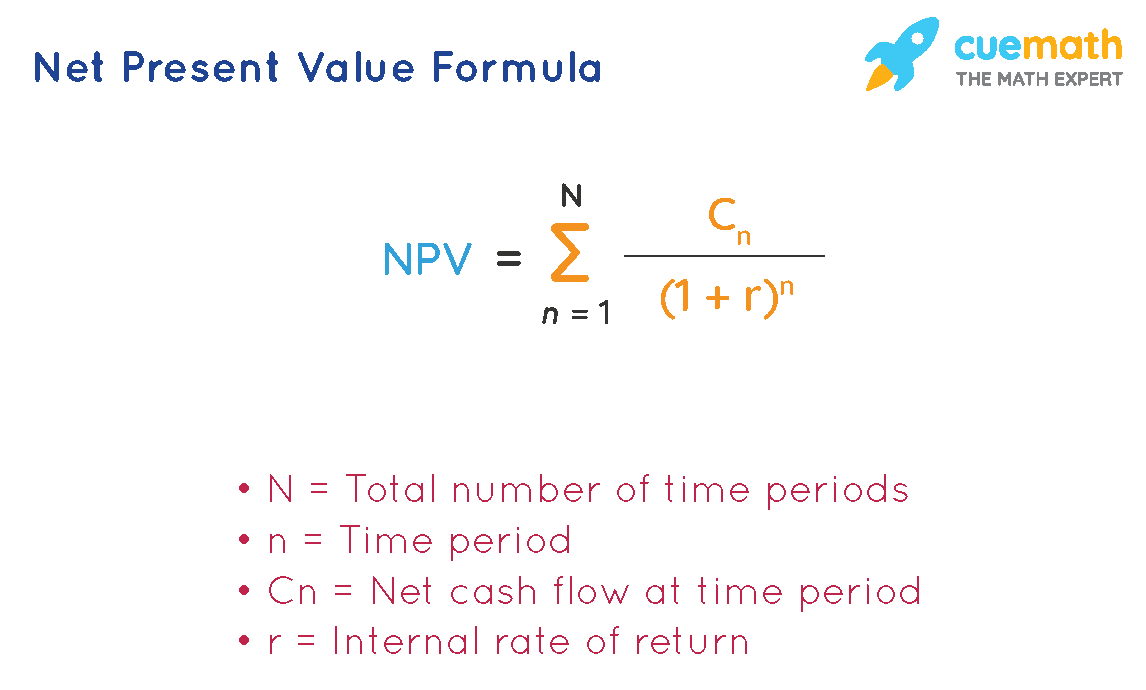

NPV formula for net present value Excel formula Exceljet

Npv, or net present value, is a fundamental component of financial analysis. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the.

