Aggrg Deduction In Salary Slip - It means that all wage type is regular taxable income. Salary packages or ctcs for employees include various allowances and perquisites; Each allowance and perquisite is. Generally shift allowance and overtime is irregular taxable income. It contains a detailed summary of an. 10k+ visitors in the past month For a employee agg of chapter vi is coming wrong. 10k+ visitors in the past month A salary slip or payslip is a document issued monthly by an employer to its employees. I have check it0585 = no data is there and in it0586= 97,554 in proposed.

A salary slip or payslip is a document issued monthly by an employer to its employees. It means that all wage type is regular taxable income. Generally shift allowance and overtime is irregular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It contains a detailed summary of an. Each allowance and perquisite is. Total income wage type (/434) = gross. For a employee agg of chapter vi is coming wrong. 10k+ visitors in the past month

Total income wage type (/434) = gross. It means that all wage type is regular taxable income. 10k+ visitors in the past month Each allowance and perquisite is. It contains a detailed summary of an. Salary packages or ctcs for employees include various allowances and perquisites; I have check it0585 = no data is there and in it0586= 97,554 in proposed. Generally shift allowance and overtime is irregular taxable income. A salary slip or payslip is a document issued monthly by an employer to its employees. For a employee agg of chapter vi is coming wrong.

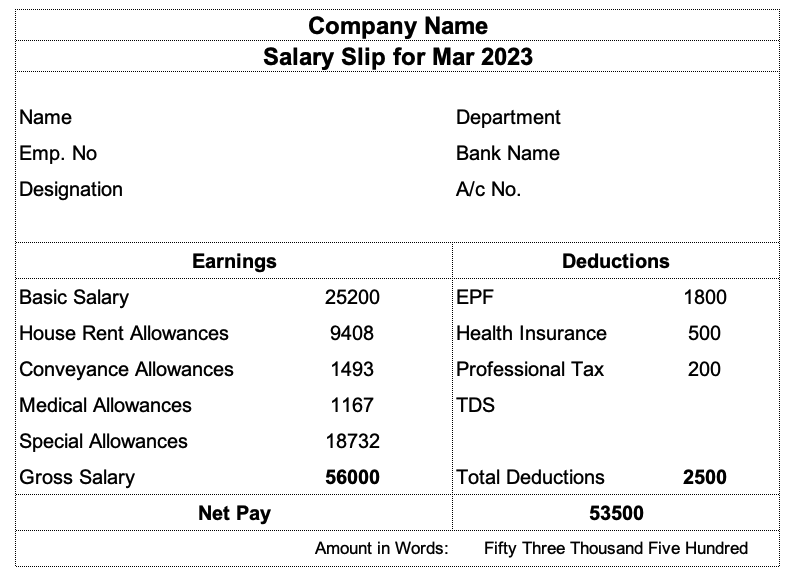

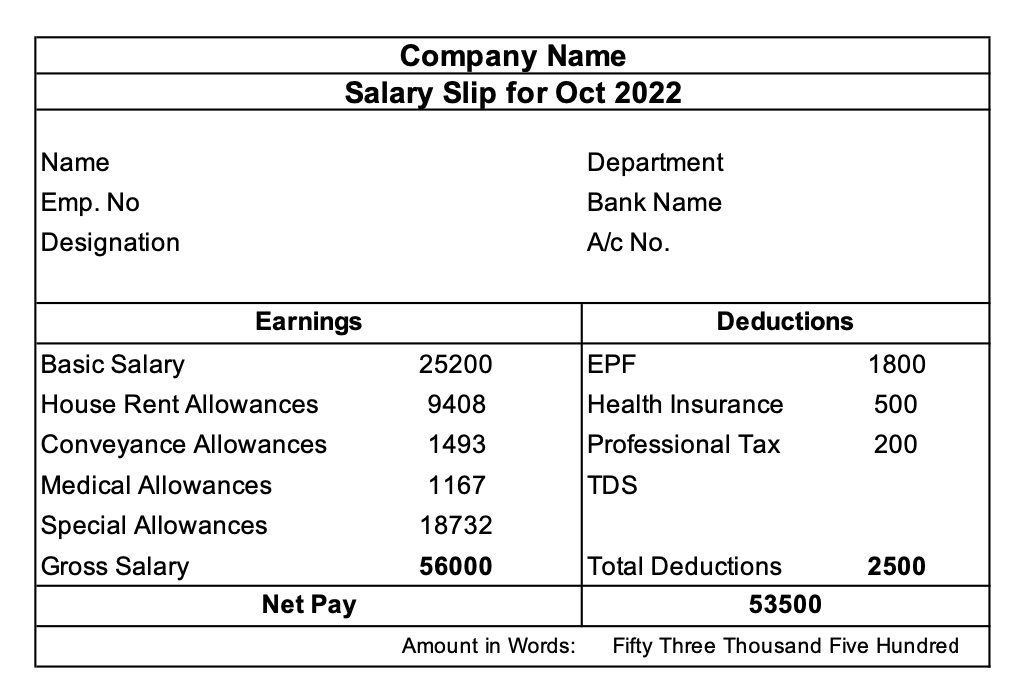

Payslip Templates Excel

