Calculate Discounted Cash Flow - Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Learn the formula, see examples, and get excel tips. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Easily calculate discounted cash flows with our simple dcf calculator.

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Learn the formula, see examples, and get excel tips. Easily calculate discounted cash flows with our simple dcf calculator.

Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Easily calculate discounted cash flows with our simple dcf calculator. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Learn the formula, see examples, and get excel tips.

Discounted Cash Flow QuickBooks Global

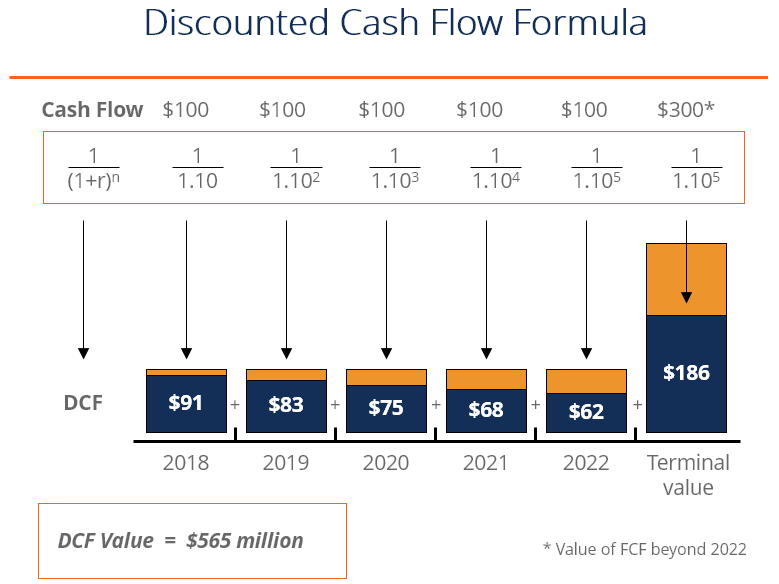

Learn the formula, see examples, and get excel tips. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Easily calculate discounted cash flows with our simple.

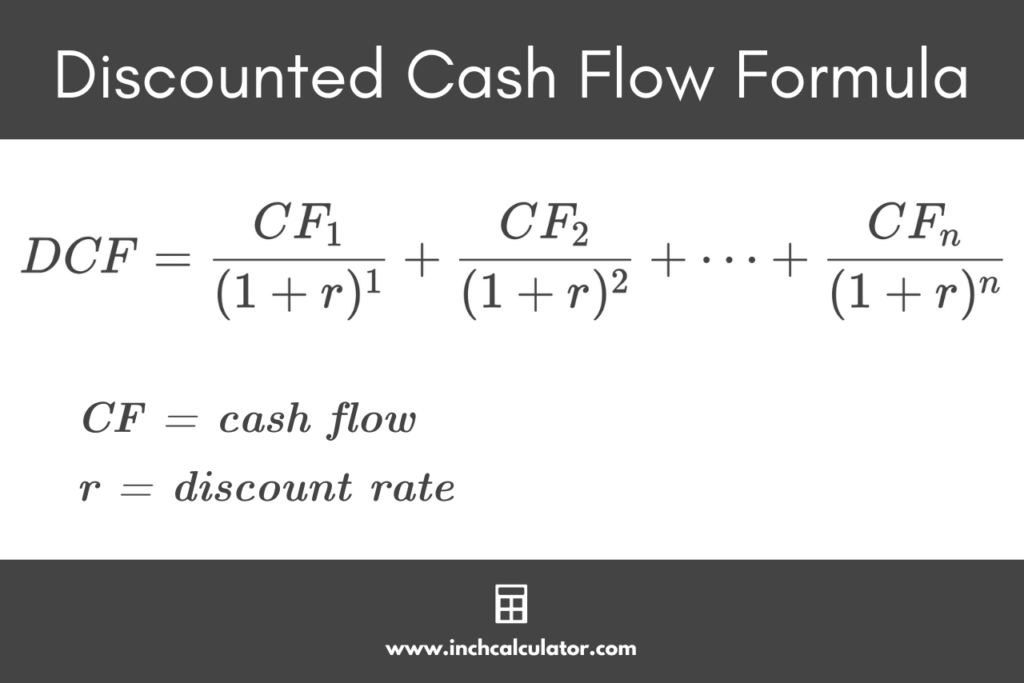

Discounted Cash Flow DCF Formula Calculate NPV CFI

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Learn the formula, see examples, and get excel tips. Use this dcf calculator to compute the discounted.

Discounted Cash Flow Calculator Inch Calculator

Easily calculate discounted cash flows with our simple dcf calculator. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Learn the formula, see examples, and get excel tips. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its.

Discounted Cash Flow DCF Formula

Learn the formula, see examples, and get excel tips. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Easily calculate discounted cash flows with our simple.