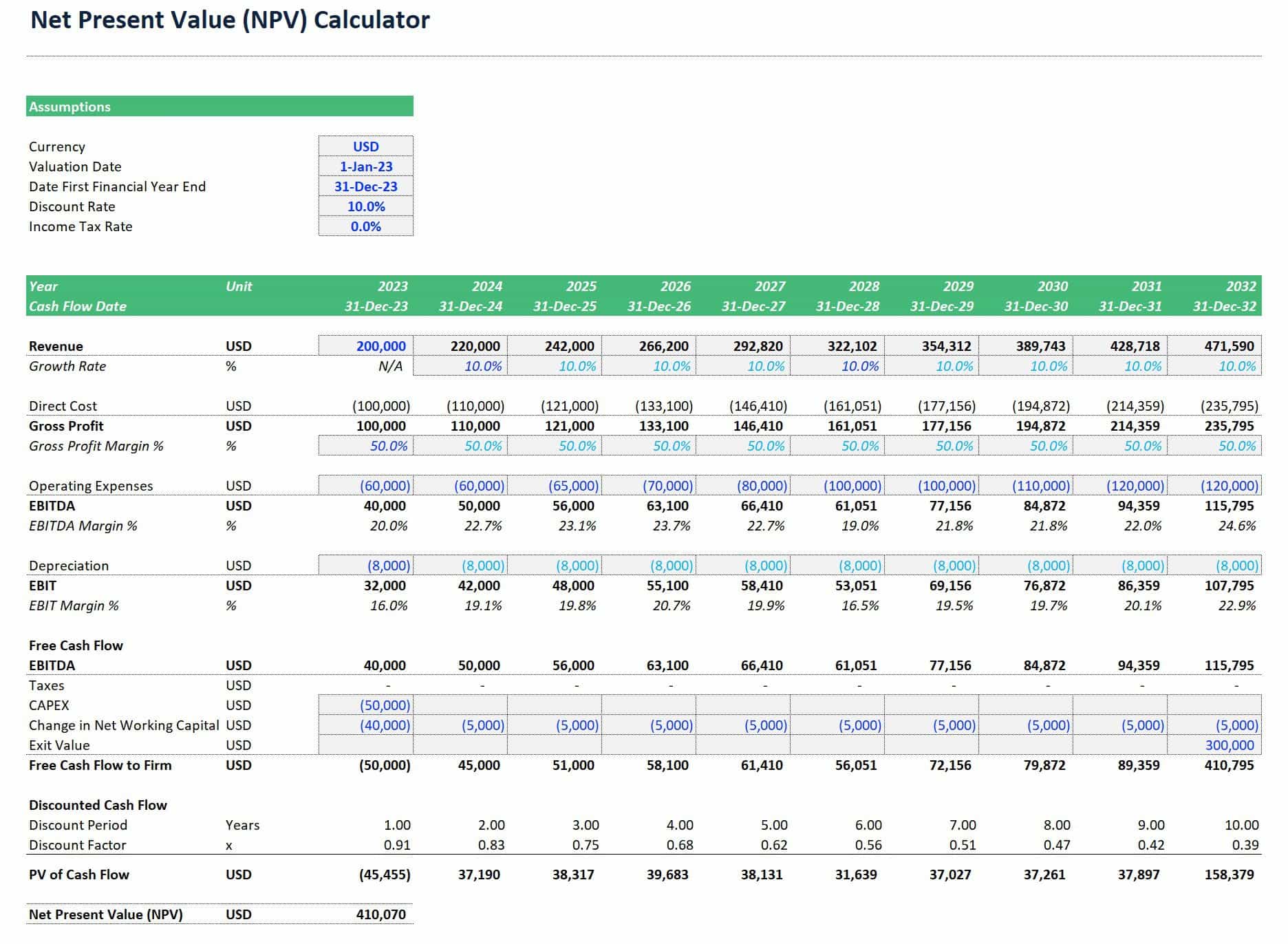

Net Present Value Calculator in Excel eFinancialModels

Npv, or net present value, is a fundamental component of financial analysis. It helps determine whether a project will be. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Calculates the net present value of an investment by using a discount rate and.

Net Present Value Formula On Excel at sasfloatblog Blog

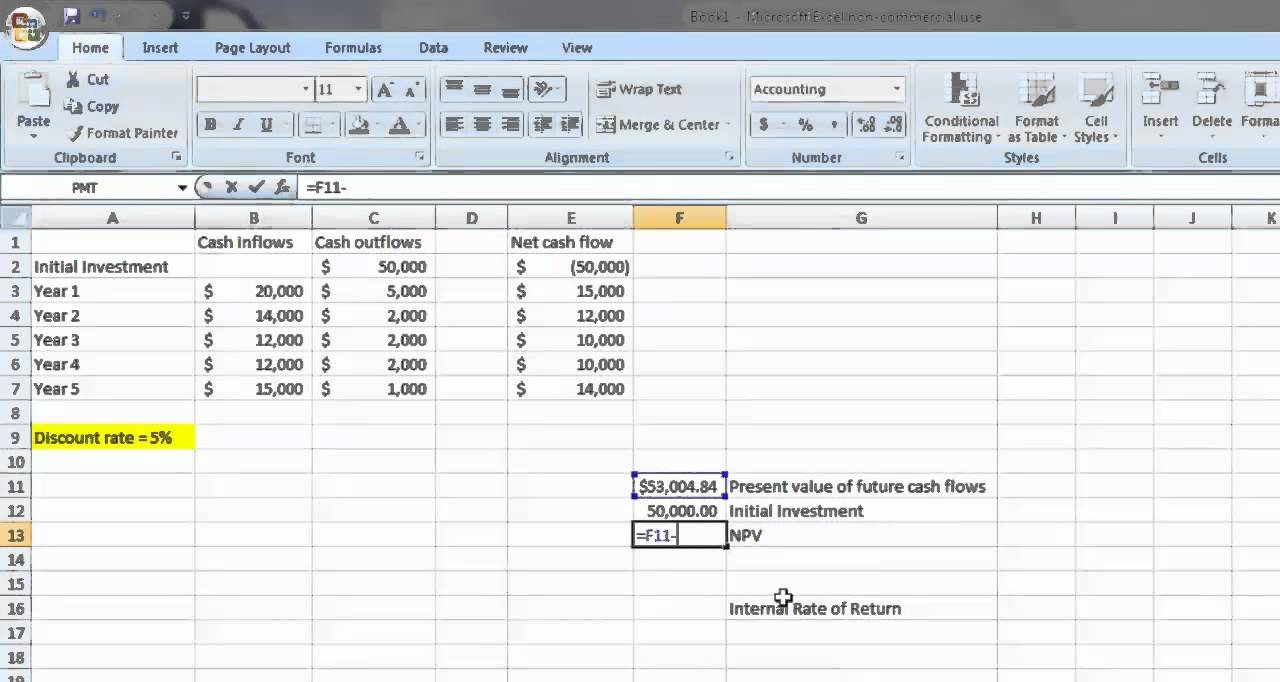

Npv, or net present value, is a fundamental component of financial analysis. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the.

Net Present Value Formula On Excel at sasfloatblog Blog

Npv, or net present value, is a fundamental component of financial analysis. It helps determine whether a project will be. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. The correct npv formula in excel uses the npv function to calculate the present value of a.

Net Present Value Excel Template

It helps determine whether a project will be. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Npv, or net present value, is a fundamental component of financial analysis. Calculates the net present value of an investment by using a discount rate and.

Net Present Value Excel Template

Npv, or net present value, is a fundamental component of financial analysis. The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. It helps determine whether a project will be. Calculates the net present value of an investment by using a discount rate and.

Present Value Excel Template

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. It helps determine whether a project will be. Npv, or net.

How to Calculate NPV Using Excel

It helps determine whether a project will be. Npv, or net present value, is a fundamental component of financial analysis. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. The correct npv formula in excel uses the npv function to calculate the present value of a.

How to Calculate Net Present Value

Npv, or net present value, is a fundamental component of financial analysis. It helps determine whether a project will be. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income. The correct npv formula in excel uses the npv function to calculate the present value of a.

Present Value Excel Template

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. It helps determine whether a project will be. Npv, or net present value, is a fundamental component of financial analysis. Calculates the net present value of an investment by using a discount rate and.

Npv, Or Net Present Value, Is A Fundamental Component Of Financial Analysis.

The correct npv formula in excel uses the npv function to calculate the present value of a series of future cash flows and subtracts the initial. It helps determine whether a project will be. Calculates the net present value of an investment by using a discount rate and a series of future payments (negative values) and income.