Salary packages or ctcs for employees include various allowances and perquisites; 10k+ visitors in the past month It contains a detailed summary of an. Total income wage type (/434) = gross. I have check it0585 = no data is there and in it0586= 97,554 in proposed.

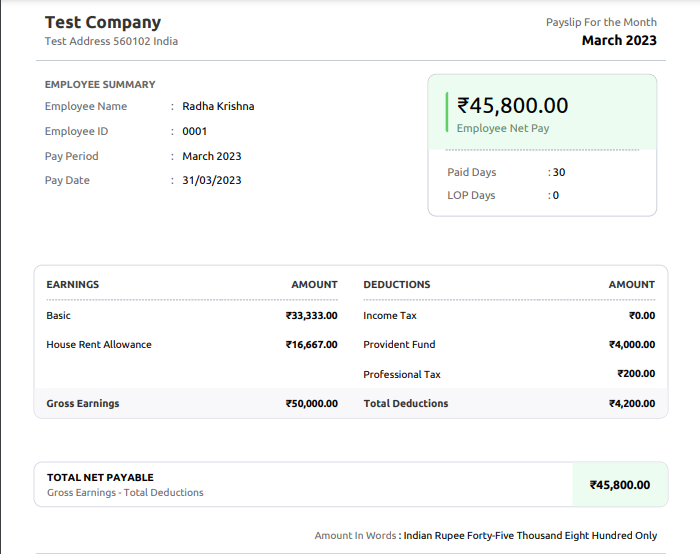

Analysis of Salary slip

For a employee agg of chapter vi is coming wrong. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It means that all wage type is regular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed. Generally shift allowance and overtime is.

Salary Slip कैसे बनायें

10k+ visitors in the past month As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. Total income wage type (/434) = gross. For a employee agg of chapter vi is coming wrong. It means that all wage type is regular taxable income.

Editable salary slip format in excel tokera

For a employee agg of chapter vi is coming wrong. Salary packages or ctcs for employees include various allowances and perquisites; It means that all wage type is regular taxable income. Generally shift allowance and overtime is irregular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed.

Salary Slip Meaning, Format and Components

For a employee agg of chapter vi is coming wrong. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. It means that all wage type is regular taxable income. It contains a detailed summary of an. Salary packages or ctcs for employees include various allowances and perquisites;

Employee Salary Slip What is Earnings & Deductions?

Total income wage type (/434) = gross. A salary slip or payslip is a document issued monthly by an employer to its employees. Generally shift allowance and overtime is irregular taxable income. Each allowance and perquisite is. It contains a detailed summary of an.