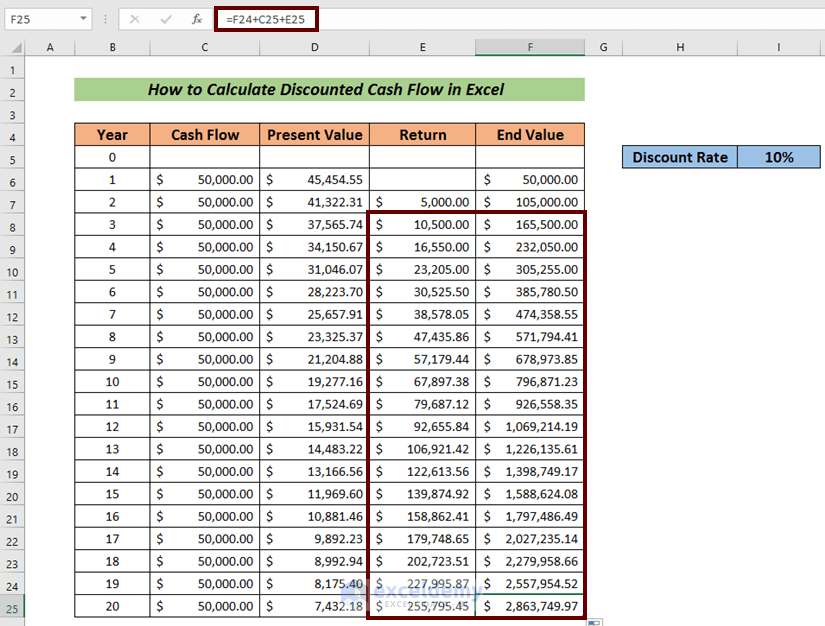

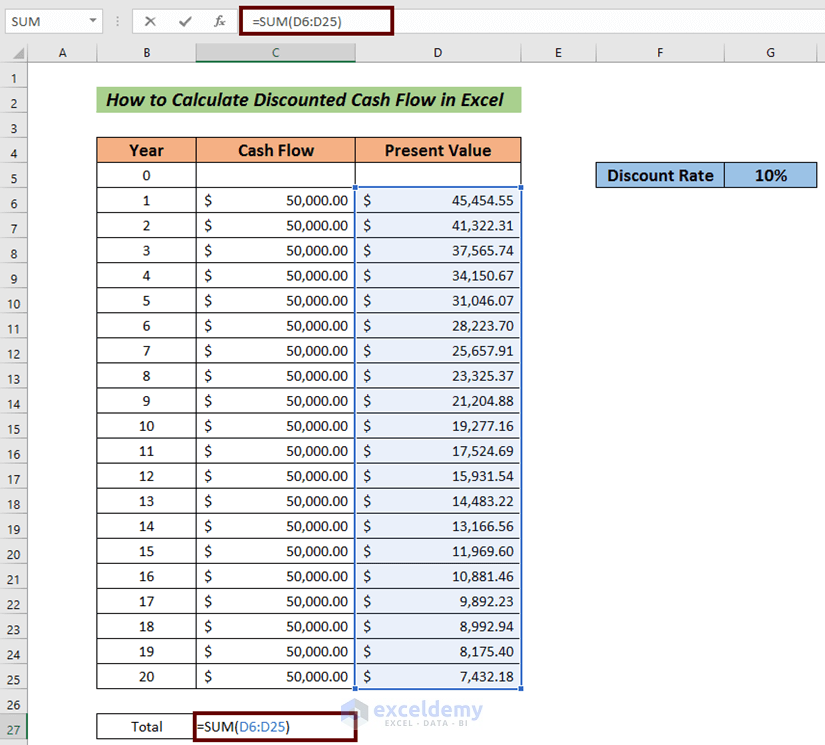

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Easily calculate discounted cash flows with our simple dcf calculator. Learn the formula, see examples, and get excel tips..

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Easily calculate discounted cash flows with our simple dcf calculator. Learn the formula, see examples, and get.

Discounted Cash Flow Model in Excel Solving Finance

Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Easily calculate discounted cash flows with our simple dcf calculator. Use this dcf calculator to compute the.

Discounted Cash Flow Method

Learn the formula, see examples, and get excel tips. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Easily calculate discounted cash flows with our simple dcf calculator..

How to Calculate the Discounted Cash Flow in Excel 3 Easy Steps

Easily calculate discounted cash flows with our simple dcf calculator. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates.

Discounted future cash flow calculator JohnAnnaleigh

Easily calculate discounted cash flows with our simple dcf calculator. Use this dcf calculator to compute the discounted present value (dpv) of an investment using an analysis based on the discounted. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates.

Use This Dcf Calculator To Compute The Discounted Present Value (Dpv) Of An Investment Using An Analysis Based On The Discounted.

Learn the formula, see examples, and get excel tips. Easily calculate discounted cash flows with our simple dcf calculator. Calculating the sum of future discounted cash flows is the gold standard to determine how much an investment is worth. Discounted cash flow is a valuation method that calculates the value of an investment based on the present value of its future income.