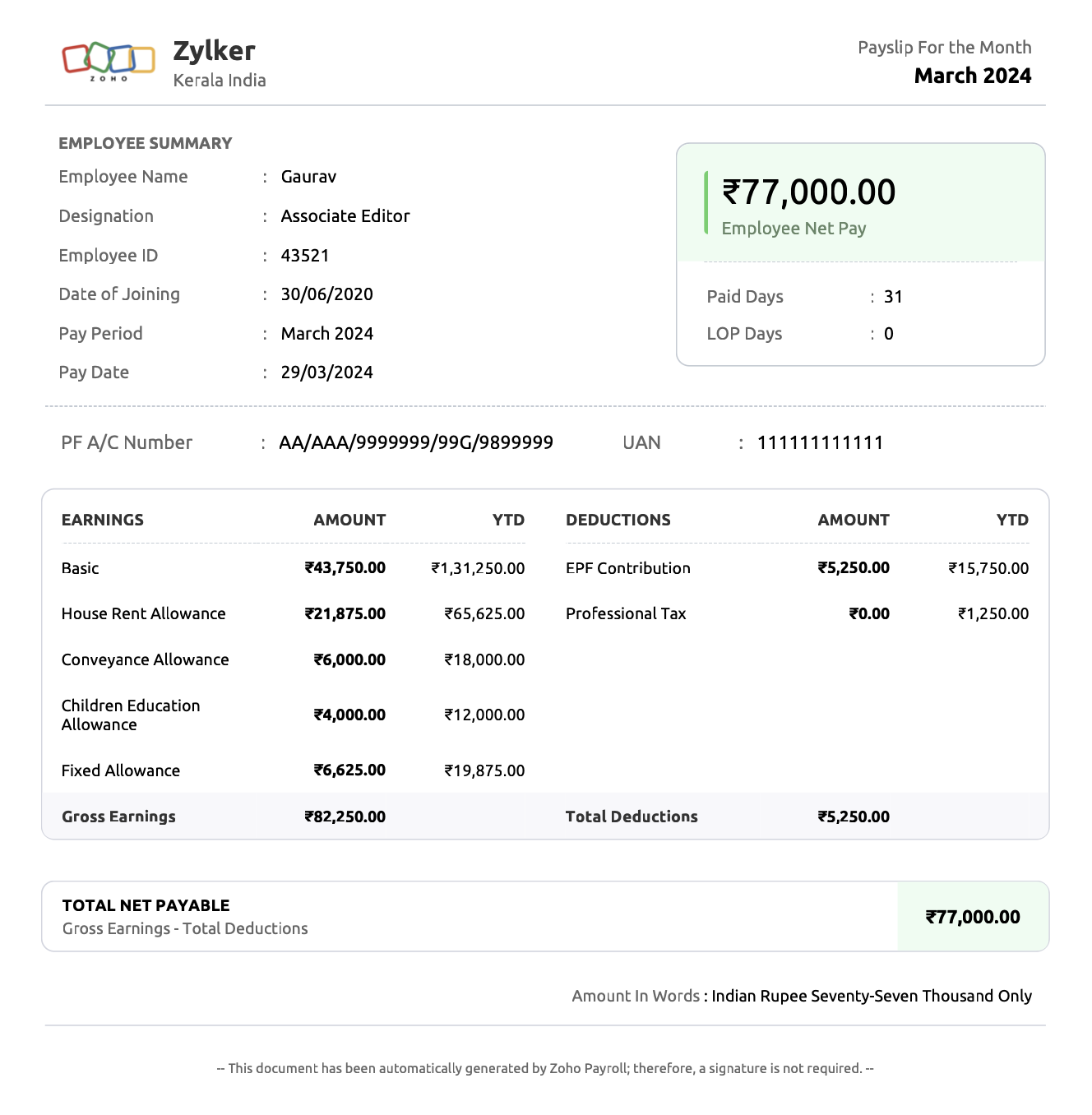

What is salary slip or payslip? Format & components Zoho Payroll

A salary slip or payslip is a document issued monthly by an employer to its employees. 10k+ visitors in the past month Generally shift allowance and overtime is irregular taxable income. I have check it0585 = no data is there and in it0586= 97,554 in proposed. As the employee does not have any section 80 deductions, agg of chapter vi.

What is Salary Slip Components of Salary Slip, Format & Payslip Breakdown

I have check it0585 = no data is there and in it0586= 97,554 in proposed. Generally shift allowance and overtime is irregular taxable income. Each allowance and perquisite is. For a employee agg of chapter vi is coming wrong. It contains a detailed summary of an.

Salary Slip PDF Tax Deduction Taxes

Generally shift allowance and overtime is irregular taxable income. For a employee agg of chapter vi is coming wrong. I have check it0585 = no data is there and in it0586= 97,554 in proposed. It means that all wage type is regular taxable income. Total income wage type (/434) = gross.

Salary Slip PDF Paycheck Tax Deduction

I have check it0585 = no data is there and in it0586= 97,554 in proposed. 10k+ visitors in the past month It means that all wage type is regular taxable income. 10k+ visitors in the past month A salary slip or payslip is a document issued monthly by an employer to its employees.

For A Employee Agg Of Chapter Vi Is Coming Wrong.

Each allowance and perquisite is. Salary packages or ctcs for employees include various allowances and perquisites; I have check it0585 = no data is there and in it0586= 97,554 in proposed. It contains a detailed summary of an.

A Salary Slip Or Payslip Is A Document Issued Monthly By An Employer To Its Employees.

10k+ visitors in the past month It means that all wage type is regular taxable income. As the employee does not have any section 80 deductions, agg of chapter vi wage type (/432) = 00.00. Generally shift allowance and overtime is irregular taxable income.

Total Income Wage Type (/434) = Gross.

10k+ visitors in the past month